Get Louisiana act of donation Form in PDF

The Louisiana Act of Donation form serves as a crucial legal instrument for individuals wishing to transfer ownership of property or assets without the exchange of monetary compensation. This document is particularly significant in the context of family and charitable donations, facilitating the process of gifting real estate, personal property, or other valuable assets. Key elements of the form include the identification of the donor and the recipient, a clear description of the property being donated, and any conditions or restrictions that may apply to the donation. Additionally, the form requires signatures from both parties, often necessitating witnesses or notarization to ensure its validity. Understanding the nuances of this form can empower individuals to make informed decisions regarding their assets, fostering a culture of generosity while adhering to the legal requirements set forth by Louisiana law. With the right information and guidance, the act of donation can be a straightforward and fulfilling process, enabling donors to express their intentions clearly and effectively.

Misconceptions

The Louisiana act of donation form is often misunderstood. Here are six common misconceptions about this important legal document:

-

It is only for wealthy individuals.

Many believe that the act of donation is reserved for those with significant assets. In reality, anyone can use this form to donate property or assets to another person, regardless of their financial status.

-

It requires a lawyer to complete.

While legal advice can be beneficial, it is not mandatory. Individuals can fill out the act of donation form on their own, as long as they understand the requirements and implications of their donation.

-

Donations made through this act are irrevocable.

This is not entirely true. Although the act creates a legal obligation, donors can include specific terms that allow for the possibility of revocation under certain conditions.

-

The form must be notarized to be valid.

While notarization can add an extra layer of authenticity, it is not strictly required for the act of donation to be legally binding in Louisiana.

-

Only real estate can be donated.

Many people think that the act of donation is limited to real estate. However, it can also be used for personal property, such as vehicles, jewelry, and other valuable items.

-

It is a complicated process.

Some may perceive the act of donation as overly complex. In fact, the process can be straightforward if the donor follows the guidelines and understands the requirements of the form.

Understanding these misconceptions can help individuals navigate the act of donation process more effectively.

Louisiana act of donation: Usage Instruction

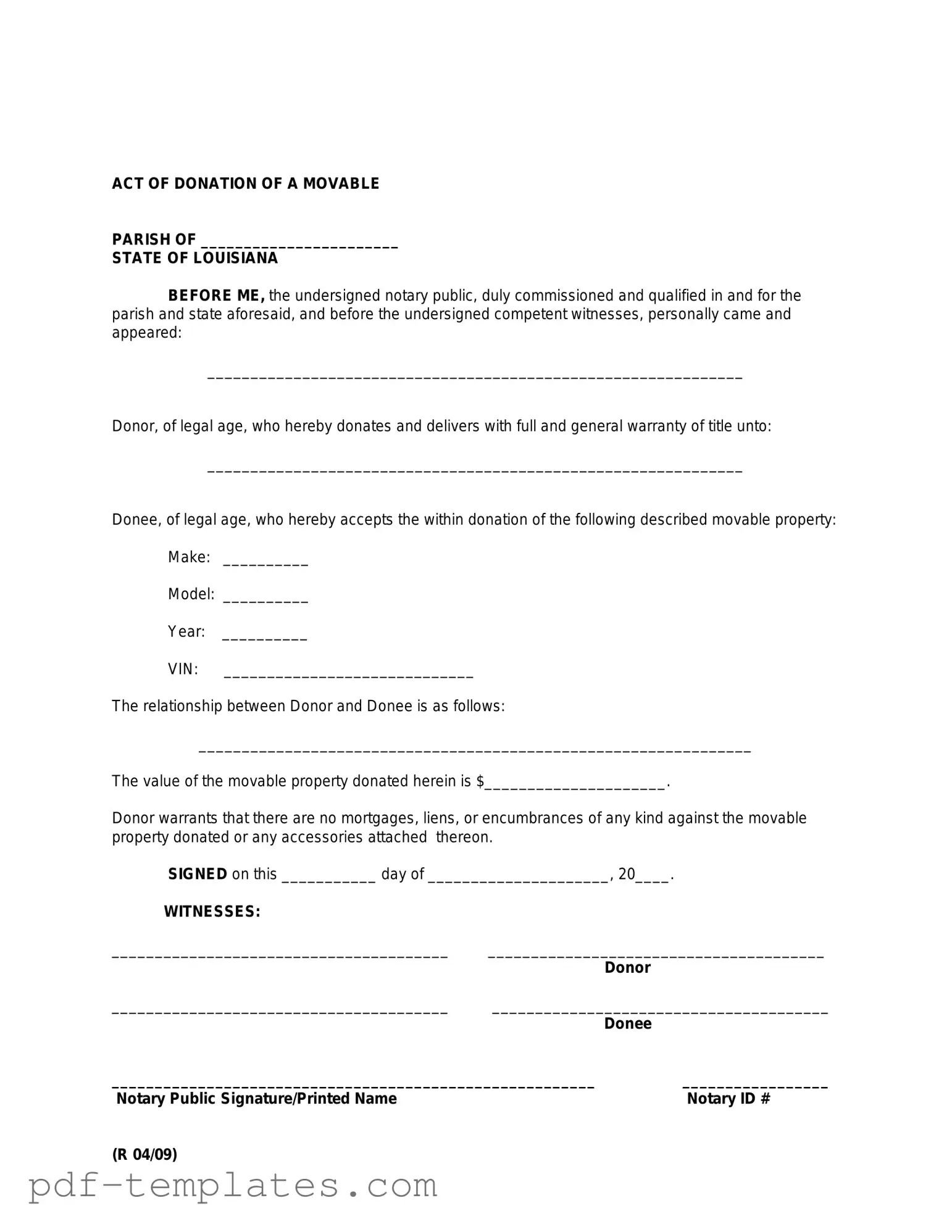

Filling out the Louisiana act of donation form requires attention to detail to ensure accuracy. This form facilitates the transfer of ownership of property from one person to another. Follow these steps to complete the form correctly.

- Obtain the Form: Download the Louisiana act of donation form from the official state website or visit a local government office to get a physical copy.

- Identify the Parties: Clearly state the names and addresses of both the donor (the person giving the property) and the donee (the person receiving the property).

- Describe the Property: Provide a detailed description of the property being donated. Include specifics such as location, type, and any relevant identifying information.

- Specify the Terms: Outline any conditions or terms associated with the donation. This may include restrictions or stipulations regarding the use of the property.

- Signatures: Ensure that both the donor and the donee sign the form. If applicable, have a witness sign as well.

- Notarization: Consider having the document notarized to add an extra layer of authenticity, especially if required by local laws.

- Submit the Form: File the completed form with the appropriate local government office, or provide it to the donee for their records.

Common mistakes

Filling out the Louisiana Act of Donation form can be straightforward, but mistakes can happen. Here are nine common errors to avoid:

- Not providing complete information

- Ensure all required fields are filled out. Missing information can delay processing.

- Using incorrect names

- Double-check the spelling of names. Any errors can cause confusion and may lead to legal issues.

- Failing to include a description of the property

- A clear description is essential. Without it, the donation may not be valid.

- Not signing the form

- All parties involved must sign. An unsigned form is not legally binding.

- Overlooking the date

- Include the date of signing. This helps establish the timeline of the donation.

- Ignoring witness requirements

- Some donations require witnesses. Make sure to follow the specific requirements for your situation.

- Not consulting with a professional

- Consider seeking advice from a legal expert. They can help clarify any uncertainties.

- Neglecting to keep copies

- Always keep a copy of the completed form for your records. This can be important for future reference.

- Submitting the form to the wrong office

- Confirm where to submit the form. Sending it to the wrong place can cause delays.

By avoiding these mistakes, you can ensure a smoother process when filling out the Louisiana Act of Donation form. Taking the time to review your submission can save you from potential issues down the line.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Louisiana Act of Donation form is used to legally transfer ownership of property from one person to another without any exchange of payment. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1465 to 1473, which outline the rules for donations. |

| Types of Donations | Donations can be either inter vivos (between living persons) or mortis causa (effective upon death). |

| Requirements | The form must be signed by the donor and, in some cases, by witnesses or a notary public to be valid. |

| Revocability | Generally, donations made inter vivos are irrevocable unless specific conditions allow for revocation. |

| Tax Implications | Donations may have tax consequences, including potential gift tax obligations, which should be considered by both parties. |

| Property Types | Real estate, personal property, and certain rights can be donated using this form. |

| Legal Capacity | Both the donor and the donee must have the legal capacity to enter into a donation agreement. |

| Filing Requirements | While the form itself does not require filing with a government office, recording the donation may be necessary for real property transfers. |

Dos and Don'ts

When filling out the Louisiana Act of Donation form, it is essential to ensure that the process goes smoothly. Here are some helpful guidelines on what to do and what to avoid:

- Do: Read the entire form carefully before you start filling it out.

- Do: Provide accurate and complete information to avoid delays.

- Do: Use clear and legible handwriting if filling out the form by hand.

- Do: Double-check all entries for any errors before submitting the form.

- Don't: Leave any required fields blank; this could lead to rejection.

- Don't: Use abbreviations or shorthand that may confuse the reader.

- Don't: Submit the form without reviewing it for accuracy.

- Don't: Forget to sign and date the form where indicated.

Similar forms

The Louisiana act of donation form shares similarities with a will, particularly in its function of transferring ownership of property. A will is a legal document that outlines how a person's assets should be distributed upon their death. Both documents require the intent of the donor or testator to transfer property, and both must adhere to specific legal requirements to be valid. For instance, both may need witnesses to ensure authenticity. However, unlike a will, which takes effect only after death, the act of donation is effective immediately, allowing the donor to see the impact of their gift during their lifetime.

Understanding the complexities of legal documents is crucial, especially when it comes to matters like healthcare and property rights. Just as the Louisiana act of donation is vital for ensuring rightful ownership without complications, so too is having a All California Forms ready for situations where medical decisions need to be made on behalf of someone who cannot communicate their wishes. This proactive approach helps secure both healthcare preferences and property management, reflecting clear intent and trust.

Another document akin to the act of donation is a gift deed. Like the act of donation, a gift deed is used to transfer property without any exchange of money. Both documents require the donor to have the intent to give and the recipient to accept the gift. A gift deed, however, often includes more formalities, such as being recorded with the local government to provide public notice of the transfer. This recording aspect can be essential for establishing ownership and protecting the recipient's rights against future claims.

Lastly, a trust agreement also shares characteristics with the act of donation. Both documents involve the transfer of property and can be used to manage assets for the benefit of another party. In a trust, the property is held by a trustee for the benefit of a beneficiary, while in an act of donation, the property is transferred directly to the recipient. Trusts can provide more control over how and when assets are distributed, often incorporating specific conditions or timelines. However, the act of donation is typically simpler and more straightforward, focusing solely on the immediate transfer of ownership.

Other PDF Forms

Ms Word Chart Examples - Prioritize clarity over complexity in your entries.

A Texas Vehicle Purchase Agreement is a legal document that outlines the terms and conditions of a vehicle sale between a buyer and a seller. This form serves to protect both parties by detailing the specifics of the transaction, including the sale price, vehicle information, and any warranties or representations. For more information, you can refer to the document available at https://documentonline.org/blank-texas-vehicle-purchase-agreement. Understanding this agreement is essential for ensuring a smooth and legally compliant purchase process.

Form Dr-835 - A practical step for taxpayers who need support with IRS matters.