Get Payroll Check Form in PDF

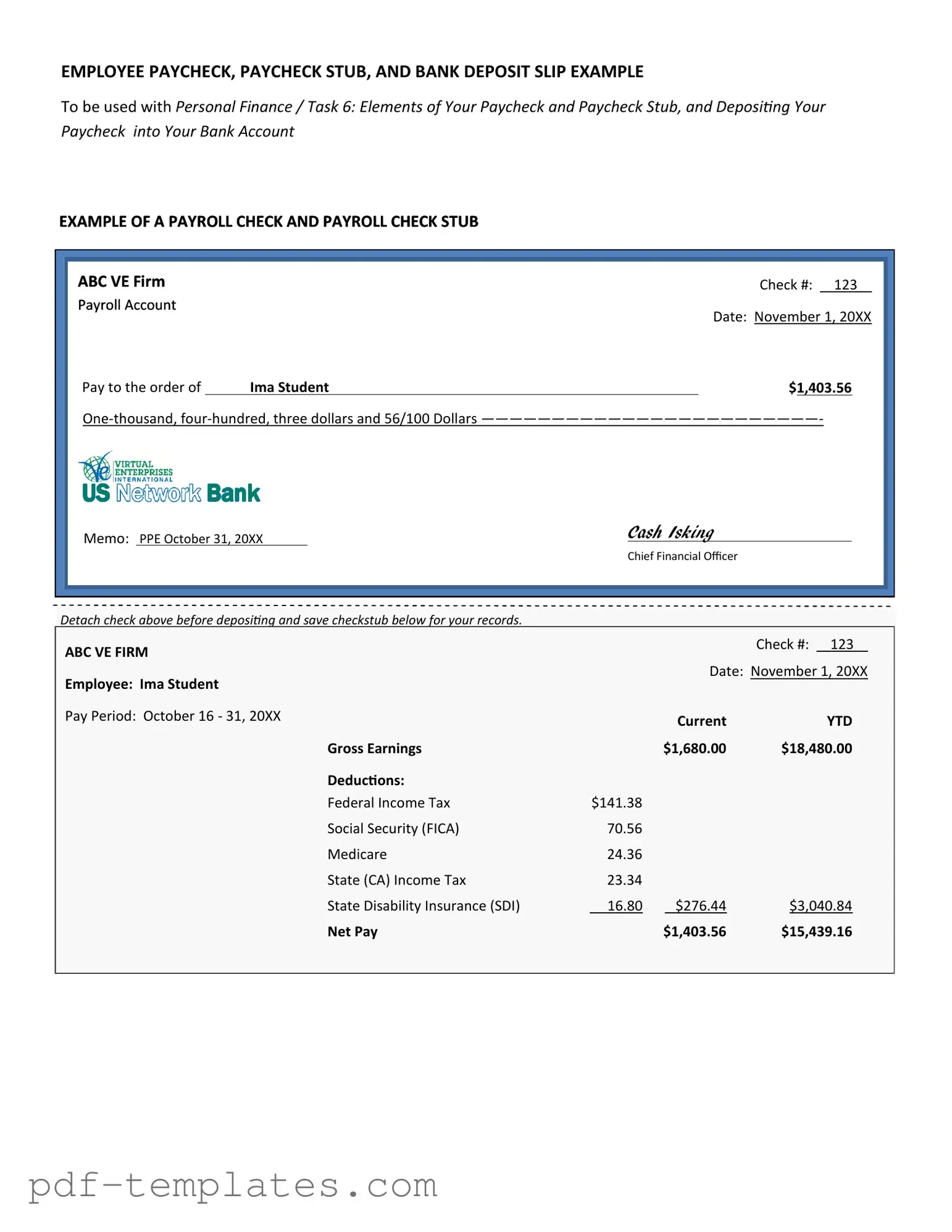

The Payroll Check form is an essential document in the realm of employee compensation, serving as a formal record of wages paid to employees for their work. This form typically includes critical information such as the employee's name, identification number, and payment period, ensuring clarity and accuracy in payroll processing. Additionally, it outlines the gross pay, deductions for taxes and benefits, and the net amount the employee receives. Employers must complete this form meticulously to comply with labor laws and maintain transparent financial practices. Each entry on the Payroll Check form plays a significant role in both the employer's accounting records and the employee's financial documentation. Understanding its components can help ensure that employees are compensated fairly and that employers fulfill their legal obligations. Proper management of this form contributes to a smooth payroll process and fosters trust between employers and employees.

Misconceptions

Understanding the Payroll Check form is crucial for both employers and employees. However, several misconceptions can lead to confusion. Here are seven common misconceptions explained:

-

Payroll Check forms are only for full-time employees.

This is not true. Payroll Check forms apply to all employees, whether they are part-time, full-time, or temporary. Every worker who receives payment through payroll should have a Payroll Check form on file.

-

Once submitted, the Payroll Check form never needs to be updated.

In reality, any changes in personal information, such as a change of address or marital status, require an updated Payroll Check form. Keeping this information current is essential for accurate tax withholding and benefits.

-

The Payroll Check form only affects payment amounts.

This misconception overlooks the fact that the form also influences tax deductions, benefits eligibility, and retirement contributions. All these factors are tied to the information provided on the form.

-

Employers do not need to keep copies of Payroll Check forms.

On the contrary, employers are required to maintain records of these forms for auditing and compliance purposes. This helps ensure that all employees are paid correctly and that tax obligations are met.

-

Payroll Check forms are the same across all companies.

This is a misconception. Different companies may have unique formats or requirements for their Payroll Check forms, depending on their payroll systems and policies.

-

Employees can ignore the Payroll Check form if they are on direct deposit.

This is incorrect. Even if an employee opts for direct deposit, they must still complete a Payroll Check form. This ensures that the employer has the necessary information for processing payments accurately.

-

Filling out the Payroll Check form is a one-time task.

Many believe that once they fill out the form, they never need to revisit it. However, it’s important to review and update the form periodically, especially during tax season or when personal circumstances change.

Addressing these misconceptions can lead to better understanding and management of payroll processes, ensuring that both employers and employees are on the same page.

Payroll Check: Usage Instruction

Filling out the Payroll Check form is an important task that ensures employees receive their wages accurately. Following these steps carefully will help you complete the form correctly.

- Begin by entering the date on the top right corner of the form. This should reflect the date the check is being issued.

- Next, write the employee's name on the line provided. Ensure that the spelling is correct to avoid any issues with payment.

- In the designated area, input the employee's address. Include the street address, city, state, and ZIP code.

- Enter the amount to be paid in both numbers and words. This is crucial for clarity and to prevent any misunderstandings.

- Fill in the pay period dates. This indicates the start and end of the period for which the employee is being paid.

- Provide any necessary deductions or withholdings that apply to the employee. This could include taxes or benefits.

- Finally, sign the form in the designated area to authorize the payment.

Common mistakes

-

Incorrect Employee Information: Filling out the form with the wrong name, address, or Social Security number can lead to significant issues, including delays in payment.

-

Wrong Pay Rate: Entering an incorrect hourly wage or salary can result in underpayment or overpayment, both of which can complicate payroll records.

-

Missing Hours Worked: Failing to accurately report the number of hours worked during the pay period can lead to errors in compensation.

-

Neglecting Overtime Calculation: Not calculating overtime hours correctly can result in violations of labor laws and employee dissatisfaction.

-

Ignoring Deductions: Overlooking necessary deductions, such as taxes or benefits, can cause issues with compliance and employee paychecks.

-

Failure to Sign: Not signing the form can render it invalid, delaying the payroll process and payments.

-

Using Incorrect Pay Period Dates: Entering the wrong dates for the pay period can confuse payroll processing and lead to payment errors.

-

Not Keeping Copies: Failing to keep a copy of the submitted form can make it difficult to resolve disputes or track payroll history.

-

Inconsistent Formatting: Using inconsistent or unclear formatting can lead to misunderstandings and errors in processing the payroll check.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Payroll Check form is used to disburse wages to employees for their work during a specified pay period. |

| Components | The form typically includes employee details, pay period dates, gross pay, deductions, and net pay. |

| Legal Requirement | Employers must provide a payroll check or an equivalent pay stub as mandated by state labor laws. |

| State-Specific Laws | Each state has its own regulations governing payroll checks. For example, California requires itemized statements of deductions. |

| Frequency of Payment | Employers must adhere to state laws regarding the frequency of payroll, such as weekly, bi-weekly, or monthly payments. |

| Tax Deductions | Federal and state taxes must be withheld from employee wages as specified by IRS guidelines and state tax laws. |

| Record Keeping | Employers are required to keep payroll records for a specific period, typically three to seven years, depending on state laws. |

Dos and Don'ts

When filling out the Payroll Check form, it is important to follow certain guidelines to ensure accuracy and compliance. Below are some dos and don'ts to consider:

- Do double-check all employee information for accuracy.

- Do ensure that the payment amount is correct and matches the agreed-upon salary or wages.

- Do use clear and legible handwriting or type the information to avoid confusion.

- Do keep a copy of the completed form for your records.

- Do submit the form before the payroll deadline to ensure timely processing.

- Don't leave any required fields blank.

- Don't use abbreviations or shorthand that may not be understood by others.

- Don't forget to sign and date the form where required.

- Don't alter any pre-printed information on the form without proper authorization.

Similar forms

The Payroll Check form serves a critical function in the payment process for employees. It is similar to the Pay Stub, which provides a detailed breakdown of an employee's earnings for a specific pay period. The Pay Stub typically includes information such as gross wages, deductions for taxes and benefits, and net pay. Both documents serve as proof of payment and help employees understand their compensation, making them essential for financial planning and tax purposes.

Another document akin to the Payroll Check form is the Direct Deposit Authorization form. This document allows employees to authorize their employer to deposit their wages directly into their bank accounts. Like the Payroll Check, it ensures that employees receive their earnings securely and efficiently. Both forms require accurate banking information and employee consent, emphasizing the importance of proper documentation in the payroll process.

The W-2 form is also comparable to the Payroll Check form. Issued annually, the W-2 summarizes an employee's total earnings and tax withholdings for the year. While the Payroll Check provides details for each pay period, the W-2 serves as a comprehensive record for tax reporting. Both documents are crucial for employees to understand their income and tax obligations, reinforcing the need for accurate payroll records.

In addition, the Employee Time Sheet shares similarities with the Payroll Check form. This document records the hours worked by an employee during a pay period, which is essential for calculating wages. The time sheet, like the Payroll Check, must be meticulously completed to ensure accurate compensation. Both documents are integral to the payroll process, as they directly influence the amounts reflected in payroll checks.

The Payroll Register is another document that parallels the Payroll Check form. This internal record summarizes all payroll transactions for a specific period, including gross pay, deductions, and net pay for each employee. While the Payroll Check is issued to individual employees, the Payroll Register provides a broader overview for the employer, aiding in financial reporting and budgeting. Both documents are vital for maintaining accurate payroll records.

Additionally, the Employment Contract can be viewed as similar to the Payroll Check form. This document outlines the terms of employment, including salary and payment frequency. While the Payroll Check reflects the actual payment made to the employee, the Employment Contract sets the foundation for those payments. Both documents are essential for establishing the employer-employee relationship and ensuring that both parties understand their rights and obligations.

For those navigating the complexities of child care, understanding the importance of the temporary Power of Attorney for a Child arrangement can alleviate concerns during unexpected situations. This document empowers designated adults to act on behalf of a child, offering peace of mind in critical moments.

Lastly, the Tax Withholding Form (such as the W-4) is comparable to the Payroll Check form. This form allows employees to indicate their tax withholding preferences, which directly affects the amount of taxes deducted from their paychecks. Both documents play a crucial role in the payroll process, as they ensure that employees receive the correct net pay while complying with tax regulations. Understanding these forms helps employees manage their finances effectively.

Other PDF Forms

Puppy Health Record - This form includes space for notes on examinations and health observations.

To ensure compliance with state regulations, beauty professionals must be vigilant about completing the Cosmetology License Renewal California form. This essential document not only involves providing detailed personal information and paying requisite fees but also requires an affirmation of the information's accuracy. Submission of this form with the appropriate fee is critical to avoid the pitfalls of working with an expired license, which can lead to legal complications. For a comprehensive guide, professionals can refer to All California Forms.

Dollar Sheet Fundraiser - Join the movement with just a dollar donation!