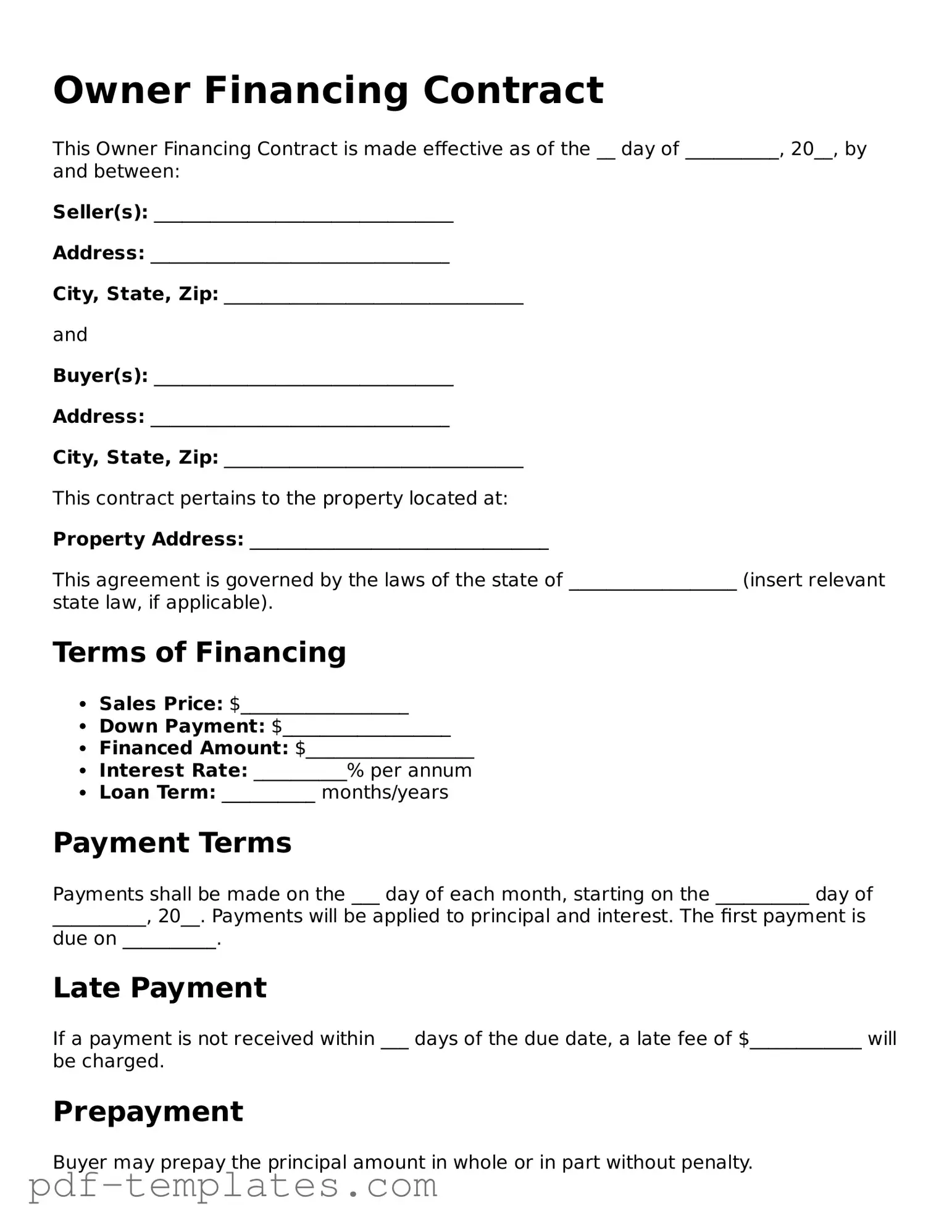

Owner Financing Contract Document

When it comes to purchasing a home, many buyers find themselves exploring various financing options, and one increasingly popular choice is owner financing. This arrangement allows the seller to act as the lender, providing the buyer with a more flexible way to secure a mortgage. The Owner Financing Contract form plays a crucial role in this process, outlining the key terms and conditions of the agreement. It typically includes important details such as the purchase price, down payment amount, interest rate, and repayment schedule. Additionally, it specifies the responsibilities of both parties, including property maintenance and insurance obligations. By clearly laying out these terms, the contract helps to protect both the buyer and the seller, ensuring a smoother transaction. Understanding this form can empower buyers and sellers alike, making the home buying experience more accessible and manageable.

Misconceptions

Understanding owner financing can be challenging, especially with the misconceptions that often arise. Here are nine common misunderstandings about the Owner Financing Contract form:

- Owner financing is only for buyers with poor credit. Many believe that owner financing is solely a last resort for buyers with bad credit. In reality, it can be a viable option for anyone looking to purchase a home, regardless of their credit history.

- All owner financing agreements are the same. Each owner financing contract can vary significantly. Terms, interest rates, and payment schedules can differ based on the agreement between the buyer and seller.

- Owner financing eliminates the need for a real estate agent. While some buyers and sellers choose to work directly with each other, involving a real estate agent can provide valuable guidance and help navigate the complexities of the contract.

- The seller has no legal obligations. Sellers in an owner financing agreement are still bound by the terms of the contract. They must adhere to the agreed-upon payment schedule and other conditions outlined in the document.

- Owner financing is always risky for sellers. While there are risks involved, many sellers find that owner financing can provide a steady income stream and potentially a higher sales price.

- The buyer automatically owns the property after signing. Buyers do not gain full ownership of the property immediately upon signing the contract. Ownership typically transfers only after all terms are fulfilled, such as completing all payments.

- Owner financing is a complicated process. While there are details to manage, owner financing can be straightforward. With clear communication and a well-drafted contract, both parties can navigate the process smoothly.

- Interest rates in owner financing are always higher than traditional loans. Interest rates can vary widely. Some sellers may offer competitive rates, making owner financing an attractive option.

- Owner financing is only for residential properties. Although commonly associated with homes, owner financing can apply to various types of real estate, including commercial properties.

Being informed about these misconceptions can empower both buyers and sellers to make better decisions regarding owner financing agreements.

Owner Financing Contract: Usage Instruction

Completing the Owner Financing Contract form is an important step in ensuring that both parties understand the terms of the agreement. Taking your time and being thorough will help prevent misunderstandings down the road.

- Begin by entering the date at the top of the form. This establishes when the agreement is being made.

- Fill in the names and addresses of both the seller and the buyer. Make sure to include complete and accurate information.

- Specify the property address. This should be the exact location of the property being financed.

- Indicate the total purchase price of the property. This is the amount that the buyer will be financing through the seller.

- Detail the down payment amount. This is the initial payment made by the buyer before financing begins.

- Set the interest rate for the financing. This is the percentage that will be charged on the remaining balance.

- Outline the repayment terms, including the length of the loan and the frequency of payments (monthly, quarterly, etc.).

- Describe any late fees or penalties for missed payments. This helps clarify the consequences of not adhering to the payment schedule.

- Include any additional terms or conditions that both parties agree upon. This may cover specific agreements or contingencies.

- Both the seller and the buyer should sign and date the form at the bottom. This confirms that both parties agree to the terms outlined in the contract.

After completing the form, it is advisable for both parties to keep a copy for their records. This ensures that everyone has access to the agreed-upon terms and can refer back to them if needed.

Common mistakes

-

Not Clearly Defining Terms: One common mistake is failing to clearly outline the terms of the financing agreement. This includes the interest rate, repayment schedule, and any penalties for late payments. Ambiguity in these areas can lead to disputes later on.

-

Ignoring State Regulations: Each state has specific laws governing owner financing. Many people overlook these regulations, which can result in an unenforceable contract. It’s crucial to research and comply with local laws to avoid legal complications.

-

Neglecting to Include Contingencies: Failing to include contingencies can be a significant oversight. For example, what happens if the buyer defaults? Including provisions for such scenarios helps protect both parties and ensures clarity in the agreement.

-

Not Seeking Professional Help: Many individuals attempt to fill out the contract without professional guidance. This can lead to errors that could have been easily avoided. Consulting with a real estate attorney or a qualified professional can provide valuable insights and help prevent costly mistakes.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract allows a buyer to purchase property directly from the seller, bypassing traditional mortgage lenders. |

| Payment Terms | The contract outlines the payment schedule, including down payment, interest rate, and monthly installments. |

| Governing Law | In the United States, the laws governing owner financing contracts vary by state. For example, in California, the relevant laws include the California Civil Code. |

| Default Provisions | The contract specifies what happens if the buyer fails to make payments, including potential foreclosure options for the seller. |

| Title Transfer | Ownership of the property typically transfers to the buyer once the contract terms are fulfilled, though some contracts may retain title with the seller until paid in full. |

Dos and Don'ts

When filling out the Owner Financing Contract form, it's important to approach the task with care. Here are some things to keep in mind:

- Do read the entire contract carefully before filling it out.

- Don't leave any blank spaces; fill in all required fields.

- Do ensure that all parties involved understand the terms of the agreement.

- Don't rush through the process; take your time to review your entries.

- Do seek clarification on any terms you do not understand.

By following these guidelines, you can help ensure that the contract is completed accurately and effectively.

Similar forms

The Owner Financing Contract is similar to a Lease Purchase Agreement. In a Lease Purchase Agreement, a tenant has the option to buy the property after a specified lease period. Like owner financing, this arrangement allows the buyer to live in the home while working towards ownership. The key difference lies in the fact that a Lease Purchase Agreement typically includes a rental component, whereas owner financing directly involves the seller providing financing to the buyer without the need for a traditional mortgage.

Another document that shares similarities with the Owner Financing Contract is the Land Contract, also known as a Contract for Deed. In this arrangement, the seller retains the title to the property while the buyer makes payments over time. Once the full payment is made, the title transfers to the buyer. This method is similar to owner financing in that it allows buyers to purchase a home without a bank loan, but it often involves more specific terms regarding property maintenance and payment schedules.

The Promissory Note is another document closely related to the Owner Financing Contract. A Promissory Note is a written promise to pay a specific amount of money at a designated time. In owner financing, this note outlines the buyer's commitment to repay the seller for the loan amount. While the Owner Financing Contract details the terms of the sale, the Promissory Note serves as a formal acknowledgment of the debt, reinforcing the buyer’s obligation to make payments.

Similar to the Owner Financing Contract is the Mortgage Agreement, which is used in traditional financing. A Mortgage Agreement secures a loan with the property itself as collateral. While both documents involve a buyer obtaining financing, the Owner Financing Contract eliminates the need for a bank or financial institution, allowing for a more direct relationship between the buyer and seller.

The Installment Sale Agreement is yet another document that shares characteristics with the Owner Financing Contract. This agreement allows a buyer to pay for a property in installments over time, similar to owner financing. However, an Installment Sale Agreement usually requires the buyer to make a down payment upfront, which may not always be the case in owner financing arrangements.

When engaging in real estate transactions, understanding the various agreements available is crucial, and the Texas Real Estate Purchase Agreement form is no exception. This legal document helps clarify the terms of sale, ensuring all parties are aligned on their responsibilities. For detailed guidelines on filling this out, you can visit https://pdftemplates.info/texas-real-estate-purchase-agreement-form/, which serves as a valuable resource throughout the purchasing process.

The Seller Financing Addendum is also relevant. This document is often added to a standard purchase agreement when the seller agrees to finance the buyer’s purchase. It outlines the terms of the financing, including interest rates and payment schedules. Like the Owner Financing Contract, it provides an alternative to traditional mortgage financing, making homeownership more accessible for buyers who may not qualify for conventional loans.

Another related document is the Option to Purchase Agreement. This agreement gives a tenant the right to purchase a property within a specified timeframe, usually at a predetermined price. While this document does not directly provide financing, it often accompanies owner financing arrangements, allowing the buyer to secure the right to buy while negotiating financing terms with the seller.

Lastly, the Real Estate Purchase Agreement shares similarities with the Owner Financing Contract. This document outlines the terms of a real estate transaction, including price, contingencies, and closing dates. In cases of owner financing, the Purchase Agreement can incorporate financing terms, ensuring both parties understand their obligations. While the Purchase Agreement can be used with traditional financing, it is also adaptable for owner financing situations.

Additional Types of Owner Financing Contract Templates:

Purchase Agreement Addendum - Overall, the addendum is a practical solution to finalize agreements that require modification.

The New York Real Estate Purchase Agreement form is a legally binding document that outlines the terms and conditions under which a piece of real estate will be sold and purchased. It details everything from the price to the responsibilities of both the buyer and the seller. Understanding this form is essential for anyone looking to navigate the complexities of buying or selling property in New York, and additional resources can be found through NY PDF Forms.

Real Estate Contract Termination Letter - Timely submission of this form can help avoid wasted time and resources.