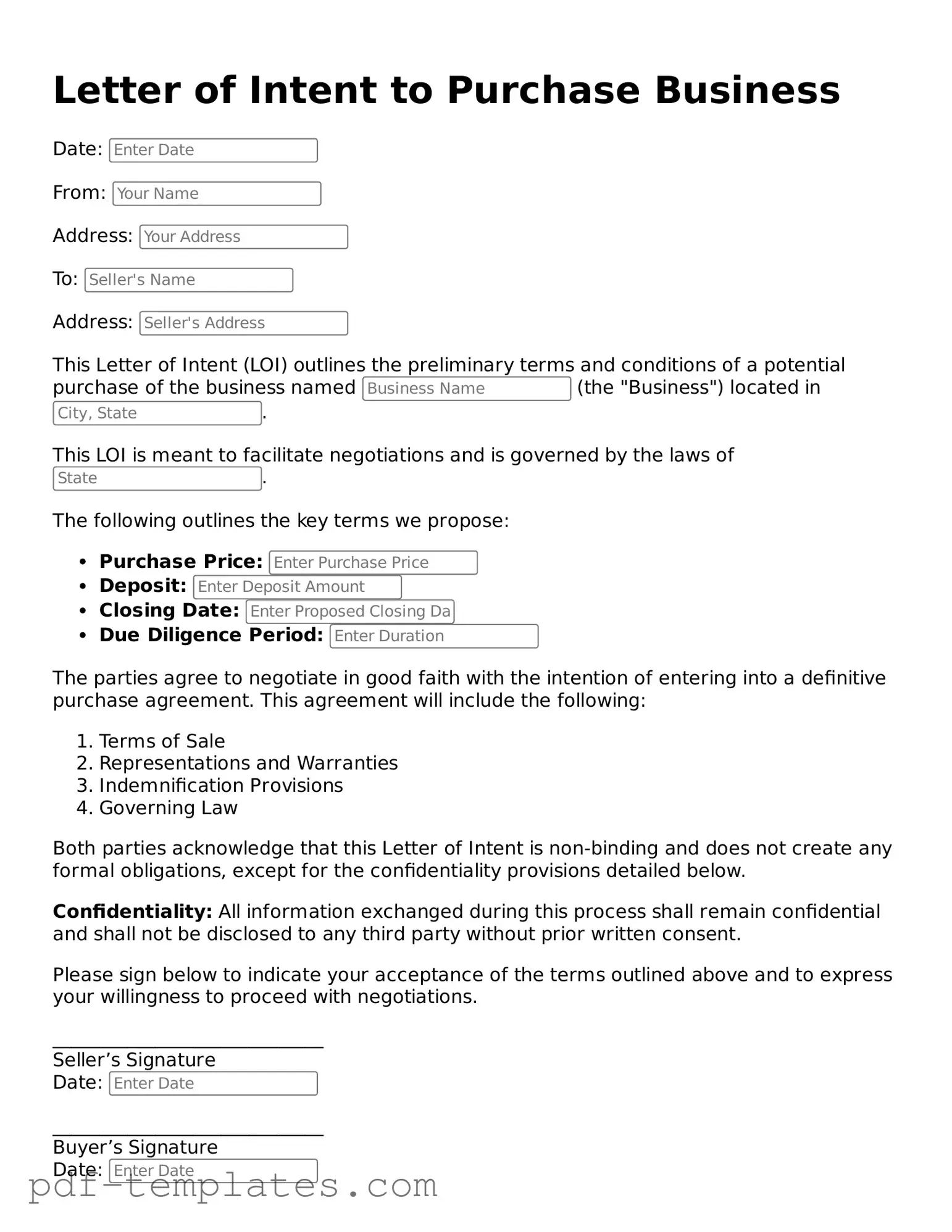

Letter of Intent to Purchase Business Document

When contemplating the acquisition of a business, a Letter of Intent to Purchase Business serves as a crucial first step in the negotiation process. This document outlines the preliminary terms and conditions agreed upon by both the buyer and the seller, establishing a framework for the transaction. Key components typically include the purchase price, payment structure, and any contingencies that must be met before the deal is finalized. Additionally, the letter may address the timeline for due diligence and closing, as well as confidentiality clauses to protect sensitive information. By clearly articulating the intentions and expectations of both parties, this letter not only facilitates open communication but also sets the stage for a smoother transition, fostering trust and collaboration. Understanding the significance of this form can empower both buyers and sellers to navigate the complexities of business transactions with confidence.

Misconceptions

When considering a Letter of Intent (LOI) to purchase a business, several misconceptions often arise. Here are five common misunderstandings:

- 1. An LOI is a legally binding contract. Many believe that signing an LOI means they are legally obligated to proceed with the purchase. In reality, an LOI typically outlines the terms and intentions of the parties but is usually non-binding unless specified otherwise.

- 2. An LOI guarantees the sale will go through. Just because an LOI is signed does not mean the sale is guaranteed. The LOI is a starting point for negotiations, and various factors can affect the final agreement.

- 3. The LOI must include all details of the transaction. Some think an LOI needs to cover every detail of the sale. However, it generally summarizes key points and leaves room for further negotiation and clarification in the final purchase agreement.

- 4. An LOI is only necessary for large transactions. Many assume that only significant business purchases require an LOI. In fact, even smaller transactions can benefit from an LOI to clarify intentions and expectations.

- 5. Once signed, the LOI cannot be changed. Some individuals believe that once an LOI is signed, it is set in stone. However, parties can negotiate changes to the LOI before finalizing the purchase agreement.

Understanding these misconceptions can help clarify the role of a Letter of Intent in business transactions.

Letter of Intent to Purchase Business: Usage Instruction

Completing the Letter of Intent to Purchase Business form is an important step in your journey toward acquiring a business. This document outlines your intentions and helps establish a framework for negotiations. Once you have filled out the form, you will be ready to move forward with discussions and due diligence.

- Gather Necessary Information: Before you begin, collect all relevant details about the business you wish to purchase, including its name, address, and the names of the current owners.

- Identify Yourself: At the top of the form, provide your full name, address, and contact information. This identifies you as the buyer.

- Describe the Business: Clearly state the name of the business you intend to purchase and its location. Be specific to avoid any confusion.

- Outline the Purchase Price: Indicate the proposed purchase price for the business. This figure should be realistic and based on your research.

- Detail Payment Terms: Specify how you plan to pay for the business. Will it be a lump sum, installments, or a combination? Clarity here is crucial.

- Include Conditions: List any conditions that must be met before the sale can proceed, such as obtaining financing or satisfactory due diligence.

- Set a Timeline: Indicate your desired timeline for completing the purchase. This helps both parties stay on track.

- Sign and Date: Finally, sign and date the form. If applicable, have the current owner sign as well to acknowledge receipt of your intent.

Common mistakes

-

Neglecting to Clearly Define Terms: One of the most common mistakes is failing to clearly outline the terms of the agreement. Vague language can lead to misunderstandings down the line.

-

Omitting Essential Details: Some people forget to include critical information, such as the purchase price or payment terms. This omission can create confusion and complications later.

-

Not Specifying Contingencies: Contingencies are conditions that must be met for the sale to proceed. If these are not specified, both parties may have different expectations.

-

Ignoring Legal and Financial Advice: Skipping consultation with legal or financial professionals can be a costly mistake. Their expertise can help identify potential pitfalls.

-

Failing to Include a Timeline: Without a timeline for the transaction, it can become unclear when various steps should occur. This lack of structure may lead to delays.

-

Overlooking Confidentiality Clauses: Many people forget to include confidentiality provisions. Protecting sensitive information is crucial during negotiations.

-

Not Reviewing the Document Thoroughly: Rushing through the review process can result in missed errors or unclear language. Taking the time to carefully read the document is essential.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | A Letter of Intent to Purchase Business outlines the preliminary agreement between a buyer and seller regarding the sale of a business. |

| Non-Binding Nature | This document is typically non-binding, meaning it expresses an intention to negotiate but does not create a legal obligation to complete the sale. |

| Key Components | It generally includes terms such as purchase price, payment structure, and timelines for due diligence. |

| Confidentiality | Many Letters of Intent include confidentiality clauses to protect sensitive business information during negotiations. |

| State-Specific Laws | Each state may have specific laws governing business transactions, so it's essential to consult local regulations. |

| Negotiation Tool | The document serves as a negotiation tool, helping both parties clarify their intentions and expectations before entering into a formal contract. |

Dos and Don'ts

When filling out a Letter of Intent to Purchase a Business form, it is essential to approach the task with care. Here are nine important things to consider, including what to do and what to avoid.

- Do clearly state your intent to purchase the business.

- Do include specific details about the business you wish to acquire.

- Do outline the proposed terms of the purchase, including price and payment structure.

- Do mention any contingencies that may affect the sale.

- Do ensure all parties involved sign the document to confirm agreement.

- Don't use vague language that could lead to misunderstandings.

- Don't omit important details that could impact the transaction.

- Don't make promises you cannot keep regarding the terms of the sale.

- Don't forget to include a timeline for the transaction process.

By following these guidelines, you can create a comprehensive and effective Letter of Intent that facilitates a smoother business acquisition process.

Similar forms

The Non-Disclosure Agreement (NDA) is similar to the Letter of Intent to Purchase Business in that it establishes the confidentiality of shared information. When two parties engage in discussions about a potential business transaction, they often exchange sensitive data. An NDA ensures that this information remains private and cannot be disclosed to outside parties. This document protects both the buyer and the seller by setting clear boundaries around the use of proprietary information during negotiations.

The Memorandum of Understanding (MOU) serves a purpose akin to that of the Letter of Intent to Purchase Business. An MOU outlines the preliminary understanding between parties before finalizing a deal. It typically includes the intentions of both parties and the general terms of the agreement. While it is less formal than a contract, it indicates a commitment to move forward and can help clarify the expectations of each party involved in the transaction.

A Purchase Agreement is another document closely related to the Letter of Intent to Purchase Business. This agreement is more formal and legally binding, detailing the terms and conditions under which the business will be sold. It includes specifics such as the purchase price, payment terms, and any contingencies that must be met. The Letter of Intent often serves as a precursor to this agreement, setting the stage for the more detailed negotiations that follow.

In the realm of investment transactions, understanding the nuances of various agreements is essential for successful negotiations. For instance, a well-crafted Investment Letter of Intent not only streamlines the preliminary discussions but also establishes a foundation of trust between parties. Resources like OnlineLawDocs.com provide valuable insights into drafting these important documents, ensuring that investors and sellers are well-prepared for the negotiations ahead and can navigate the complexities of asset acquisition with confidence.

The Term Sheet outlines the basic terms of a proposed agreement between parties. It is similar to the Letter of Intent to Purchase Business in that it summarizes key points of the deal, such as pricing, timelines, and responsibilities. While a term sheet is not legally binding, it provides a framework that guides the drafting of more formal agreements. This document helps both parties align their expectations before moving forward with negotiations.

An Asset Purchase Agreement is specifically related to the acquisition of a business's assets rather than its stock or ownership. Like the Letter of Intent, it details the specifics of the transaction, including which assets are included in the sale. This document is crucial for clarifying what is being sold and helps prevent misunderstandings during the purchase process. The Letter of Intent often precedes this agreement, outlining the buyer's interest in the assets.

The Confidentiality Agreement, similar to the NDA, focuses on protecting sensitive information during negotiations. This document is essential when discussing the purchase of a business, as it assures both parties that proprietary information will not be disclosed. It fosters trust and encourages open communication, which is vital for successful negotiations. The Letter of Intent may reference this agreement to emphasize the importance of confidentiality during the transaction process.

The Due Diligence Checklist is a tool used during the evaluation phase of a business acquisition. It is similar to the Letter of Intent to Purchase Business in that it helps buyers assess the viability of the purchase. This checklist outlines the information and documentation the buyer needs to review before finalizing the deal. While the Letter of Intent expresses the buyer's intent, the due diligence checklist ensures that all necessary evaluations are completed to make an informed decision.

The Closing Statement is the final document in a business purchase transaction. It is similar to the Letter of Intent to Purchase Business in that it summarizes the terms agreed upon by both parties. The closing statement includes details about the financial aspects of the sale, such as the final purchase price and any adjustments. While the Letter of Intent initiates the process, the closing statement represents the culmination of negotiations and the official transfer of ownership.

Additional Types of Letter of Intent to Purchase Business Templates:

How to Create a Letter of Intent - Outline your project idea briefly in this letter.

To begin the homeschooling process in California, it is essential to complete the California Homeschool Letter of Intent form, which serves as the official notification to school authorities regarding a parent’s decision to educate their child at home. This form not only guarantees compliance with state education laws but also lays a strong foundation for families as they embark on their educational journey. For those seeking guidance and resources, Top Forms Online offers valuable assistance in understanding and completing this important document.

Intent to Homeschool - For some families, this process reinforces their educational philosophy and commitment to lifelong learning.

Example of a Letter of Interest - This letter emphasizes cooperation and teamwork in the investment process.