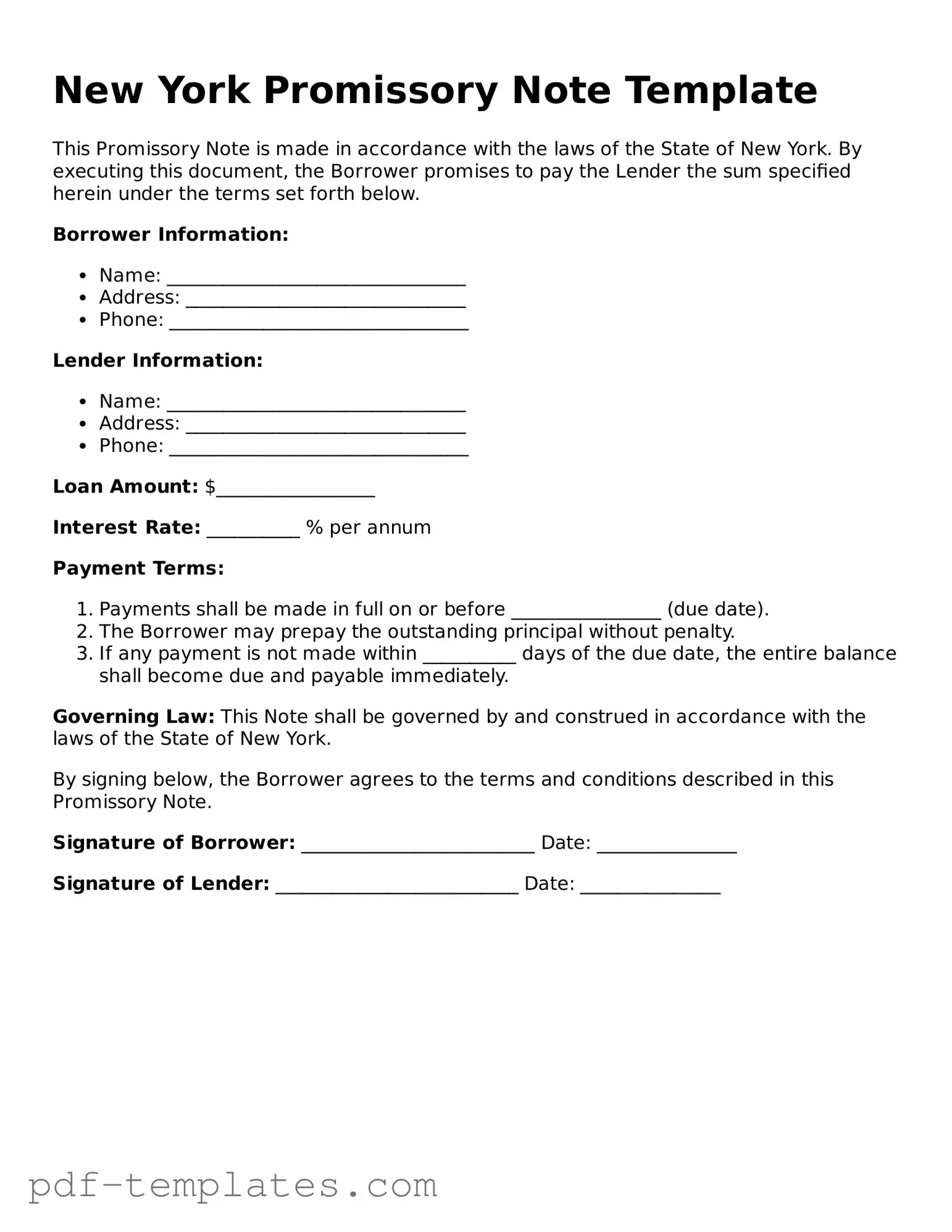

Official Promissory Note Template for New York State

When entering into a loan agreement in New York, a Promissory Note serves as a crucial document that outlines the terms of the borrowing arrangement. This legally binding contract details the borrower's promise to repay the lender a specified amount of money, typically with interest, by a certain date. Key elements include the principal amount borrowed, the interest rate, repayment schedule, and any provisions for late payments or defaults. Additionally, the Promissory Note may specify whether the loan is secured or unsecured, providing clarity on what happens if the borrower fails to repay. Understanding these components is essential for both lenders and borrowers, as they establish the framework for the financial relationship and protect the interests of both parties. Whether you're lending money to a friend or engaging in a more formal business transaction, having a well-structured Promissory Note can help prevent misunderstandings and disputes down the line.

Misconceptions

Understanding the New York Promissory Note form is crucial for anyone involved in lending or borrowing money. Unfortunately, several misconceptions can lead to confusion and potentially costly mistakes. Here are nine common misconceptions:

- All promissory notes are the same. Many believe that promissory notes are interchangeable, but each state has its own requirements and formats. The New York Promissory Note has specific provisions that must be included to be enforceable.

- A verbal agreement is sufficient. Some individuals think that a verbal promise to pay is enough. However, without a written document like a promissory note, proving the terms of the agreement can be extremely difficult.

- Promissory notes are only for large loans. While often associated with significant sums, promissory notes can be used for any amount. Even small loans deserve clear documentation to avoid misunderstandings.

- Interest rates are not important. Many people overlook the interest rate included in a promissory note. It is essential to specify this rate to avoid legal disputes later on.

- Once signed, a promissory note cannot be changed. This is not true. Amendments can be made if both parties agree, but it is crucial to document any changes properly.

- Notarization is always required. While notarization can add an extra layer of security, it is not a requirement for a promissory note to be valid in New York. However, having it notarized can help in case of disputes.

- Promissory notes are only for personal loans. This is a misconception. Businesses frequently use promissory notes for transactions, making them a versatile tool in both personal and commercial contexts.

- A promissory note guarantees repayment. While it serves as a formal promise to pay, it does not guarantee that the borrower will fulfill their obligation. Lenders should always assess the borrower's creditworthiness.

- All parties must be present when signing. While it is ideal for all parties to be present, it is not a strict requirement. As long as the signatories agree to the terms, the document remains valid.

Being aware of these misconceptions can help individuals navigate the complexities of promissory notes more effectively. Clear understanding and proper documentation are key to ensuring that both lenders and borrowers are protected.

New York Promissory Note: Usage Instruction

Once you have the New York Promissory Note form in hand, you can begin filling it out. Make sure to have all necessary information ready, such as the names of the parties involved, the loan amount, and any agreed-upon terms. Follow the steps below to complete the form accurately.

- Start by entering the date at the top of the form.

- Fill in the name of the borrower. This is the person or entity receiving the loan.

- Provide the name of the lender. This is the person or entity providing the loan.

- Specify the principal amount of the loan. This is the total amount borrowed.

- Indicate the interest rate, if applicable. This is the percentage charged on the loan amount.

- Outline the repayment terms. Include details such as the payment schedule and any late fees.

- Sign the form. The borrower must sign to acknowledge the terms of the loan.

- Have the lender sign the form as well. This confirms their agreement to the terms.

- Make copies of the completed form for both parties. Keep these for your records.

Common mistakes

-

Inaccurate Borrower Information: Failing to provide the correct name and address of the borrower can lead to confusion and potential legal issues.

-

Missing Lender Details: Just as with the borrower, omitting the lender's information can create problems down the line. It is essential to include the full name and contact information.

-

Unclear Loan Amount: Writing the loan amount incorrectly or ambiguously can result in disputes. Be specific and clear about the total amount being borrowed.

-

Incorrect Interest Rate: If an interest rate is applicable, it must be stated clearly. Leaving this blank or miscalculating it could lead to misunderstandings.

-

Failure to Specify Payment Terms: Not detailing how and when payments are to be made can create complications. Include the payment schedule, such as monthly or quarterly payments.

-

Omitting Signatures: A promissory note is not valid without the necessary signatures. Both the borrower and lender must sign the document for it to be enforceable.

-

Neglecting Witness or Notary Requirements: Depending on the situation, some promissory notes may require a witness or notary public. Failing to comply can affect the note's validity.

-

Leaving Out Default Terms: It is crucial to include what happens in the event of a default. This might include late fees or the right to accelerate the loan.

-

Ignoring State-Specific Laws: Each state may have specific requirements for promissory notes. Not adhering to New York's regulations can render the document unenforceable.

-

Using Ambiguous Language: Clarity is key in legal documents. Using vague terms can lead to different interpretations, which can create disputes.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated party at a specified time. |

| Governing Law | New York's Uniform Commercial Code (UCC) governs promissory notes. |

| Parties Involved | The note involves two parties: the maker (borrower) and the payee (lender). |

| Payment Terms | It must clearly state the amount to be paid and the payment schedule, including interest rates. |

| Signature Requirement | The maker must sign the note for it to be legally binding. |

| Transferability | Promissory notes can be transferred to other parties, making them negotiable instruments. |

| Default Consequences | If the maker fails to pay, the payee has the right to take legal action to recover the owed amount. |

| Formality | While a promissory note can be informal, having a written document is highly recommended for clarity and enforceability. |

| Notarization | Notarization is not required, but it can add an extra layer of authenticity to the document. |

| Use Cases | Commonly used for personal loans, business loans, and real estate transactions. |

Dos and Don'ts

When filling out the New York Promissory Note form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are four things you should and shouldn't do:

- Do provide clear and accurate information.

- Do include the full names and addresses of all parties involved.

- Don't leave any required fields blank.

- Don't use ambiguous language that could lead to misunderstandings.

Similar forms

A loan agreement is similar to a New York Promissory Note in that both documents outline the terms of a loan between a borrower and a lender. A loan agreement typically provides more detailed information, including repayment terms, interest rates, and any collateral involved. While a promissory note serves as a simple promise to repay, a loan agreement can include additional clauses regarding default, late fees, and other conditions that govern the borrowing relationship.

For professionals navigating the intricacies of the beauty industry, renewing a license in California requires careful attention to detail, as reflected in the Cosmetology License Renewal California form. This essential document, overseen by the State and Consumer Services Agency and the Board of Barbering and Cosmetology, necessitates comprehensive personal information, license type, and applicable fees. Timely submission of the form accompanied by the appropriate fee is crucial to avoid the risks associated with working under an expired license and to ensure compliance with legal requirements. More information can be found at https://formcalifornia.com.

A mortgage is another document that shares similarities with a New York Promissory Note. Both involve a borrower agreeing to repay a loan, but a mortgage specifically secures the loan with real property. In this case, the promissory note represents the borrower’s promise to repay the loan, while the mortgage provides the lender with the right to take possession of the property if the borrower defaults. This dual structure protects the lender’s interests while also formalizing the borrower’s obligation.

An IOU, or informal acknowledgment of debt, resembles a New York Promissory Note in its basic function of recognizing a debt owed. However, an IOU is generally less formal and may not include specific repayment terms or interest rates. While a promissory note is a legally binding document that can be enforced in court, an IOU may lack the same level of legal protection. Still, both serve as evidence of a debt and the obligation to repay it.

A personal guarantee is another document that can be compared to a New York Promissory Note. In this case, an individual agrees to be personally responsible for a debt incurred by a business or another party. While the promissory note outlines the borrower’s commitment to repay, a personal guarantee adds an additional layer of security for the lender. If the primary borrower defaults, the lender can seek repayment from the guarantor, thereby increasing the likelihood of recovering the owed amount.

Check out Popular Promissory Note Forms for Different States

Virginia Promissory Note - Creating a clear repayment plan within the note will help prevent disputes.

Promissory Note Florida - It is recommended to frequently review and discuss the terms outlined in the note.

The ADP Pay Stub form is essential for employees to track their earnings and understand various deductions applicable during each pay period; for more information, you can visit https://pdftemplates.info/adp-pay-stub-form, which provides additional resources and assistance regarding this important document.

Promissory Note Texas - The form can stipulate where payments will be sent during the loan period.

Blank Promissory Note - It serves as a reminder of financial obligations over time.