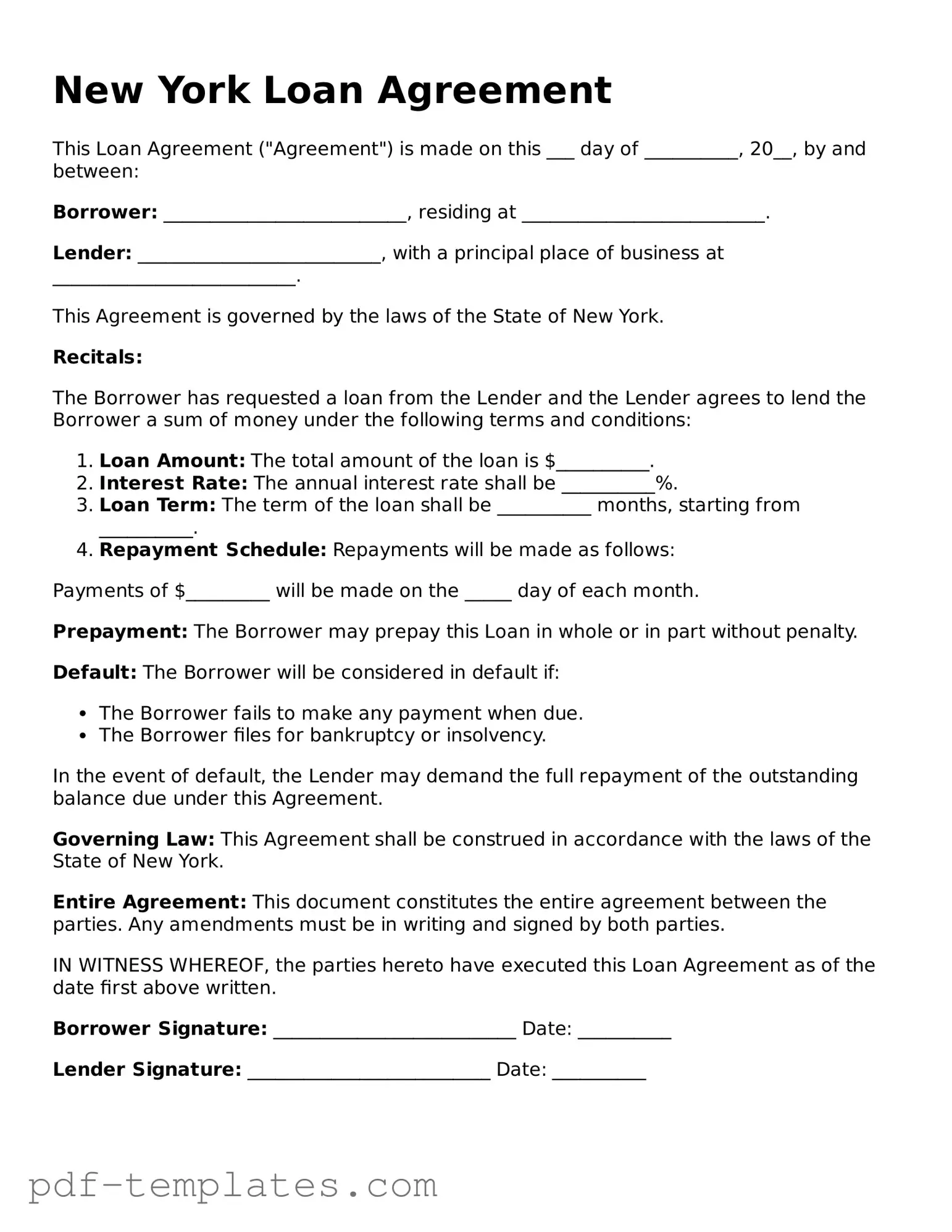

Official Loan Agreement Template for New York State

The New York Loan Agreement form serves as a crucial document in the lending process, establishing the terms and conditions under which a borrower receives funds from a lender. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It outlines the rights and obligations of both parties, ensuring clarity and legal protection. Additionally, the agreement may specify provisions for default, prepayment, and dispute resolution, creating a comprehensive framework for the financial transaction. By clearly delineating these aspects, the New York Loan Agreement form helps to foster trust and accountability, making it a fundamental tool for individuals and businesses engaging in borrowing and lending activities.

Misconceptions

The New York Loan Agreement form is often surrounded by various misconceptions that can lead to confusion for borrowers and lenders alike. Here are seven common misunderstandings:

-

All loan agreements are the same. Many people assume that all loan agreements follow a standard template. In reality, each agreement can vary significantly based on the lender’s policies, the type of loan, and specific borrower circumstances.

-

Signing a loan agreement is a guarantee of approval. Some individuals mistakenly believe that signing the loan agreement means they will receive the funds. Approval is contingent upon further verification of the borrower’s financial status and creditworthiness.

-

Loan agreements are only for large amounts. Many think that loan agreements are only necessary for substantial loans. However, even small loans can require formal agreements to protect both parties involved.

-

Once signed, the terms cannot be changed. It is a common belief that the terms of a loan agreement are set in stone after signing. In fact, borrowers and lenders can negotiate terms before finalizing the agreement, and modifications may be possible later with mutual consent.

-

Interest rates are fixed in every agreement. Many assume that interest rates in loan agreements are always fixed. However, some loans may have variable interest rates that can change over time based on market conditions.

-

Loan agreements are only for personal loans. Some people think that loan agreements apply solely to personal loans. In truth, they are used for various types of loans, including business loans, mortgages, and auto loans.

-

You don’t need to read the agreement. A frequent misconception is that borrowers can sign a loan agreement without reading it thoroughly. Understanding the terms is crucial, as they outline the rights and obligations of both parties.

Being aware of these misconceptions can help individuals navigate the loan process more effectively, ensuring they make informed decisions.

New York Loan Agreement: Usage Instruction

Filling out the New York Loan Agreement form is an important step in securing a loan. This document lays out the terms and conditions of the loan, ensuring that both the lender and the borrower understand their obligations. To make the process easier, follow these steps carefully.

- Begin by entering the date at the top of the form. This date should reflect when you are completing the agreement.

- Fill in the names of both the lender and the borrower. Make sure to include full legal names as they appear on official documents.

- Provide the addresses for both parties. This helps ensure clear communication throughout the loan period.

- Specify the loan amount. Clearly state the total amount of money being borrowed.

- Outline the interest rate. Indicate whether it is fixed or variable and provide the percentage rate.

- Detail the repayment schedule. Include how often payments will be made (e.g., monthly, quarterly) and the duration of the loan.

- Include any fees associated with the loan. This may cover processing fees, late fees, or prepayment penalties.

- Sign and date the agreement. Both parties should do this to indicate their acceptance of the terms.

Once you have completed these steps, review the form for accuracy. Both parties should keep a copy of the signed agreement for their records. This ensures that everyone is on the same page moving forward.

Common mistakes

-

Inaccurate Personal Information: Many individuals fail to provide correct personal details such as their name, address, or Social Security number. This can lead to delays in processing the loan or even rejection.

-

Missing Signatures: Some applicants overlook the requirement for signatures. Every party involved in the agreement must sign. Without these signatures, the document is not legally binding.

-

Omitting Loan Details: Important information such as the loan amount, interest rate, and repayment terms are sometimes left blank. This can create confusion and disputes later on.

-

Not Reviewing Terms and Conditions: Applicants often fail to read the fine print. Understanding the terms and conditions is crucial to avoid unexpected fees or penalties.

-

Ignoring Additional Documentation: Some people forget to include required supporting documents. These may include proof of income or identification, which are necessary for the approval process.

PDF Features

| Fact Name | Details |

|---|---|

| Definition | The New York Loan Agreement form is a legal document outlining the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of New York. |

| Parties Involved | The form typically includes the names and addresses of both the lender and the borrower. |

| Loan Amount | The specific amount being loaned is clearly stated in the agreement. |

| Repayment Terms | The document outlines the repayment schedule, including interest rates and due dates. |

Dos and Don'ts

When filling out the New York Loan Agreement form, it is essential to adhere to certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information to avoid delays.

- Do sign and date the form in the appropriate sections.

- Do keep a copy of the completed form for your records.

- Do consult with a legal expert if you have questions about the terms.

- Don't leave any required fields blank.

- Don't use abbreviations or slang in your responses.

- Don't sign the form without reading it thoroughly.

- Don't provide false information, as this can lead to legal consequences.

- Don't ignore the submission deadline specified in the agreement.

Similar forms

The New York Loan Agreement form shares similarities with a Promissory Note. A Promissory Note is a written promise to pay a specified amount of money to a designated party at a predetermined time. Like the Loan Agreement, it outlines the terms of the loan, including the interest rate and repayment schedule. Both documents serve to formalize the borrower-lender relationship, ensuring that the obligations are clearly defined and legally enforceable.

Another document akin to the Loan Agreement is the Mortgage Agreement. This document is used when real property is involved as collateral for a loan. Similar to the Loan Agreement, it details the terms of the loan, including the amount borrowed and the repayment terms. However, the Mortgage Agreement also includes provisions related to the property, such as the rights of the lender in case of default, providing additional security for the loan.

In real estate transactions, understanding the various legal documents is crucial for successful property transfers, particularly within California where forms like the California Quitclaim Deed play an essential role. This document allows for the swift transfer of property interests without the extensive guarantees associated with other deeds, making it especially useful in familial situations or to rectify title issues. For those seeking a comprehensive understanding of property-related documentation, it's advisable to explore All California Forms that can offer additional insights and clarity.

The Security Agreement is also comparable to the Loan Agreement. This document is used when personal property is pledged as collateral for a loan. Like the Loan Agreement, it specifies the terms of the loan and outlines the rights and responsibilities of both parties. The Security Agreement ensures that the lender has a claim on the collateral in case the borrower fails to meet their obligations.

A Credit Agreement is another document that resembles the Loan Agreement. This agreement outlines the terms under which a lender extends credit to a borrower. Similar to the Loan Agreement, it details the amount of credit, interest rates, and repayment terms. However, a Credit Agreement may also include additional provisions related to fees and covenants that the borrower must adhere to throughout the duration of the credit line.

The Loan Application is also related to the Loan Agreement. While the Loan Application is a document that the borrower submits to request a loan, it provides essential information that the lender uses to assess the borrower's creditworthiness. The Loan Agreement, on the other hand, is the final document that formalizes the terms of the loan once the lender has approved the application.

Another similar document is the Loan Disclosure Statement. This document provides borrowers with important information about the loan terms, including the annual percentage rate (APR), fees, and total repayment amounts. Like the Loan Agreement, it aims to ensure transparency and understanding of the loan terms before the borrower commits to the agreement.

The Forbearance Agreement also bears similarities to the Loan Agreement. This document is used when a lender agrees to temporarily reduce or suspend payments due to the borrower’s financial hardship. It outlines the terms of the forbearance, including how long the reduced payments will last and what the borrower’s obligations will be afterward. Both documents seek to provide a clear framework for the borrower’s obligations while addressing their financial situation.

Finally, the Loan Modification Agreement is comparable to the Loan Agreement. This document is used when the terms of an existing loan are changed, often due to the borrower’s request for more favorable conditions. Like the Loan Agreement, it specifies the new terms, including interest rates and repayment schedules. The Loan Modification Agreement serves to protect both parties by clearly stating the revised obligations and expectations.

Check out Popular Loan Agreement Forms for Different States

Free Promissory Note Template Texas - It may include information on interest rates and fees.

To effectively document your rental agreement, consider utilizing a specialized Commercial Lease Agreement template that ensures all necessary details are properly outlined. For a well-structured form, visit this Commercial Lease Agreement template to streamline the process.

Loan Agreement Template California - Clear guidelines for dispute resolution can promote fairness.