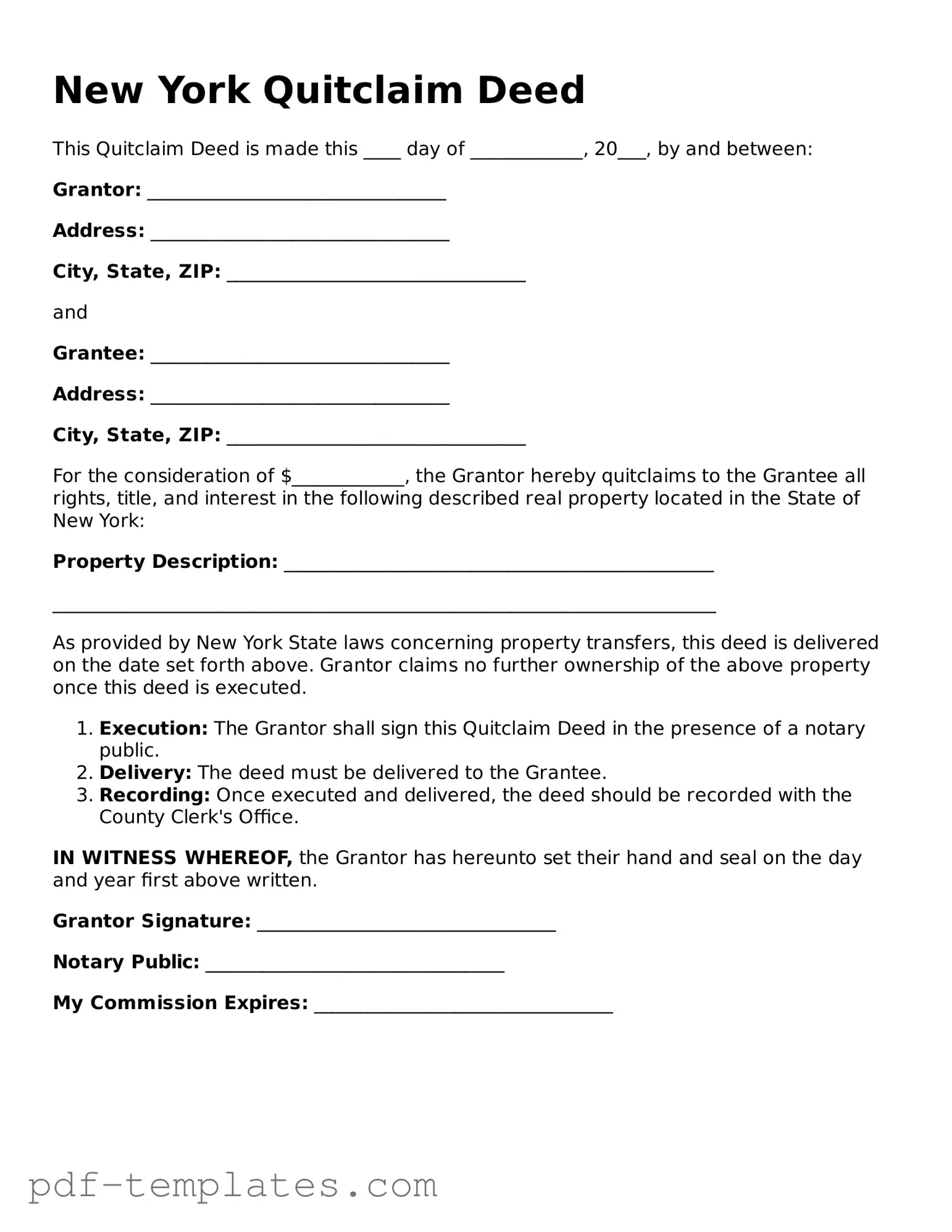

Official Quitclaim Deed Template for New York State

The New York Quitclaim Deed form serves as a crucial tool in real estate transactions, allowing property owners to transfer their interest in a property to another party without making any guarantees about the title. This form is particularly useful in situations where the grantor, or the person transferring the property, may not have complete ownership rights or wishes to simplify the transfer process. Typically, it contains essential details such as the names of the parties involved, a legal description of the property, and the date of the transfer. Importantly, the Quitclaim Deed does not provide any warranties, meaning that the grantee, or the person receiving the property, accepts it "as is." This aspect makes it a popular choice among family members, friends, or in cases of divorce, where the parties involved may trust each other. Understanding the specifics of the Quitclaim Deed form is vital for anyone looking to navigate property transfers in New York effectively.

Misconceptions

The New York Quitclaim Deed is often misunderstood. Here are nine common misconceptions that need clarification:

-

Quitclaim Deeds Transfer Ownership Completely.

Many believe that a quitclaim deed transfers full ownership rights. In reality, it transfers only the interest the grantor has at the time of signing. If the grantor has no ownership interest, the recipient receives nothing.

-

Quitclaim Deeds Are Only for Divorces.

While it's true that quitclaim deeds are often used in divorce settlements, they can also be utilized for various other reasons, such as transferring property between family members or clearing up title issues.

-

Quitclaim Deeds Are Always Legal and Binding.

Some people assume that all quitclaim deeds are automatically valid. However, they must be properly executed and notarized to be legally binding. Without these steps, the deed may not hold up in court.

-

Quitclaim Deeds Eliminate All Liabilities.

It’s a common belief that transferring property via a quitclaim deed removes all associated debts or liens. This is not true; the new owner may still be responsible for existing liens on the property.

-

Quitclaim Deeds Are Only for Real Estate.

Many think quitclaim deeds apply solely to real estate transactions. However, they can also be used for transferring interests in other types of property, like vehicles or personal assets.

-

All States Use the Same Quitclaim Deed Format.

People often assume that the quitclaim deed format is the same across all states. In fact, each state has its own requirements and forms, so it’s essential to use the correct one for New York.

-

Quitclaim Deeds Are Risk-Free.

Some believe that using a quitclaim deed involves no risk. However, since the grantor does not guarantee the title, the grantee may face potential legal issues down the line.

-

Quitclaim Deeds Are Always Quick and Easy.

While quitclaim deeds can simplify property transfers, they may still require time for preparation, execution, and recording. Rushing through the process can lead to mistakes or oversights.

-

Quitclaim Deeds Are the Same as Warranty Deeds.

Many confuse quitclaim deeds with warranty deeds. Unlike a warranty deed, which guarantees the grantor's ownership and protects the grantee against future claims, a quitclaim deed offers no such assurances.

Understanding these misconceptions can help individuals make informed decisions when dealing with property transfers in New York.

New York Quitclaim Deed: Usage Instruction

After obtaining the New York Quitclaim Deed form, you will need to complete it accurately to ensure the transfer of property rights is properly documented. Follow these steps carefully to fill out the form correctly.

- Identify the Grantor: In the first section, provide the full name and address of the person transferring the property.

- Identify the Grantee: Next, fill in the full name and address of the person receiving the property.

- Describe the Property: Include a complete description of the property being transferred. This typically includes the street address and any additional identifying information, such as the lot number or tax ID.

- State the Consideration: Enter the amount of money or value exchanged for the property. If no payment is involved, you can state "For love and affection" or similar language.

- Sign the Document: The grantor must sign the deed in the presence of a notary public. Ensure the signature matches the name listed in the grantor section.

- Notarization: Have the notary public complete their section, which includes their signature and seal, verifying the grantor's identity and signature.

- Record the Deed: Finally, submit the completed and notarized Quitclaim Deed to the appropriate county clerk’s office for recording. Check for any required fees and ensure you keep a copy for your records.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a clear and accurate description of the property being transferred. The description should include the property's address, lot number, and any other relevant details. Omitting or misrepresenting this information can lead to confusion or legal disputes.

-

Improper Signatures: All parties involved in the transfer must sign the Quitclaim Deed. A frequent error is having missing signatures or signatures from individuals who are not authorized to transfer the property. Ensure that all necessary parties are present and that their signatures are properly notarized.

-

Failure to Notarize: A Quitclaim Deed must be notarized to be legally binding. Some individuals overlook this requirement, thinking that the document is valid without a notary's acknowledgment. Without notarization, the deed may not be accepted by the county clerk or other relevant authorities.

-

Neglecting to Record the Deed: After filling out the Quitclaim Deed, it is essential to file it with the appropriate county office. Many people forget this crucial step, which can result in the transfer not being recognized legally. Recording the deed protects the new owner's rights and provides public notice of the property transfer.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties regarding the title. |

| Governing Law | In New York, Quitclaim Deeds are governed by the New York Real Property Law. |

| Use Cases | Commonly used in divorce settlements, property transfers between family members, or to clear up title issues. |

| No Guarantees | The grantor does not guarantee that the title is free of liens or encumbrances. |

| Signature Requirements | The deed must be signed by the grantor in the presence of a notary public. |

| Recording | To be effective against third parties, the Quitclaim Deed must be recorded in the county where the property is located. |

| Consideration | A nominal consideration is often sufficient; the deed does not need to specify a sale price. |

| Tax Implications | Transfer taxes may apply, depending on the circumstances of the transfer. |

| Revocation | Once executed and recorded, a Quitclaim Deed generally cannot be revoked without the consent of both parties. |

| Alternative Options | Other types of deeds, such as Warranty Deeds, offer more protection to the grantee and may be more appropriate in certain situations. |

Dos and Don'ts

When filling out the New York Quitclaim Deed form, it's essential to approach the task with care. Here are ten important dos and don'ts to guide you through the process.

- Do ensure that all names are spelled correctly. A small typo can lead to significant issues later.

- Don't leave any required fields blank. Incomplete forms can be rejected.

- Do provide a clear and accurate description of the property. This should include the address and any relevant identifiers.

- Don't use legal jargon or complicated language. Keep it simple and straightforward.

- Do have the form notarized. This step is crucial for the deed to be legally valid.

- Don't forget to include the date of the transaction. This is important for record-keeping.

- Do review the form multiple times before submission. Errors can be costly and time-consuming to fix.

- Don't submit the form without checking local requirements. Different counties may have specific rules.

- Do keep a copy of the completed form for your records. This can be invaluable in the future.

- Don't underestimate the importance of consulting a legal professional if you have questions. Getting it right the first time can save you headaches later.

Similar forms

A warranty deed is similar to a quitclaim deed in that both are used to transfer property ownership. However, a warranty deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. This means that if any issues arise regarding the title, the seller is responsible for resolving them. In contrast, a quitclaim deed makes no such guarantees, leaving the buyer with less protection against potential title problems.

A special warranty deed also shares similarities with a quitclaim deed. Like a quitclaim deed, a special warranty deed transfers ownership without warranties against title defects. However, the key difference lies in the seller's assurances. A special warranty deed guarantees that the seller has not caused any title issues during their ownership, while a quitclaim deed offers no such assurances.

A bargain and sale deed is another document that resembles a quitclaim deed. This type of deed conveys property ownership but does not guarantee a clear title. Unlike a quitclaim deed, a bargain and sale deed implies that the seller has some interest in the property. It may be used in transactions where the seller cannot provide full title guarantees, similar to a quitclaim deed's limitations.

A deed in lieu of foreclosure is similar in purpose to a quitclaim deed, as both involve the transfer of property ownership. In a deed in lieu of foreclosure, a homeowner voluntarily transfers their property to the lender to avoid foreclosure. This document allows the lender to take ownership of the property without going through the foreclosure process, much like how a quitclaim deed allows for a quick transfer of ownership without warranties.

A transfer on death deed (TOD) is another document that shares some characteristics with a quitclaim deed. A TOD allows an individual to transfer property to a beneficiary upon their death without going through probate. While a quitclaim deed is used during the owner's lifetime, both documents facilitate the transfer of property ownership without the need for a formal sale process.

To protect themselves from potential liabilities in property transactions, individuals and entities often utilize a Hold Harmless Agreement form. This document helps clarify the responsibilities of each party and shields them from claims stemming from the actions of others involved in the agreement. For those seeking a way to safeguard their interests, you can download the form in pdf to ensure a clear understanding and peace of mind in your dealings.

An executor's deed is similar to a quitclaim deed in that it is used to transfer property after the owner has passed away. When a property owner dies, the executor of their estate can use an executor's deed to transfer property to heirs or beneficiaries. Like a quitclaim deed, an executor's deed does not provide warranties regarding the title, reflecting the same limitations in protecting the new owner.

Finally, a leasehold deed can also be compared to a quitclaim deed. A leasehold deed conveys the rights to a property for a specific period, similar to how a quitclaim deed transfers ownership. However, a leasehold deed does not transfer full ownership rights; instead, it grants temporary rights to use the property. Both documents facilitate property transactions but differ in the extent of rights transferred.

Check out Popular Quitclaim Deed Forms for Different States

Quit Claim Deed Washington - A Quitclaim Deed keeps the transfer process straightforward and minimalistic.

Quitclaim Deed Form Pennsylvania - By signing a Quitclaim Deed, the grantor relinquishes their rights, making it clear to all parties involved.

When renewing your cosmetology license in California, it's essential to utilize the proper documentation, such as the Cosmetology License Renewal California form, which can be accessed at https://formcalifornia.com/. This mandatory form helps ensure that all required information is collected accurately and submitted with the appropriate fees, thus preventing any issues associated with maintaining a valid license in the beauty industry.

How to File a Quitclaim Deed in Texas - The Quitclaim Deed is straightforward and requires no formal appraisal.