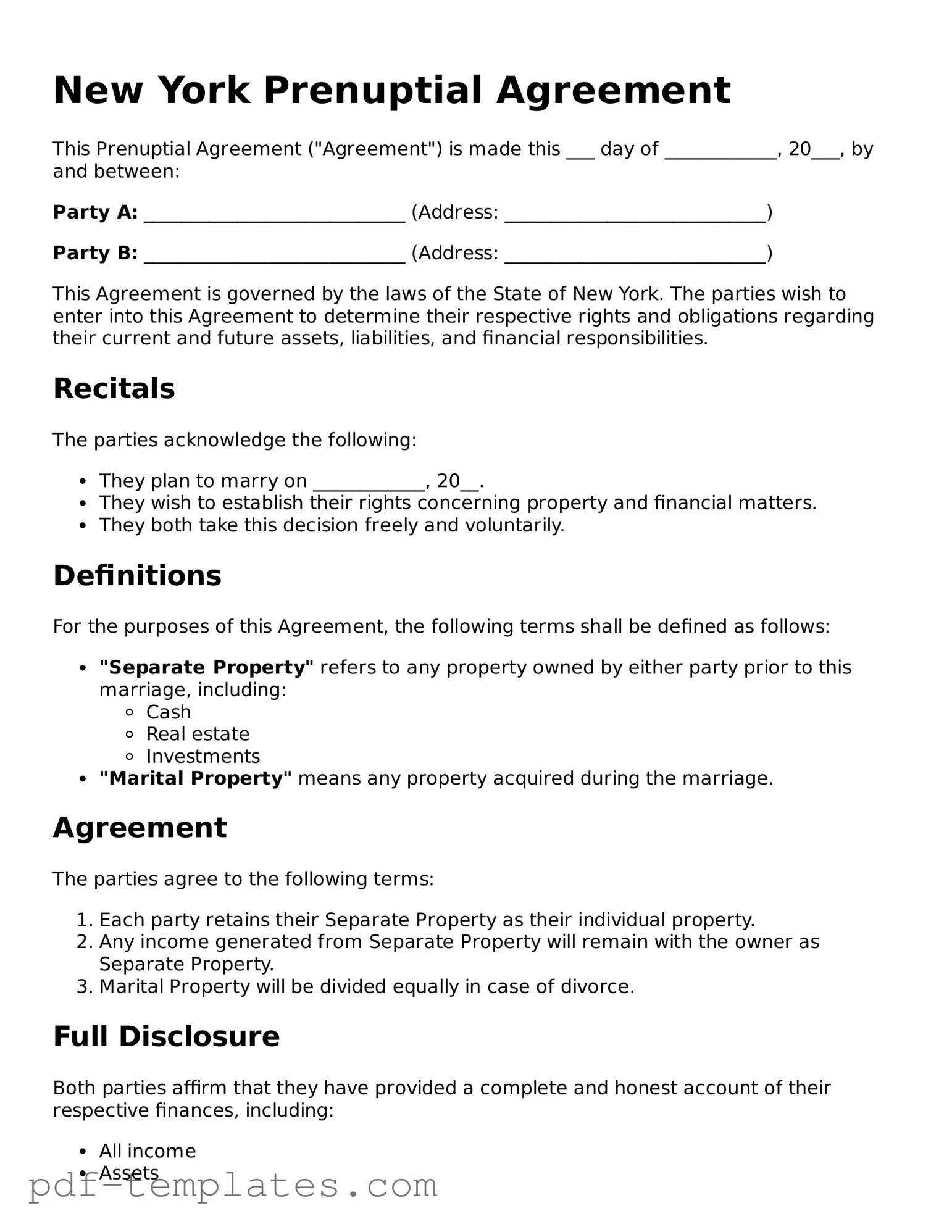

Official Prenuptial Agreement Template for New York State

Entering into a marriage is often one of the most significant life decisions a person can make, filled with excitement and anticipation for the future. However, alongside this joyous occasion, many couples in New York consider the practicalities of their financial futures, leading them to explore the option of a prenuptial agreement. This legal document serves as a foundation for understanding how assets and debts will be managed during the marriage and in the event of a divorce. A New York Prenuptial Agreement form typically includes essential components such as the identification of both parties, a clear outline of each individual's assets and liabilities, and the terms regarding the division of property. Additionally, it may address spousal support and any other financial arrangements that the couple deems necessary. By thoughtfully drafting this agreement, couples can foster open communication about their financial expectations and responsibilities, ultimately contributing to a more secure and harmonious partnership.

Misconceptions

When it comes to prenuptial agreements in New York, several misconceptions can lead to confusion. Understanding these misconceptions is essential for anyone considering a prenup. Below are nine common misunderstandings.

-

Prenuptial agreements are only for the wealthy.

This is not true. Prenuptial agreements can benefit anyone, regardless of their financial situation. They help clarify financial responsibilities and protect individual assets.

-

Prenups are only for divorce situations.

While they are often associated with divorce, prenuptial agreements can also provide clarity during the marriage. They outline financial expectations and can reduce conflicts.

-

A prenup can cover child custody and support.

This misconception is misleading. While you can discuss child-related issues, courts typically do not enforce these agreements regarding custody or support, as they prioritize the child's best interests.

-

Prenups are unromantic and imply distrust.

Many people view prenuptial agreements as practical tools. They can foster open communication about finances, which can strengthen a relationship rather than weaken it.

-

Once signed, a prenup cannot be changed.

This is incorrect. Couples can modify their prenuptial agreements at any time, as long as both parties agree to the changes and follow the legal requirements for amendments.

-

Prenups are automatically enforceable.

Not all prenuptial agreements are enforceable. They must meet specific legal criteria, including being fair and entered into voluntarily by both parties.

-

You don’t need a lawyer to create a prenup.

While it is possible to create a prenup without legal assistance, it is highly advisable to consult with an attorney. This ensures that the agreement meets legal standards and protects both parties' interests.

-

Prenups are only for second marriages.

This is a common myth. Individuals entering their first marriage can also benefit from a prenup, especially if they have significant assets, debts, or children from previous relationships.

-

A prenup will protect me from all financial issues in a divorce.

This is not entirely accurate. While a prenup can help clarify asset division, it cannot cover every possible financial issue, and courts may still consider various factors during a divorce.

Understanding these misconceptions can help individuals make informed decisions about prenuptial agreements and their role in marriage.

New York Prenuptial Agreement: Usage Instruction

Filling out the New York Prenuptial Agreement form is an important step for couples looking to outline their financial arrangements before marriage. The process is straightforward, but careful attention to detail is essential to ensure that all necessary information is accurately recorded. Below are the steps to guide you through completing the form.

- Begin by gathering all relevant personal information for both parties, including full names, addresses, and dates of birth.

- Clearly state the purpose of the agreement at the top of the form.

- Detail the assets and liabilities of each party. This includes property, bank accounts, investments, and any debts.

- Discuss and outline how you plan to manage financial matters during the marriage. This may include income, expenses, and property ownership.

- Include provisions for what will happen in the event of a divorce or separation. Specify how assets will be divided and any spousal support arrangements.

- Both parties should review the completed form together to ensure all information is correct and understood.

- Sign the form in the presence of a notary public to validate the agreement.

- Make copies of the signed agreement for both parties to keep in a safe place.

Common mistakes

-

Not understanding the purpose of a prenuptial agreement. Many people fill out the form without realizing it’s meant to protect assets and clarify financial responsibilities.

-

Failing to disclose all assets and debts. Complete transparency is crucial. Omitting any financial information can lead to issues later on.

-

Using vague language. Clarity is essential. Ambiguous terms can cause confusion and disputes down the line.

-

Not considering future changes. Life circumstances change, and it’s important to address how the agreement will adapt over time.

-

Neglecting to consult with a legal professional. Many individuals attempt to navigate the form on their own, which can lead to costly mistakes.

-

Not discussing the agreement with your partner. Open communication is key. Both parties should understand and agree to the terms.

-

Forgetting to review the agreement regularly. It’s wise to revisit the document periodically to ensure it still meets your needs.

-

Ignoring state laws. Each state has its own rules regarding prenuptial agreements. Familiarity with New York laws is essential.

-

Failing to consider the timing of signing the agreement. Rushing to sign right before the wedding can raise questions about coercion.

-

Not having witnesses or notarization. Some people overlook the importance of having the agreement properly executed, which can affect its validity.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement is a legal contract between two individuals before they marry, outlining the division of assets and responsibilities in the event of a divorce. |

| Governing Law | In New York, prenuptial agreements are governed by the New York Domestic Relations Law, specifically Section 236(B). |

| Enforceability | For a prenuptial agreement to be enforceable in New York, it must be in writing and signed by both parties. |

| Full Disclosure | Both parties must fully disclose their financial situations. This transparency is crucial for the agreement's validity. |

| Independent Legal Advice | While not required, it is highly recommended that each party seeks independent legal counsel to ensure their interests are protected. |

| Modification and Revocation | A prenuptial agreement can be modified or revoked at any time, but this must also be done in writing and signed by both parties. |

Dos and Don'ts

When filling out the New York Prenuptial Agreement form, it’s essential to be thorough and precise. Here’s a list of things to do and avoid.

- Do provide complete and accurate financial information for both parties.

- Do discuss the terms openly with your partner to ensure mutual understanding.

- Do consult with a legal professional to review the agreement before signing.

- Do keep copies of all documents for your records.

- Don't rush through the process; take your time to consider all terms.

- Don't hide assets or financial information; transparency is crucial.

Similar forms

A cohabitation agreement shares similarities with a prenuptial agreement, as both documents outline the rights and responsibilities of partners. While a prenuptial agreement is established before marriage, a cohabitation agreement is created for couples who choose to live together without marrying. Both documents address issues such as property division, financial obligations, and dispute resolution, helping to clarify expectations and protect individual interests in the relationship.

A postnuptial agreement is another document akin to a prenuptial agreement. This agreement is executed after a couple has married and serves a similar purpose: to define the division of assets and responsibilities in the event of a divorce or separation. Like prenuptial agreements, postnuptial agreements can address issues such as spousal support and property rights, providing couples with clarity and security regarding their financial arrangements.

A separation agreement is also comparable to a prenuptial agreement. This document is typically drafted when a couple decides to separate but not divorce. It outlines the terms of the separation, including asset division, child custody, and support obligations. Both agreements aim to protect the interests of each party and can help prevent disputes during the separation process.

An estate plan, particularly a will or trust, shares some characteristics with a prenuptial agreement. Both documents address the distribution of assets and can help prevent conflicts among heirs. While a prenuptial agreement focuses on the division of property during a marriage or divorce, an estate plan ensures that an individual's wishes are honored after death, providing a framework for asset management and inheritance.

The CA DMV SR1 form is essential for documenting traffic accidents in California, ensuring compliance with the state's Department of Motor Vehicles (DMV) regulations. This form must be filled out accurately to report incidents involving personal injury, death, or significant property damage, with a threshold of $1,000. Timely submission is critical to maintain driving privileges and avoid potential penalties. For further assistance and resources, you can refer to All California Forms, which provide comprehensive information on necessary documentation.

Finally, a financial disclosure statement is akin to a prenuptial agreement in that it requires both parties to disclose their financial information. This transparency is essential in both documents to ensure that all parties are fully informed about assets and liabilities, which can significantly impact the terms of a prenuptial agreement. By ensuring full disclosure, both parties can make informed decisions and foster trust in the relationship.

Check out Popular Prenuptial Agreement Forms for Different States

Florida Prenuptial Contract - It empowers couples to make informed financial decisions pre-marriage.

Washington Prenuptial Contract - This document aims to establish informed consent regarding financial arrangements.

Pennsylvania Prenuptial Contract - The agreement may address what happens to retirement accounts.

To properly complete the USCIS I-864 form, also known as the Affidavit of Support, it's crucial to follow the detailed guidelines provided by the USCIS, and you can find a helpful resource at documentonline.org/blank-uscis-i-864, which outlines the necessary steps and required information for sponsors.

California Prenuptial Contract - It can help maintain privacy regarding financial matters during a divorce.