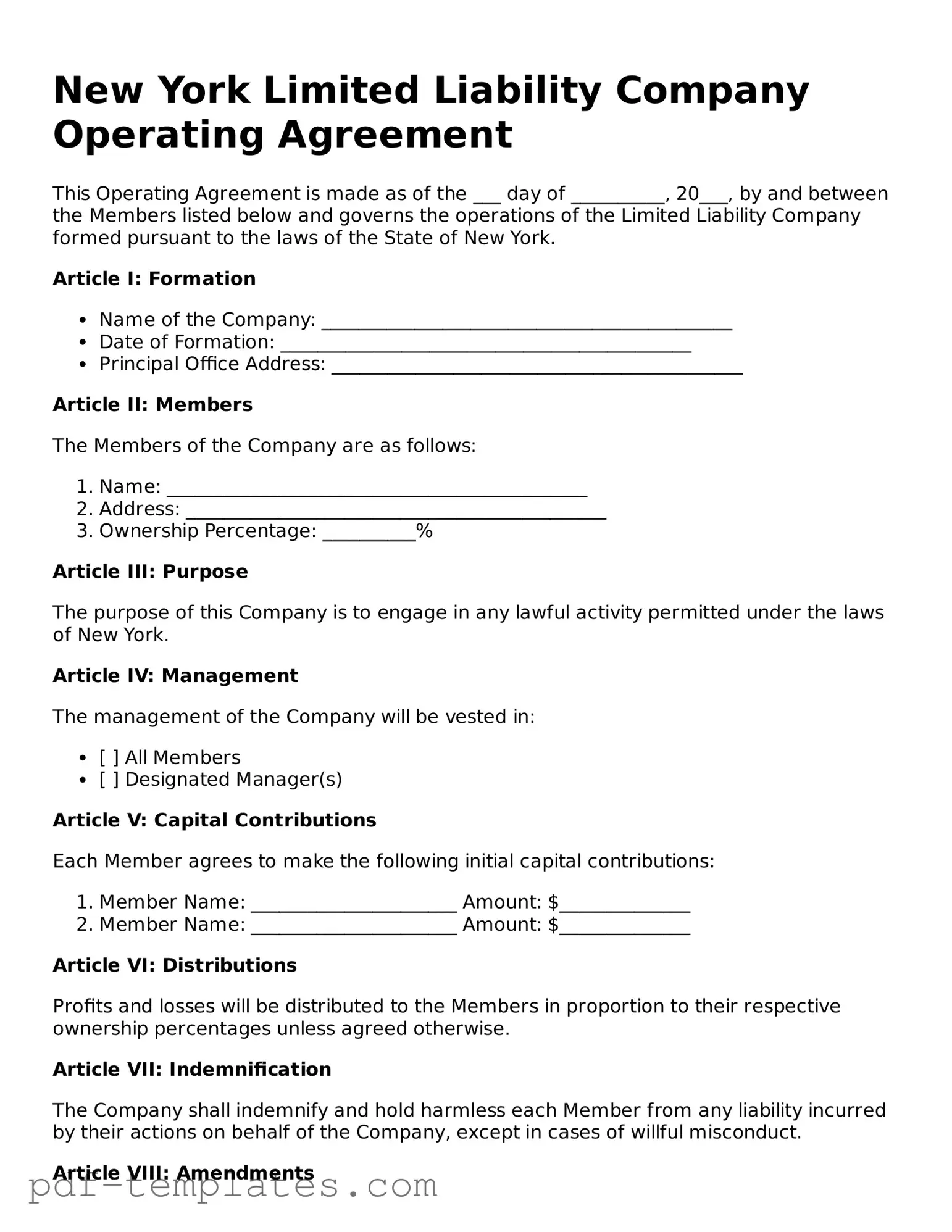

Official Operating Agreement Template for New York State

The New York Operating Agreement form serves as a foundational document for Limited Liability Companies (LLCs) operating within the state. This agreement outlines the management structure, operational guidelines, and financial arrangements of the LLC, ensuring that all members are on the same page regarding their rights and responsibilities. It typically includes key components such as member contributions, profit-sharing ratios, and procedures for adding or removing members. Additionally, the form addresses decision-making processes, dispute resolution mechanisms, and the handling of member withdrawals or transfers of interest. By establishing clear rules and expectations, the Operating Agreement helps prevent misunderstandings and conflicts among members, ultimately contributing to a smoother operation of the business. Properly drafting this agreement is essential for compliance with state laws and for protecting the interests of all parties involved.

Misconceptions

-

Misconception 1: An Operating Agreement is only necessary for large businesses.

This is not true. All limited liability companies (LLCs) in New York, regardless of size, benefit from having an Operating Agreement. It outlines the management structure and operational procedures, which can help prevent disputes among members.

-

Misconception 2: An Operating Agreement must be filed with the state.

In New York, the Operating Agreement does not need to be filed with the state. It is an internal document meant for the members of the LLC. Keeping it on file is essential for reference and legal protection.

-

Misconception 3: The Operating Agreement is a one-time document.

This misconception overlooks the fact that an Operating Agreement can and should be updated as the business evolves. Changes in membership, management structure, or business goals may necessitate revisions to the agreement.

-

Misconception 4: All LLCs must use a standard Operating Agreement template.

While templates can provide a useful starting point, each LLC has unique needs. Customizing the Operating Agreement to reflect the specific goals and circumstances of the business is advisable for effective governance.

New York Operating Agreement: Usage Instruction

Completing the New York Operating Agreement form is an essential step for any Limited Liability Company (LLC) in the state. This document outlines the management structure and operational guidelines for your LLC. After filling out the form, you will have a clear framework for how your business will operate, which can help prevent misunderstandings among members and provide a solid foundation for your company's future.

- Start by entering the name of your LLC at the top of the form. Ensure that it matches the name registered with the state.

- Next, list the principal address of your LLC. This should be a physical address where the business is located, not a P.O. Box.

- Fill in the names and addresses of all members of the LLC. Include each member’s full legal name and their respective addresses.

- Specify the management structure of the LLC. Indicate whether it will be member-managed or manager-managed.

- Outline the percentage of ownership for each member. This section should reflect how profits and losses will be distributed among members.

- Detail the voting rights of each member. This should clarify how decisions will be made within the LLC.

- Include any additional provisions that are relevant to your LLC. This could cover things like dispute resolution, member withdrawal, or the addition of new members.

- Finally, have all members sign and date the agreement. This step is crucial as it signifies that everyone agrees to the terms outlined in the document.

Common mistakes

-

Neglecting to Identify Members: Failing to list all members of the LLC can lead to disputes later. Each member's name and address should be clearly stated.

-

Omitting the Purpose of the LLC: Not specifying the business purpose can create confusion. Clearly define what the LLC will do to ensure everyone is on the same page.

-

Inadequate Capital Contributions: Members often forget to detail their initial capital contributions. This information is crucial for understanding each member's investment and ownership stake.

-

Ignoring Voting Rights: Failing to outline voting rights can lead to power struggles. Clearly state how decisions will be made and the voting power of each member.

-

Not Including a Dissolution Clause: Omitting a plan for dissolution can cause complications if the LLC needs to be dissolved. Include a clear procedure for winding down the business.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | The New York Operating Agreement outlines the management structure and operating procedures for a limited liability company (LLC) in New York. |

| Governing Law | This agreement is governed by the New York Limited Liability Company Law (NY LLC Law), specifically Article 2. |

| Membership | The agreement specifies the rights and responsibilities of members, including voting rights and profit distribution. |

| Flexibility | New York law allows LLCs to customize their Operating Agreements to fit their unique needs, providing a high degree of flexibility. |

| Filing Requirement | While the Operating Agreement does not need to be filed with the state, it must be kept on record at the LLC’s principal office. |

| Amendments | The agreement can be amended by a majority vote of the members, ensuring that it remains relevant as the business evolves. |

Dos and Don'ts

When filling out the New York Operating Agreement form, it's important to approach the task with care. Here are some key do's and don'ts to keep in mind:

- Do read the entire form thoroughly before starting. Understanding what is required will save you time and effort.

- Do provide accurate information. Ensure that all names, addresses, and details are correct to avoid future complications.

- Do consult with a legal professional if you have any questions. Getting expert advice can clarify complex issues.

- Do include all members of the LLC in the agreement. This ensures everyone is on the same page and aware of their rights and responsibilities.

- Do keep a copy of the completed agreement for your records. This document is important for legal and operational purposes.

- Don't rush through the form. Taking your time will help you avoid mistakes that could lead to legal issues.

- Don't leave any required fields blank. Incomplete forms may be rejected or cause delays.

- Don't use vague language. Clearly define terms and conditions to prevent misunderstandings among members.

- Don't forget to review the agreement periodically. Changes in your business or membership may necessitate updates to the document.

By following these guidelines, you can ensure that your New York Operating Agreement is filled out correctly and serves its intended purpose effectively.

Similar forms

The New York Operating Agreement is similar to a Partnership Agreement, which outlines the terms and conditions under which partners operate a business together. Like the Operating Agreement, a Partnership Agreement defines each partner's roles, responsibilities, and profit-sharing arrangements. Both documents aim to establish clear expectations among the parties involved, helping to prevent misunderstandings and disputes down the line.

Another document that shares similarities is the Bylaws of a Corporation. Bylaws serve as the internal rules governing the management of a corporation, much like how an Operating Agreement governs the operations of a Limited Liability Company (LLC). Both documents detail the structure of the organization, including the roles of members or shareholders, decision-making processes, and procedures for meetings. This consistency in structure helps ensure smooth operations and compliance with applicable laws.

The Shareholders' Agreement is also akin to the Operating Agreement. This document is used by corporations to outline the rights and obligations of shareholders. Similar to an Operating Agreement, it addresses issues such as share transfer restrictions, voting rights, and the management of the corporation. Both agreements aim to protect the interests of the parties involved while providing a framework for governance and decision-making.

A Joint Venture Agreement is another document that aligns closely with the New York Operating Agreement. This type of agreement is used when two or more parties collaborate on a specific project or business venture. Like the Operating Agreement, it outlines the contributions of each party, how profits and losses will be shared, and the governance structure. This helps ensure that all parties are on the same page regarding their roles and responsibilities.

The Limited Partnership Agreement shares similarities with the Operating Agreement as well. This document governs the relationship between general and limited partners in a limited partnership. It specifies the roles of each partner, profit distribution, and management responsibilities, much like how an Operating Agreement does for LLC members. Both agreements serve to clarify expectations and protect the interests of the involved parties.

The Membership Agreement is another document that resembles the New York Operating Agreement. This agreement is often used in multi-member LLCs to outline the rights and responsibilities of each member. Similar to the Operating Agreement, it addresses issues such as ownership percentages, decision-making processes, and profit-sharing arrangements. Both documents work to create a harmonious working relationship among members.

The Franchise Agreement is also comparable to the Operating Agreement. This document governs the relationship between a franchisor and franchisee, detailing the rights and obligations of both parties. Like an Operating Agreement, it includes terms related to fees, operational guidelines, and the duration of the agreement. Both documents aim to establish a clear framework for business operations and expectations.

Lastly, the Non-Disclosure Agreement (NDA) can be seen as similar in terms of establishing clear terms, although it serves a different purpose. An NDA protects confidential information shared between parties, while the Operating Agreement governs the operational aspects of an LLC. However, both documents emphasize the importance of clarity and mutual understanding in business relationships, ensuring that all parties are aware of their rights and responsibilities.

Check out Popular Operating Agreement Forms for Different States

Create an Operating Agreement - An Operating Agreement is typically not filed with the state but kept on record.

Operating Agreement Template Pdf - This document provides guidelines for handling member disputes.

How to Create an Operating Agreement - This document can include limitations on members' authority to act on behalf of the LLC.