Official Deed Template for Pennsylvania State

The Pennsylvania Deed form serves as a crucial document in real estate transactions within the state, facilitating the transfer of property ownership from one party to another. This form includes essential details such as the names of the grantor (the seller) and the grantee (the buyer), the legal description of the property being conveyed, and the consideration, or payment, involved in the transaction. Additionally, the form may require notarization to validate the signatures of the parties involved, ensuring that the transfer is legally binding. Various types of deeds exist under Pennsylvania law, including warranty deeds, quitclaim deeds, and special warranty deeds, each serving distinct purposes based on the level of protection and rights being conveyed. Properly executing this form is vital to prevent future disputes and to establish clear ownership rights, making it an indispensable tool for both buyers and sellers in the real estate market.

Misconceptions

Understanding the Pennsylvania Deed form is essential for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion. Below are five common misconceptions along with clarifications to help clear up any misunderstandings.

-

All deeds are the same in Pennsylvania.

This is not true. There are different types of deeds, such as warranty deeds and quitclaim deeds, each serving distinct purposes. A warranty deed provides a guarantee that the seller holds clear title to the property, while a quitclaim deed transfers whatever interest the seller has without any warranties.

-

Only attorneys can prepare a Pennsylvania Deed.

While it is advisable to consult an attorney for complex transactions, individuals can prepare their own deeds. However, they must ensure that all legal requirements are met to avoid future complications.

-

A deed must be notarized to be valid.

-

Once a deed is signed, it cannot be changed.

This is a misconception. If both parties agree, a deed can be amended or corrected. The process typically involves drafting a new deed that reflects the desired changes and executing it properly.

-

Recording a deed is optional.

Recording a deed is crucial for establishing public notice of ownership. While it is not legally required for the validity of the deed, failing to record can lead to disputes over property ownership and may affect the ability to sell or transfer the property in the future.

By addressing these misconceptions, individuals can navigate the complexities of real estate transactions more effectively and make informed decisions regarding their property. Understanding the nuances of the Pennsylvania Deed form is vital for protecting one’s rights and interests.

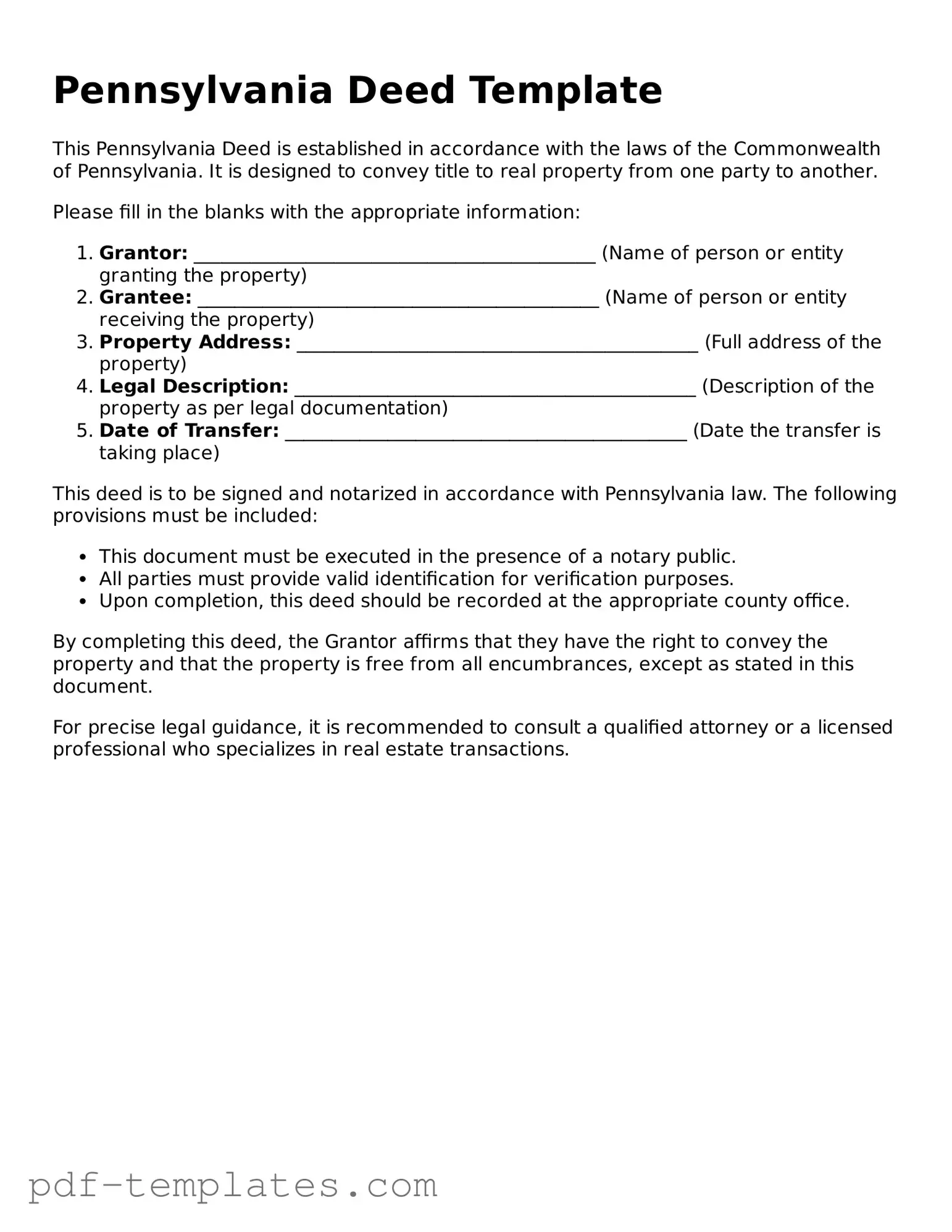

Pennsylvania Deed: Usage Instruction

After completing the Pennsylvania Deed form, the next steps involve ensuring that the document is properly executed and recorded with the appropriate county office. This is essential to legally transfer property ownership. Make sure to gather any additional documents required for the recording process.

- Obtain the Pennsylvania Deed form from a reliable source or the county office.

- Enter the names of the grantor(s) (the person(s) transferring the property) in the designated section.

- Provide the names of the grantee(s) (the person(s) receiving the property) accurately.

- Fill in the legal description of the property. This may include the parcel number and specific location details.

- Indicate the consideration amount, which is the price paid for the property.

- Include any necessary additional clauses or conditions that apply to the transfer.

- Sign the form in the presence of a notary public. Ensure that all signatures are properly notarized.

- Check for any additional requirements specific to your county, such as witness signatures.

- Submit the completed form to the county recorder’s office along with any required fees.

Common mistakes

-

Incorrect Names: One common mistake is failing to use the full legal names of all parties involved. Abbreviations or nicknames can lead to confusion and potential legal issues.

-

Missing Signatures: All required parties must sign the deed. Omitting a signature can invalidate the document, making it unenforceable.

-

Improper Notarization: The deed must be notarized correctly. If the notary public does not follow the proper procedures, the document may not be recognized.

-

Incorrect Property Description: Providing an inaccurate or vague description of the property can create significant problems. It is essential to include the correct address and any relevant legal descriptions.

-

Failure to Include Consideration: The deed should state the consideration, or the value exchanged for the property. Omitting this detail can lead to complications in the future.

-

Not Checking Local Requirements: Different counties may have specific requirements for deeds. Failing to check local regulations can result in a rejected filing.

-

Inconsistent Information: Ensure that all information matches across documents. Discrepancies can raise red flags and complicate the transfer process.

-

Neglecting to Record the Deed: After completing the deed, it must be recorded with the appropriate county office. Failing to do so can leave the ownership status unclear.

PDF Features

| Fact Name | Details |

|---|---|

| Purpose of the Deed | The Pennsylvania Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Pennsylvania recognizes various types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. |

| Governing Laws | The Pennsylvania Deed is governed by Title 21 of the Pennsylvania Consolidated Statutes, specifically the Real Property Statutes. |

| Signature Requirements | The deed must be signed by the grantor (the person transferring the property) and may require notarization to be legally binding. |

| Recording the Deed | To ensure public notice of the transfer, the deed should be recorded in the county where the property is located. |

| Tax Considerations | Transfer taxes may apply when a property is sold or transferred, and it is important to check local regulations for specific rates. |

Dos and Don'ts

When filling out the Pennsylvania Deed form, it's essential to approach the task with care. Here are some key dos and don’ts to consider:

- Do ensure that all names are spelled correctly.

- Do provide accurate property descriptions.

- Do include the correct date of the transaction.

- Do sign the deed in the presence of a notary public.

- Don’t leave any required fields blank.

- Don’t use abbreviations for names or addresses.

- Don’t forget to check local recording requirements.

- Don’t rush through the process; take your time to review.

By following these guidelines, you can help ensure that your deed is completed correctly and is legally valid.

Similar forms

The Pennsylvania Deed form is similar to the Quitclaim Deed. A Quitclaim Deed transfers ownership interest in a property from one party to another without guaranteeing that the title is clear. Like the Pennsylvania Deed, it requires signatures from the grantor and often needs to be notarized. However, it does not provide any warranties about the property’s title, making it a more straightforward, yet riskier, option for transferring property ownership.

Another document similar to the Pennsylvania Deed is the Warranty Deed. This type of deed offers a guarantee that the grantor holds clear title to the property and has the right to sell it. Like the Pennsylvania Deed, it requires the grantor's signature and must be recorded to be effective. The key difference lies in the warranties provided; the Warranty Deed assures the grantee that they will not face any claims against the property’s title.

The Bargain and Sale Deed is also comparable. This deed conveys property without any warranties against encumbrances. While it transfers ownership like the Pennsylvania Deed, it does not guarantee a clear title. The grantor’s signature is required, and recording the deed is essential for public notice. This type of deed is often used in transactions where the buyer is willing to accept the risk associated with potential title issues.

A Special Purpose Deed is another document that shares similarities with the Pennsylvania Deed. This type of deed is used for specific situations, such as transferring property from a trust or estate. Like the Pennsylvania Deed, it requires the grantor's signature and is recorded to ensure legal validity. However, it may include additional clauses that address the unique circumstances of the transfer.

The California Medical Power of Attorney form is a vital legal instrument that empowers individuals to designate a trusted person to make healthcare decisions on their behalf if they cannot express their wishes. This document ensures that a person's healthcare preferences are honored, even in situations where they are unable to communicate directly. By establishing a medical power of attorney, individuals can secure peace of mind knowing their health decisions are taken care of by someone they trust, making resources like All California Forms invaluable for understanding and executing these important legal procedures.

The Grant Deed is also akin to the Pennsylvania Deed. It conveys property ownership and includes some implied warranties, such as the assurance that the property has not been sold to anyone else. The Grant Deed requires the grantor's signature and must be recorded. While it provides some protection to the grantee, it does not offer the same level of assurance as a Warranty Deed.

The Deed of Trust is another document that resembles the Pennsylvania Deed. This document secures a loan by placing a lien on the property. While it serves a different primary purpose, it still involves the transfer of an interest in real estate. The Deed of Trust must be recorded, and it requires the signatures of the borrower, lender, and trustee. Unlike the Pennsylvania Deed, it does not transfer ownership but rather creates a security interest.

A Leasehold Deed is similar in that it involves the transfer of an interest in real estate, but it typically pertains to leasing rather than outright ownership. This document grants the lessee rights to use the property for a specified period. Like the Pennsylvania Deed, it requires signatures and may need to be recorded. The Leasehold Deed focuses on the terms of the lease rather than the transfer of ownership.

Finally, the Executor’s Deed is comparable as it is used to transfer property from a deceased person's estate. This document is executed by the executor of the estate and must be recorded to be effective. While it serves a specific purpose in estate administration, it shares the basic elements of a Pennsylvania Deed, including the need for signatures and public recording. The Executor’s Deed may also include specific language that addresses the authority of the executor to convey the property.

Check out Popular Deed Forms for Different States

Deed Form New York - A quitclaim deed transfers whatever interest the grantor has in the property, without any warranties.

For those navigating complex healthcare decisions, understanding the implications of a Do Not Resuscitate Order can be invaluable. Take the time to learn about the necessary steps by reviewing this important Do Not Resuscitate Order form, which outlines your rights and options in a medical emergency.

Who Has the Deed to My House - Each state has specific forms and regulations regarding property Deeds.

Sample Deed - Can help prevent legal issues regarding boundary disputes.

Florida Deed Form - A Deed could include terms for how the property may be used or any restrictions that are imposed.