Get Netspend Dispute Form in PDF

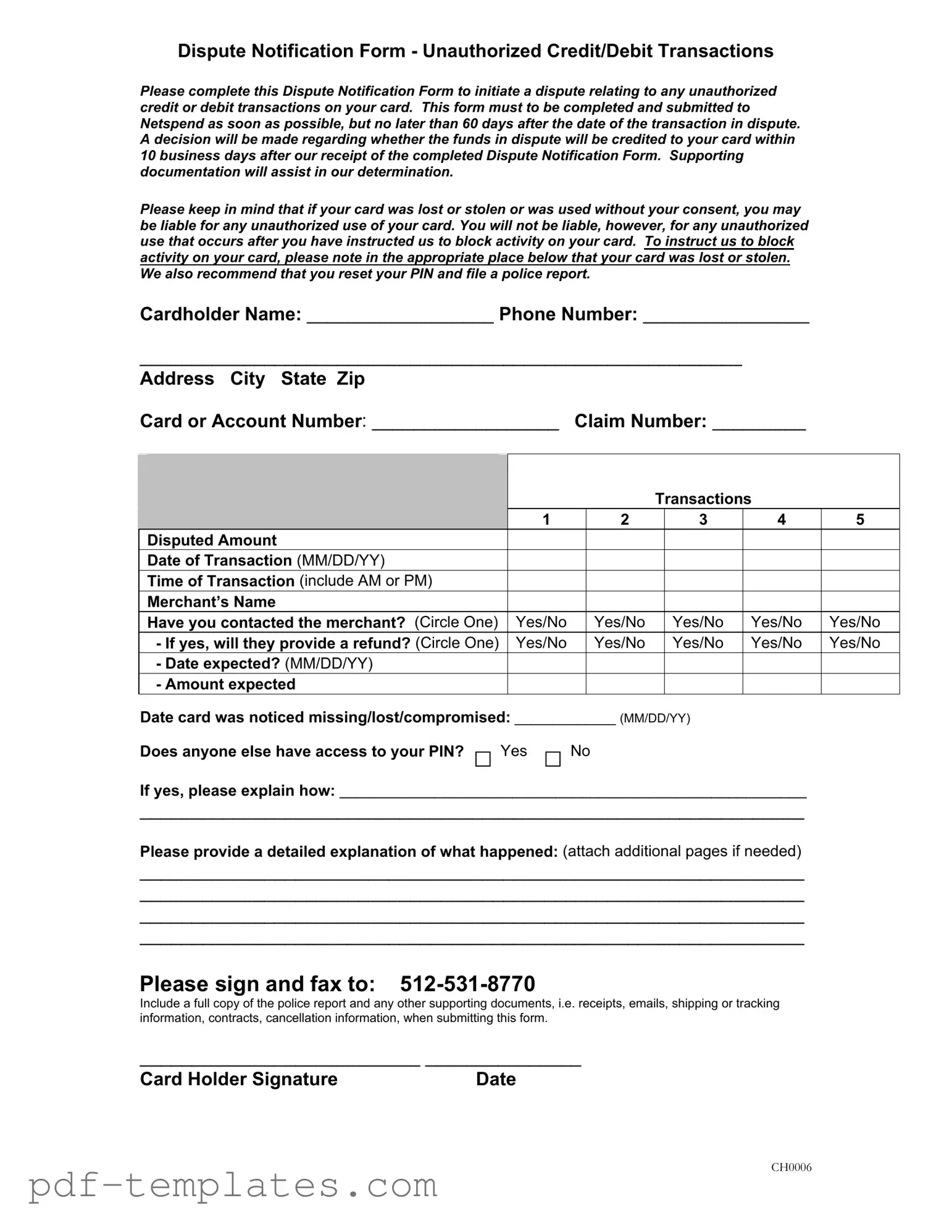

When faced with unauthorized transactions on a Netspend card, taking prompt action is crucial. The Netspend Dispute Notification Form serves as a vital tool for cardholders seeking to resolve issues related to unauthorized credit or debit transactions. This form must be completed and submitted within 60 days of the disputed transaction, ensuring that the cardholder's rights are preserved. Upon receipt of the completed form, Netspend commits to making a decision regarding the disputed funds within 10 business days. To facilitate a thorough investigation, cardholders are encouraged to provide supporting documentation, which may include police reports, receipts, or any correspondence with merchants. It is important to note that if a card is lost or stolen, the cardholder may be liable for unauthorized transactions that occur prior to reporting the loss. However, liability ceases once the cardholder has instructed Netspend to block further activity. The form requires essential details such as the cardholder's name, contact information, and specifics about the disputed transactions, including amounts, dates, and merchant names. Additionally, cardholders must disclose whether they have contacted the merchant regarding the dispute and provide a detailed explanation of the incident. By understanding the components of the Netspend Dispute Notification Form, cardholders can navigate the dispute process more effectively and work towards recovering their funds.

Misconceptions

Understanding the Netspend Dispute form can be challenging, and several misconceptions often arise. Here are five common misunderstandings about this important document:

- Misconception 1: The form must be submitted immediately after noticing a transaction.

- Misconception 2: You will automatically receive a refund after submitting the form.

- Misconception 3: You are liable for all unauthorized transactions until you submit the form.

- Misconception 4: Only one transaction can be disputed at a time.

- Misconception 5: Supporting documentation is optional.

While it is advisable to submit the form as soon as possible, you have up to 60 days from the date of the disputed transaction to file your dispute. This window allows you time to gather necessary information and documentation.

A refund is not guaranteed. After receiving your completed Dispute Notification Form, Netspend will review the information and make a determination. A decision will be communicated within 10 business days.

This is not entirely true. If your card is lost or stolen, you may be liable for unauthorized transactions that occur before you report the loss and request to block the card. However, you will not be liable for transactions made after you have reported the loss.

The form allows you to dispute multiple transactions simultaneously. You can submit up to five transactions on a single form, streamlining the process for cardholders.

In fact, providing supporting documentation is highly recommended. Submitting receipts, emails, or a police report can significantly aid in the review process and increase the likelihood of a favorable outcome.

Netspend Dispute: Usage Instruction

Completing the Netspend Dispute Notification Form is an essential step in addressing unauthorized transactions on your account. After you fill out the form, submit it promptly to ensure your dispute is processed efficiently. Remember, you must do this within 60 days of the transaction in question. Once Netspend receives your completed form, they will make a decision regarding your dispute within 10 business days.

- Gather your information: Collect your cardholder name, phone number, address, and card or account number.

- Complete the cardholder information: Fill in your name, phone number, address, city, state, and zip code.

- Enter your card or account number: Write down the number associated with the card in question.

- Provide the claim number: If you have a claim number, include it in the designated space.

- Detail the disputed transactions: For each transaction you are disputing (up to five), fill in the following:

- Disputed amount

- Date of transaction (MM/DD/YY)

- Time of transaction (AM/PM)

- Merchant’s name

- Have you contacted the merchant? (Circle Yes or No)

- If yes, will they provide a refund? (Circle Yes or No)

- Date expected for refund (MM/DD/YY)

- Amount expected for refund

- Indicate if your card was lost or stolen: Provide the date when you noticed your card was missing or compromised.

- Access to your PIN: State whether anyone else has access to your PIN and provide an explanation if applicable.

- Provide a detailed explanation: Describe the situation surrounding the unauthorized transactions. Attach additional pages if necessary.

- Sign and date the form: Ensure you sign and date the form before submission.

- Submit the form: Fax the completed form to 512-531-8770 along with a full copy of the police report and any supporting documents, such as receipts or emails.

Common mistakes

-

Missing Information: One of the most common mistakes is failing to fill out all required fields. Ensure that your name, contact information, and card details are complete. Incomplete forms can delay the processing of your dispute.

-

Late Submission: Submitting the form after the 60-day window can lead to automatic denial of your dispute. Be aware of the timeline and act promptly.

-

Insufficient Documentation: Not including supporting documents, such as receipts or police reports, can weaken your case. Gather all relevant materials before submitting your form to strengthen your claim.

-

Incorrect Transaction Details: Double-check the transaction amounts, dates, and merchant names. Errors in these details can lead to confusion and may result in a denial of your dispute.

-

Failure to Contact the Merchant: Neglecting to reach out to the merchant before filing a dispute can be a missed opportunity. Many issues can be resolved directly with the merchant, potentially saving you time and effort.

-

Not Indicating Card Status: If your card was lost or stolen, it’s essential to indicate this on the form. This information is crucial for Netspend to take appropriate action regarding your account.

File Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is designed to initiate a dispute regarding unauthorized credit or debit transactions on a Netspend card. |

| Submission Deadline | Cardholders must complete and submit the form within 60 days of the disputed transaction date. |

| Decision Timeline | Netspend will make a decision about crediting disputed funds within 10 business days after receiving the completed form. |

| Liability Conditions | Cardholders may be liable for unauthorized transactions if their card was lost or stolen, unless they reported it and requested to block activity. |

| Documentation Requirements | Supporting documents, such as police reports and receipts, should accompany the form to assist in the dispute resolution process. |

| Contact Information | Cardholders must provide their name, phone number, and address, along with details of the disputed transactions on the form. |

Dos and Don'ts

When filling out the Netspend Dispute form, it is essential to follow specific guidelines to ensure your dispute is processed efficiently. Below is a list of things you should and shouldn't do:

- Do complete the form as soon as possible, ideally within 60 days of the transaction.

- Do provide accurate and detailed information for each disputed transaction.

- Do include supporting documentation, such as receipts or emails, to strengthen your case.

- Do indicate if your card was lost or stolen to block further unauthorized transactions.

- Do sign and date the form before submission.

- Don't wait too long to submit the form; delays may affect your claim.

- Don't leave any required fields blank; incomplete forms may be rejected.

- Don't forget to keep copies of all documents submitted for your records.

- Don't assume that your dispute will be automatically resolved without follow-up.

- Don't provide false information, as this could jeopardize your claim.

By adhering to these guidelines, you can enhance the likelihood of a successful resolution to your dispute.

Similar forms

The Netspend Dispute Form shares similarities with a Credit Card Dispute Form. Both documents are designed to address unauthorized transactions on a cardholder's account. They require cardholders to provide details about the disputed transaction, including the amount, date, and merchant. Additionally, both forms emphasize the importance of submitting the dispute promptly, typically within a specified timeframe, to ensure that the cardholder's rights are protected. Supporting documentation is also encouraged to strengthen the case for a refund or credit.

Another similar document is the Fraud Report Form. This form is used when a cardholder suspects fraudulent activity on their account. Like the Netspend Dispute Form, it requires detailed information about the transactions in question. Both forms aim to gather essential information to help the financial institution assess the situation and take appropriate action. The focus on timely submission and the inclusion of supporting evidence, such as a police report, is common in both documents.

In addition to these important forms, families looking to educate their children outside the traditional school system must also consider the necessary paperwork involved in homeschooling, particularly the Homeschool Letter of Intent form. This document serves as a formal notification to the local school district, ensuring that parents communicate their intentions and lay a solid foundation for their child's educational journey.

The Chargeback Request Form is yet another document that aligns with the Netspend Dispute Form. Chargebacks are initiated by cardholders when they believe a transaction was unauthorized or incorrect. Both forms require similar information about the transaction and allow for multiple disputes to be listed. They also highlight the need for prompt action and the submission of relevant documentation to support the claim.

The Unauthorized Transaction Report serves a similar purpose as the Netspend Dispute Form. It is specifically designed for reporting transactions that were made without the cardholder's consent. Both documents require the cardholder to detail the circumstances surrounding the unauthorized use, including any attempts to resolve the issue with the merchant. Timeliness and supporting documentation are emphasized in both forms to facilitate a quicker resolution.

A Lost or Stolen Card Report is comparable to the Netspend Dispute Form as well. When a cardholder reports their card as lost or stolen, they often need to provide information about unauthorized transactions. Both forms require the cardholder to indicate when the card was noticed missing and to describe any unauthorized activity. The need for immediate action and the potential for liability based on the timing of the report are common themes.

The Identity Theft Affidavit is another document that parallels the Netspend Dispute Form. When a cardholder believes their identity has been compromised, they may need to fill out this affidavit to report fraudulent transactions. Both documents require detailed explanations of the events leading to the dispute and encourage the inclusion of supporting evidence. They also stress the importance of acting quickly to mitigate further damage.

Lastly, the Account Verification Form is similar in that it may be used when there are discrepancies in account activity. This form requests information from the cardholder to confirm transactions and account status. Like the Netspend Dispute Form, it aims to clarify any issues and resolve them efficiently. Both documents highlight the importance of providing accurate information and supporting documentation to facilitate a smooth resolution process.

Other PDF Forms

Employment Application in Spanish - Employers appreciate candidates who show they’ve done their homework.

Bbb File a Complaint - The company did not provide adequate support for its product issues.

When selling a trailer, it is important to use a reliable document. The essential template for a Trailer Bill of Sale ensures that you properly record the transaction by including vital information about the trailer and the sale.

Skin Assessment Shower Sheets for Cna - All findings and actions are forwarded to the Director of Nursing (DON) if necessary.