Get Membership Ledger Form in PDF

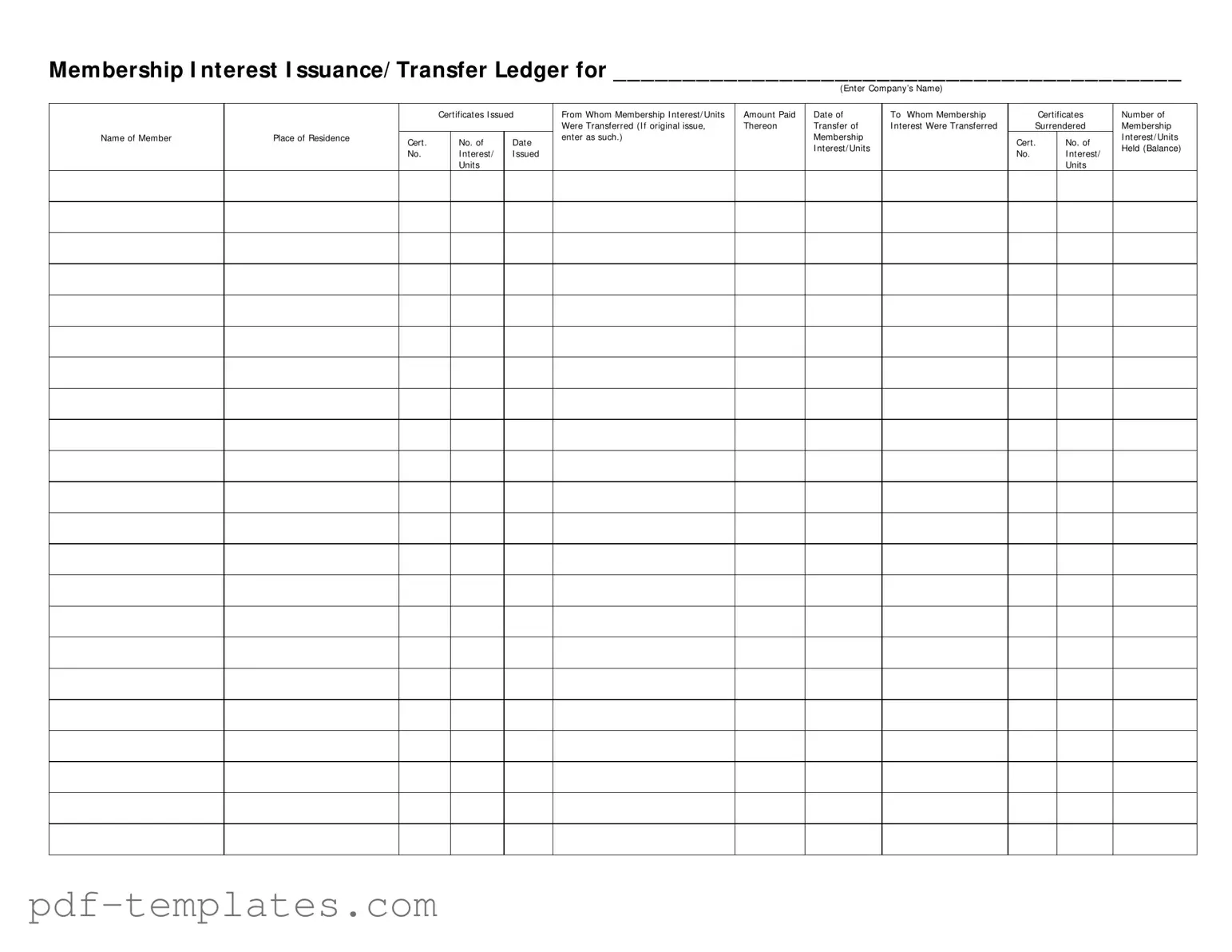

The Membership Ledger form serves as a crucial tool for tracking and managing membership interests within an organization. This document facilitates the issuance and transfer of membership certificates, ensuring that all transactions are accurately recorded. It includes essential fields such as the name of the company, the certificates issued, and details regarding the transfer of membership interests. Additionally, the form captures the amount paid for the membership units, the date of the transaction, and the names and residences of the members involved. By maintaining a clear record of these transactions, the Membership Ledger helps organizations uphold transparency and accountability. Furthermore, it provides a systematic approach to documenting the surrender of certificates and the balance of membership interests held by each member, thereby supporting effective governance and management of the organization's membership structure.

Misconceptions

Understanding the Membership Ledger form is crucial for accurate record-keeping in membership organizations. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

- It is only for tracking new memberships. Many believe the Membership Ledger is solely for new member registrations. In reality, it also tracks transfers, surrenders, and the overall balance of membership interests.

- Only the company can fill it out. Some think that only company officials can complete the form. In fact, authorized representatives or designated individuals can fill it out, ensuring accurate and timely updates.

- It is not necessary for small organizations. There is a misconception that small organizations do not need to maintain a Membership Ledger. Regardless of size, accurate records are essential for compliance and effective management.

- All entries must be made in real-time. While timely updates are important, some believe that every entry must be made immediately. It is acceptable to update the ledger at regular intervals, as long as the information remains accurate.

- Once filled, it does not need to be reviewed. Many assume that the ledger requires no further attention after it is completed. Regular reviews are necessary to ensure accuracy and to identify any discrepancies in membership records.

By addressing these misconceptions, organizations can ensure they maintain accurate and effective membership records.

Membership Ledger: Usage Instruction

Filling out the Membership Ledger form is an important step in tracking membership interests and their transfers. Once you have completed this form, it will help maintain accurate records for your organization, ensuring that all transactions are documented properly.

- Begin by entering the Company’s Name in the designated space at the top of the form.

- In the section labeled Certificates Issued From Whom, provide the name of the individual or entity that issued the certificates.

- Next, under Membership Interest/Units, specify the number of interests or units being issued or transferred.

- Indicate the Amount Paid for the membership interest or units in the corresponding field.

- Fill in the Date of Transfer to record when the membership interest was transferred.

- In the To Whom Membership Were Transferred section, enter the name of the individual or entity receiving the membership interest.

- If this is an original issue, note that in the Name of Member section.

- Provide the Place of Residence for the member in the specified area.

- Document the Certificate Number of the membership interest being issued or transferred.

- In the Membership Interest/Units Issued field, write down the total number of interests or units that are being issued or transferred.

- For Certificates Surrendered, indicate the number of certificates that are being returned or canceled.

- Record the Certificate Number for the surrendered interests or units.

- Finally, in the Number of Membership Interest/Units Held (Balance) section, provide the total balance of interests or units held after the transfer.

Common mistakes

-

Incorrect Company Name: Failing to accurately enter the company's name can lead to confusion and potential legal issues. Ensure the name matches official documents.

-

Missing Dates: Omitting the date of issuance or transfer can result in a lack of clarity regarding the timeline of membership interests. Always include specific dates.

-

Improper Certificate Numbers: Entering incorrect or incomplete certificate numbers can complicate record-keeping. Double-check all numbers for accuracy.

-

Failure to Identify Parties: Not clearly stating who the membership interest is being transferred from and to can create disputes. Clearly identify all parties involved.

-

Neglecting Amounts Paid: Forgetting to list the amount paid for the membership interest can lead to misunderstandings about ownership and value. Always include this information.

-

Not Updating Balances: Failing to update the balance of membership interests held can lead to inaccuracies in records. Regularly review and adjust as necessary.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Membership Ledger form is designed to track the issuance and transfer of membership interests or units within a company. |

| Company Name | At the top of the form, the name of the company must be entered to identify the entity associated with the membership interests. |

| Certificate Information | The form includes sections for recording the certificate numbers related to the membership interests issued and transferred. |

| Transfer Details | It captures essential information about the transfer of membership interests, including the date of transfer and the parties involved. |

| Amount Paid | The ledger requires the amount paid for the membership interests, ensuring transparency in financial transactions. |

| Balance Tracking | It allows for tracking the balance of membership interests held by each member, providing a clear overview of ownership at any time. |

| Governing Laws | Depending on the state, specific laws govern the use of membership ledgers, such as the Uniform Limited Liability Company Act (ULLCA) or state corporation laws. |

| Record Keeping | Maintaining this ledger is crucial for compliance and helps in resolving disputes related to membership interests. |

Dos and Don'ts

When filling out the Membership Ledger form, it’s important to follow certain guidelines to ensure accuracy and clarity. Here are some dos and don’ts to keep in mind:

- Do enter the company's name clearly at the top of the form.

- Do ensure that all dates are written in a consistent format.

- Do double-check the membership interest or units being issued or transferred.

- Do include the correct certificate numbers for each transaction.

- Don't leave any fields blank; fill in all required information.

- Don't use abbreviations that might confuse the reader.

- Don't forget to sign and date the form after completing it.

- Don't submit the form without reviewing it for errors.

Similar forms

The Membership Ledger form is similar to a Shareholder Ledger. Both documents track ownership interests in a company. The Shareholder Ledger records the names of shareholders, the number of shares they own, and any transfers of shares. Like the Membership Ledger, it helps maintain an accurate record of ownership and ensures that all transactions are documented properly, which is essential for legal compliance.

For those interested in understanding various membership-related documents, it's important to consider how the Request for Authorization for Medical Treatment (DWC Form RFA) parallels these records by highlighting the essential tracking of interests and obligations. Just as membership documents maintain accountability and transparency, the RFA form ensures that employees receive the necessary medical treatment following an occupational injury, supported by relevant medical documentation. For more detailed information on this form, you can visit https://formcalifornia.com/.

Another similar document is the Partnership Ledger. This form serves to document the interests of partners in a business. It lists the names of the partners, their respective ownership percentages, and any changes in partnership interests. Just as the Membership Ledger keeps track of membership units, the Partnership Ledger ensures that all changes in partnership stakes are clearly recorded for future reference.

The Certificate of Membership form is also akin to the Membership Ledger. This document serves as proof of ownership of membership units in a company. It includes details such as the member's name, the number of units owned, and any restrictions on transfer. Like the Membership Ledger, it provides essential information about membership interests and is crucial for maintaining accurate ownership records.

Another comparable document is the Stock Transfer Book. This book records all transactions involving the transfer of stock ownership. It includes details about the seller and buyer, the number of shares transferred, and the date of the transaction. Similar to the Membership Ledger, it ensures that all transfers are documented, which is vital for maintaining the integrity of ownership records.

The Capital Contributions Ledger shares similarities with the Membership Ledger as well. This document tracks the contributions made by members or partners to the business. It details the amount contributed, the date of contribution, and the member's name. Like the Membership Ledger, it provides a clear record of financial interests in the company.

The Unit Transfer Agreement is another document that parallels the Membership Ledger. This agreement outlines the terms under which membership units can be transferred from one member to another. It includes details such as the parties involved, the number of units being transferred, and any conditions of the transfer. Just as the Membership Ledger tracks these transfers, the Unit Transfer Agreement formalizes the process.

The Operating Agreement is also relevant. This document outlines the management structure and operational procedures of a business entity. It often includes information about membership interests and how they can be transferred. While the Membership Ledger focuses on recording transactions, the Operating Agreement provides the framework within which those transactions occur.

The Annual Report is another document that bears similarities to the Membership Ledger. It provides a comprehensive overview of a company's financial performance and ownership structure over the year. Like the Membership Ledger, it helps stakeholders understand the distribution of ownership interests and any changes that have occurred during the reporting period.

The Membership Interest Purchase Agreement is akin to the Membership Ledger as well. This document formalizes the sale of membership interests between parties. It includes terms of the sale, the purchase price, and the parties involved. While the Membership Ledger records the transfer, this agreement lays out the specific details of the transaction.

Lastly, the Corporate Bylaws are relevant when discussing similar documents. Bylaws govern the internal management of a corporation and often include provisions regarding membership interests and their transfer. Like the Membership Ledger, they ensure that all members are aware of their rights and responsibilities concerning ownership interests.

Other PDF Forms

Odometer Disclosure Statement California - This document ensures that both the seller and buyer acknowledge the reported mileage together.

In the state of Florida, utilizing a cease and desist letter form can be an effective tool to formally demand that an individual or organization stop any unlawful activities, thereby promoting a resolution outside the judicial system. For those looking for a template to guide their request, All Florida Forms provides a valuable resource. This letter not only conveys the complainant's serious intent but also establishes a foundation for further legal measures if necessary.

Trucking Companies With Lease Purchase - Refrigerated cargo must have an operational generator set unless otherwise specified by Carrier.

Free Printable Physical Exam Forms - Record past hospitalizations or surgical procedures for context during your exam.