Partial Release of Lien Document

The Partial Release of Lien form is an essential document in the construction and real estate industries, serving to clarify the financial relationships between parties involved in a project. This form allows a contractor, subcontractor, or supplier to release a portion of their lien rights on a property, typically after receiving payment for specific work completed or materials supplied. By filing this form, the lien claimant acknowledges that they have been compensated for the agreed-upon services or goods, which helps to ensure that the property owner can proceed with future financing or sales without the burden of outstanding claims. It also protects the interests of both the property owner and the lien claimant, fostering trust and transparency in the transaction. Additionally, the Partial Release of Lien can help streamline the payment process and mitigate disputes, as it provides clear documentation of the amounts paid and the remaining obligations. Understanding this form is crucial for anyone involved in property development, construction management, or real estate transactions, as it plays a vital role in maintaining good business relationships and ensuring compliance with state laws.

Misconceptions

The Partial Release of Lien form can be confusing. Here are four common misconceptions about it:

-

It only applies to contractors.

This form is not limited to contractors. Any party involved in a construction project, including subcontractors and suppliers, can use it to release their claim on a portion of the property.

-

It eliminates the entire lien.

A partial release does not remove the entire lien. It only releases a specific portion of the claim, allowing the property owner to pay for completed work while still protecting the lien rights for the remaining amount.

-

It must be filed immediately after payment.

While it's good practice to file the form promptly after receiving payment, there is no strict requirement to do so immediately. However, delays could complicate matters if disputes arise later.

-

It's not legally binding.

The Partial Release of Lien form is a legally binding document once executed. It serves as proof that a specific portion of the lien has been released, which can be important for both parties involved.

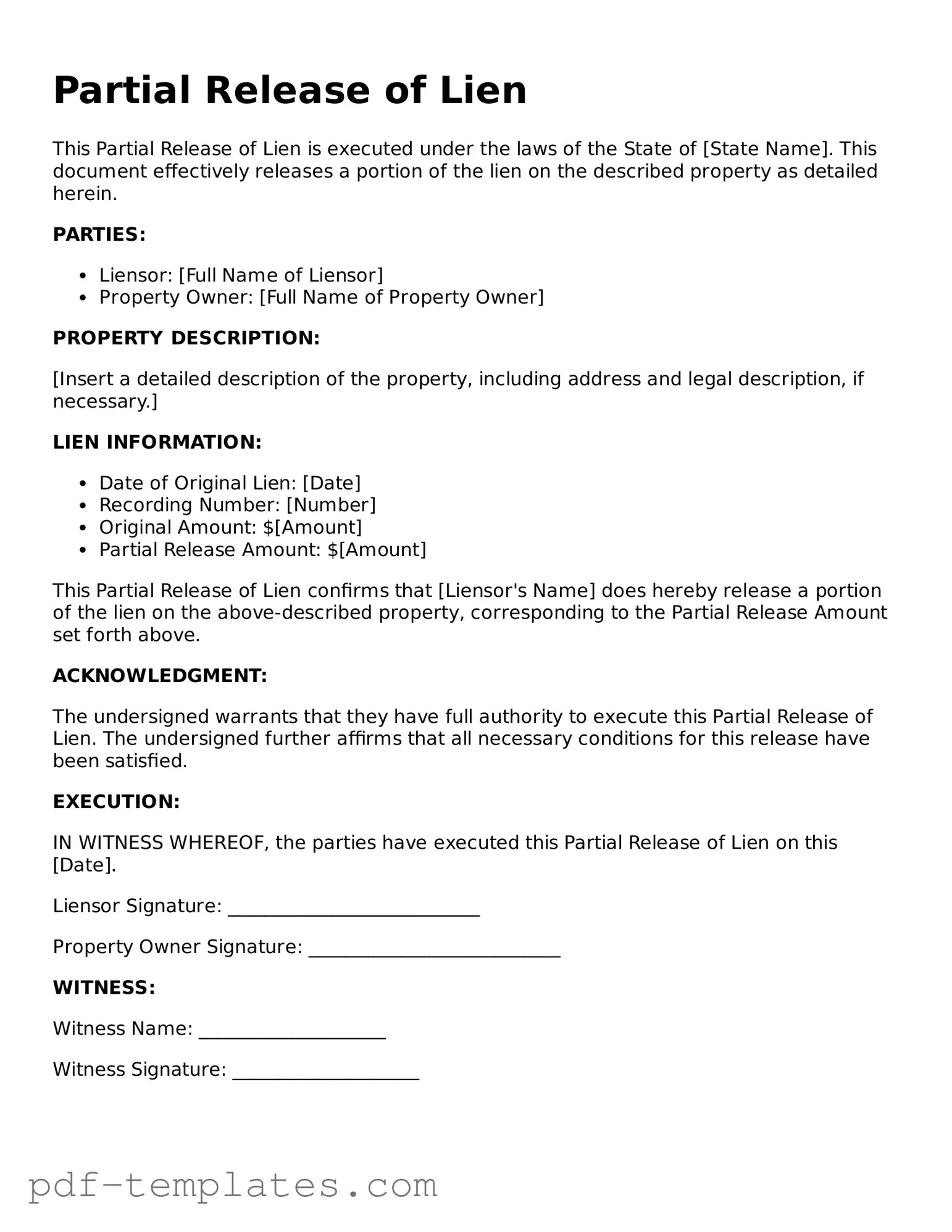

Partial Release of Lien: Usage Instruction

After you have gathered all necessary information, you can begin filling out the Partial Release of Lien form. This document is important for formally releasing a portion of a lien on a property. Ensure you have the correct details ready to avoid any delays.

- Start by entering the name of the lien claimant at the top of the form.

- Provide the address of the lien claimant, including the city, state, and zip code.

- Next, write the name of the property owner or the individual who is responsible for the lien.

- Fill in the address of the property owner, including the city, state, and zip code.

- Identify the property that the lien pertains to by including the legal description or the address of the property.

- Indicate the specific amount being released from the lien.

- Include the date when the lien was originally recorded.

- Sign the form where indicated. Ensure that the signature is dated.

- If required, have the form notarized by a licensed notary public.

Once you have completed the form, review it carefully for any errors. After confirming all information is accurate, submit the form according to local regulations. This may involve filing it with a county clerk or another relevant authority. Keep a copy for your records.

Common mistakes

-

Incorrect Property Description: One common mistake is providing an inaccurate or incomplete description of the property. It’s essential to include the correct address and any relevant legal descriptions to ensure the lien is properly released.

-

Missing Signatures: Failing to obtain all necessary signatures can lead to delays. All parties involved must sign the form, and missing a signature could render the document invalid.

-

Not Including the Correct Amount: When specifying the amount being released, individuals sometimes miscalculate or omit this detail. It’s crucial to accurately state the amount to avoid confusion or disputes later on.

-

Improper Notarization: Some individuals overlook the notarization requirement. A notary public must witness the signing of the document to validate it, and failure to do so can lead to issues with acceptance.

-

Filing in the Wrong Jurisdiction: Submitting the Partial Release of Lien form in the wrong jurisdiction is another frequent error. It’s important to file in the appropriate county or state office to ensure the release is officially recognized.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Partial Release of Lien form is a legal document that removes a portion of a lien from a property, typically after a partial payment has been made. |

| Purpose | This form is used to acknowledge that a specified amount of the debt has been satisfied, thereby releasing the lien on that portion of the property. |

| State-Specific Forms | Each state may have its own version of the Partial Release of Lien form, reflecting local laws and requirements. |

| Governing Laws | In many states, the Uniform Commercial Code (UCC) governs the release of liens, but specific statutes may vary by state. |

| Filing Requirements | To be effective, the form must typically be signed by the lienholder and may need to be notarized before being filed with the appropriate county office. |

| Impact on Credit | Filing a Partial Release of Lien can positively impact the property owner's credit by reducing the overall debt associated with the property. |

| Potential Fees | Some jurisdictions may require a filing fee when submitting the Partial Release of Lien, which can vary significantly. |

| Legal Advice | It is often advisable to consult with a legal professional before completing and filing this form to ensure compliance with local laws. |

| Consequences of Non-Compliance | If the form is not properly filed or executed, the lien may remain in effect, potentially causing complications for the property owner. |

Dos and Don'ts

When filling out a Partial Release of Lien form, it is essential to approach the task with care and attention to detail. Here are nine important dos and don'ts to consider:

- Do ensure that all parties involved are correctly identified on the form.

- Do provide accurate descriptions of the property affected by the lien.

- Do include the correct amount being released from the lien.

- Do review the form for any errors or omissions before submitting.

- Do sign and date the form in the appropriate sections.

- Don't leave any fields blank unless specifically instructed to do so.

- Don't use ambiguous language that could lead to misunderstandings.

- Don't forget to check local regulations that may affect the form's requirements.

- Don't submit the form without making copies for your records.

Similar forms

The Partial Release of Lien form is similar to a Full Release of Lien, which serves to formally remove a lien from a property. In a Full Release, the lien claimant acknowledges that they have received full payment for the debt owed and relinquishes all rights to the property. This document provides the property owner with clear title, ensuring that no claims remain against the property. Both forms are crucial in real estate transactions, as they help clarify the status of any financial claims against the property, allowing for smoother sales and transfers.

In the context of managing various claims and financial responsibilities associated with property, it is essential to have reliable documentation, such as the Vehicle Accident Damage Release form. This form plays a crucial role in settling claims arising from auto accidents, serving as a legal acknowledgment of agreed compensation and freeing the payer from further liabilities. For further information and templates regarding such documents, visit TopTemplates.info.

Another document that resembles the Partial Release of Lien is the Lien Waiver. A Lien Waiver is often used in construction projects to confirm that a contractor or subcontractor has received payment for work completed. By signing this document, the contractor agrees not to place a lien on the property for the amount paid. While a Lien Waiver is typically issued upon payment, a Partial Release of Lien specifically addresses the release of a portion of the lien, making it clear that some obligations remain. Both documents aim to protect property owners and facilitate financial transactions in the construction industry.

The Notice of Intent to Lien also shares similarities with the Partial Release of Lien. This document serves as a warning to property owners that a lien may be placed if payment is not made. It informs the property owner of the outstanding debt and gives them an opportunity to settle the matter before a lien is officially recorded. While the Partial Release of Lien indicates that a portion of the lien has been released, the Notice of Intent to Lien is more about notifying the owner of potential legal action. Both documents are essential in managing financial obligations related to property ownership.

Lastly, the Satisfaction of Mortgage document is akin to the Partial Release of Lien. When a mortgage is paid off, the lender issues a Satisfaction of Mortgage, confirming that the debt has been fully satisfied and releasing the lien on the property. This document is vital for homeowners, as it signifies that they own their property free and clear. In contrast, a Partial Release of Lien indicates that only part of a lien has been removed, often in cases where multiple payments have been made. Both documents play a significant role in ensuring that property titles are clear and free of encumbrances.

Additional Types of Partial Release of Lien Templates:

Dmv Title - This document serves to minimize misunderstandings about vehicle maintenance during the loan period.

The Vehicle Release of Liability form is a legal document that protects vehicle owners from claims or damages that may arise after transferring ownership of a vehicle. This form clarifies that the new owner assumes all risks associated with the vehicle. It is crucial to complete this form accurately to avoid any potential disputes in the future, and you can find a template at documentonline.org/blank-vehicle-release-of-liability.

Waiver Liability Form - Can vary widely in length and detail depending on the activity.