Get P 45 It Form in PDF

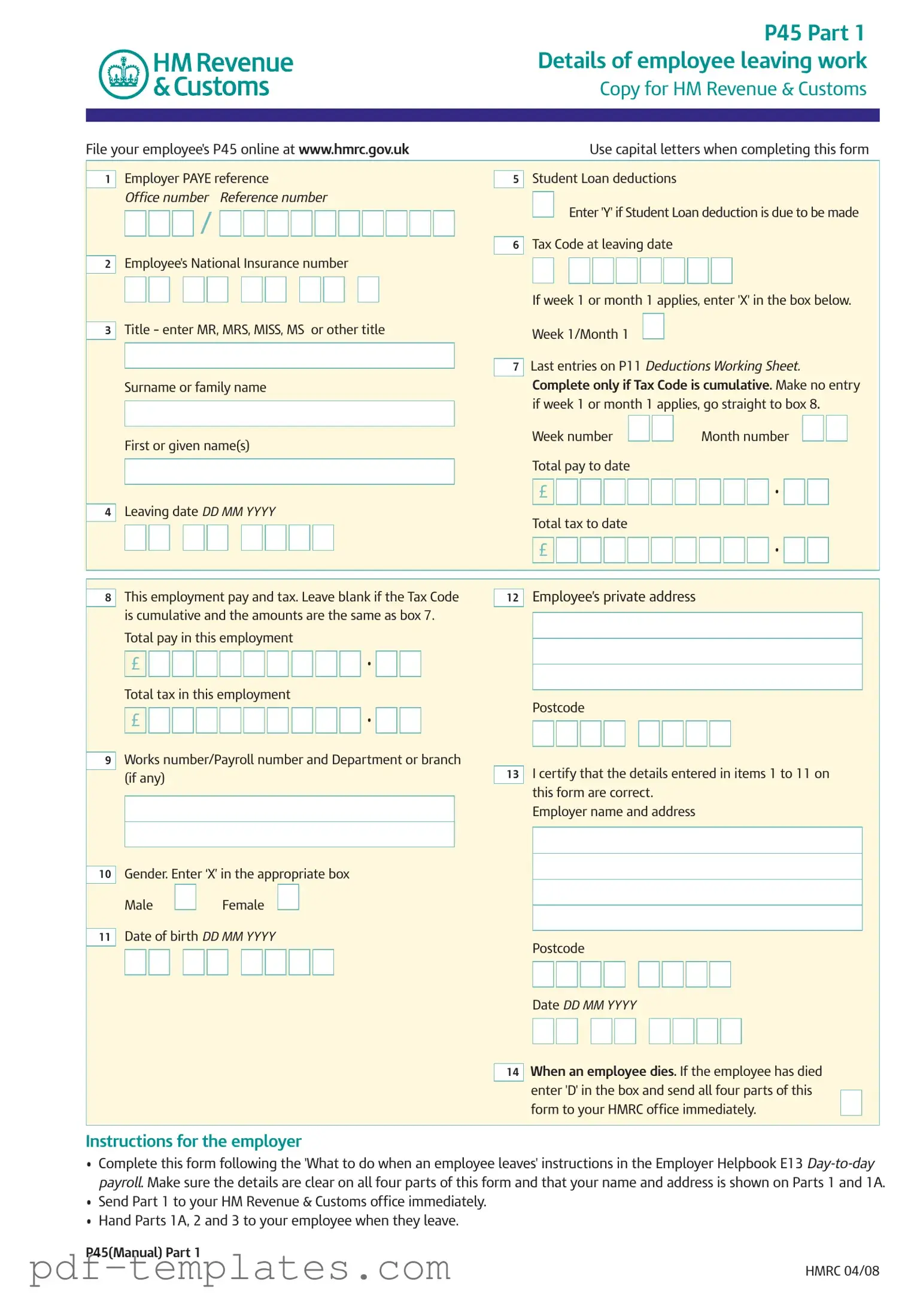

The P45 It form plays a crucial role in the employment landscape of the United Kingdom, particularly when an employee leaves a job. This form is divided into three parts, each serving distinct purposes for the employer, employee, and new employer. Part 1 contains essential details about the employee's departure, including their National Insurance number, tax code, and total pay and tax to date. Employers must complete this section accurately and send it to HM Revenue & Customs (HMRC) promptly. Part 1A is intended for the employee, who should keep it safe for future reference, especially when filing a tax return or if they need to claim benefits. Part 2 is designed for the new employer, who must ensure that they receive the necessary information to process payroll correctly and avoid any tax complications. Additionally, the form includes specific instructions regarding student loan deductions and provides guidance for employees who may be transitioning to new roles or claiming benefits. Understanding the P45 It form is essential for all parties involved, as it helps facilitate a smooth transition during employment changes.

Misconceptions

- Misconception 1: The P45 form is only for employees who quit their jobs.

- Misconception 2: The P45 is not important for new employment.

- Misconception 3: I can obtain a replacement P45 if I lose it.

- Misconception 4: The P45 form is only relevant for tax purposes.

- Misconception 5: I don’t need to worry about the P45 if I’m self-employed.

- Misconception 6: The P45 only needs to be filled out by the employer.

- Misconception 7: The P45 is a one-time document and does not need to be kept after employment ends.

This is not true. The P45 is issued when an employee leaves a job for any reason, including resignation, redundancy, or even termination. It is a crucial document regardless of the circumstances surrounding the departure.

In reality, the P45 is vital for your new employer. It contains important tax information that helps them determine the correct amount of tax to deduct from your pay. Without it, you may end up paying too much tax initially.

Unfortunately, if you lose your P45, you cannot get a replacement. The form is issued only once, and it is essential to keep it safe. If you misplace it, you may need to provide your new employer with a different form of tax information.

While the P45 is primarily a tax document, it also plays a role in other benefits, such as Jobseeker's Allowance. If you are unemployed and wish to claim benefits, the P45 will be necessary for your application.

This is misleading. If you transition from being employed to self-employed, you still need to be aware of your tax responsibilities. The P45 will help you understand your tax situation when making this change.

While the employer is responsible for completing the P45, employees must also provide accurate information. This includes personal details and tax codes, ensuring that everything is correct before submission.

This is a common misunderstanding. You should keep your P45 for your records, as it may be required for future tax returns or claims. It is wise to store it safely along with other important documents.

P 45 It: Usage Instruction

Filling out the P45 form is essential when an employee leaves a job. This form must be completed accurately to ensure proper tax records are maintained. Below are the steps to fill out the P45 form.

- Begin with the Employer PAYE reference. Enter your unique reference number.

- Fill in the Office number and Reference number.

- Provide the Employee's National Insurance number.

- In the Title section, enter MR, MRS, MISS, MS, or another title.

- Input the Surname or family name of the employee.

- Enter the First or given name(s).

- Specify the Leaving date in the format DD MM YYYY.

- Indicate if Student Loan deductions apply by entering 'Y' if applicable.

- If the Tax Code at the leaving date is week 1 or month 1, mark 'X' in the box.

- Complete the Week number and Month number if applicable.

- Provide the Total pay to date and Total tax to date in the respective fields.

- Fill in the Employee’s private address and Postcode.

- Enter the Works number/Payroll number and Department or branch if applicable.

- Certify the details by signing and dating the form.

After completing the P45 form, it is crucial to distribute the parts correctly. Send Part 1 to HM Revenue & Customs immediately. Provide Parts 1A, 2, and 3 to the employee. These steps ensure compliance with tax regulations and maintain accurate records for both the employer and employee.

Common mistakes

-

Incorrectly Filling Out Personal Information: Many individuals forget to enter their full name, leaving out either the first name or surname. This can lead to confusion when processing the form.

-

Failing to Use Capital Letters: The instructions clearly state to use capital letters when completing the form. Neglecting this requirement can cause issues with legibility and processing.

-

Not Indicating Week 1 or Month 1: If the employee's pay is calculated on a week 1 or month 1 basis, the form must reflect this by entering an 'X' in the appropriate box. Omitting this detail can result in incorrect tax calculations.

-

Leaving Out the Tax Code: It is essential to include the tax code at the time of leaving. Failing to do so may lead to complications for both the employee and the new employer.

-

Not Certifying the Details: The form requires a certification that the details entered are correct. Skipping this step can lead to delays or rejection of the form.

File Specifics

| Fact Name | Details |

|---|---|

| Purpose of P45 | The P45 form is used to document an employee's tax information when they leave a job. It helps ensure that the correct tax is deducted in future employment. |

| Parts of the Form | The P45 consists of three parts: Part 1 for HM Revenue & Customs, Part 1A for the employee, and Parts 2 and 3 for the new employer. |

| Filing Requirements | Employers must send Part 1 to HM Revenue & Customs immediately after an employee leaves. Parts 1A, 2, and 3 are to be given to the employee and the new employer. |

| Information Required | Essential details include the employee's National Insurance number, leaving date, total pay, and total tax to date. Accurate completion is crucial. |

| Student Loan Deductions | If applicable, employers must indicate if student loan deductions are due. This ensures proper handling of the employee's financial obligations. |

| Tax Code Information | The form includes a section for the employee's tax code at the leaving date. This information is important for determining future tax deductions. |

| Legal Compliance | The P45 must be completed in accordance with UK tax laws and regulations. Employers should refer to the Employer Helpbook E13 for guidance. |

Dos and Don'ts

When filling out the P45 form, attention to detail is crucial. Below are some guidelines to follow and to avoid:

- Do use capital letters when completing the form to ensure clarity.

- Do double-check the employee's National Insurance number for accuracy.

- Do ensure that all relevant sections are completed, particularly regarding tax codes and student loan deductions.

- Do file the P45 online promptly to ensure compliance with HM Revenue & Customs.

- Don't leave any sections blank unless specifically instructed to do so.

- Don't forget to include the employer's PAYE reference; this is essential for processing.

- Don't make assumptions about tax codes; always verify whether they are cumulative or not.

- Don't delay in sending the completed form to the appropriate HMRC office.

Similar forms

The P60 form is a document that summarizes an employee's total pay and deductions for the tax year. It is issued by employers at the end of the tax year, unlike the P45, which is provided when an employee leaves a job. Both forms serve to inform employees about their earnings and tax contributions, but the P60 covers the entire year while the P45 focuses on the period of employment that has just ended. Employees use the P60 for tax returns and to verify their income for various purposes, making it an essential document for financial record-keeping.

To ensure a smooth transfer of property, utilizing the appropriate legal documents is essential; one such tool is the Quitclaim Deed. This document, particularly in California, is designed to clarify ownership and address title issues without the warranties that come with other types of deeds. For those interested in more details, you can refer to the resource available at https://formcalifornia.com/, which provides valuable information on how to properly manage property transfers.

The P11D form is used to report expenses and benefits provided to employees by their employer. Similar to the P45, it is related to an employee's tax situation but focuses specifically on non-cash benefits, such as company cars or health insurance. Employers must submit the P11D to HM Revenue & Customs (HMRC) annually, detailing the taxable benefits provided to each employee. Both forms are crucial for tax calculations, but while the P45 indicates what an employee earned and paid in tax upon leaving, the P11D outlines additional benefits that may affect their overall tax liability.

The P60U form serves a similar purpose to the P60 but is specifically for employees who have been paid under the PAYE system but do not receive a P60 because they have not been employed for the full tax year. This document helps those individuals consolidate their tax information for the year. Like the P45, it is important for tax purposes, as it provides a summary of earnings and taxes paid, enabling employees to claim refunds or adjust their tax situations appropriately.

The P85 form is used when an individual leaves the UK to live or work abroad. It allows them to claim a tax refund if they have overpaid taxes during their time in the UK. Similar to the P45, the P85 is concerned with tax implications upon leaving a job, but it specifically addresses international moves. Both forms are critical for ensuring that individuals manage their tax responsibilities correctly, whether they are transitioning to a new job within the UK or relocating overseas.

The P50 form is used to claim a tax refund when someone stops working and has paid too much tax. This form is similar to the P45 in that it addresses tax matters related to employment cessation. While the P45 provides details about the employment that has ended, the P50 is a request for a refund based on the tax paid during that employment. Both documents are essential for individuals who need to reconcile their tax payments after leaving a job.

The P2 form is a notice of coding issued by HMRC that informs employees about their tax code and how it affects their pay. It is similar to the P45 in that both documents relate to an individual's tax status. The P2 provides essential information that can impact how much tax is deducted from an employee's earnings, while the P45 summarizes what has already been earned and taxed. Both are crucial for understanding tax obligations and ensuring accurate payroll processing.

The P14 form is now obsolete but was previously used to report an employee's earnings and deductions to HMRC at the end of the tax year. It served a similar function to the P60 and P45, providing a summary of earnings and taxes paid. Although it is no longer in use, the P14 was important for employees to understand their tax position, much like the P45, which details earnings and tax contributions upon leaving a job.

The P46 form is used by employers when they take on new employees who do not have a P45. This document helps employers determine the correct tax code for the new employee. Similar to the P45, which is used when an employee leaves a job, the P46 assists in managing tax responsibilities but focuses on new hires. Both forms are essential for ensuring that tax deductions are accurate and reflect the employee's current situation.

Other PDF Forms

Minor Incident Report - Attach relevant health and safety regulations cited.

In order to facilitate the process of appointing an agent, it is advisable for individuals to download an editable document that ensures all necessary details are correctly captured and the powers granted are clear and comprehensive. This not only aids in avoiding misunderstandings but also reinforces the legal standing of the document.

4 Point Inspection Form - Hazards like exposed wiring and improper grounding must be highlighted.