Mobile Home Purchase Agreement Document

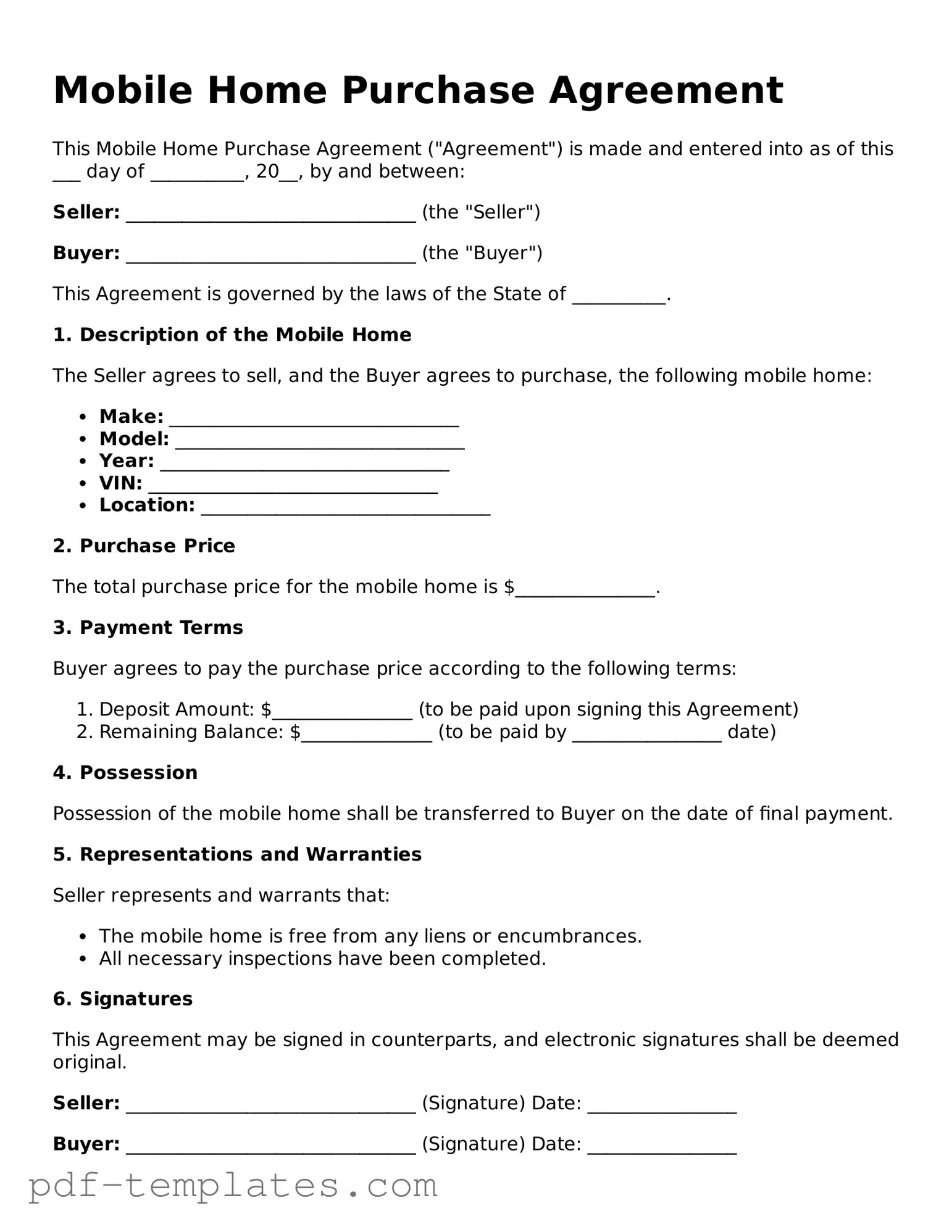

When considering the purchase of a mobile home, understanding the Mobile Home Purchase Agreement form is crucial for both buyers and sellers. This document serves as a legally binding contract that outlines the terms and conditions of the sale, ensuring that both parties are protected throughout the transaction. Key aspects of the agreement include the purchase price, payment terms, and any contingencies that may apply, such as financing or inspections. Additionally, the form typically specifies the responsibilities of both the buyer and seller, including disclosures about the condition of the home and any warranties that may be offered. It is essential to pay close attention to the details within the agreement, as they can significantly impact the overall transaction and future ownership experience. By clearly outlining the rights and obligations of each party, the Mobile Home Purchase Agreement promotes transparency and helps to prevent misunderstandings, making it an indispensable tool in the mobile home buying process.

Misconceptions

When considering a Mobile Home Purchase Agreement, various misconceptions can lead to confusion. Understanding these common myths can help buyers make informed decisions.

- Misconception 1: A Mobile Home Purchase Agreement is the same as a traditional home purchase agreement.

- Misconception 2: The agreement is only necessary for new mobile homes.

- Misconception 3: Once signed, the agreement cannot be changed.

- Misconception 4: A Mobile Home Purchase Agreement does not require legal review.

This is not true. While both documents serve the purpose of transferring ownership, a Mobile Home Purchase Agreement often includes specific clauses related to mobile home regulations, financing options, and land leasing agreements that differ from traditional home purchases.

This misconception overlooks the fact that a Mobile Home Purchase Agreement is essential for both new and used mobile homes. Regardless of the age of the mobile home, having a written agreement protects both the buyer and seller by clearly outlining the terms of the sale.

While it is true that a signed agreement is legally binding, it can be amended if both parties agree to the changes. Any modifications should be documented in writing and signed by both parties to ensure clarity and enforceability.

Some buyers believe they can navigate the purchase without legal assistance. However, having a legal professional review the agreement is advisable. This step can help identify any potential issues and ensure that the buyer’s rights are protected.

Mobile Home Purchase Agreement: Usage Instruction

Completing a Mobile Home Purchase Agreement form is an important step in the process of buying a mobile home. This document outlines the terms of the sale and protects both the buyer and the seller. Once the form is filled out, both parties will need to review and sign it to finalize the agreement.

- Obtain the form: Ensure you have the correct Mobile Home Purchase Agreement form. This can often be found online or through a real estate agent.

- Fill in the date: Write the date when the agreement is being completed at the top of the form.

- Identify the parties: Clearly state the names and contact information of both the buyer(s) and the seller(s). Make sure to include full legal names.

- Describe the mobile home: Provide a detailed description of the mobile home, including its make, model, year, and identification number (VIN).

- Specify the purchase price: Clearly indicate the total purchase price for the mobile home. Include any deposit amount if applicable.

- Outline payment terms: Describe how the payment will be made, including any financing arrangements or payment schedules.

- Include contingencies: If there are any conditions that must be met before the sale is finalized, such as inspections or financing approval, list them here.

- Set the closing date: Indicate the proposed closing date for the sale. This is when the transfer of ownership will occur.

- Signatures: Ensure that both the buyer(s) and seller(s) sign and date the agreement at the designated spaces. This signifies their acceptance of the terms.

Common mistakes

-

Incomplete Information: Failing to fill in all required fields can lead to delays or even invalidation of the agreement. Ensure every section is addressed.

-

Incorrect Dates: Entering the wrong dates for the transaction can cause confusion. Double-check that all dates reflect the intended timeline.

-

Missing Signatures: Not signing the document or forgetting to obtain the seller's signature can render the agreement unenforceable. Always confirm that all parties have signed.

-

Failure to Specify Payment Terms: Vague payment terms can lead to disputes. Clearly outline the payment method, amount, and due dates.

-

Neglecting to Include Contingencies: Omitting contingencies can expose buyers to unnecessary risks. Include any conditions that must be met for the sale to proceed.

-

Not Reviewing Local Laws: Ignoring local regulations regarding mobile home sales can lead to legal issues. Research and ensure compliance with state and local laws.

-

Using Outdated Forms: Utilizing an old version of the Mobile Home Purchase Agreement can result in missing important updates. Always use the most current form available.

-

Ignoring Inspection Clauses: Skipping the inspection clause can lead to costly surprises after the purchase. Always include a provision for a home inspection.

-

Not Keeping Copies: Failing to retain copies of the signed agreement can complicate future reference. Make sure to keep a signed copy for your records.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Mobile Home Purchase Agreement is a legal document outlining the terms of sale for a mobile home. |

| Parties Involved | The agreement typically includes the buyer and seller, both of whom must sign the document. |

| Purchase Price | The total price of the mobile home must be clearly stated in the agreement. |

| Deposit Requirements | The form often specifies a deposit amount that the buyer must pay upon signing. |

| Financing Terms | If applicable, the agreement outlines financing terms, including interest rates and payment schedules. |

| Condition of the Home | The agreement may include disclosures about the condition of the mobile home, including any known defects. |

| Governing Law | The agreement is subject to state laws, which vary by location. For example, California law governs mobile home transactions in that state. |

| Closing Date | The agreement should specify a closing date when the transaction will be finalized. |

| Contingencies | Common contingencies may include financing approval or inspections that must be completed before the sale is finalized. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

Dos and Don'ts

When filling out the Mobile Home Purchase Agreement form, it’s important to follow certain guidelines to ensure a smooth transaction. Here are some key dos and don’ts to consider:

- Do read the entire agreement carefully before signing.

- Do provide accurate information about the mobile home and the parties involved.

- Do ask questions if any part of the agreement is unclear.

- Do keep a copy of the signed agreement for your records.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any sections blank unless instructed to do so.

- Don't sign the agreement without understanding all terms and conditions.

Similar forms

The Mobile Home Purchase Agreement is similar to a Residential Purchase Agreement. Both documents outline the terms and conditions of a property sale. They specify the purchase price, financing arrangements, and any contingencies that must be met before the sale is finalized. While the Residential Purchase Agreement is typically used for traditional homes, the Mobile Home Purchase Agreement caters specifically to mobile homes, addressing unique aspects such as title transfer and land lease agreements.

Another comparable document is the Lease Agreement. This document outlines the terms under which a tenant can occupy a property, whether it be a mobile home or a traditional residence. Both agreements detail the responsibilities of the parties involved, including rent payment and maintenance obligations. However, a Lease Agreement is usually temporary and does not involve a transfer of ownership, unlike the Mobile Home Purchase Agreement, which is a step toward ownership.

In the realm of personal property transactions, understanding the necessary documentation is key to a smooth process. For those looking to transfer ownership, a crucial resource is the documentonline.org/blank-general-bill-of-sale, which provides a clear framework for the sale agreement. By using such documentation, both parties can detail important elements like the item, purchase price, and the identities of the buyer and seller, ultimately fostering a transparent and secure transaction.

The Bill of Sale is also similar, as it serves as proof of transfer of ownership. This document is often used in conjunction with the Mobile Home Purchase Agreement to finalize the sale. It includes details such as the buyer and seller's names, a description of the mobile home, and the sale price. While the Mobile Home Purchase Agreement sets the terms for the sale, the Bill of Sale serves as the official record of the transaction.

A Financing Agreement shares similarities with the Mobile Home Purchase Agreement, particularly when the buyer requires financing to complete the purchase. Both documents outline the terms of payment and any interest rates involved. The Financing Agreement specifically addresses the loan details, while the Mobile Home Purchase Agreement encompasses the overall sale terms, including contingencies and conditions for the transfer of ownership.

The Purchase and Sale Agreement is another related document. This agreement is used in various real estate transactions and outlines the specifics of the sale, including the price, closing date, and any conditions that must be met. Like the Mobile Home Purchase Agreement, it serves as a binding contract between the buyer and seller, ensuring that both parties are aware of their obligations and rights during the transaction.

Lastly, the Addendum to Purchase Agreement can also be compared to the Mobile Home Purchase Agreement. An addendum is used to modify or add terms to the original agreement. This could include changes to the closing date, financing terms, or additional contingencies. Both documents work together to ensure that all aspects of the sale are clearly defined and agreed upon by both parties, ensuring a smoother transaction process.

More Documents

Online Invoice Maker - Create invoices any way you like, all for free.

Shares Purchase Agreement - Can serve as a basis for negotiation of future ownership changes.

Understanding the intricacies of an Investment Letter of Intent form is essential for both investors and companies, as it sets the stage for future negotiations. This document not only highlights the foundational terms of the proposed investment but also emphasizes the importance of clarity to prevent misunderstandings. For more insights and detailed templates regarding this crucial agreement, you can visit TopTemplates.info.

Semi Truck Pre Trip Inspection Diagram - Can serve as a teaching tool for new drivers learning about vehicle care.