Official Power of Attorney Template for New York State

In New York, the Power of Attorney form serves as an essential legal tool that allows individuals to appoint someone else to make decisions on their behalf. This document can cover a wide range of financial and legal matters, from managing bank accounts to handling real estate transactions. It is particularly useful for those who may be unable to manage their affairs due to illness or absence. The form can be tailored to grant broad or limited powers, depending on the needs of the person creating it, known as the principal. Additionally, it requires careful consideration regarding the choice of agent, as this person will have significant authority. The New York Power of Attorney form must be properly executed, including notarization, to ensure its validity. Understanding the nuances of this form can help individuals safeguard their interests and ensure that their wishes are respected, making it a vital component of financial planning.

Misconceptions

- Misconception 1: A Power of Attorney is only for financial matters.

- Misconception 2: A Power of Attorney is permanent and cannot be revoked.

- Misconception 3: Only elderly individuals need a Power of Attorney.

- Misconception 4: A Power of Attorney gives the agent unlimited power.

- Misconception 5: A Power of Attorney is only necessary if someone is incapacitated.

- Misconception 6: All Power of Attorney forms are the same.

- Misconception 7: You need a lawyer to create a Power of Attorney.

- Misconception 8: A Power of Attorney automatically ends when the principal dies.

- Misconception 9: A Power of Attorney can only be used in financial institutions.

While many people associate Power of Attorney with financial decisions, it can also cover healthcare and personal matters. You can create a document that specifies your wishes regarding medical treatment and appoint someone to make those decisions on your behalf.

This is not true. A Power of Attorney can be revoked at any time, as long as the principal is mentally competent. It’s important to formally notify the agent and any institutions involved when revoking the document.

People of all ages can benefit from having a Power of Attorney. Unexpected events, such as accidents or sudden illnesses, can happen to anyone, making it wise to have this document in place regardless of age.

The authority granted to an agent can be limited or broad, depending on the language used in the document. You can specify exactly what powers you want to give, whether they are financial, medical, or both.

A Power of Attorney is useful even when the principal is fully capable of making decisions. It allows someone else to act on their behalf, which can be beneficial in situations where the principal is unavailable or prefers not to handle certain tasks.

Power of Attorney forms can vary significantly based on state laws and the specific needs of the individual. It is crucial to use a form that complies with New York law and addresses your unique situation.

While consulting a lawyer can provide valuable guidance, it is not strictly necessary to have one to create a Power of Attorney. Many resources are available that allow individuals to draft these documents on their own, provided they follow state requirements.

This is correct. However, it’s important to note that any actions taken by the agent while the principal was alive remain valid. The Power of Attorney ceases to be effective upon the principal’s death.

A Power of Attorney can be used in various situations, including healthcare settings, real estate transactions, and legal matters. The document grants the agent the authority to act in the specified areas, which can extend beyond just financial institutions.

New York Power of Attorney: Usage Instruction

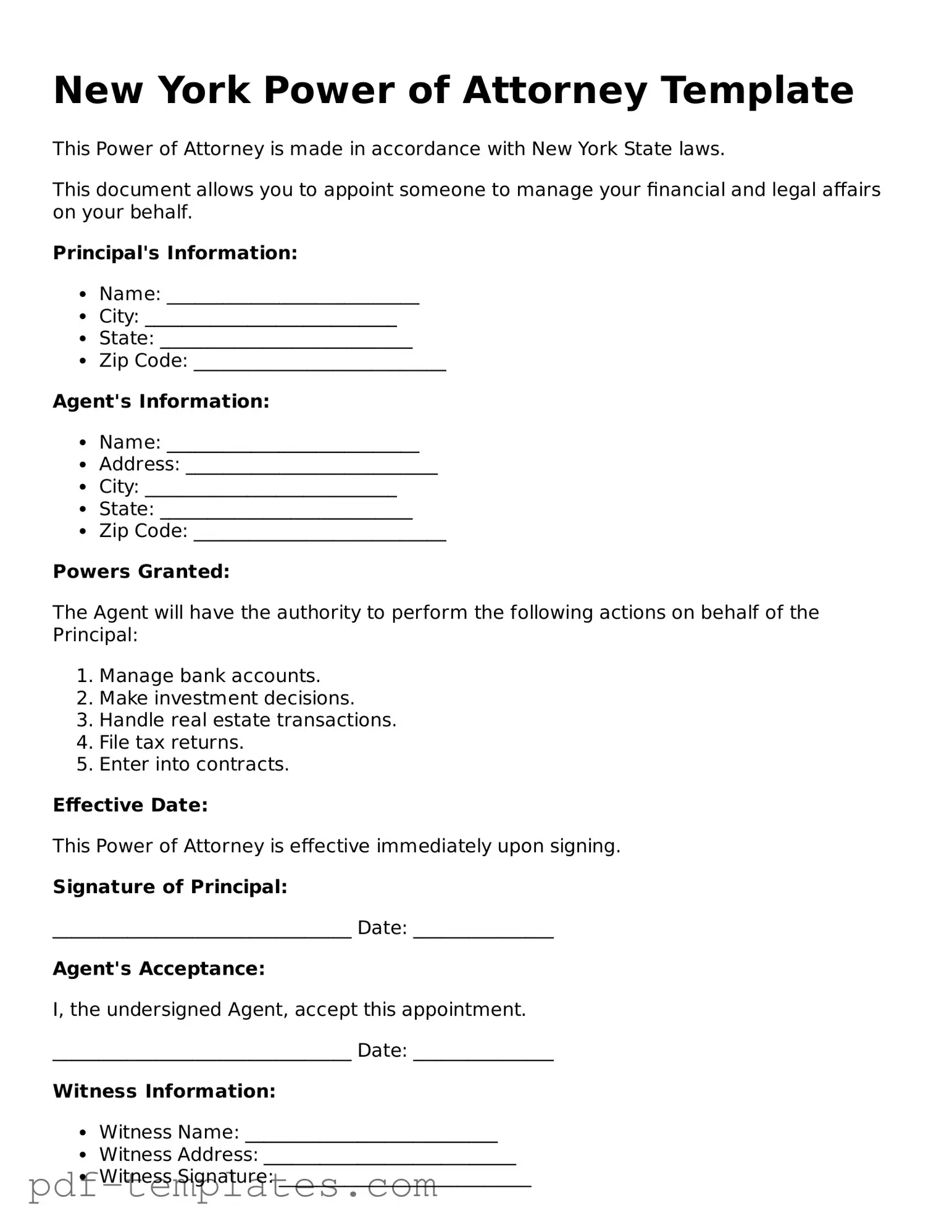

Filling out a Power of Attorney form in New York is a straightforward process that allows an individual to designate someone else to act on their behalf in various matters. This document is crucial for ensuring that your financial and legal affairs are managed according to your wishes, particularly if you become unable to do so yourself. The following steps will guide you through the process of completing the form accurately.

- Obtain the New York Power of Attorney form. You can find it online or at legal supply stores.

- Begin by entering your full name and address in the designated sections. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your agent. This individual will have the authority to act on your behalf.

- Specify the powers you wish to grant your agent. You can choose to give general authority or limit their powers to specific areas, such as financial or health care decisions.

- Include any additional instructions or limitations that you want to impose on your agent's authority. Be clear and precise to avoid confusion later.

- Sign and date the form in the presence of a notary public. This step is crucial, as a notary’s signature verifies your identity and the authenticity of your signature.

- Make copies of the completed and notarized form for your records and for your agent. It’s important that all parties involved have access to the document.

- Consider discussing your decision with your agent to ensure they understand their responsibilities and your wishes.

Common mistakes

-

Not Specifying the Powers Granted: One common mistake is failing to clearly outline the specific powers being granted to the agent. The form allows for a variety of powers, including financial and medical decisions. If these are not clearly defined, it can lead to confusion and disputes later on.

-

Inadequate Identification of the Agent: It is crucial to provide the full name and contact information of the person designated as the agent. Omitting this information can render the document ineffective, as there may be ambiguity about who is authorized to act on behalf of the principal.

-

Failing to Sign and Date the Document: A Power of Attorney form must be signed and dated by the principal. Without these essential steps, the document may not be legally valid. It is important to ensure that the signature is clear and the date is accurate.

-

Not Including Witnesses or Notarization: Depending on the specific requirements in New York, some Power of Attorney forms may need to be witnessed or notarized. Neglecting this requirement can lead to challenges regarding the legitimacy of the document.

-

Using Outdated Forms: Laws and requirements can change. Using an outdated version of the Power of Attorney form may lead to complications. Always ensure that the most current form is being utilized to comply with legal standards.

-

Overlooking Revocation Procedures: Many people forget to include or understand how to revoke a Power of Attorney. If circumstances change and the principal wishes to revoke the authority granted, it is important to know the proper steps to do so effectively.

PDF Features

| Fact Name | Details |

|---|---|

| Definition | A Power of Attorney (POA) allows one person to act on behalf of another in legal or financial matters. |

| Governing Law | New York General Obligations Law, Article 5, Title 15. |

| Types | New York recognizes several types of POAs, including Durable, Springing, and Limited POAs. |

| Durable POA | This type remains effective even if the principal becomes incapacitated. |

| Springing POA | This type only takes effect upon the principal's incapacity. |

| Agent Responsibilities | The agent must act in the principal's best interests and keep accurate records. |

| Signing Requirements | The principal must sign the POA in the presence of a notary public and two witnesses. |

| Revocation | The principal can revoke a POA at any time as long as they are competent. |

| Limitations | Some actions, like making a will, cannot be delegated through a POA. |

| Filing | POAs do not need to be filed with the state unless they involve real estate transactions. |

Dos and Don'ts

When filling out the New York Power of Attorney form, it's essential to follow certain guidelines to ensure that the document is valid and meets your needs. Here are some important dos and don'ts:

- Do read the entire form carefully before filling it out.

- Do clearly identify the person you are appointing as your agent.

- Do specify the powers you are granting to your agent, as this can vary widely.

- Do sign the form in the presence of a notary public.

- Don't leave any sections blank; incomplete forms can lead to issues later.

- Don't use the form if you do not understand what powers you are granting.

- Don't appoint someone who may not act in your best interest.

- Don't forget to keep a copy of the signed document for your records.

Following these guidelines will help ensure that your Power of Attorney form is properly completed and legally effective.

Similar forms

The New York Power of Attorney form is similar to the Advance Healthcare Directive. Both documents allow individuals to appoint someone to make decisions on their behalf. While the Power of Attorney focuses on financial and legal matters, the Advance Healthcare Directive specifically addresses medical decisions. This ensures that a person's healthcare preferences are respected when they cannot communicate them directly.

Another document similar to the Power of Attorney is the Living Will. This legal document outlines a person's wishes regarding medical treatment in situations where they cannot express their desires. Like the Power of Attorney, a Living Will provides guidance to healthcare providers and family members. However, it does not appoint an agent to make decisions, unlike the Power of Attorney.

The Healthcare Proxy is also akin to the Power of Attorney. This document allows someone to make healthcare decisions for another person if they are unable to do so. While both documents serve to protect an individual's interests, the Healthcare Proxy is specifically focused on medical choices, whereas the Power of Attorney covers a broader range of financial and legal matters.

A Trust is another document that shares similarities with the Power of Attorney. Both can be used to manage assets and provide for beneficiaries. However, a Trust is a legal arrangement that holds and manages property, while the Power of Attorney grants authority to an individual to act on someone else's behalf. Trusts can also avoid probate, which is not a feature of a Power of Attorney.

The Will is a key document that resembles the Power of Attorney in that both deal with the management of a person's affairs. A Will outlines how a person's assets will be distributed after their death, while the Power of Attorney is effective during a person's lifetime. Both documents are essential for ensuring that an individual's wishes are honored, but they serve different purposes and timelines.

The Declaration of Guardian is similar to the Power of Attorney in that it allows individuals to designate someone to make decisions on their behalf. This document is specifically for appointing a guardian for minors or incapacitated adults. While the Power of Attorney can cover financial and legal decisions, the Declaration of Guardian focuses on personal and custodial matters.

Lastly, the Authorization for Release of Information shares some similarities with the Power of Attorney. This document allows individuals to grant permission for others to access their personal information, such as medical records or financial details. While the Power of Attorney gives broader authority to act on behalf of someone, the Authorization for Release of Information is more limited in scope, focusing on information sharing rather than decision-making.

Check out Popular Power of Attorney Forms for Different States

Florida Power of Attorney - This document can include provisions for financial management and healthcare decisions.

Texas Power of Attorney Form - Provides a trusted person with decision-making power.