Official Deed Template for New York State

The New York Deed form serves as a crucial document in real estate transactions, facilitating the transfer of property ownership between parties. It includes essential information such as the names of the grantor and grantee, a detailed description of the property, and the legal terms governing the transfer. This form must be executed in accordance with state laws to ensure its validity and enforceability. Additionally, it often requires notarization and may need to be filed with the county clerk to establish public record. Understanding the components of the New York Deed form is vital for anyone involved in property transactions, as it helps protect the rights of both the seller and the buyer while ensuring a clear title transfer. With the right knowledge, individuals can navigate the complexities of real estate transfers more effectively, minimizing potential disputes and facilitating smoother transactions.

Misconceptions

Understanding the New York Deed form can be challenging due to several misconceptions. Here are seven common misunderstandings about this important legal document:

- All deeds are the same. Many people think that all deeds function the same way. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each serving unique purposes.

- A deed does not need to be recorded. Some believe that recording a deed is optional. However, recording is crucial for establishing public notice of ownership and protecting against future claims.

- Only a lawyer can prepare a deed. While it’s wise to consult a lawyer, individuals can prepare their own deeds as long as they follow the correct format and legal requirements.

- Once signed, a deed is final and cannot be changed. Many assume that a deed is irrevocable after signing. In fact, deeds can be modified or revoked under certain conditions, depending on the type of deed and state laws.

- Deeds are only for transferring ownership. Some people think deeds only serve to transfer property. However, they can also be used for other purposes, such as creating life estates or securing loans.

- All property transfers require a deed. It's a common belief that every property transfer necessitates a deed. In some cases, property can be transferred through other means, such as inheritance or court order.

- Deeds do not have to be signed in front of a witness. Many assume that a witness is unnecessary. In New York, a deed must be signed in the presence of a notary public to be legally valid.

Clarifying these misconceptions can help individuals navigate the process of creating and executing a New York Deed form more effectively.

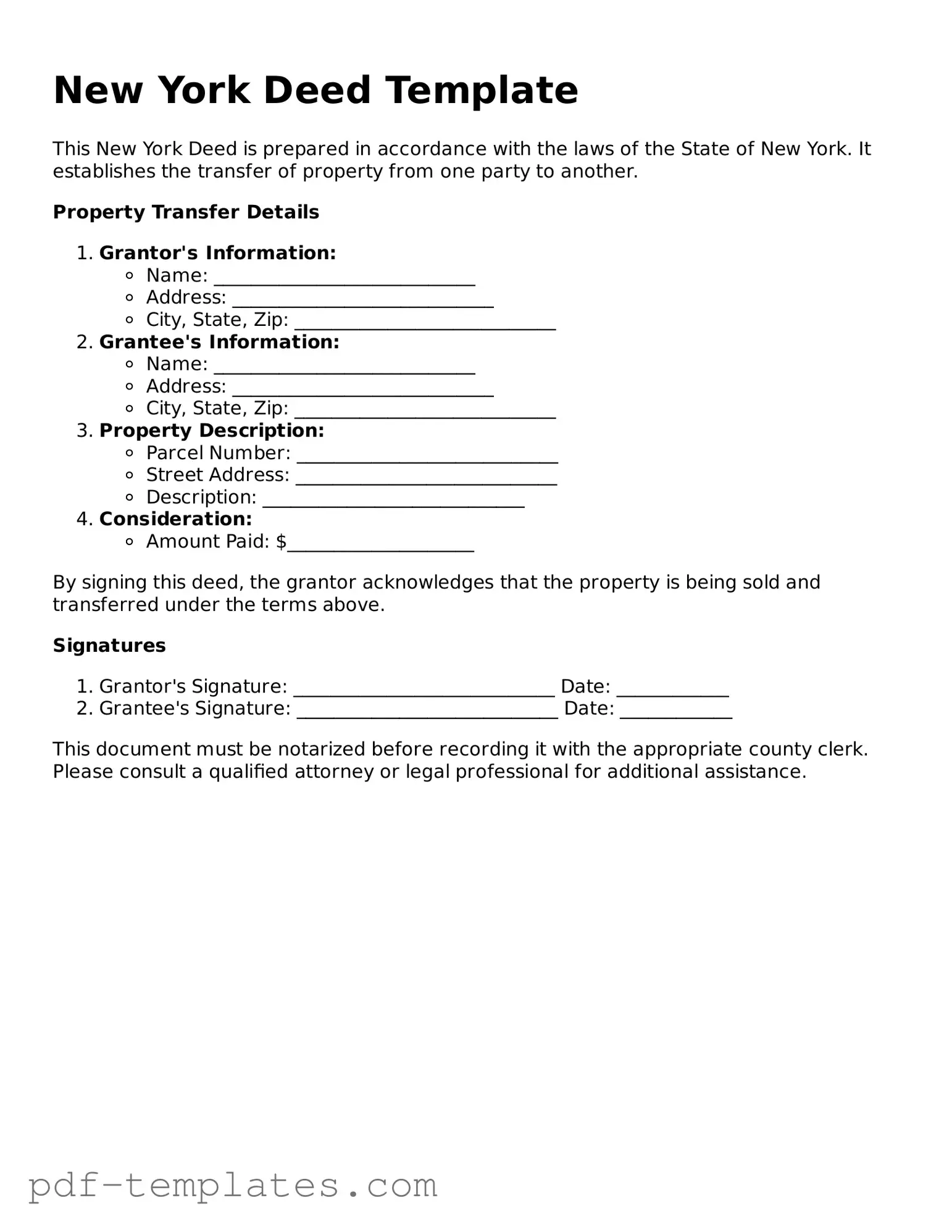

New York Deed: Usage Instruction

After obtaining the New York Deed form, you will need to carefully fill it out with accurate information. This process involves providing details about the property, the parties involved, and any necessary legal descriptions. Ensure that all information is correct before submission.

- Begin by entering the date at the top of the form.

- Provide the name of the grantor (the person transferring the property) in the designated space.

- Next, enter the name of the grantee (the person receiving the property).

- Fill in the property description, including the address and any relevant details that identify the property clearly.

- Include the consideration amount, which is the value exchanged for the property.

- If applicable, add any additional terms or conditions related to the transfer.

- Both the grantor and grantee must sign the form. Ensure that signatures are dated.

- Have the signatures notarized by a licensed notary public.

- Finally, submit the completed form to the appropriate county clerk’s office for recording.

Common mistakes

-

Inaccurate Property Description: One common mistake is failing to provide a precise description of the property. This includes not specifying the correct boundaries or failing to include the lot number. Such inaccuracies can lead to disputes over property lines or ownership.

-

Incorrect Names of Parties: It is crucial to list the names of the grantor and grantee accurately. Errors in spelling or using incorrect legal names can invalidate the deed. Always verify that the names match those on official identification or previous deeds.

-

Omitting Signatures: A deed must be signed by the grantor to be valid. Sometimes, individuals forget to sign the document or mistakenly assume that a witness or notary's signature is sufficient. Without the grantor's signature, the deed cannot transfer ownership.

-

Neglecting to Notarize: In New York, a deed must be notarized to be legally binding. Failing to obtain notarization can result in the deed being challenged in court. It is important to ensure that the notary's information is correctly filled out and that the notary is properly licensed.

PDF Features

| Fact Name | Details |

|---|---|

| Purpose | The New York Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Warranty Deeds, Quitclaim Deeds, and Bargain and Sale Deeds. |

| Governing Law | The transfer of property in New York is governed by New York Real Property Law. |

| Signature Requirement | The deed must be signed by the grantor (seller) in the presence of a notary public. |

| Recording | To protect the buyer's interest, the deed should be recorded in the county clerk's office where the property is located. |

| Consideration | The deed must state the consideration (payment) involved in the property transfer. |

| Legal Description | A detailed legal description of the property must be included to clearly identify it. |

| Tax Implications | Transfer taxes may apply, and the grantor typically pays these taxes at the time of transfer. |

Dos and Don'ts

When filling out the New York Deed form, attention to detail is essential. Here are some important do's and don'ts to keep in mind:

- Do ensure that all names are spelled correctly and match official documents.

- Do provide accurate property descriptions to avoid future disputes.

- Do sign the form in the presence of a notary public.

- Do check for any local requirements that may apply to your specific situation.

- Don't leave any sections blank; fill in all required fields.

- Don't use correction fluid or tape on the form; make changes clearly and legibly.

- Don't forget to keep a copy of the completed deed for your records.

Similar forms

The New York Deed form shares similarities with the Warranty Deed, which provides a guarantee from the seller that they hold clear title to the property. Both documents serve to transfer ownership, but the Warranty Deed offers additional protection to the buyer. If any issues arise regarding the title, the seller is responsible for addressing them. This assurance can provide peace of mind for buyers, making it a popular choice in real estate transactions.

Another document akin to the New York Deed is the Quitclaim Deed. This form transfers ownership without any guarantees regarding the title. While it may seem less secure than a Warranty Deed, it is often used in situations like transferring property between family members or in divorce settlements. The Quitclaim Deed allows for a quick and straightforward transfer, but buyers should be aware that they assume the risk regarding the title.

The Bargain and Sale Deed is also similar to the New York Deed. This document conveys property from one party to another but does not guarantee a clear title. It’s often used in foreclosure sales or tax lien sales. While it transfers ownership, it leaves the buyer to investigate any potential title issues. It’s a practical choice for certain transactions where speed is more critical than title assurance.

Next, the Special Warranty Deed offers a middle ground between the Warranty Deed and the Quitclaim Deed. It guarantees that the seller has not caused any title issues during their ownership. However, it does not cover any problems that may have existed before the seller acquired the property. This type of deed is often used in commercial real estate transactions, where the seller may want to limit their liability while still providing some level of protection to the buyer.

The Grant Deed is another document that resembles the New York Deed. It serves to transfer property ownership and provides some assurances about the title. Specifically, it guarantees that the property has not been sold to anyone else and that there are no undisclosed encumbrances. This makes the Grant Deed a reliable option for buyers who want a bit more security than what a Quitclaim Deed offers but do not require the full protection of a Warranty Deed.

The Deed of Trust is also worth mentioning. While it primarily serves as a security instrument in financing transactions, it operates similarly to a deed in that it transfers legal title of the property to a trustee. This is done to secure a loan, and the borrower retains equitable title. This document is common in states that use deeds of trust instead of mortgages, providing a clear structure for both lenders and borrowers.

The Affidavit of Title is another document that complements the New York Deed. While it does not transfer ownership, it serves as a sworn statement by the seller regarding the status of the title. This document can be used alongside a deed to reassure the buyer that there are no hidden claims or liens against the property. It adds an extra layer of confidence for buyers, who want to ensure they are making a sound investment.

In the realm of property transactions, understanding various deed types is crucial, and just as the New York Deed has its comparisons in the form of Quitclaim, General Warranty, Bargain and Sale, and Special Purpose Deeds, individuals managing their financial affairs in California may benefit from legal documentation like the All California Forms that empowers them to assign decision-making authority to an agent when necessary.

Lastly, the Leasehold Deed is similar in that it involves a transfer of rights, but it focuses on leasing rather than outright ownership. This document grants a tenant the right to use and occupy property for a specified period. While it doesn’t convey ownership, it establishes a legal relationship between the landlord and tenant, similar to how a deed establishes ownership between the seller and buyer. Understanding these nuances can help individuals navigate their real estate transactions more effectively.

Check out Popular Deed Forms for Different States

Conveyance Document Deed Washington State - Used frequently in estate planning to convey property to heirs.

Who Has the Deed to My House - The Deed outlines the parties involved in the transfer, including the seller and buyer.

For those looking to clarify their medical treatment preferences, completing the essential Do Not Resuscitate Order form is vital. This form provides a clear directive for healthcare professionals to follow, ensuring that an individual's wishes are honored during critical situations. Understanding and utilizing this document can significantly impact end-of-life care decisions, helping individuals and their families navigate difficult circumstances. To get started, you can access the form by following this link: accessible Do Not Resuscitate Order form.

Sample Deed - May be challenged in court if not executed correctly.

Florida Deed Form - The Deed form must include a legal description of the property to clearly identify it.