Operating Agreement Document

In the world of business, clarity and organization are paramount, especially when it comes to structuring a company. An Operating Agreement serves as a foundational document for Limited Liability Companies (LLCs), outlining essential aspects of the business's operations. This form typically includes details about ownership percentages, management structure, and the roles and responsibilities of each member. It also addresses how profits and losses will be distributed among members, ensuring that everyone understands their financial stake. Additionally, the Operating Agreement sets forth procedures for adding new members or handling the departure of existing ones, providing a roadmap for the company's future. By establishing clear guidelines, this document helps prevent conflicts and misunderstandings, fostering a collaborative environment. Ultimately, an Operating Agreement is not just a legal formality; it is a vital tool for any LLC aiming for long-term success and stability.

Misconceptions

Operating agreements are essential documents for LLCs, yet several misconceptions surround them. Understanding these misconceptions can help business owners navigate their responsibilities and rights effectively.

- Misconception 1: An operating agreement is not necessary for a single-member LLC.

- Misconception 2: The operating agreement is a public document.

- Misconception 3: An operating agreement is a one-time document.

- Misconception 4: All states have the same requirements for operating agreements.

- Misconception 5: An operating agreement can only be created by a lawyer.

- Misconception 6: The operating agreement is only for multi-member LLCs.

- Misconception 7: Once signed, the operating agreement cannot be changed.

Many believe that a single-member LLC does not need an operating agreement. However, having one is still beneficial as it clarifies the owner's rights and responsibilities and can help establish credibility with banks and potential investors.

Some assume that operating agreements are filed with the state and become public records. In reality, these documents are typically kept private and are not submitted to state authorities, unless required by specific regulations.

Many think that once an operating agreement is created, it never needs to be updated. This is misleading. Changes in ownership, business structure, or operations may necessitate revisions to ensure the agreement remains relevant.

It is incorrect to assume that operating agreement requirements are uniform across all states. Each state has its own laws regarding LLCs, and some may not even require an operating agreement, while others have specific provisions that must be included.

While consulting a lawyer can be beneficial, it is not mandatory to have a lawyer draft an operating agreement. Business owners can create their own agreements using templates and resources available online, provided they comply with state laws.

This belief overlooks the value of an operating agreement for single-member LLCs. It serves as a formal record of the owner's intentions and can help protect personal assets in case of legal disputes.

Some individuals think that signing an operating agreement makes it set in stone. In fact, amendments can be made if all members agree, allowing the document to adapt as the business evolves.

Operating Agreement - Customized for State

Operating Agreement Document Subtypes

Operating Agreement: Usage Instruction

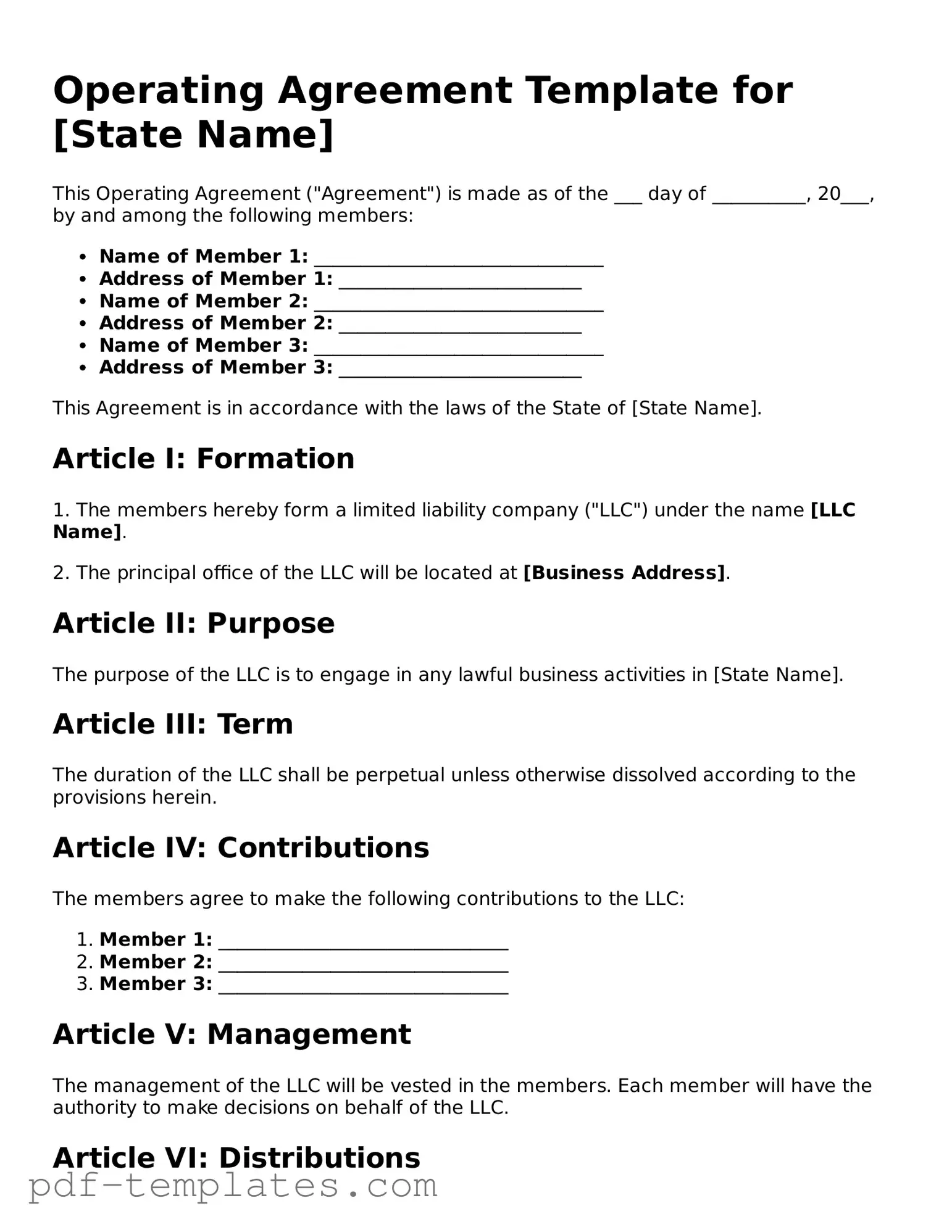

After gathering the necessary information, the next step involves completing the Operating Agreement form accurately. This document outlines the management structure and operating procedures for a business entity. Follow the steps below to ensure all required sections are filled out correctly.

- Begin by entering the name of the business at the top of the form.

- Fill in the principal address of the business, including city, state, and zip code.

- List the names and addresses of all members involved in the business.

- Specify the percentage of ownership for each member.

- Indicate the management structure, whether it will be member-managed or manager-managed.

- Outline the voting rights of each member, including how decisions will be made.

- Detail the distribution of profits and losses among members.

- Include any additional provisions relevant to the operation of the business.

- Review the completed form for accuracy and completeness.

- Sign and date the document, ensuring all members do the same if required.

Common mistakes

-

Not including all members: It's essential to list all members of the LLC. Omitting a member can lead to disputes later.

-

Failing to define roles and responsibilities: Clearly outline each member's role to avoid confusion about who does what.

-

Ignoring profit and loss distribution: Specify how profits and losses will be shared among members to prevent misunderstandings.

-

Not addressing decision-making processes: Include details on how decisions will be made, whether by majority vote or unanimous consent.

-

Neglecting to outline procedures for adding or removing members: Establish a clear process for changes in membership to ensure smooth transitions.

-

Overlooking dispute resolution methods: Specify how disputes will be resolved, whether through mediation, arbitration, or litigation.

-

Not updating the agreement regularly: Review and revise the Operating Agreement as needed to reflect any changes in the business or membership.

-

Failing to include a buy-sell agreement: Plan for what happens if a member wants to leave or passes away to protect the interests of remaining members.

-

Using vague language: Avoid ambiguous terms. Clear and precise language helps prevent misinterpretation.

-

Not seeking legal advice: Consulting with a legal professional can provide valuable insights and ensure compliance with state laws.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement outlines the management structure and operating procedures of a limited liability company (LLC). |

| Purpose | It serves to clarify the roles of members and managers, ensuring smooth operations and reducing potential conflicts. |

| Legal Requirement | Not all states require an Operating Agreement, but it is highly recommended for all LLCs. |

| State-Specific Forms | Each state may have its own requirements for Operating Agreements. For example, California follows the California Corporations Code. |

| Member Rights | The agreement specifies the rights and responsibilities of each member, including voting rights and profit distribution. |

| Amendments | It provides procedures for amending the agreement, allowing flexibility as the business evolves. |

| Dispute Resolution | Provisions for resolving disputes among members can be included, promoting harmony and reducing legal costs. |

| Confidentiality | Operating Agreements can include confidentiality clauses to protect sensitive business information. |

| Duration | The agreement can specify the duration of the LLC, whether it is perpetual or set for a specific term. |

| Governing Law | The agreement will typically specify which state's laws govern the LLC, ensuring clarity in legal matters. |

Dos and Don'ts

When filling out the Operating Agreement form, it's essential to be thorough and accurate. Here are some key dos and don'ts to consider:

- Do provide accurate information about all members and their contributions.

- Do clearly outline the management structure and decision-making processes.

- Do specify the procedures for adding or removing members.

- Do review the document for clarity and completeness before signing.

- Don't leave any sections blank or incomplete.

- Don't use vague language that could lead to misunderstandings.

- Don't overlook state-specific requirements that may apply.

- Don't rush through the process; take your time to ensure accuracy.

Similar forms

An Operating Agreement is similar to a Partnership Agreement. Both documents outline the roles, responsibilities, and profit-sharing arrangements among business partners. In a Partnership Agreement, partners agree on how to manage the business and what happens if a partner wants to leave or if the partnership dissolves. This agreement serves to prevent disputes by clearly defining expectations and obligations.

Another similar document is the Bylaws of a corporation. Bylaws govern the internal management of a corporation, detailing how meetings are conducted, how directors are elected, and how decisions are made. Like an Operating Agreement, Bylaws establish rules that help ensure smooth operations and clarify the relationship among stakeholders.

A Shareholders' Agreement is also akin to an Operating Agreement. This document outlines the rights and obligations of shareholders in a corporation. It addresses issues such as share transfers, voting rights, and dispute resolution. Both agreements are designed to protect the interests of the parties involved and to provide a clear framework for governance.

The Limited Liability Company (LLC) Membership Agreement shares similarities with an Operating Agreement. This document details the rights and responsibilities of LLC members. It covers topics such as capital contributions, profit distribution, and management structure. Both documents serve to define the relationship among members and provide a roadmap for the company's operations.

A Joint Venture Agreement is another document that resembles an Operating Agreement. It outlines the terms of collaboration between two or more parties working together on a specific project. Similar to an Operating Agreement, it specifies each party's contributions, responsibilities, and how profits and losses will be shared. This clarity helps prevent misunderstandings and promotes successful partnerships.

The Franchise Agreement is also comparable to an Operating Agreement. This document outlines the relationship between a franchisor and a franchisee. It details the rights and obligations of both parties, including fees, operational procedures, and branding guidelines. Like an Operating Agreement, it aims to ensure that all parties understand their roles and responsibilities within the business framework.

A Non-Disclosure Agreement (NDA) can be similar in terms of protecting sensitive information. While not directly related to operational procedures, it establishes confidentiality between parties. This agreement ensures that proprietary information shared during business dealings remains confidential, similar to how an Operating Agreement protects the business's internal processes and member information.

The Employment Agreement is another document that shares some characteristics with an Operating Agreement. It outlines the terms of employment for individuals working within a company. This agreement specifies job responsibilities, compensation, and termination conditions. Both documents aim to clarify expectations and responsibilities, fostering a better working relationship.

A Loan Agreement can also be likened to an Operating Agreement. This document details the terms under which a loan is made, including repayment schedules and interest rates. Like an Operating Agreement, it establishes clear expectations between the lender and borrower, helping to prevent disputes and misunderstandings.

Lastly, a Memorandum of Understanding (MOU) can be similar to an Operating Agreement. An MOU outlines the intentions and agreements between parties before formalizing a contract. It serves as a preliminary agreement that sets the stage for future collaboration. Both documents aim to clarify the terms of a relationship and establish a framework for cooperation.

More Documents

Imm1294 - Missed information may lead to delays in processing your application.

Rent Agreement Format - It outlines any modifications to the agreement during the lease term.