Loan Agreement Document

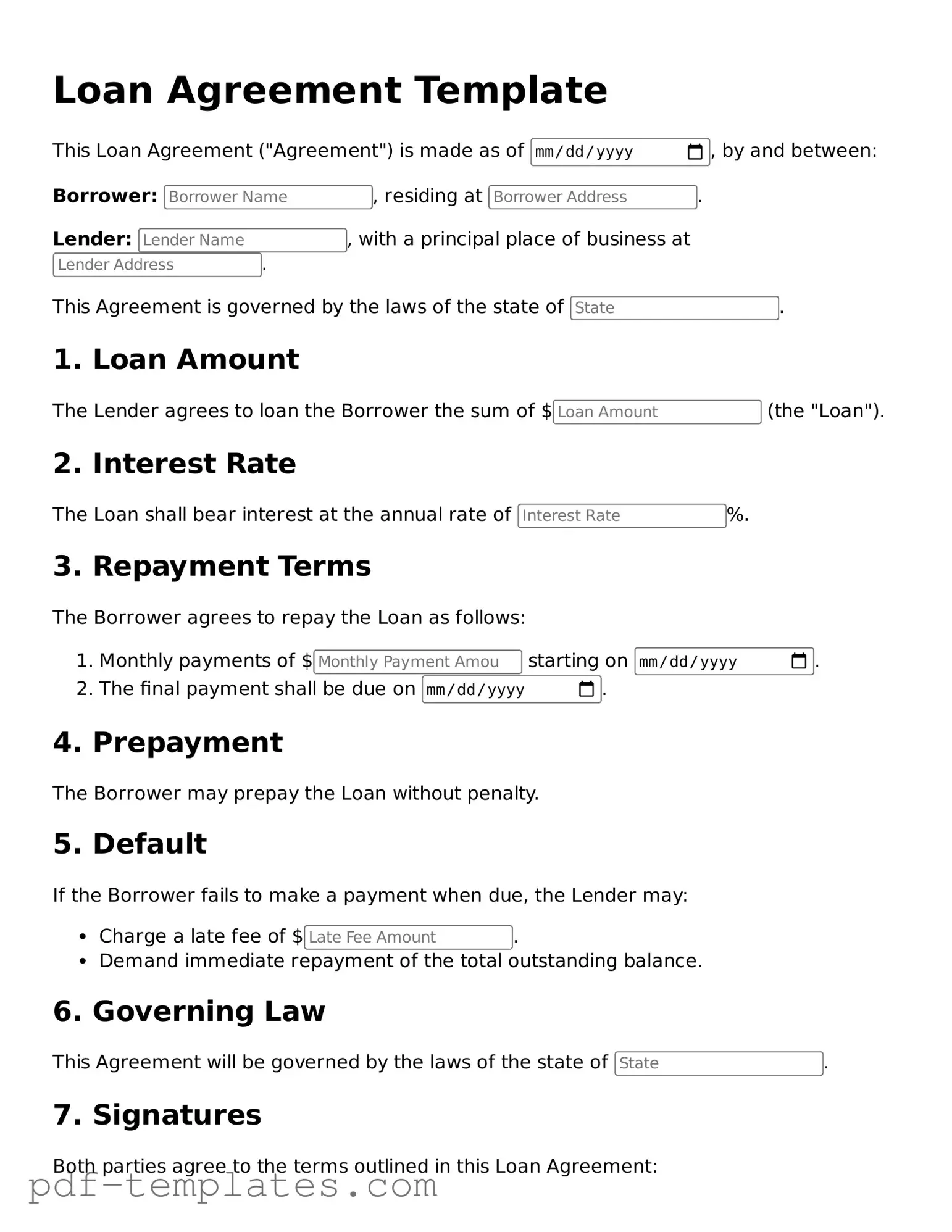

When you need to borrow money, a Loan Agreement form is a crucial document that outlines the terms of the loan. This form serves as a written record of the agreement between the lender and the borrower, detailing important aspects such as the loan amount, interest rate, repayment schedule, and any collateral involved. Clarity is key; both parties must understand their rights and responsibilities. The form typically includes provisions for late payments, default conditions, and the process for resolving disputes. By using a Loan Agreement, you can protect yourself and ensure that everyone is on the same page. Whether you're lending or borrowing, having this document in place can help avoid misunderstandings and provide a clear path forward.

Misconceptions

Loan agreements are essential documents in financial transactions. However, several misconceptions can lead to confusion. Below is a list of common misconceptions about loan agreements, along with clarifications.

- All loan agreements are the same. Each loan agreement is unique and tailored to the specific terms negotiated between the lender and the borrower. Factors such as interest rates, repayment schedules, and fees can vary significantly.

- You do not need to read the loan agreement. It is crucial to read and understand the entire agreement before signing. Important details about your obligations and rights are contained within the document.

- A verbal agreement is sufficient. While verbal agreements may seem convenient, they are not legally binding in most cases. A written loan agreement provides clear evidence of the terms agreed upon.

- Loan agreements are only for large sums of money. Loan agreements can be used for both small and large loans. Even minor loans should be documented to protect both parties.

- Once signed, you cannot change the loan agreement. Modifications can be made, but they typically require mutual consent from both the lender and the borrower. Any changes should be documented in writing.

- Loan agreements are only necessary for personal loans. Business loans, mortgages, and other types of financing also require formal loan agreements. These documents help establish the terms of the financial relationship.

- Defaulting on a loan agreement has no consequences. Defaulting can lead to serious repercussions, including damage to credit scores, legal action, and loss of collateral. Understanding the implications of default is essential.

By addressing these misconceptions, individuals can approach loan agreements with a clearer understanding and make informed decisions.

Loan Agreement - Customized for State

Loan Agreement Document Subtypes

Loan Agreement: Usage Instruction

Completing the Loan Agreement form is an important step in securing your loan. Follow these steps carefully to ensure that all necessary information is provided accurately.

- Begin by reading the entire form to understand what information is required.

- Fill in your personal details, including your full name, address, and contact information.

- Provide the loan amount you are requesting.

- Specify the purpose of the loan clearly.

- Indicate the repayment terms, including the duration and frequency of payments.

- Include any collateral information, if applicable.

- Review the form for accuracy and completeness.

- Sign and date the form at the designated area.

- Submit the completed form as instructed, ensuring you keep a copy for your records.

Common mistakes

-

Incorrect Personal Information: Many individuals fail to provide accurate personal details, such as their full name, address, or Social Security number. This can lead to delays or complications in the loan process.

-

Missing Financial Information: Applicants often overlook the need to include all relevant financial details, such as income, expenses, and existing debts. Incomplete financial disclosures can affect loan approval.

-

Not Reading the Terms: Some people skip over the loan terms and conditions, which can lead to misunderstandings about interest rates, repayment schedules, and penalties.

-

Forgetting Signatures: A common mistake is neglecting to sign the agreement. Without a signature, the document is not legally binding, and the loan cannot be processed.

-

Providing Outdated Information: Using outdated financial statements or tax returns can misrepresent an applicant's current financial situation. This may result in a denial or unfavorable loan terms.

-

Ignoring Co-signer Requirements: Some borrowers fail to include necessary information about co-signers. If a co-signer is required, their details must be accurately provided to avoid delays.

-

Neglecting to Check for Errors: Typos or errors in the application can lead to significant issues. Review the form carefully to ensure all information is correct before submission.

-

Assuming All Loans Are the Same: Different lenders have varying requirements and terms. Not researching these differences can lead to choosing a loan that is not suitable for one's needs.

-

Failing to Ask Questions: Many applicants do not seek clarification on terms they do not understand. It is important to ask questions to ensure full comprehension of the agreement.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Loan Agreement is a contract between a lender and a borrower outlining the terms of a loan. |

| Key Components | It typically includes the loan amount, interest rate, repayment schedule, and any collateral. |

| Governing Law | The governing law may vary by state, such as California Civil Code or New York General Obligations Law. |

| Types of Loans | Loan Agreements can cover personal loans, business loans, and mortgages. |

| Enforceability | For a Loan Agreement to be enforceable, it must be in writing and signed by both parties. |

| Default Consequences | If the borrower defaults, the lender may have the right to take legal action or seize collateral. |

Dos and Don'ts

When filling out a Loan Agreement form, it is crucial to follow certain guidelines to ensure accuracy and completeness. Below is a list of things to do and things to avoid.

- Do: Read the entire form carefully before starting.

- Do: Provide accurate personal information, including your full name and address.

- Do: Double-check all numbers and financial figures for correctness.

- Do: Sign and date the form where required.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any fields blank unless specified.

- Don't: Use abbreviations or shorthand in your responses.

- Don't: Provide false information or misrepresent your financial situation.

- Don't: Rush through the form; take your time to ensure accuracy.

- Don't: Forget to read the terms and conditions before signing.

Similar forms

A promissory note is a written promise to pay a specific amount of money to a designated party at a defined time or on demand. Like a loan agreement, it outlines the terms of the loan, including the interest rate and repayment schedule. However, a promissory note is typically simpler and may not include all the detailed terms and conditions found in a full loan agreement. It serves as a straightforward acknowledgment of debt, making it a common tool for personal loans between friends or family members.

A mortgage agreement is a specific type of loan agreement that is secured by real property. This document outlines the terms of the loan used to purchase a home or other real estate. Similar to a loan agreement, it includes details about the loan amount, interest rate, and repayment schedule. However, a mortgage agreement also includes provisions regarding the property itself, such as what happens if the borrower defaults. This added layer of security for the lender distinguishes it from a standard loan agreement.

An installment agreement is a contract that allows a borrower to repay a debt in scheduled payments over time. This document shares similarities with a loan agreement in that it specifies the total amount owed, the interest rate, and the payment schedule. However, installment agreements are often used in situations where a borrower needs to settle a debt in smaller, manageable amounts rather than obtaining a new loan. This makes it a useful option for individuals looking to pay off existing obligations.

A credit agreement, typically used by financial institutions, outlines the terms under which a borrower can access credit. Like a loan agreement, it specifies the amount of credit available, the interest rate, and repayment terms. However, credit agreements often allow for revolving credit, meaning borrowers can draw from the credit line multiple times up to a set limit. This flexibility distinguishes credit agreements from traditional loan agreements, which usually involve a fixed sum that is paid back in installments.

An equipment lease agreement is a contract that allows one party to use equipment owned by another party for a specified period in exchange for payment. This document is similar to a loan agreement in that it outlines the terms of the financial arrangement, including payment amounts and duration. However, rather than borrowing money, the lessee pays for the use of the equipment. The agreement may also include terms regarding maintenance and insurance, which are less common in traditional loan agreements.

A personal guarantee is a document in which an individual agrees to be responsible for another party's debt if that party defaults. While it is not a loan agreement itself, it often accompanies loan agreements, especially for small businesses. It provides additional security for lenders by ensuring that they have recourse to the personal assets of the guarantor. This document emphasizes the personal responsibility aspect of borrowing, which is a critical element in many loan agreements.

A lease purchase agreement combines elements of a lease and a purchase agreement. It allows a tenant to rent a property with the option to buy it later. Similar to a loan agreement, it outlines payment terms and conditions, but it also includes provisions for eventual ownership transfer. This type of agreement can be beneficial for those who may not currently qualify for a mortgage but wish to secure a future purchase.

A joint venture agreement is a contract between two or more parties to undertake a specific project or business activity together. It is similar to a loan agreement in that it outlines the contributions of each party, the financial terms, and the responsibilities involved. However, joint ventures typically involve shared profits and losses, which sets them apart from loan agreements that focus primarily on repayment of borrowed funds.

A business loan agreement is tailored specifically for business financing. It outlines the terms under which a lender provides funds to a business, including interest rates, repayment schedules, and collateral requirements. While it shares many similarities with a personal loan agreement, the business loan agreement often includes additional clauses related to business operations and financial reporting. This specificity helps protect the lender's investment while providing the business with necessary capital.

More Documents

Organization Meeting Minutes - Record attendees present at the meeting.

Purchase Agreement Template - This document can specify when and how ownership transfers between parties.