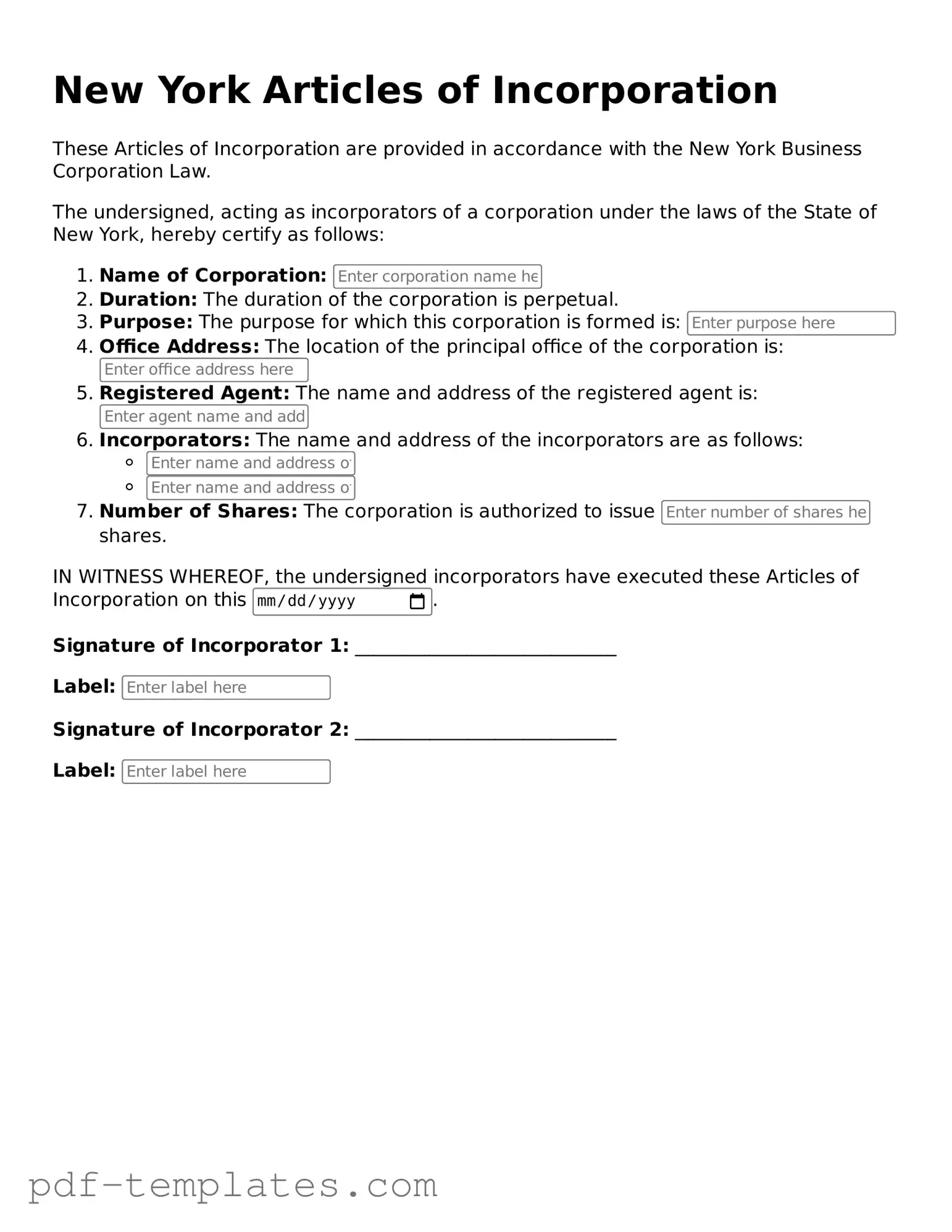

Official Articles of Incorporation Template for New York State

When starting a business in New York, one of the most crucial steps is filing the Articles of Incorporation. This document serves as the foundation for your corporation, laying out essential details that define your business structure and operations. It typically includes the corporation's name, which must be unique and compliant with state regulations, as well as the purpose of the business, which outlines what activities the corporation will engage in. Additionally, the form requires information about the registered agent, who will act as the official point of contact for legal matters. The Articles of Incorporation also specify the number of shares the corporation is authorized to issue, along with the par value of those shares, if applicable. This information is vital, as it affects the ownership and financial structure of your corporation. Furthermore, the form may ask for details regarding the incorporators, who are the individuals responsible for setting up the corporation. Understanding each component of the Articles of Incorporation is essential for ensuring compliance with state laws and for laying a strong groundwork for your business's future.

Misconceptions

When it comes to the New York Articles of Incorporation, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- Only large businesses need Articles of Incorporation. Many believe that only big companies or corporations require this document. In reality, any business entity, regardless of size, must file Articles of Incorporation to establish legal recognition.

- Filing Articles of Incorporation guarantees business success. Some think that simply filing these documents will ensure their business thrives. However, success depends on many factors, including planning, management, and market conditions.

- Articles of Incorporation are the same as a business license. Many confuse these two concepts. Articles of Incorporation establish a corporation, while a business license permits the operation of that business within a specific jurisdiction.

- Once filed, Articles of Incorporation cannot be changed. This is a common myth. While changes require a formal process, amendments can be made to the Articles of Incorporation if necessary.

- All states have the same Articles of Incorporation requirements. People often assume that the requirements are uniform across the country. In fact, each state has its own specific rules and forms that must be followed.

- Filing Articles of Incorporation is a one-time event. Some believe that once they file, they are done. However, ongoing compliance and annual filings may be required to maintain good standing.

- Anyone can file Articles of Incorporation without assistance. While it is possible to file without help, many find it beneficial to consult with a legal expert. This ensures that all requirements are met and reduces the risk of errors.

- Articles of Incorporation are only for for-profit entities. This misconception overlooks the fact that non-profit organizations also need to file Articles of Incorporation to operate legally.

Understanding these misconceptions can help individuals navigate the process of incorporating a business in New York more effectively.

New York Articles of Incorporation: Usage Instruction

Once you have gathered all necessary information, you can proceed to fill out the New York Articles of Incorporation form. This document is essential for establishing your corporation in New York. Follow these steps carefully to ensure that all information is accurate and complete.

- Begin by downloading the New York Articles of Incorporation form from the New York Department of State website.

- Provide the name of your corporation. Ensure that the name complies with New York naming requirements.

- Enter the purpose of your corporation. Be specific about the business activities your corporation will engage in.

- Fill in the county in New York where the corporation's office will be located.

- List the address of the corporation’s principal office. Include the street address, city, state, and zip code.

- Designate a registered agent. This individual or business must have a physical address in New York and be available during business hours.

- Provide the names and addresses of the initial directors. Include all required information for each director.

- State the duration of the corporation. Most corporations are set to exist perpetually unless specified otherwise.

- Sign and date the form. Ensure that the person signing has the authority to do so on behalf of the corporation.

- Submit the completed form along with the required filing fee to the New York Department of State.

After submitting the Articles of Incorporation, you will receive confirmation from the state. This confirmation is an important document for your records, as it officially recognizes your corporation's existence in New York.

Common mistakes

-

Failing to provide a clear and specific business name. The name must be unique and not similar to existing businesses.

-

Not including the required purpose of the corporation. A vague description can lead to issues later.

-

Omitting the registered agent information. Every corporation needs a designated registered agent for service of process.

-

Incorrectly stating the number of shares the corporation is authorized to issue. This can affect ownership and investment opportunities.

-

Neglecting to include the address of the corporation's principal office. This information is essential for legal and communication purposes.

-

Not providing the names and addresses of the initial directors. This information is crucial for governance.

-

Failing to sign the form. An unsigned form will be rejected, causing delays in the incorporation process.

-

Not checking for typos or errors. Simple mistakes can lead to complications and delays.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | The New York Articles of Incorporation form is used to legally establish a corporation in New York State. |

| Governing Law | This form is governed by the New York Business Corporation Law (BCL). |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Required Information | The form requires basic information, including the corporation's name, address, and the purpose of the business. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Approval Process | Once submitted, the New York Department of State reviews the Articles of Incorporation for compliance before granting approval. |

Dos and Don'ts

When filling out the New York Articles of Incorporation form, it's important to follow certain guidelines to ensure your submission is successful. Here are ten things to keep in mind:

- Do provide accurate information about your corporation's name.

- Do include the purpose of your corporation clearly and concisely.

- Do list the names and addresses of the initial directors.

- Do ensure that the registered agent's name and address are correct.

- Do sign and date the form before submission.

- Don't use a name that is already taken by another corporation.

- Don't forget to check the filing fee and include payment.

- Don't leave any sections of the form blank; provide all required information.

- Don't submit the form without reviewing it for errors.

- Don't ignore the state’s specific requirements for incorporation.

Similar forms

The New York Articles of Incorporation form is similar to the Certificate of Incorporation, which serves as the official document that establishes a corporation's existence in New York. Both documents outline essential information about the corporation, such as its name, purpose, and the number of shares it is authorized to issue. While the Articles of Incorporation is a broader term often used in various states, the Certificate of Incorporation is specific to New York and is filed with the Department of State. This document is crucial for legal recognition and provides a foundation for the corporation's operations.

Another document akin to the Articles of Incorporation is the Bylaws. Bylaws outline the internal rules and procedures for managing a corporation. Unlike the Articles of Incorporation, which are filed with the state, Bylaws are typically adopted by the board of directors and are not submitted to any governmental authority. They detail the roles of officers, the process for holding meetings, and how decisions are made. Together, these documents ensure that a corporation operates smoothly and within the framework of the law.

The Operating Agreement is also comparable to the Articles of Incorporation, especially for limited liability companies (LLCs). This document outlines the ownership structure and operating procedures of the LLC. While the Articles of Incorporation is focused on corporations, the Operating Agreement serves a similar purpose for LLCs, detailing member roles, profit distribution, and decision-making processes. Both documents are vital for establishing the legal framework within which the business operates.

Lastly, the Statement of Information is another document that shares similarities with the Articles of Incorporation. This document is often required by states for corporations and LLCs to provide updated information about their business. It typically includes details such as the business address, names of directors or members, and contact information. While the Articles of Incorporation establish the corporation's initial existence, the Statement of Information ensures that the state has current and accurate records about the business as it evolves.

Check out Popular Articles of Incorporation Forms for Different States

Form California Llc - Serves as a foundational document for businesses.

Florida Incorporation - Timely filing ensures the business remains in good standing.

Scc Documents - Corporate naming conventions are important to avoid conflicts.

How Much Is an Llc in Texas - Allows for flexibility in corporate structure and operations.