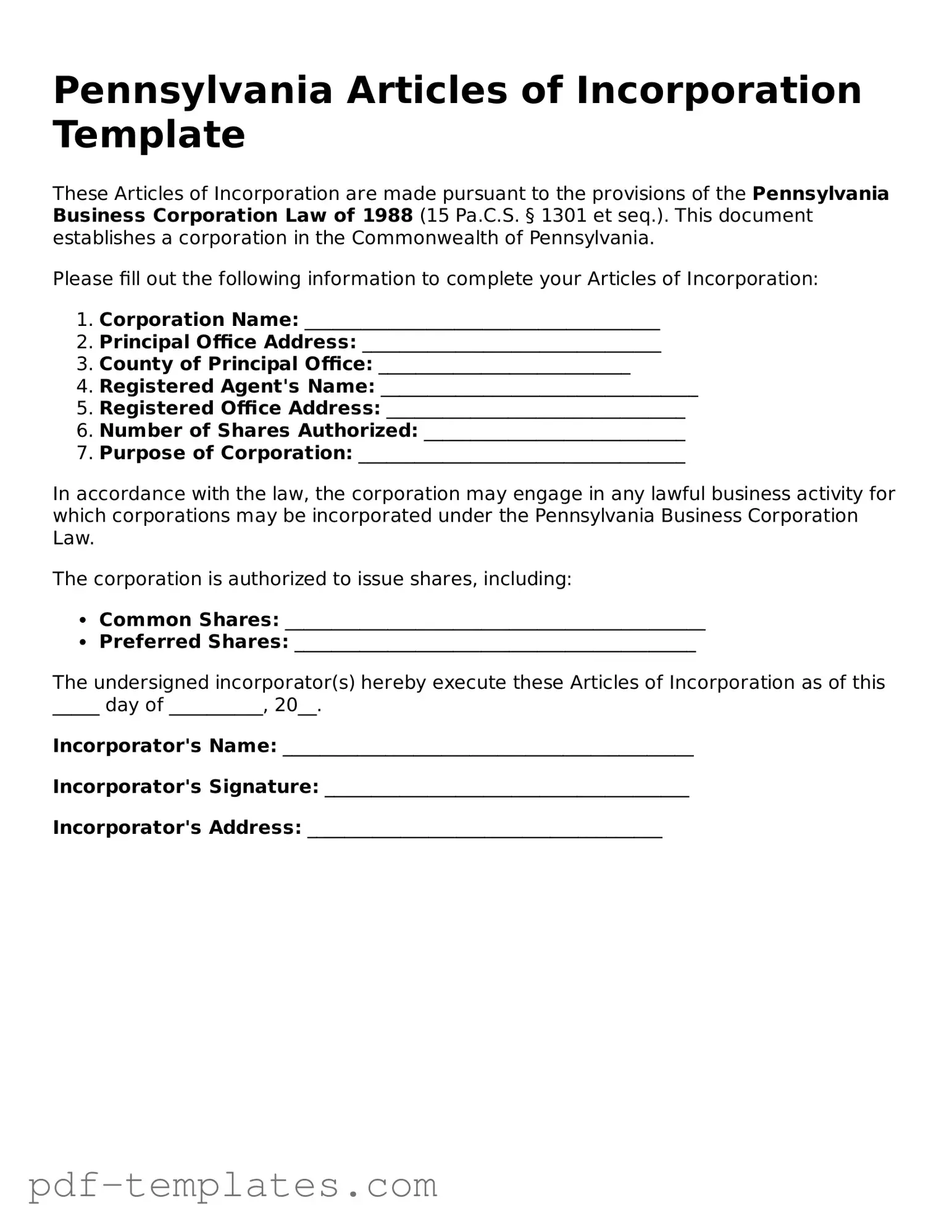

Official Articles of Incorporation Template for Pennsylvania State

The Pennsylvania Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in the state. This form serves as the foundational blueprint for a new business entity, outlining essential details such as the corporation's name, purpose, and the address of its registered office. It also requires information about the incorporators, who are the individuals responsible for filing the document. Additionally, the form may include provisions regarding the number of shares the corporation is authorized to issue, as well as any specific limitations or rights associated with those shares. Understanding the requirements and implications of this form is vital for ensuring compliance with state laws and for laying a solid groundwork for future business operations. Properly completing the Articles of Incorporation can help streamline the incorporation process, allowing entrepreneurs to focus on growing their businesses while adhering to legal standards.

Misconceptions

Understanding the Pennsylvania Articles of Incorporation is crucial for anyone looking to start a business in the state. However, several misconceptions can lead to confusion. Here’s a list of ten common misunderstandings:

- It’s only for large businesses. Many believe that only large corporations need to file Articles of Incorporation. In reality, any business entity, regardless of size, can benefit from incorporation.

- Filing is optional. Some think that filing Articles of Incorporation is optional for all businesses. This is not true; it is required for those who wish to form a corporation.

- It guarantees business success. Incorporating a business does not guarantee success. While it provides legal protections, success depends on various factors like management and market conditions.

- All states have the same requirements. Each state has unique requirements for Articles of Incorporation. Pennsylvania has specific forms and guidelines that must be followed.

- Only lawyers can file. While it’s advisable to seek legal advice, anyone can file the Articles of Incorporation. However, understanding the process is vital to avoid mistakes.

- Once filed, it cannot be changed. Many believe that Articles of Incorporation are set in stone. In fact, amendments can be made if changes are necessary.

- It’s the same as a business license. Articles of Incorporation and business licenses serve different purposes. Incorporation establishes a legal entity, while a business license allows you to operate.

- Filing is a quick process. Some expect the filing process to be immediate. However, it can take time for the state to process and approve the documents.

- Only for profit businesses. Non-profit organizations also need to file Articles of Incorporation in Pennsylvania. This process helps establish their legal status.

- Once incorporated, you never need to file again. Incorporation is not a one-time event. Annual reports and other filings are often required to maintain good standing.

Being aware of these misconceptions can help you navigate the incorporation process more effectively. Take the time to research and understand your obligations. This will set a strong foundation for your business.

Pennsylvania Articles of Incorporation: Usage Instruction

Once you have the Pennsylvania Articles of Incorporation form in hand, you will need to fill it out carefully. This document is essential for establishing your corporation in the state. After completing the form, you will submit it to the appropriate state office along with the required fee.

- Begin by entering the name of your corporation at the top of the form. Ensure that the name complies with Pennsylvania naming requirements.

- Provide the purpose of the corporation. Be clear and concise about what your business will do.

- List the registered office address. This must be a physical address in Pennsylvania, not a P.O. Box.

- Include the name and address of each incorporator. Incorporators are individuals responsible for setting up the corporation.

- Indicate the number of shares the corporation is authorized to issue. Specify the classes of shares, if applicable.

- Fill in any additional provisions if desired. This section allows for specific rules or regulations for your corporation.

- Sign and date the form. Ensure that the signature is from an authorized individual.

- Prepare the payment for the filing fee. Check the current fee amount and acceptable payment methods.

- Submit the completed form and payment to the Pennsylvania Department of State. You can do this by mail or online, depending on your preference.

Common mistakes

-

Incorrect Business Name: One of the most common mistakes is choosing a name that is already taken or too similar to an existing business. Always check the availability of your desired name through the Pennsylvania Department of State’s database.

-

Missing Registered Agent Information: Every corporation needs a registered agent. Failing to provide accurate details about the agent can lead to delays or rejection of your application.

-

Inaccurate Purpose Statement: The purpose of the corporation must be clearly defined. A vague or overly broad statement can cause confusion and may not meet state requirements.

-

Improper Filing Fees: Each type of corporation has a specific filing fee. Ensure you include the correct amount with your application to avoid processing delays.

-

Failure to Include All Directors: If your corporation has multiple directors, all must be listed on the form. Omitting any director can lead to complications in the approval process.

-

Not Specifying the Number of Shares: If your corporation plans to issue shares, you must specify the number and type. Leaving this blank can result in your application being returned.

-

Neglecting to Sign the Form: It may seem simple, but forgetting to sign the Articles of Incorporation can lead to rejection. Ensure that the form is signed by the appropriate person.

-

Inadequate Review Before Submission: Rushing through the form can lead to errors. Take the time to review your application thoroughly before submission to catch any mistakes.

PDF Features

| Fact Name | Details |

|---|---|

| Governing Law | The Pennsylvania Articles of Incorporation are governed by the Pennsylvania Business Corporation Law of 1988. |

| Purpose | This form is used to legally establish a corporation in Pennsylvania. |

| Filing Requirement | Articles of Incorporation must be filed with the Pennsylvania Department of State. |

| Information Required | The form typically requires the corporation's name, registered office address, and details about the incorporators. |

| Corporate Name | The name of the corporation must be unique and not similar to existing entities in Pennsylvania. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Filing Fee | There is a filing fee associated with submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Effective Date | The Articles of Incorporation can specify an effective date, which can be the date of filing or a future date. |

| Public Record | Once filed, the Articles of Incorporation become part of the public record and are accessible to the public. |

| Amendments | Changes to the Articles of Incorporation can be made through a formal amendment process as outlined in the law. |

Dos and Don'ts

When filling out the Pennsylvania Articles of Incorporation form, it’s important to follow certain guidelines to ensure your submission is successful. Here are some dos and don'ts to keep in mind:

- Do provide accurate information about your business name and address.

- Do include the names and addresses of the initial directors.

- Do specify the purpose of your corporation clearly.

- Do check for any additional requirements specific to your business type.

- Don't leave any sections blank; incomplete forms can cause delays.

- Don't forget to sign and date the form before submission.

- Don't submit the form without reviewing it for errors or typos.

By following these guidelines, you can help ensure that your Articles of Incorporation are processed smoothly and efficiently.

Similar forms

The Articles of Incorporation form in Pennsylvania is similar to the Certificate of Incorporation used in Delaware. Both documents serve as the foundational legal paperwork needed to establish a corporation. They outline essential details such as the corporation's name, purpose, and registered agent. The Delaware Certificate of Incorporation is often favored for its business-friendly laws, but both documents ultimately achieve the same goal: to formally create a legal entity recognized by the state.

Another document that shares similarities with the Articles of Incorporation is the Bylaws of a corporation. While the Articles of Incorporation establish the corporation's existence, the Bylaws provide the internal rules that govern its operations. These rules cover aspects such as the roles and responsibilities of directors and officers, how meetings are conducted, and how decisions are made. Both documents are crucial for the smooth functioning of a corporation, but they serve different purposes.

The Operating Agreement used in Limited Liability Companies (LLCs) is akin to the Articles of Incorporation in that it lays out the structure and governance of the LLC. Like the Articles, the Operating Agreement outlines the members' roles, management structure, and operational procedures. While the Articles of Incorporation are specific to corporations, the Operating Agreement fulfills a similar function for LLCs, detailing how the entity will operate and what rules will apply.

The Partnership Agreement is another document that shares common ground with the Articles of Incorporation. This agreement governs the relationship between partners in a partnership, outlining each partner's contributions, responsibilities, and profit-sharing arrangements. Like the Articles, it serves to formalize the structure of the business, ensuring that all parties understand their roles and obligations. Both documents are vital for establishing clear guidelines and expectations among stakeholders.

The Certificate of Formation is a document required for creating a nonprofit organization. Similar to the Articles of Incorporation, it establishes the organization as a legal entity and includes information such as the nonprofit's name, purpose, and registered agent. Both documents aim to provide legal recognition and structure, but the Certificate of Formation is tailored specifically for nonprofits, focusing on their charitable or public benefit missions.

The Statement of Information is a document that corporations must file periodically, similar to the ongoing obligations that follow the initial filing of the Articles of Incorporation. This statement updates the state on key information about the corporation, such as its address, officers, and registered agent. While the Articles of Incorporation are a one-time filing that establishes the corporation, the Statement of Information serves as a way to keep the state informed about changes over time.

The USCIS I-864 form is an essential component in navigating the immigration process, particularly for those seeking permanent residency. It acts as a financial assurance from the sponsor, ensuring the immigrant won't rely on government support. For more information about filling out this vital document, you can refer to documentonline.org/blank-uscis-i-864, which provides detailed guidance on its requirements and implications.

Finally, the Application for Authority to Transact Business is relevant for corporations that wish to operate in a state other than where they were incorporated. This document is similar to the Articles of Incorporation in that it provides the necessary information for the state to recognize the corporation's legal status. Both documents ensure that the corporation complies with state regulations, whether it is establishing itself or expanding into new territories.

Check out Popular Articles of Incorporation Forms for Different States

Florida Incorporation - Incorporation may shield owners from certain debts incurred by the business.

Articles of Organization Washington State - In many cases, the articles detail the number of authorized shares of stock.

To ensure compliance with state regulations, individuals involved in traffic accidents must be aware of the necessity to file the CA DMV SR1 form. This document is essential for reporting incidents that result in personal injury, death, or significant property damage. Timely submission is paramount to maintaining driving privileges, and for those in California seeking additional information, they can refer to All California Forms.

Form California Llc - Outlines the business's intended activities or goals.

Scc Documents - You must file this form with the state where you plan to incorporate.