Official Transfer-on-Death Deed Template for New York State

The New York Transfer-on-Death Deed form is a valuable tool for individuals looking to streamline the process of transferring property to their loved ones after passing away. This legal document allows property owners to designate beneficiaries who will automatically receive the property upon their death, bypassing the often lengthy and costly probate process. By filling out this form, you can ensure that your real estate assets are transferred directly to your chosen heirs, providing peace of mind and clarity for both you and your family. It’s important to note that the deed must be executed properly, which involves signing it in front of a notary public and recording it with the county clerk. Additionally, the form can be revoked or modified at any time during the property owner’s lifetime, allowing for flexibility as circumstances change. Understanding the nuances of this form can help you make informed decisions about your estate planning and ensure that your wishes are honored when the time comes.

Misconceptions

Understanding the New York Transfer-on-Death Deed form can be tricky. Here are some common misconceptions that people often have:

- It automatically avoids probate. Many believe that using a Transfer-on-Death Deed means the property will automatically bypass probate. While it does simplify the transfer process, certain conditions may still require probate.

- It can be used for any type of property. Some think this deed applies to all property types. However, it is specifically designed for real estate and cannot be used for personal property or financial accounts.

- Once signed, it cannot be changed. There is a belief that the deed is set in stone once executed. In reality, the owner can revoke or change the deed at any time before death, as long as they follow the proper legal procedures.

- It only benefits the property owner. Some assume that only the owner gains from this deed. However, it can also provide peace of mind to the beneficiaries, knowing that the property will transfer smoothly after the owner's passing.

- It eliminates the need for a will. Many think that having a Transfer-on-Death Deed means a will is unnecessary. This is not true; a will is still important for addressing other assets and personal matters.

- All heirs automatically receive equal shares. There is a misconception that all beneficiaries will inherit equally. The deed specifies who receives the property, which may not reflect the owner's wishes regarding other assets.

- It can be used to transfer property to a trust. Some people believe they can use this deed to transfer property into a trust. However, this deed is meant for direct transfers to individuals, not entities like trusts.

- It has no tax implications. Many think that using a Transfer-on-Death Deed avoids tax consequences. While it may simplify the transfer process, tax obligations may still arise for the beneficiaries.

- It is the same as a joint tenancy. Some confuse the Transfer-on-Death Deed with joint tenancy. They are different; joint tenancy involves shared ownership during the owner's lifetime, while the Transfer-on-Death Deed transfers ownership only after death.

New York Transfer-on-Death Deed: Usage Instruction

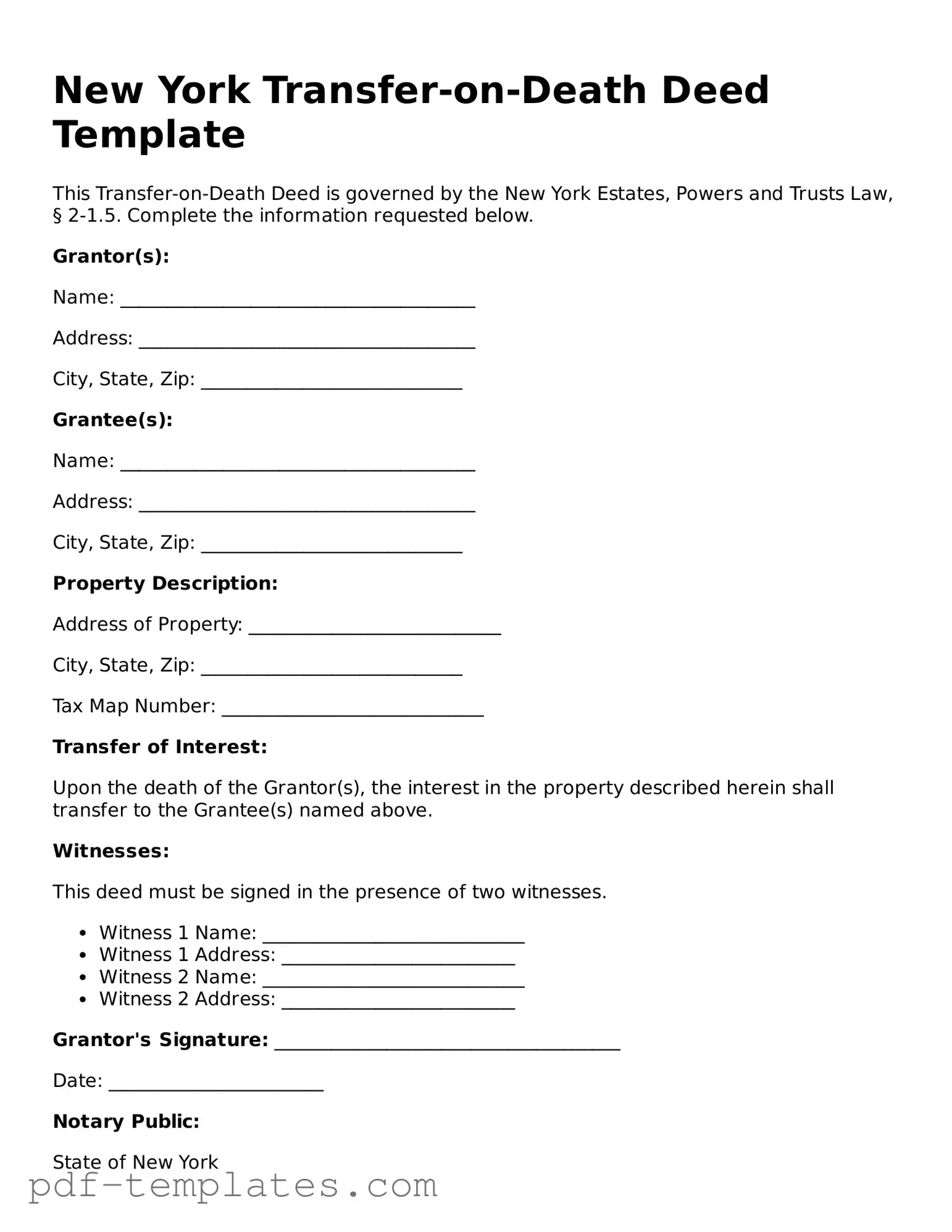

After gathering the necessary information, you can proceed to fill out the New York Transfer-on-Death Deed form. This deed allows property owners to designate beneficiaries who will receive the property upon the owner's death, without going through probate. Follow the steps below to complete the form accurately.

- Begin by entering the date at the top of the form.

- Provide the name and address of the property owner(s). This includes all individuals who hold ownership rights.

- List the legal description of the property. You can find this information on the property deed or tax records.

- Identify the beneficiaries by providing their full names and addresses. Ensure that you include all individuals you wish to designate.

- Include any specific instructions regarding the property, if applicable.

- Sign the form in the presence of a notary public. All owners must sign.

- Have the notary public complete their section, verifying the signatures.

- Make copies of the completed and notarized form for your records.

- File the original form with the county clerk's office in the county where the property is located. Be aware of any filing fees that may apply.

Common mistakes

-

Not verifying eligibility: Before filling out the Transfer-on-Death Deed (TODD) form, individuals often overlook the eligibility criteria. It's crucial to ensure that the property in question qualifies for this type of deed. Properties that are not eligible can lead to complications and invalidations.

-

Incorrectly identifying the property: Many people make the mistake of not providing accurate property descriptions. It's essential to include the correct legal description of the property, not just the address. Failing to do so can create confusion and may render the deed ineffective.

-

Improperly naming beneficiaries: When selecting beneficiaries, individuals sometimes fail to specify their full names or relationship to the property owner. This oversight can lead to disputes or challenges in the future. Clarity is key to ensuring that the intended recipients receive the property as planned.

-

Neglecting to sign and date: A common error is forgetting to sign and date the deed. Without a signature, the document is not legally binding. Additionally, the date is important for establishing the timing of the transfer, which can affect tax implications and other legal considerations.

-

Failing to record the deed: After completing the form, individuals often forget to file it with the appropriate county office. Recording the deed is a critical step in making the transfer official. Without this step, the deed may not be recognized, leaving the property in limbo.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real property to a beneficiary upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed in New York is governed by New York Estates, Powers and Trusts Law (EPTL) § 2-1.11. |

| Eligibility | Any individual who owns real property in New York can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Multiple beneficiaries can be designated in the deed, and they can be individuals or entities. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time before the death of the grantor by executing a new deed or a written revocation. |

| Recording Requirement | The deed must be recorded in the county where the property is located to be effective. |

| Tax Implications | The transfer of property via a Transfer-on-Death Deed does not trigger gift taxes during the grantor's lifetime. |

| Impact on Creditors | Property transferred through a Transfer-on-Death Deed may still be subject to the grantor's debts, depending on the circumstances. |

Dos and Don'ts

When filling out the New York Transfer-on-Death Deed form, it is crucial to navigate the process carefully to ensure that your intentions are accurately reflected and legally binding. Here are some essential dos and don'ts to consider:

- Do ensure that the property description is accurate and complete. This helps prevent any disputes or confusion later.

- Do include the full names and addresses of both the grantor and the beneficiary. Clarity is key in legal documents.

- Do sign the deed in the presence of a notary public. This step is essential for the document’s validity.

- Do file the deed with the appropriate county clerk’s office. This makes the transfer official and public.

- Do keep a copy of the filed deed for your records. Having documentation can be helpful in the future.

- Don't use vague language or general terms when describing the property. Specificity is important to avoid misunderstandings.

- Don't forget to check for any existing liens or encumbrances on the property. This could impact the transfer.

- Don't neglect to inform the beneficiary about the deed. Transparency can help prevent potential conflicts.

- Don't attempt to fill out the form without understanding its implications. Consider consulting with a legal professional if needed.

Similar forms

The New York Transfer-on-Death Deed (TODD) is similar to a Last Will and Testament in that both documents allow individuals to express their wishes regarding the distribution of their property after death. However, a will requires probate, which can be a lengthy and costly process. In contrast, the TODD allows for the direct transfer of property to designated beneficiaries without the need for probate, simplifying the process and potentially saving time and money for the heirs.

For those interested in leasing commercial space, the necessary Commercial Lease Agreement details will assist in establishing clear terms between tenant and landlord. This document plays a vital role in defining the obligations and expectations of both parties involved, thereby promoting a smooth rental experience.

Another document comparable to the TODD is the Revocable Living Trust. Like the TODD, a living trust enables individuals to transfer assets to beneficiaries upon their death. However, a living trust can also manage assets during the individual's lifetime, allowing for greater control and flexibility. While both documents avoid probate, a living trust may be more complex to set up and maintain than a simple TODD.

A Beneficiary Designation form is similar in that it allows individuals to name beneficiaries for specific assets, such as bank accounts or retirement plans. This document ensures that the designated assets pass directly to the beneficiaries upon the individual’s death, avoiding probate. Unlike the TODD, which applies to real estate, beneficiary designations typically pertain to financial accounts and insurance policies.

The Life Estate Deed is another document that resembles the TODD. It allows an individual to retain the right to use and benefit from a property during their lifetime while designating a beneficiary to receive the property after their death. While both documents facilitate the transfer of property outside of probate, the life estate deed involves a retained interest that can complicate ownership rights during the grantor's lifetime.

A Transfer-on-Death Account (TOD Account) functions similarly to the TODD by allowing individuals to designate beneficiaries for bank accounts. Upon the account holder's death, the funds transfer directly to the named beneficiaries without going through probate. This document is straightforward and effective for financial assets, much like the TODD is for real estate.

The Payable-on-Death (POD) designation is also comparable to the TODD. This designation allows individuals to name beneficiaries for bank accounts, ensuring that the funds are transferred directly to the beneficiaries upon death. Both the POD and the TODD simplify the transfer process, but the POD is limited to financial accounts rather than real property.

Similar to the TODD, the Durable Power of Attorney for Health Care allows individuals to designate someone to make health care decisions on their behalf if they become incapacitated. While not directly related to property transfer, both documents empower individuals to control their affairs and designate trusted individuals to act on their behalf. The key difference lies in the focus on health care decisions versus property management.

Finally, the Declaration of Trust can be seen as similar to the TODD in that it allows for the management and distribution of assets. This document outlines the terms under which assets are held and distributed, often avoiding probate. While it serves a broader purpose than the TODD, both documents aim to facilitate the transfer of property according to the grantor’s wishes without the complications of probate.

Check out Popular Transfer-on-Death Deed Forms for Different States

Pennsylvania Transfer on Death Deed Form - If multiple beneficiaries are named, the distribution rules should be clearly stated in the deed.

For those looking to navigate the complexities of property ownership in California, understanding the Quitclaim Deed is essential. This document facilitates the transfer of real estate interest without the assurances that accompany traditional deeds, making it a practical choice for family matters or resolving title disputes. To explore additional resources, you can check out All California Forms, which provide valuable information on various legal documents necessary for property transactions.

Free Printable Transfer on Death Deed Form Florida - Those using the Transfer-on-Death Deed should keep a copy of the recorded deed with their important documents.

Transfer on Death Deed Texas Form Free - This legal tool can help avoid inheritance disputes by clearly outlining the intended beneficiaries.