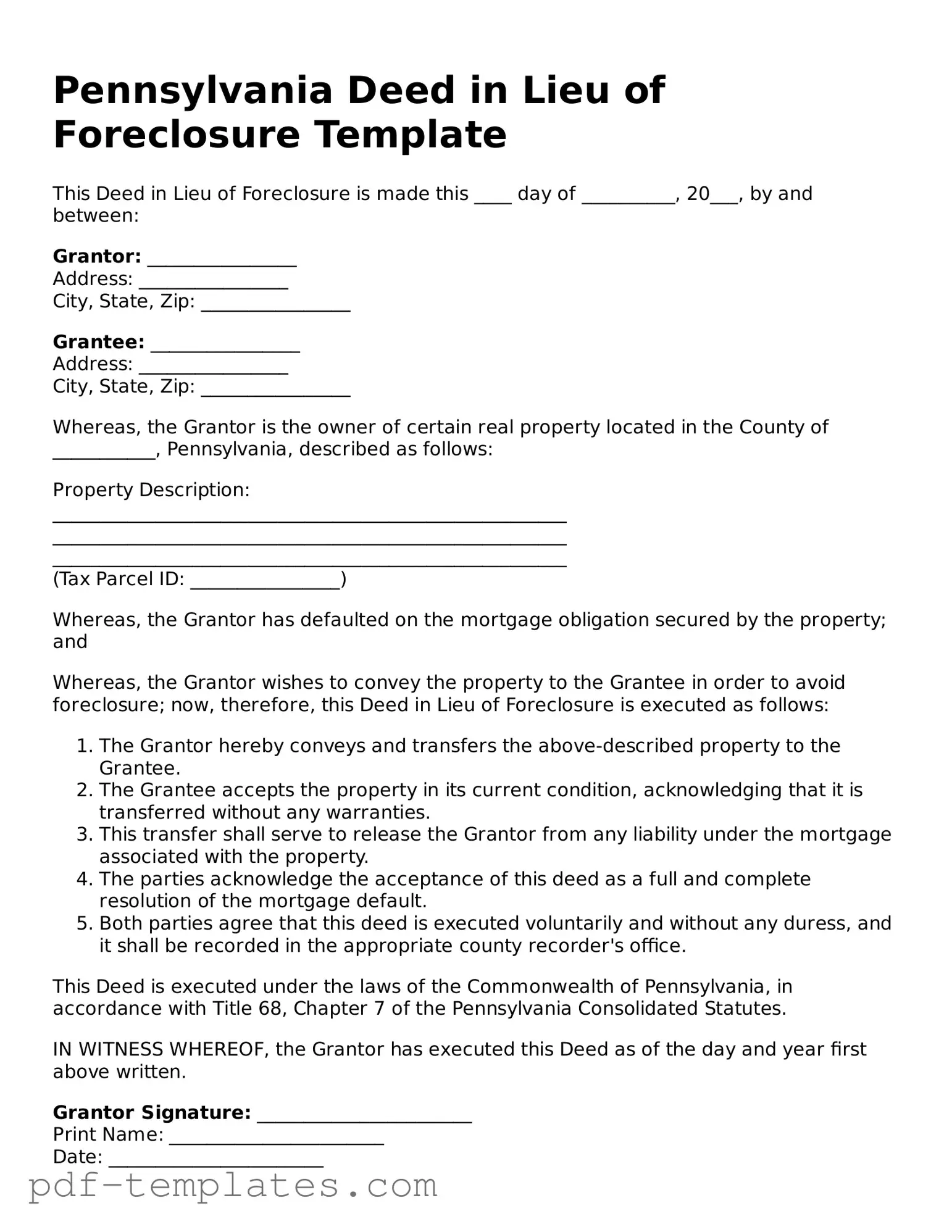

Official Deed in Lieu of Foreclosure Template for Pennsylvania State

In Pennsylvania, homeowners facing the possibility of foreclosure may find relief through a Deed in Lieu of Foreclosure. This legal document allows a property owner to voluntarily transfer ownership of their property to the lender, effectively settling the mortgage debt without the lengthy and often stressful foreclosure process. By choosing this option, homeowners can avoid the negative consequences associated with foreclosure, such as damage to their credit score and the potential for legal complications. The Deed in Lieu of Foreclosure form outlines the terms of the transfer, including any agreements regarding the remaining balance of the mortgage and the condition of the property. It is essential for homeowners to understand the implications of this form, as it may affect their future financial options and housing stability. Additionally, lenders may require specific conditions to be met before accepting the deed, making it crucial for homeowners to seek guidance and ensure all necessary steps are followed. Overall, this form serves as a practical solution for those looking to navigate the challenges of financial hardship while maintaining some control over their circumstances.

Misconceptions

When it comes to the Pennsylvania Deed in Lieu of Foreclosure, there are several misconceptions that can lead to confusion for homeowners. Understanding these misconceptions is crucial for anyone considering this option. Below is a list of ten common misunderstandings.

- A Deed in Lieu of Foreclosure is the same as a foreclosure. Many people believe these two processes are identical. In reality, a Deed in Lieu allows the homeowner to voluntarily transfer the property to the lender, while foreclosure is a legal process initiated by the lender to take possession of the property.

- It will ruin my credit score. While a Deed in Lieu can impact your credit, it may not be as damaging as a foreclosure. The effect on your credit score depends on various factors, including your overall credit history.

- I can just walk away from my mortgage. This is a common misconception. A Deed in Lieu requires the homeowner to formally transfer the property to the lender. Simply walking away could lead to legal and financial consequences.

- The lender will forgive all my debts. While a Deed in Lieu may relieve you of the property, it does not automatically cancel any remaining mortgage debt. Lenders may still pursue the borrower for any deficiency, depending on state laws and the terms of the agreement.

- I won't have to pay any closing costs. Homeowners often assume there are no costs involved. However, there can be fees associated with the Deed in Lieu process, including potential legal fees or other administrative costs.

- It’s a quick and easy process. Many believe that a Deed in Lieu is a simple solution. In truth, it can involve negotiations and paperwork, and the timeline can vary depending on the lender's policies.

- I can still live in my home after signing the Deed. Once the Deed is executed, the lender takes ownership of the property. This means the homeowner must vacate the premises, which can be a difficult transition.

- All lenders accept Deeds in Lieu. Not every lender is open to this option. Some lenders may prefer to proceed with foreclosure instead, so it's important to check with your lender to see if they offer this alternative.

- I can negotiate the terms of the Deed in Lieu. While homeowners can discuss terms with their lender, the lender ultimately has the final say. The terms may not be as flexible as one might hope.

- Once I sign, I have no recourse. This is not entirely true. Homeowners can still negotiate certain aspects of the process, and legal advice can help in understanding any rights that may remain.

By clarifying these misconceptions, homeowners can make more informed decisions regarding their options in the face of financial difficulties.

Pennsylvania Deed in Lieu of Foreclosure: Usage Instruction

Completing the Pennsylvania Deed in Lieu of Foreclosure form is an important step for homeowners looking to transfer their property back to the lender. Once the form is filled out correctly, it should be submitted to the appropriate lender for processing. Below are the steps to ensure accurate completion of the form.

- Begin by obtaining the Pennsylvania Deed in Lieu of Foreclosure form from a reliable source, such as the lender or a legal website.

- Enter the full name of the property owner(s) in the designated space. Ensure that all names are spelled correctly.

- Provide the address of the property being transferred. Include the street number, street name, city, state, and ZIP code.

- List the legal description of the property. This information can typically be found on the property’s deed or tax records.

- Indicate the date of the transfer in the specified section. This should be the date you are signing the document.

- Sign the document in the appropriate area. All property owners must sign the form.

- Have the signatures notarized. This step is crucial for the document to be considered valid.

- Make copies of the completed and notarized form for your records before submitting it to the lender.

- Submit the original form to the lender, along with any required supporting documentation, as specified by the lender.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as names, addresses, and property descriptions, can lead to delays or rejection of the form.

-

Incorrect Signatures: All necessary parties must sign the document. Missing signatures or incorrect signatories can invalidate the deed.

-

Notary Issues: Neglecting to have the deed notarized can render it unenforceable. Ensure a qualified notary witnesses the signatures.

-

Failure to Understand Tax Implications: Ignoring potential tax consequences of a deed in lieu can result in unexpected financial liabilities.

-

Not Reviewing the Mortgage Agreement: Overlooking the terms of the mortgage may lead to misunderstandings about obligations and rights.

-

Missing Deadlines: Each step in the process has specific timelines. Delays can complicate or nullify the deed in lieu process.

-

Assuming All Creditors Will Accept the Deed: Not all creditors may agree to a deed in lieu. It's essential to communicate with all parties involved.

-

Not Seeking Legal Advice: Filling out the form without consulting a legal professional can lead to mistakes that may have been avoided with proper guidance.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | This form is governed by Pennsylvania state law, specifically under the Pennsylvania Uniform Commercial Code. |

| Eligibility | Typically, borrowers must demonstrate financial hardship to qualify for a Deed in Lieu of Foreclosure. |

| Process | The process involves negotiations between the borrower and lender, followed by the execution of the deed. |

| Impact on Credit | A Deed in Lieu of Foreclosure may have less severe effects on a borrower's credit score compared to a full foreclosure. |

| Tax Implications | Borrowers should consult a tax professional, as there may be tax consequences associated with the transfer of property. |

| Legal Assistance | It is advisable for borrowers to seek legal advice before signing a Deed in Lieu of Foreclosure to understand their rights and obligations. |

Dos and Don'ts

When filling out the Pennsylvania Deed in Lieu of Foreclosure form, it is important to approach the process with care. Here are some guidelines to help ensure that the form is completed correctly.

- Do read the instructions carefully before beginning to fill out the form.

- Don't rush through the process; take your time to ensure accuracy.

- Do provide complete and accurate information about the property and the parties involved.

- Don't omit any required signatures; all necessary parties must sign the document.

- Do consult with a legal professional if you have questions about the form or the process.

- Don't use outdated versions of the form; ensure you have the most current version.

- Do keep a copy of the completed form for your records.

- Don't forget to notarize the document, as this may be required for it to be valid.

- Do submit the form to the appropriate county office once it is completed.

Following these guidelines can help facilitate a smoother process when dealing with a deed in lieu of foreclosure. Attention to detail is crucial, and seeking professional assistance can provide peace of mind.

Similar forms

The Pennsylvania Deed in Lieu of Foreclosure is a valuable tool for homeowners facing foreclosure. It allows a homeowner to voluntarily transfer the title of their property to the lender in exchange for the cancellation of the mortgage debt. This process can be less stressful than a traditional foreclosure, providing a smoother transition for those in financial distress. However, several other documents serve similar purposes in the realm of real estate and debt resolution.

The Trader Joe's application form is a vital document for job seekers wishing to join this beloved grocery chain. It outlines necessary information about potential employees and provides an opportunity to showcase their unique skills and experience. Completing the form accurately can significantly increase the chances of landing a position at one of their stores. For more details, you can access the application form here: https://documentonline.org/blank-trader-joe-s-application.

One such document is the Short Sale Agreement. In a short sale, a homeowner sells their property for less than the amount owed on the mortgage, with the lender's approval. This agreement allows the homeowner to avoid foreclosure while still relieving them of their mortgage debt. Both the Deed in Lieu of Foreclosure and a Short Sale Agreement aim to provide a solution for distressed homeowners, but they differ in the method of debt resolution and the involvement of a buyer.

Another similar document is the Mortgage Modification Agreement. This agreement allows homeowners to renegotiate the terms of their existing mortgage, often resulting in lower monthly payments or a reduced interest rate. While the Deed in Lieu of Foreclosure involves surrendering the property, a Mortgage Modification Agreement keeps the homeowner in their home, providing a different pathway to financial stability.

The Loan Assumption Agreement is also comparable. In this scenario, a buyer takes over the seller's existing mortgage, assuming responsibility for the remaining debt. This can be beneficial for both parties, as it can help the seller avoid foreclosure while allowing the buyer to take advantage of potentially favorable loan terms. Like the Deed in Lieu, it facilitates a transfer of responsibility, but it involves a new party stepping in rather than a direct surrender to the lender.

The Forbearance Agreement is another important document. In this arrangement, a lender allows a borrower to temporarily pause or reduce their mortgage payments due to financial hardship. This can provide much-needed relief and time for the homeowner to recover financially. While the Deed in Lieu of Foreclosure results in the transfer of property, a Forbearance Agreement focuses on retaining ownership while addressing immediate financial concerns.

A Promissory Note is also relevant in this context. This document outlines the borrower's promise to repay a specified amount of money, often in connection with a mortgage. While it serves a different function, both the Promissory Note and the Deed in Lieu of Foreclosure deal with the obligations of the borrower and the lender. The Deed in Lieu represents a resolution of that obligation through property transfer.

The Release of Mortgage document is similar in that it signifies the end of a mortgage obligation. When a mortgage is paid off or settled, the lender issues a release, freeing the homeowner from further claims on the property. While the Deed in Lieu of Foreclosure results in the homeowner relinquishing the property, both documents ultimately aim to resolve the mortgage debt and clarify ownership status.

The Bankruptcy Filing can also be compared to the Deed in Lieu of Foreclosure. When a homeowner files for bankruptcy, they seek relief from debts, including mortgage obligations. This legal process can lead to foreclosure, but it may also allow for the retention of the home under certain circumstances. Both processes provide pathways for individuals facing financial difficulties, though they operate within different legal frameworks.

Lastly, the Property Settlement Agreement is relevant, especially in divorce situations. This document outlines the division of property and debts between parties. Similar to a Deed in Lieu of Foreclosure, it can facilitate a change in ownership and financial responsibilities. However, the Property Settlement Agreement typically occurs in the context of marital dissolution, while the Deed in Lieu focuses on resolving mortgage debt.

Check out Popular Deed in Lieu of Foreclosure Forms for Different States

California Voluntary Property Surrender Document - The deed in lieu can serve as a strategic move for homeowners looking to manage their debts effectively.

Deeds in Lieu of Foreclosure - The process typically requires both parties to agree to the terms outlined in the deed before it is finalized.

Understanding the intricacies of the California Independent Contractor Agreement is essential for both parties involved in freelance work. By clearly delineating the responsibilities and compensation, this form helps protect the interests of independent contractors and their clients, thereby mitigating potential disputes. For a comprehensive range of necessary documentation, refer to All California Forms, which can assist in ensuring all agreements are properly structured and legally compliant.

Deed in Lieu of Foreclosure Florida - Ultimately, a Deed in Lieu can provide a peaceful exit from a challenging homeownership situation.