Get Mortgage Statement Form in PDF

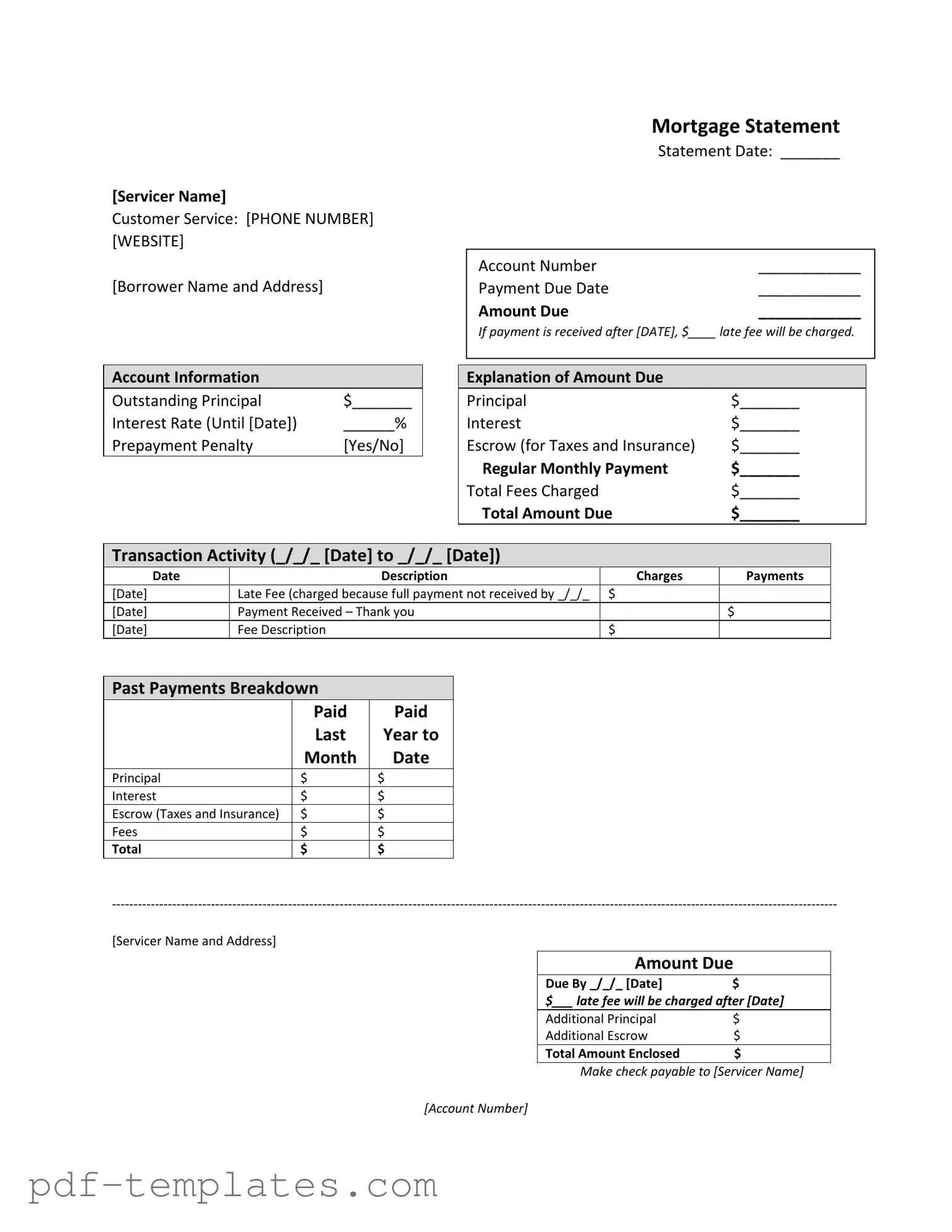

A Mortgage Statement form serves as a crucial document for homeowners, providing a detailed overview of their mortgage account. It typically includes essential information such as the servicer's name and contact details, the borrower's name and address, and specific account information. Key dates, including the statement date and payment due date, are prominently featured, along with the total amount due and any applicable late fees. The form breaks down the payment structure, detailing the outstanding principal, interest rate, and escrow amounts for taxes and insurance. Furthermore, it provides a clear explanation of the total fees charged and the transaction activity over a specified period. Homeowners can also find important messages regarding partial payments and delinquency notices, which alert them to any missed payments and the potential consequences of not addressing their mortgage obligations. Overall, the Mortgage Statement form is designed to keep borrowers informed about their mortgage status and guide them in managing their payments effectively.

Misconceptions

There are several misconceptions about the Mortgage Statement form that can lead to confusion for borrowers. Below is a list of eight common misunderstandings along with clarifications.

- All payments are applied immediately. Many borrowers believe that any payment made is applied to their mortgage right away. However, partial payments are held in a suspense account until the full amount is received.

- The late fee is charged immediately after the due date. Some individuals think that a late fee is applied the moment a payment is late. In reality, the fee is charged only after a specified grace period has passed.

- The amount due includes all fees and charges. It is a common assumption that the total amount due reflects all outstanding fees. However, the statement may not include additional fees incurred after the statement date.

- Escrow payments are optional. Many borrowers mistakenly believe that escrow payments for taxes and insurance are optional. In fact, these payments are typically required as part of the mortgage agreement.

- Receiving a delinquency notice means foreclosure is imminent. While a delinquency notice indicates that payments are overdue, it does not mean foreclosure will happen immediately. There are often options available for borrowers to address their delinquency.

- All servicers provide the same information on statements. Borrowers may think that all mortgage servicers present information in the same format. Each servicer may have different layouts and details included in their statements.

- Payments can be made in any amount without consequences. Some borrowers believe that they can pay any amount without repercussions. However, partial payments may not be applied to the mortgage until the full payment is made.

- Mortgage counseling is only for those in severe financial distress. There is a misconception that mortgage counseling is only available to those facing foreclosure. In reality, counseling services can assist anyone experiencing financial difficulty, regardless of their current situation.

Understanding these misconceptions can help borrowers navigate their mortgage statements more effectively and make informed decisions regarding their payments and financial obligations.

Mortgage Statement: Usage Instruction

Filling out the Mortgage Statement form is an important step in managing your mortgage. Please follow these steps carefully to ensure that all necessary information is provided accurately.

- Begin by entering the Servicer Name at the top of the form.

- Provide the Customer Service Phone Number and Website for the servicer.

- Fill in your Borrower Name and Address in the designated area.

- Write the Statement Date in the space provided.

- Enter your Account Number accurately.

- Indicate the Payment Due Date.

- Fill in the Amount Due for your mortgage payment.

- Note the date after which a late fee will be charged, and enter the amount of the late fee.

- Provide details for Outstanding Principal and Interest Rate until the specified date.

- Indicate whether there is a Prepayment Penalty by selecting Yes or No.

- Break down the Amount Due into Principal, Interest, Escrow, and Total Fees Charged.

- Calculate the Total Amount Due and enter it in the appropriate space.

- Fill in the Transaction Activity section, listing dates, descriptions, charges, and payments.

- Review the Past Payments Breakdown to ensure accuracy in reporting.

- Complete the section for Amount Due and Due By date.

- Indicate any additional amounts, such as Additional Principal and Additional Escrow.

- Write the Total Amount Enclosed if you are sending a payment.

- Make your check payable to the Servicer Name and include your Account Number on it.

After completing the form, review it carefully for any errors or missing information. It is essential to ensure that everything is correct before submitting it. If you have questions or need assistance, please reach out to customer service using the contact information provided at the top of the form.

Common mistakes

-

Incorrect Account Information: Failing to provide accurate account details can lead to confusion. Make sure the account number is correct and matches the one provided by your mortgage servicer.

-

Missing Payment Due Date: Not filling in the payment due date can result in late fees. Always check that this date is clearly indicated on the form.

-

Ignoring Late Fee Information: Some people overlook the late fee section. Be aware of the amount that will be charged if the payment is not received on time.

-

Overlooking Escrow Details: The escrow section is crucial for understanding your total monthly payment. Ensure that the amounts for taxes and insurance are correctly filled out.

-

Not Providing a Contact Number: It’s important to include a contact number where you can be reached. This helps the servicer to clarify any issues regarding your mortgage statement.

-

Neglecting to Review Transaction Activity: Always review the transaction history for any discrepancies. This section provides a record of payments and fees that can affect your total amount due.

-

Ignoring Financial Difficulty Information: If you are struggling financially, do not skip the section about mortgage counseling. Resources are available, and reaching out for help can prevent further issues.

File Specifics

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for easy contact. |

| Borrower Details | It lists the borrower's name and address, ensuring that all parties are clearly identified. |

| Account Number | An account number is provided, which helps in identifying the specific mortgage loan. |

| Payment Information | The statement specifies the payment due date, amount due, and any late fees applicable after that date. |

| Outstanding Principal | It shows the outstanding principal balance and the interest rate, giving borrowers a clear view of their loan status. |

| Transaction Activity | A section lists recent transactions, including charges, payments, and any late fees incurred. |

| Partial Payments Notice | The statement includes a notice that partial payments are held in a suspense account and not applied to the mortgage until fully paid. |

| Delinquency Notice | It warns borrowers of delinquency and potential foreclosure if payments are not made, emphasizing the importance of timely payments. |

Dos and Don'ts

When filling out your Mortgage Statement form, keep these important tips in mind to ensure accuracy and avoid potential issues.

- Do double-check your personal information, including your name and address, to ensure it is correct.

- Don't leave any fields blank. Fill in all required information to prevent delays.

- Do clearly write the account number and payment due date. This helps the servicer process your payment correctly.

- Don't ignore the late fee information. Be aware of the date when late fees will apply.

- Do review your outstanding principal and interest rate. Understanding these figures is crucial for managing your mortgage.

- Don't overlook the importance of providing the total amount enclosed. This ensures your payment is applied correctly.

Following these guidelines can help you navigate the Mortgage Statement form with confidence. Take your time and ensure everything is filled out accurately.

Similar forms

The first document similar to a Mortgage Statement is a Billing Statement. A Billing Statement provides a summary of charges incurred over a specific period, detailing the amounts owed and the due dates. Like a Mortgage Statement, it typically includes account information, payment history, and any fees that may apply if payments are not made on time. Both documents serve to inform the recipient of their financial obligations and the status of their account, ensuring transparency in financial transactions.

A second comparable document is a Loan Statement. A Loan Statement outlines the terms of a loan, including the principal balance, interest rate, and payment history. Similar to a Mortgage Statement, it breaks down the amounts due, including principal and interest, and may indicate any late fees or penalties. Both statements help borrowers track their repayment progress and understand their financial commitments, reinforcing the importance of timely payments.

For those needing to document their trailer transactions, the "easy Texas Trailer Bill of Sale form" is a valuable resource. This form lays out the necessary details to confirm ownership transfer, facilitating a straightforward sale process. Interested individuals can find this essential document at Texas Trailer Bill of Sale form.

A third document that bears resemblance is a Credit Card Statement. This statement summarizes the transactions made on a credit card account during a billing cycle. It lists the total balance, minimum payment due, and due date, akin to a Mortgage Statement's breakdown of amounts owed. Both documents aim to provide clear information on financial obligations, helping individuals manage their finances effectively and avoid late fees.

Lastly, a Utility Bill is another document similar to a Mortgage Statement. A Utility Bill details the services provided, usage, and the total amount due for that billing cycle. Like a Mortgage Statement, it includes information about payment due dates and potential late fees. Both documents serve as reminders of financial responsibilities and encourage timely payments to avoid service interruptions or additional charges.

Other PDF Forms

Free Editable Utility Bill Template - Providing an accurate utility bill can speed up processing times.

To ensure you have all the necessary documentation for your application, you may refer to All California Forms, which provides a comprehensive guide and templates designed to assist California residents in navigating the insurance application process smoothly.

Create a Gift Card - Let your loved ones indulge in their favorites with a gift certificate.