LLC Share Purchase Agreement Document

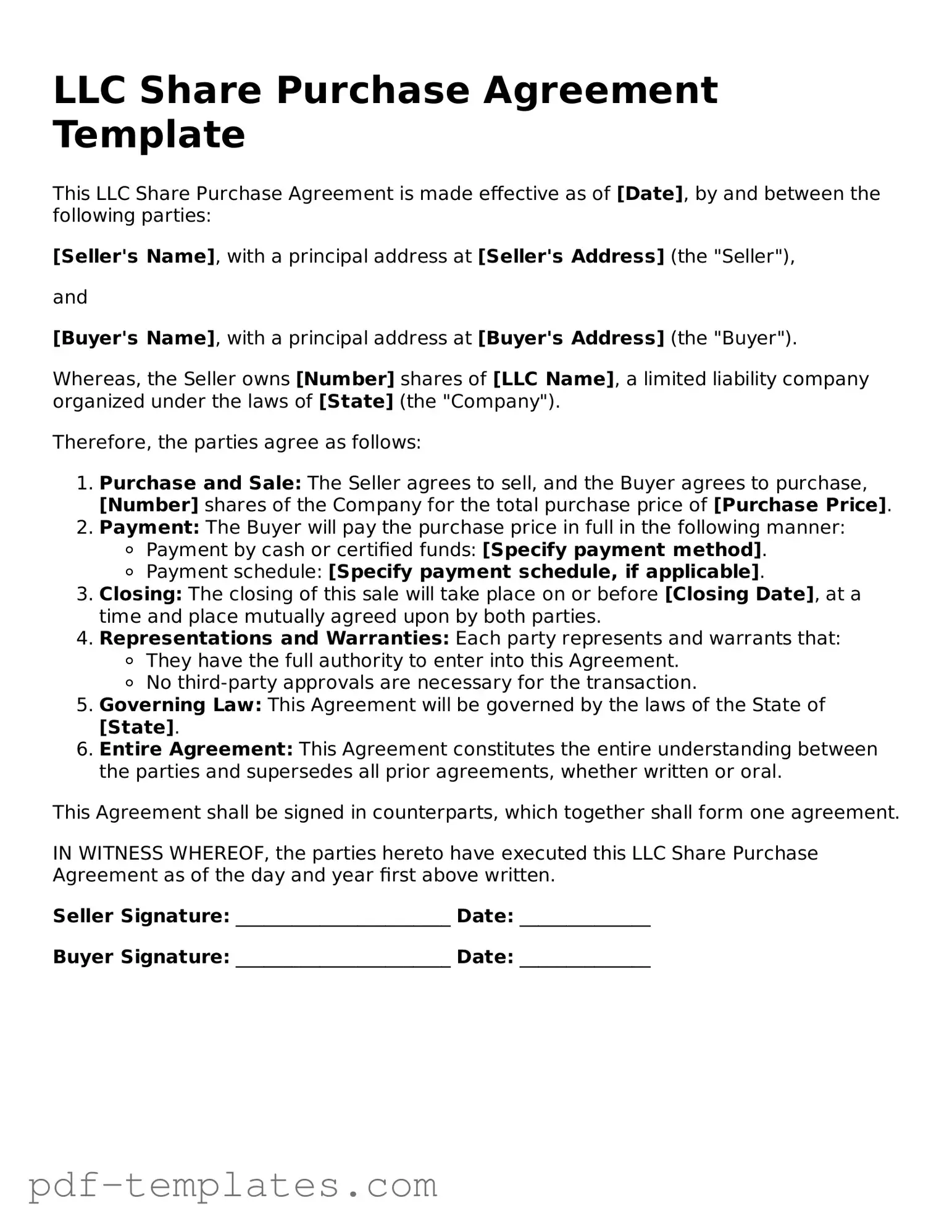

When it comes to buying or selling shares in a Limited Liability Company (LLC), having a well-structured LLC Share Purchase Agreement is crucial. This document serves as a roadmap for both the buyer and the seller, outlining the terms and conditions of the transaction. Key components typically include the purchase price, the number of shares being sold, and any warranties or representations made by either party. Additionally, the agreement addresses important details like payment terms, closing procedures, and any contingencies that must be met before the sale can be finalized. It’s also essential to consider how the agreement will handle potential disputes and what happens if either party fails to uphold their end of the bargain. By clearly laying out these aspects, the LLC Share Purchase Agreement helps ensure a smooth transfer of ownership and protects the interests of all parties involved.

Misconceptions

When dealing with an LLC Share Purchase Agreement, several misconceptions can arise. Understanding these can help clarify the purpose and importance of this document.

- Misconception 1: An LLC Share Purchase Agreement is only necessary for large transactions.

- Misconception 2: Once signed, the agreement cannot be changed.

- Misconception 3: The agreement is only about the price of the shares.

- Misconception 4: You don’t need legal advice to create an LLC Share Purchase Agreement.

This is not true. Regardless of the size of the transaction, having a formal agreement helps protect both the buyer and the seller. It outlines the terms and conditions of the sale, ensuring that everyone is on the same page.

While the agreement is a binding document, it can be amended if both parties agree to the changes. This flexibility is important as circumstances may evolve after the initial signing.

While price is a critical component, the agreement also covers other important aspects, such as payment terms, representations and warranties, and any contingencies that may apply. This comprehensive approach protects both parties.

Although it is possible to draft the agreement without professional help, consulting with a legal expert is highly recommended. They can provide valuable insights and ensure that the document complies with state laws and regulations.

LLC Share Purchase Agreement: Usage Instruction

Completing the LLC Share Purchase Agreement form is an important step in finalizing the transfer of ownership in a limited liability company. Following the steps below will help ensure that all necessary information is accurately provided, facilitating a smooth transaction.

- Obtain the Form: Ensure you have the correct version of the LLC Share Purchase Agreement form. This may be available through your legal advisor or a trusted online source.

- Identify the Parties: Fill in the names and addresses of the buyer and seller. Make sure to include any relevant titles or positions within the LLC.

- Describe the Shares: Clearly state the number of shares being purchased and any specific class of shares if applicable. This information is crucial for clarity in the agreement.

- Purchase Price: Indicate the agreed-upon purchase price for the shares. This should reflect the total amount the buyer will pay to the seller.

- Payment Terms: Specify how the payment will be made. Include details such as whether it will be a lump sum or installments, and any relevant due dates.

- Representations and Warranties: Include any representations or warranties made by either party regarding the shares or the LLC. This section is vital for protecting both parties.

- Signatures: Ensure that both parties sign the agreement. Include the date of signing to establish when the agreement takes effect.

- Witness or Notary: Depending on state requirements, consider having the agreement witnessed or notarized to add an extra layer of authenticity.

After completing these steps, review the form thoroughly to confirm that all information is accurate and complete. This will help avoid any potential issues in the future. Once satisfied, both parties can proceed with the signing process.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details in the agreement. Missing names, addresses, or signatures can render the document invalid.

-

Incorrect Purchase Price: Some people mistakenly enter the wrong purchase price for the shares. This can lead to disputes later on, affecting the transaction's validity.

-

Not Specifying Payment Terms: A common oversight is neglecting to clearly outline payment terms. Without this information, it can be unclear when and how payments should be made.

-

Failure to Include Conditions: Some agreements lack necessary conditions for the sale. Without specifying conditions, parties may face unexpected issues after the agreement is signed.

-

Ignoring State Requirements: Each state has specific laws regarding LLC transactions. Failing to adhere to these regulations can lead to legal complications.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | An LLC Share Purchase Agreement outlines the terms under which one party agrees to purchase shares from another party within a limited liability company. |

| Governing Law | The agreement is typically governed by the laws of the state in which the LLC is formed, such as Delaware, California, or New York. |

| Key Components | It includes essential details like purchase price, payment terms, and representations and warranties of the parties involved. |

| Importance | This document helps protect both the buyer and seller by clearly defining their rights and obligations, minimizing potential disputes. |

| Flexibility | The agreement can be customized to fit the specific needs of the parties, allowing for various terms regarding shares and payment structures. |

Dos and Don'ts

When filling out an LLC Share Purchase Agreement form, it's essential to approach the task with care. Here are five things you should and shouldn't do to ensure the process goes smoothly.

- Do: Read the entire form carefully before starting. Understanding each section will help you provide accurate information.

- Do: Double-check all names and addresses. Accuracy is crucial to avoid future disputes.

- Do: Consult with a legal professional if you have questions. They can provide guidance tailored to your situation.

- Do: Keep a copy of the completed form for your records. This will be helpful for future reference.

- Do: Ensure all parties involved sign the agreement. An unsigned document may not be enforceable.

- Don't: Rush through the form. Taking your time helps prevent mistakes.

- Don't: Leave any fields blank unless instructed. Incomplete forms can lead to delays.

- Don't: Use vague language. Be specific about the terms and conditions to avoid misunderstandings.

- Don't: Ignore local laws and regulations. Compliance is key to ensuring the agreement is valid.

- Don't: Forget to review the final document before submission. A final check can catch errors you might have missed.

Similar forms

The LLC Operating Agreement is similar to the LLC Share Purchase Agreement in that both documents outline the management structure and operational procedures of the company. While the Share Purchase Agreement focuses specifically on the sale and transfer of shares, the Operating Agreement provides a broader framework for how the LLC will be run, detailing the rights and responsibilities of members, decision-making processes, and profit distribution. Together, these documents ensure clarity in ownership and governance.

The Membership Interest Purchase Agreement serves a similar purpose to the LLC Share Purchase Agreement but focuses on the purchase of membership interests rather than shares. This document is crucial for LLCs, as it outlines the terms of transferring ownership interests among members. Both agreements protect the rights of the parties involved and ensure compliance with state laws regarding ownership transfers.

The Stock Purchase Agreement shares similarities with the LLC Share Purchase Agreement, particularly in its focus on the sale of equity interests. This document is typically used for corporations rather than LLCs, but it serves the same fundamental purpose: detailing the terms of a sale, including price, payment method, and representations and warranties. Both agreements aim to facilitate a smooth transaction and protect the interests of both buyers and sellers.

When engaging in a horse sale, it is vital to use the appropriate documentation to ensure a smooth transaction. For a reliable template, consider this essential Horse Bill of Sale form for your needs, which clearly outlines the details required for the transfer of ownership.

The Asset Purchase Agreement is another document that aligns closely with the LLC Share Purchase Agreement. While the latter deals with the transfer of ownership interests, the Asset Purchase Agreement focuses on the sale of specific assets of the business. This document outlines what assets are being sold, the purchase price, and any liabilities being assumed. Both agreements are critical in business transactions, ensuring all parties understand the terms and conditions involved.

The Buy-Sell Agreement is also comparable to the LLC Share Purchase Agreement. This document is designed to govern the sale of an owner’s interest in the LLC upon certain triggering events, such as death, disability, or voluntary exit. It ensures that the remaining members have the first right to purchase the departing member’s interest, thus maintaining control within the existing ownership group. Both agreements are essential for managing ownership transitions and protecting the interests of the remaining members.

The Non-Disclosure Agreement (NDA) can be seen as complementary to the LLC Share Purchase Agreement. While the Share Purchase Agreement details the terms of the sale, the NDA protects sensitive information exchanged during negotiations. Both documents work together to ensure that proprietary information remains confidential, fostering trust between the parties involved in the transaction.

The Letter of Intent (LOI) is often a precursor to the LLC Share Purchase Agreement. It outlines the preliminary terms of a proposed transaction, indicating the parties' intent to move forward with negotiations. While not legally binding, the LOI sets the stage for the more detailed Share Purchase Agreement by establishing key points of agreement. Both documents play a crucial role in the transaction process, guiding discussions and expectations.

The Confidentiality Agreement is similar to the LLC Share Purchase Agreement in its focus on protecting information. This document ensures that any sensitive data shared during negotiations remains confidential. While the Share Purchase Agreement formalizes the sale, the Confidentiality Agreement safeguards the interests of both parties by preventing unauthorized disclosure of proprietary information. Together, they create a secure environment for business transactions.

The Term Sheet is another document that parallels the LLC Share Purchase Agreement. It provides a summary of the key terms and conditions of a proposed transaction, serving as a roadmap for the more detailed agreements that follow. The Term Sheet is not legally binding but helps clarify the intentions of both parties. Both documents are essential in structuring the deal and ensuring that all parties are aligned before proceeding to the final agreements.

More Documents

Short Term Disability Ca - Claimants can check their eligibility and the requirements on the EDD website.

Irs 1040 Form - Submitting the 1040 accurately helps avoid penalties and interest charges.

The California Identification Card form, often referred to in discussions about ID verification, offers a streamlined approach for individuals who need to navigate the requirements of obtaining a state ID. For those interested in accessing detailed information and resources related to this process, formcalifornia.com serves as a useful platform, providing guidance on eligibility, application procedures, and related documentation needed to ensure a successful application experience.

Media Release Form Template - Signing permits the organization to create and distribute marketing materials freely.