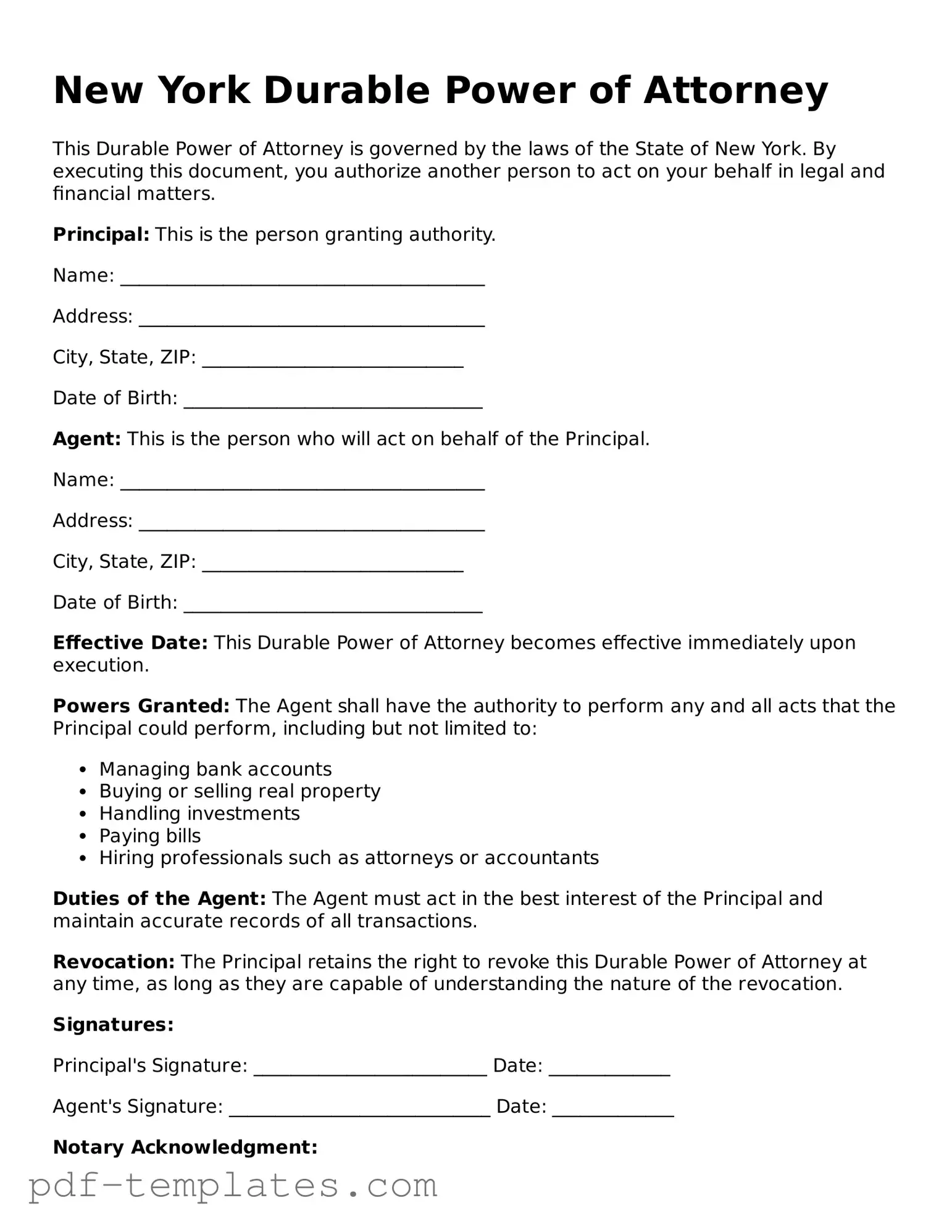

Official Durable Power of Attorney Template for New York State

The New York Durable Power of Attorney form is a crucial legal document that allows individuals to designate someone they trust to make financial and legal decisions on their behalf, particularly in situations where they may become incapacitated. This form is designed to remain effective even if the principal becomes unable to make decisions due to illness or disability, ensuring that their financial affairs can continue to be managed without interruption. In New York, the form must be signed by the principal and witnessed by at least one individual or notarized to be valid. It is important to note that the powers granted can be tailored to the principal's specific needs, allowing for broad or limited authority. Individuals should carefully consider who they appoint as their agent, as this person will have significant control over their financial matters. Additionally, understanding the implications of this document is vital, as it can impact estate planning and overall financial management. The form serves as a safeguard, ensuring that the principal's wishes are honored and that their financial interests are protected during times of vulnerability.

Misconceptions

Understanding the New York Durable Power of Attorney form is crucial for anyone considering this important legal document. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- It only applies to financial matters. Many believe that a Durable Power of Attorney is limited to financial decisions. In reality, it can also cover health care and other personal matters, depending on how it is drafted.

- It becomes invalid if the principal becomes incapacitated. This is not true. The "durable" aspect means that it remains effective even if the principal is incapacitated, allowing the designated agent to act on their behalf.

- Anyone can be appointed as an agent. While you can choose someone you trust, there are restrictions. For instance, an agent cannot be someone who is under 18 or who is not mentally competent.

- It is a one-size-fits-all document. Each Durable Power of Attorney can be tailored to meet specific needs. The powers granted can vary widely, so it’s essential to customize the form to fit individual circumstances.

- It must be notarized to be valid. While notarization is highly recommended, it is not always required. In New York, the document can also be valid if it is signed by two witnesses.

- It automatically revokes previous powers of attorney. This is a common misconception. A new Durable Power of Attorney does not automatically revoke an older one unless it explicitly states so. It’s important to clarify this in the document.

- It can only be created when the principal is healthy. This is misleading. Individuals can create a Durable Power of Attorney even if they are facing health challenges, as long as they understand the implications of the document.

- It is a permanent arrangement. While a Durable Power of Attorney can remain in effect until revoked, the principal has the right to revoke it at any time, as long as they are still competent.

Being aware of these misconceptions can help individuals make informed decisions when creating a Durable Power of Attorney in New York.

New York Durable Power of Attorney: Usage Instruction

Filling out the New York Durable Power of Attorney form is an important step in designating someone to make financial decisions on your behalf. Once you have completed the form, it will need to be signed and witnessed to ensure its validity. Follow these steps carefully to ensure that all necessary information is accurately provided.

- Obtain the New York Durable Power of Attorney form. You can find this form online or at your local courthouse.

- Begin by filling in your name and address in the designated sections. This identifies you as the principal.

- Next, enter the name and address of the person you are appointing as your agent. This person will act on your behalf.

- Specify the powers you wish to grant your agent. You can choose general powers or limit them to specific tasks.

- Decide if you want to include any special instructions or limitations regarding the authority of your agent.

- Review the form carefully to ensure all information is correct and complete.

- Sign and date the form in the presence of a notary public or two witnesses, depending on your preference.

- Provide a copy of the completed form to your agent and keep a copy for your records.

Common mistakes

-

Failing to Specify Powers Clearly: Many individuals do not take the time to clearly outline the powers they wish to grant. This can lead to confusion or disputes later on. It is essential to be specific about the authority given, whether it’s related to financial matters, healthcare decisions, or property management.

-

Not Naming Successor Agents: Some people overlook the importance of naming a successor agent. If the primary agent is unable or unwilling to act, having a designated successor ensures that decisions can still be made without delays. This oversight can create complications during critical times.

-

Inadequate Signatures and Witnesses: The form must be signed by the principal and may require witnesses or notarization. Failing to meet these requirements can invalidate the document. It is crucial to follow the state's specific rules regarding signatures to ensure the power of attorney is legally binding.

-

Not Reviewing the Document Regularly: A durable power of attorney should not be a "set it and forget it" document. Life circumstances change, and so do relationships. Regularly reviewing and updating the form can prevent issues that arise from outdated information or changes in personal circumstances.

PDF Features

| Fact Name | Details |

|---|---|

| Definition | A New York Durable Power of Attorney allows an individual to appoint someone else to manage their financial and legal affairs, even if they become incapacitated. |

| Governing Law | This form is governed by New York General Obligations Law, specifically Article 5, Title 15. |

| Durability | The "durable" aspect means that the authority granted remains effective even if the principal becomes mentally incapacitated. |

| Execution Requirements | The form must be signed by the principal and witnessed by at least one person, or notarized, to be valid. |

Dos and Don'ts

When filling out the New York Durable Power of Attorney form, keep these important tips in mind:

- Do: Clearly identify yourself and the person you are appointing as your agent.

- Do: Specify the powers you wish to grant to your agent. Be precise.

- Do: Sign the form in the presence of a notary public.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any sections blank. Fill out all required information.

- Don't: Use vague language that could lead to confusion about your intentions.

- Don't: Forget to discuss your choices with your agent beforehand.

Similar forms

The New York Durable Power of Attorney form shares similarities with the General Power of Attorney. Both documents allow an individual, known as the principal, to appoint someone else, called an agent, to make decisions on their behalf. However, the General Power of Attorney typically becomes invalid if the principal becomes incapacitated, while the Durable Power of Attorney remains effective even in such situations. This feature makes the Durable Power of Attorney particularly useful for long-term planning.

Another document similar to the Durable Power of Attorney is the Healthcare Proxy. Like the Durable Power of Attorney, a Healthcare Proxy allows someone to act on behalf of another person. However, the focus of a Healthcare Proxy is specifically on medical decisions. When a person is unable to communicate their healthcare wishes, the appointed proxy can make decisions about treatments and procedures, ensuring that the individual's preferences are honored.

The Living Will is also akin to the Durable Power of Attorney, but it serves a different purpose. A Living Will outlines a person's wishes regarding medical treatment in situations where they cannot express their preferences. While the Durable Power of Attorney allows an agent to make decisions, the Living Will provides clear instructions about what those decisions should be, particularly concerning end-of-life care.

The Revocable Trust shares some characteristics with the Durable Power of Attorney. Both documents allow for the management of a person's assets. A Revocable Trust can hold and manage assets during a person's lifetime and distribute them after their death. Unlike the Durable Power of Attorney, which appoints an agent to manage affairs, a Revocable Trust places assets in the control of a trustee, who may be the individual themselves until they become incapacitated.

The Financial Power of Attorney is closely related to the Durable Power of Attorney, focusing on financial matters. This document allows an agent to manage financial affairs, including banking, investments, and real estate transactions. While the Durable Power of Attorney can cover a broader range of decisions, the Financial Power of Attorney is specifically tailored to financial management, making it a more specialized tool.

The Guardianship document also bears some resemblance to the Durable Power of Attorney. In situations where a person is unable to make decisions due to incapacity, a court may appoint a guardian to act on their behalf. Unlike the Durable Power of Attorney, which is created by the individual, guardianship is typically established through a legal process and involves oversight by the court, making it a more formal arrangement.

The Advance Directive is another document similar to the Durable Power of Attorney. An Advance Directive encompasses both the Living Will and the Healthcare Proxy. It allows individuals to express their healthcare wishes and designate someone to make decisions for them if they cannot do so. This comprehensive approach ensures that medical preferences are clear and that an agent is available to act when needed.

Lastly, the Will is a document that, while serving a different primary purpose, has some similarities with the Durable Power of Attorney. A Will outlines how a person's assets should be distributed after their death. While the Durable Power of Attorney is concerned with managing affairs during a person’s lifetime, both documents play crucial roles in planning for the future and ensuring that an individual's wishes are respected.

Check out Popular Durable Power of Attorney Forms for Different States

Washington State Power of Attorney - Short-term or long-term authority can be established.

Pennsylvania Durable Power of Attorney Form - This form can be a cornerstone of any comprehensive estate plan.

Does a Medical Power of Attorney Need to Be Notarized in Florida - Create this document well in advance of potential health issues.

Texas Durable Power of Attorney Free Pdf - Use this form to ensure someone can manage your affairs if you are unable to do so.