Letter of Intent to Lease Commercial Property Document

When entering the world of commercial real estate, understanding the Letter of Intent to Lease Commercial Property is crucial for both landlords and tenants. This document serves as a preliminary agreement outlining the key terms and conditions before a formal lease is finalized. It typically includes essential details such as the proposed rental rate, lease duration, and property description. Additionally, it may address specific responsibilities regarding maintenance, utilities, and any potential improvements to the space. By clarifying these elements upfront, the letter helps both parties gauge their intentions and expectations, reducing the likelihood of misunderstandings later on. Not only does it establish a foundation for negotiation, but it also demonstrates a serious commitment to the leasing process. In essence, this document plays a vital role in paving the way for a smooth transition into a more formal lease agreement.

Misconceptions

Understanding the Letter of Intent to Lease Commercial Property can be challenging. Here are six common misconceptions that people often have about this important document.

-

It is a legally binding contract.

Many believe that a Letter of Intent (LOI) is a legally binding agreement. In reality, an LOI outlines the basic terms of a lease but is typically not enforceable as a contract until both parties sign a formal lease agreement.

-

It guarantees the lease will be finalized.

Some think that signing an LOI guarantees that the lease will be completed. However, an LOI is merely a starting point for negotiations and does not ensure that a lease will ultimately be signed.

-

It is only for landlords.

There is a misconception that only landlords use LOIs. In fact, tenants can also initiate an LOI to express their interest and outline their proposed terms, making it a useful tool for both parties.

-

It includes all lease details.

Many assume that an LOI contains every detail of the lease. While it may cover key terms like rent and duration, it usually leaves out specifics that will be addressed in the final lease document.

-

It is unnecessary.

Some may think that an LOI is an unnecessary step in the leasing process. However, it can help clarify intentions and expectations, making negotiations smoother and more efficient.

-

It can be ignored once signed.

Finally, there is a belief that once an LOI is signed, it can be disregarded. In truth, it serves as a reference point for negotiations and can influence the final lease terms, so it should not be overlooked.

By addressing these misconceptions, individuals can approach the leasing process with a clearer understanding of the role and purpose of a Letter of Intent.

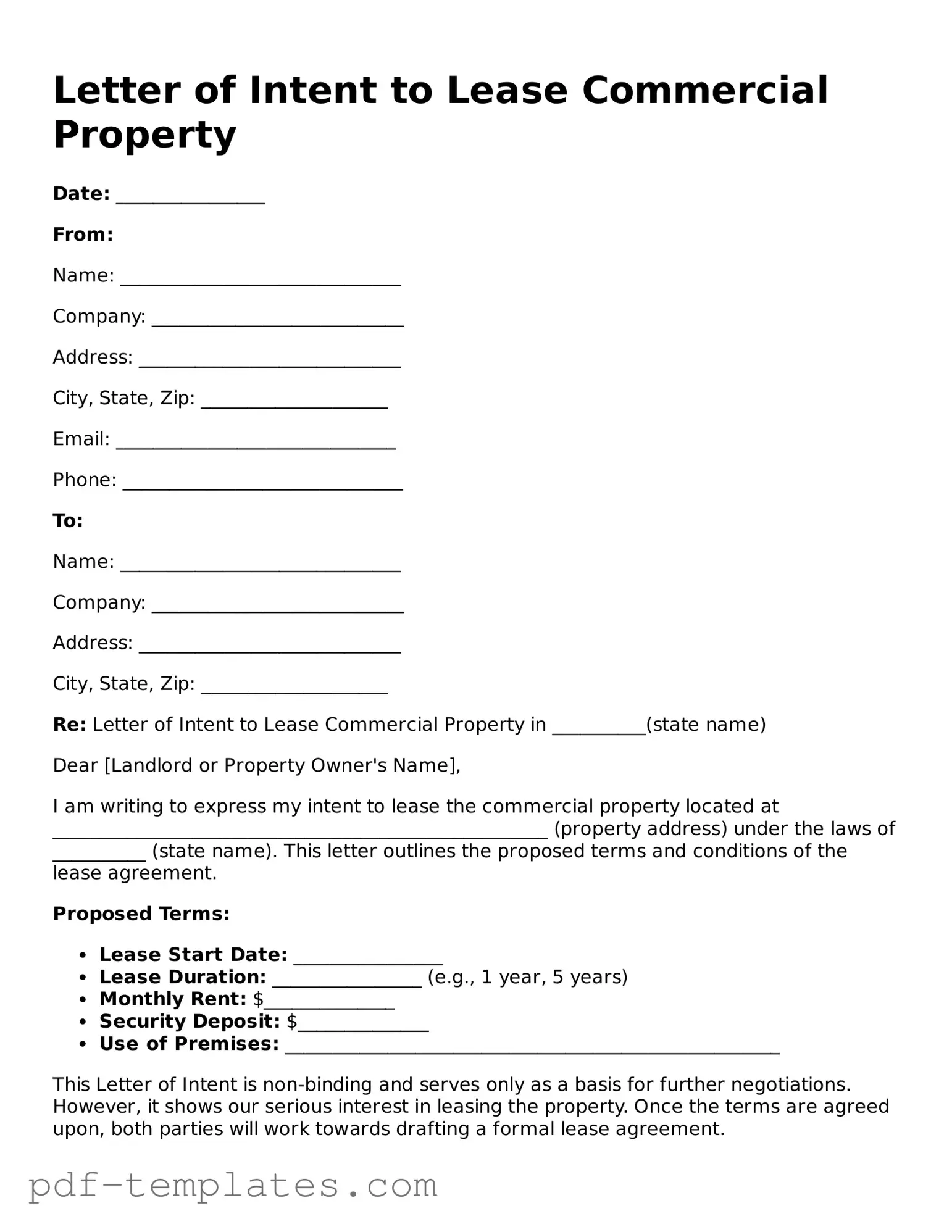

Letter of Intent to Lease Commercial Property: Usage Instruction

Once you have the Letter of Intent to Lease Commercial Property form in hand, you are ready to begin the process of filling it out. This form serves as a preliminary agreement between you and the property owner, outlining the key terms of the lease before finalizing any contracts. Follow the steps below to complete the form accurately.

- Begin by entering the date at the top of the form.

- Fill in your name and contact information, including your phone number and email address.

- Provide the name and contact details of the property owner or the representative you are negotiating with.

- Clearly specify the address of the commercial property you wish to lease.

- Indicate the intended use of the property, such as retail, office space, or warehouse.

- Outline the proposed lease term, including the start and end dates.

- State the proposed rental rate and any additional costs, such as utilities or maintenance fees.

- Include any special conditions or requests you may have regarding the lease.

- Sign and date the form to confirm your intent.

After completing the form, review it for accuracy and completeness. Once satisfied, you can submit it to the property owner or their representative to initiate discussions about the lease agreement.

Common mistakes

-

Missing Essential Details: Many people forget to include crucial information such as the property address, lease term, and rental rate. Each of these details is vital for clarity.

-

Vague Language: Using ambiguous terms can lead to misunderstandings. It's important to be specific about what is included in the lease, such as utilities or maintenance responsibilities.

-

Not Specifying the Purpose: Failing to outline the intended use of the property can create issues later. Clearly stating the purpose helps both parties understand the lease's context.

-

Ignoring Contingencies: Some people overlook the need for contingencies, like zoning approvals or financing. These can protect you if certain conditions aren’t met.

-

Overlooking the Security Deposit: It's common to forget to mention the amount and terms of the security deposit. This can lead to disputes down the line.

-

Not Considering Renewal Options: Many individuals fail to address renewal terms. Including this can provide flexibility and security for the future.

-

Neglecting to Include Signatures: A completed form without signatures is not valid. Ensure that all parties sign to confirm agreement.

-

Forgetting to Review Local Laws: Ignoring local regulations can lead to problems. Familiarize yourself with any legal requirements that may affect the lease.

-

Rushing the Process: Taking your time is essential. Rushing can lead to mistakes that might cost you later. Review your document thoroughly before submission.

-

Failing to Keep Copies: After submitting the form, not keeping a copy for your records can be a big mistake. Always retain a copy for future reference.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | A Letter of Intent (LOI) outlines the preliminary terms of a lease agreement for commercial property. |

| Non-Binding | The LOI is typically non-binding, meaning it does not legally obligate either party to finalize the lease. |

| Key Terms | Common terms included are rental rate, lease duration, and responsibilities for maintenance. |

| Negotiation Tool | The LOI serves as a negotiation tool to clarify intentions before drafting a formal lease. |

| State-Specific Forms | Some states may have specific requirements for LOIs; for example, California law may require certain disclosures. |

| Expiration Date | LOIs often include an expiration date, after which the terms may no longer be valid. |

| Confidentiality Clause | Many LOIs include a confidentiality clause to protect sensitive information during negotiations. |

Dos and Don'ts

When filling out the Letter of Intent to Lease Commercial Property form, it's important to be careful and precise. Here are some guidelines to follow:

- Do read the entire form before starting to fill it out.

- Do provide accurate information about yourself and your business.

- Do specify the desired lease terms clearly, including duration and rental rate.

- Do include any special requirements you may have for the property.

- Do sign and date the form where required.

- Don't leave any sections blank unless instructed to do so.

- Don't use vague language; be as specific as possible.

- Don't forget to proofread for spelling and grammar errors.

- Don't submit the form without a clear understanding of the terms.

- Don't rush through the process; take your time to ensure accuracy.

Similar forms

The Letter of Intent (LOI) to Lease Commercial Property is a preliminary document that outlines the basic terms of a lease agreement before a formal contract is drafted. It serves as a foundation for negotiations, similar to a Memorandum of Understanding (MOU). An MOU is often used in various business contexts to outline mutual agreements between parties. Like the LOI, an MOU is non-binding and focuses on the key points of the agreement, allowing both parties to clarify their intentions without committing to legal obligations just yet.

Another document that shares similarities with the LOI is the Term Sheet. A Term Sheet is a concise document that lays out the key terms and conditions of a business agreement. In the context of leasing, it highlights important aspects such as rent, duration, and responsibilities of each party. Both the Term Sheet and the LOI facilitate discussions and negotiations, ensuring that everyone is on the same page before drafting a more detailed contract.

When preparing for potential investment opportunities, it is essential to understand the benefits of an Investment Letter of Intent document. This form sets the groundwork for negotiations and helps streamline the process of investment integration.

The Letter of Intent also resembles a Purchase Agreement in real estate transactions. While a Purchase Agreement is a legally binding contract that outlines the terms of a property sale, the LOI serves as a preliminary step in the leasing process. Both documents aim to clarify the expectations of the involved parties, but the Purchase Agreement is more formal and detailed, reflecting a commitment to proceed with the transaction.

Another related document is the Non-Disclosure Agreement (NDA). While an NDA focuses on confidentiality, it can accompany an LOI when sensitive information is shared during negotiations. Both documents help establish trust and protect the interests of the parties involved, allowing them to discuss terms freely without fear of information leakage.

In the realm of real estate, a Lease Proposal is another document akin to the LOI. A Lease Proposal includes specific terms that a landlord offers to a prospective tenant, much like an LOI presents the tenant's intentions to lease a property. Both documents initiate discussions and help both parties understand the basic terms before moving forward with a formal lease agreement.

The LOI is also similar to a Letter of Interest, which is often used in various business sectors to express a party's interest in pursuing a deal. Like the LOI, a Letter of Interest outlines key terms and intentions, serving as a preliminary communication that can lead to further negotiations and a more formal agreement.

Lastly, a Business Plan can be compared to the LOI in the sense that both documents outline intentions and objectives. A Business Plan details the strategic approach to achieving business goals, while the LOI specifies the intent to lease a property. Both documents are essential in guiding discussions and ensuring that all parties understand the vision and direction of the proposed arrangement.

Additional Types of Letter of Intent to Lease Commercial Property Templates:

How to Create a Letter of Intent - Make it easy for funders to understand your vision.

Completing the necessary documentation is an essential step for parents wishing to homeschool, as it helps to formalize their educational choice. For those in Illinois, one such important document is the Homeschool Intent Letter, which signifies the parents' commitment to providing an alternative educational pathway for their children while meeting state requirements.

Letter of Intent Purchase Business - Acts as an essential first move in business acquisition discussions.