Official Deed in Lieu of Foreclosure Template for New York State

The New York Deed in Lieu of Foreclosure form serves as a critical instrument in the realm of real estate transactions, particularly for homeowners facing financial difficulties. This form allows a borrower to voluntarily transfer ownership of their property to the lender, thereby avoiding the lengthy and often distressing process of foreclosure. By executing this deed, the homeowner can settle their mortgage obligations in a more amicable manner, potentially mitigating the negative impacts on their credit score. The process typically involves several key components, including the assessment of the property's value, the negotiation of any remaining debt, and the formal acceptance of the deed by the lender. Additionally, this form often includes stipulations regarding the release of liability for the borrower, which can provide significant relief during a challenging financial period. Understanding the nuances of this form is essential for homeowners and lenders alike, as it presents an alternative pathway that can lead to a more favorable outcome for both parties involved.

Misconceptions

Many homeowners facing financial difficulties may consider a Deed in Lieu of Foreclosure as a solution. However, several misconceptions surround this legal process. Understanding the truth can help individuals make informed decisions.

- It eliminates all debt immediately. A Deed in Lieu of Foreclosure does not automatically erase all financial obligations. Homeowners may still be responsible for other debts or obligations, such as second mortgages or liens.

- It is a quick fix. While it may seem like a faster alternative to foreclosure, the process can still take time. Lenders must review the request, and negotiations may be necessary before an agreement is reached.

- It has no impact on credit scores. A Deed in Lieu of Foreclosure will likely affect credit scores negatively, similar to a foreclosure. Homeowners should be prepared for potential long-term consequences on their creditworthiness.

- It is available to everyone. Not all homeowners qualify for a Deed in Lieu of Foreclosure. Lenders typically require proof of financial hardship and may consider other factors, such as the value of the property and the homeowner's overall financial situation.

- It allows homeowners to keep their home. A Deed in Lieu of Foreclosure involves transferring ownership of the property to the lender. Homeowners will no longer retain ownership or the right to occupy the home after the process is complete.

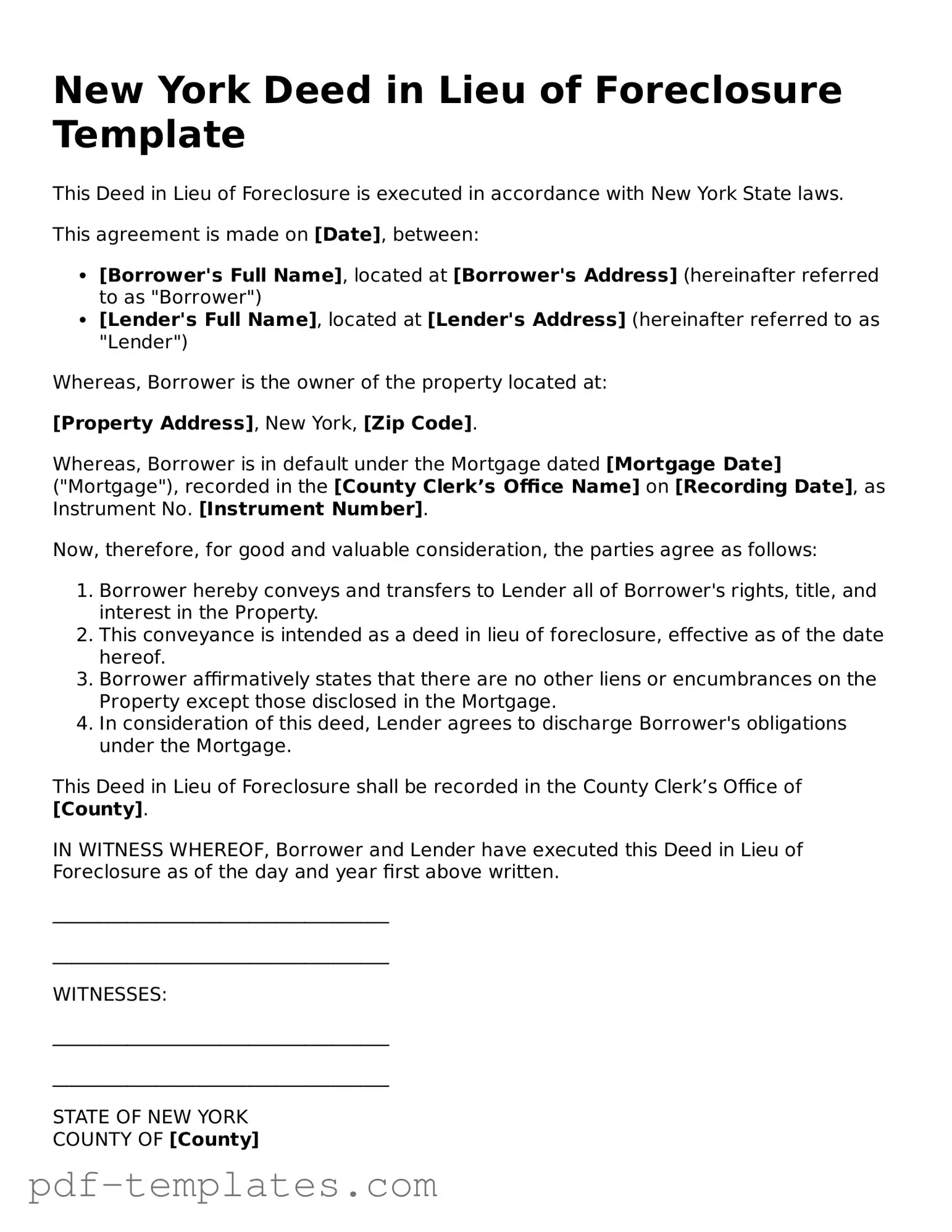

New York Deed in Lieu of Foreclosure: Usage Instruction

After completing the New York Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the appropriate parties, which may include the lender and the local county clerk's office. It’s crucial to ensure all signatures are in place and that the form is filed correctly to avoid any delays in the process.

- Obtain the New York Deed in Lieu of Foreclosure form from a reliable source, such as a legal website or your lender.

- Read through the entire form to familiarize yourself with the information required.

- Fill in the date at the top of the form.

- Provide the names and addresses of both the borrower and the lender in the designated sections.

- Describe the property being transferred, including the address and any relevant details, such as the parcel number.

- Include the legal description of the property, which can often be found on the property deed or tax documents.

- Clearly state that the borrower is voluntarily transferring the property to the lender.

- Sign the form in the appropriate section. Make sure to date your signature.

- Have the signature notarized to ensure its validity.

- Make copies of the completed and notarized form for your records.

- Submit the original form to the lender and file a copy with the local county clerk's office, if required.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details. This includes missing names, addresses, or property descriptions. Each piece of information is crucial for the document's validity.

-

Not Understanding the Terms: Some signers overlook the implications of the deed. They may not fully grasp how it affects their credit score or future borrowing capabilities. Understanding these terms is essential before signing.

-

Failure to Consult a Professional: Individuals often skip seeking legal or financial advice. This can lead to misunderstandings about rights and responsibilities. Consulting with a professional can provide clarity and guidance.

-

Ignoring Lender Requirements: Each lender may have specific conditions for accepting a deed in lieu of foreclosure. Failing to comply with these requirements can result in rejection of the deed. It’s important to review lender guidelines carefully.

-

Not Keeping Copies: After submission, some forget to keep copies of the signed document. This can create problems later if disputes arise. Always retain a copy for personal records.

PDF Features

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | In New York, the deed in lieu of foreclosure is governed by the New York Real Property Actions and Proceedings Law (RPAPL). |

| Eligibility | Homeowners facing financial difficulties may qualify for a deed in lieu, provided they have exhausted other options like loan modifications or short sales. |

| Benefits | This option can help borrowers avoid the lengthy foreclosure process, reduce damage to their credit score, and allow for a smoother transition. |

| Process | The borrower must submit a request to the lender, including financial documentation, and negotiate terms before signing the deed. |

| Tax Implications | Borrowers should be aware that a deed in lieu may have tax consequences, including potential liability for canceled debt income. |

| Legal Assistance | It is advisable for homeowners to seek legal counsel to navigate the complexities of the process and understand their rights. |

Dos and Don'ts

When filling out the New York Deed in Lieu of Foreclosure form, it’s crucial to approach the process carefully. Here are some important dos and don’ts to keep in mind:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and property details.

- Do consult with a legal professional if you have any questions or uncertainties about the process.

- Do provide any required documentation, such as proof of ownership and financial statements, as specified in the form.

- Do keep copies of all documents submitted for your records.

- Don’t rush through the form. Take your time to understand each section and its implications.

- Don’t sign the document until you fully understand the consequences of the deed in lieu of foreclosure.

- Don’t forget to notify your lender of your intention to proceed with this option before submitting the form.

By following these guidelines, you can navigate the process more effectively and with greater confidence.

Similar forms

A short sale agreement is a document that allows a homeowner to sell their property for less than the amount owed on the mortgage, with the lender's approval. Similar to a deed in lieu of foreclosure, a short sale helps the homeowner avoid foreclosure and the negative consequences that come with it. Both options require the lender's consent and aim to minimize losses for all parties involved. However, in a short sale, the homeowner remains in possession of the property until the sale is completed, whereas a deed in lieu transfers ownership immediately to the lender.

A loan modification agreement alters the terms of an existing mortgage to make it more manageable for the borrower. This document is similar to a deed in lieu of foreclosure in that both are alternatives to foreclosure. They provide the homeowner with a chance to keep their home while addressing financial difficulties. While a deed in lieu involves transferring ownership to the lender, a loan modification allows the homeowner to retain ownership and continue making payments under revised terms.

Understanding the various alternatives to foreclosure is essential for homeowners facing financial challenges. Among these options, the California Independent Contractor Agreement can play a unique role, particularly for those seeking contractual services to help navigate their situations effectively. By defining clear terms for assistance, individuals can better manage their financial circumstances and work towards a solution. For broader access to necessary legal documents, including the Independent Contractor Agreement, please refer to All California Forms.

A forbearance agreement is a temporary arrangement between a lender and a borrower that allows the borrower to pause or reduce mortgage payments for a specified period. Like a deed in lieu of foreclosure, it serves as a way to avoid foreclosure. Both documents require the lender's approval and aim to provide relief to the borrower. However, a forbearance agreement keeps the homeowner in possession of the property, while a deed in lieu results in an immediate transfer of ownership.

A bankruptcy filing can provide relief from foreclosure by allowing a homeowner to reorganize their debts or eliminate them altogether. Similar to a deed in lieu of foreclosure, filing for bankruptcy can halt foreclosure proceedings temporarily. Both options can be seen as last-resort measures for homeowners facing financial distress. However, bankruptcy involves legal proceedings and can impact the homeowner's credit for a longer period, while a deed in lieu is a direct transfer of property ownership to the lender.

A real estate settlement statement outlines the financial details of a real estate transaction. This document is similar to a deed in lieu of foreclosure in that both involve the transfer of property and must be agreed upon by both parties. While the settlement statement details costs associated with selling or transferring property, the deed in lieu serves as a means for the homeowner to relinquish ownership to the lender, often to avoid foreclosure.

A leaseback agreement allows a homeowner to sell their property to a buyer and then lease it back from them. This document shares similarities with a deed in lieu of foreclosure, as both provide a way for the homeowner to avoid foreclosure. In a leaseback, the homeowner retains the right to live in the property after selling it, while a deed in lieu results in the homeowner losing ownership entirely, although both aim to ease financial strain.

A quitclaim deed is a legal document used to transfer interest in a property without any warranties. This document is similar to a deed in lieu of foreclosure because both involve the transfer of property rights. A quitclaim deed can be used in various situations, including when a property is being transferred to a lender as part of a deed in lieu. However, a quitclaim deed does not necessarily imply a resolution of debt, while a deed in lieu specifically addresses the homeowner's mortgage obligations.

A property settlement agreement is often used in divorce cases to divide property between spouses. This document is similar to a deed in lieu of foreclosure in that both involve the transfer of ownership rights. A property settlement agreement can help individuals avoid lengthy legal disputes, while a deed in lieu allows homeowners to resolve their mortgage issues. However, a property settlement typically arises from personal circumstances, whereas a deed in lieu is primarily financial in nature.

Check out Popular Deed in Lieu of Foreclosure Forms for Different States

Deeds in Lieu of Foreclosure - This option may affect future loan applications, as lenders could view the deed as a negative mark in a borrower’s history.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Homeowners may negotiate terms with their lender to ensure a fair and smooth process.

The Trader Joe's application form is a vital document for job seekers wishing to join this beloved grocery chain. It outlines necessary information about potential employees and provides an opportunity to showcase their unique skills and experience. For those interested in applying, they can access the form at documentonline.org/blank-trader-joe-s-application/, and completing it accurately can significantly increase the chances of landing a position at one of their stores.

California Voluntary Property Surrender Document - Once the deed is executed, the lender takes possession of the property and the homeowner is released from the loan obligations.

Deed in Lieu of Foreclosure Florida - Documentation and proper filing are integral parts of executing a successful Deed in Lieu of Foreclosure.