Lady Bird Deed Document

The Lady Bird Deed, also known as an enhanced life estate deed, serves as a valuable estate planning tool for property owners in the United States. This legal instrument allows individuals to transfer their property to designated beneficiaries while retaining the right to use and control the property during their lifetime. One of the significant advantages of the Lady Bird Deed is that it bypasses the probate process upon the owner's death, facilitating a smoother transition of property ownership. The form typically includes essential details such as the names of the current owner, the beneficiaries, and a clear description of the property involved. Additionally, the Lady Bird Deed can provide flexibility, as the original owner can revoke or modify the deed at any time before their passing. This feature ensures that individuals can adapt their estate plans as circumstances change. Overall, the Lady Bird Deed is an effective way to manage property transfer while preserving the owner's rights and simplifying the estate settlement process for heirs.

Misconceptions

The Lady Bird Deed, also known as an enhanced life estate deed, is a useful estate planning tool. However, several misconceptions surround it. Here are nine common misunderstandings:

-

It avoids probate completely.

While a Lady Bird Deed can help avoid probate for the property it covers, it does not eliminate probate for other assets that are not included in the deed.

-

It can only be used for residential properties.

This deed can be used for various types of real estate, including commercial properties, as long as the owner wishes to transfer ownership upon death.

-

It requires the consent of all beneficiaries.

The property owner can create a Lady Bird Deed without needing permission from beneficiaries. The owner retains control over the property during their lifetime.

-

It is only beneficial for elderly individuals.

While often used by seniors, anyone can benefit from a Lady Bird Deed as part of their estate planning strategy, regardless of age.

-

It is the same as a regular life estate deed.

A Lady Bird Deed allows the owner to sell, mortgage, or change the property without the beneficiaries' consent, unlike a regular life estate deed.

-

It automatically transfers all property upon death.

The deed only transfers the specific property listed in it. Other assets not mentioned in the deed will still go through probate.

-

It can be revoked only through a legal process.

A Lady Bird Deed can be revoked or changed at any time by the property owner, as long as they are mentally competent.

-

It is recognized in all states.

Not all states recognize Lady Bird Deeds. It is essential to check the laws in your specific state to see if this option is available.

-

It has no tax implications.

While there are potential tax benefits, such as avoiding capital gains taxes, it is important to consult a tax professional to understand the implications fully.

Understanding these misconceptions can help individuals make informed decisions about their estate planning options.

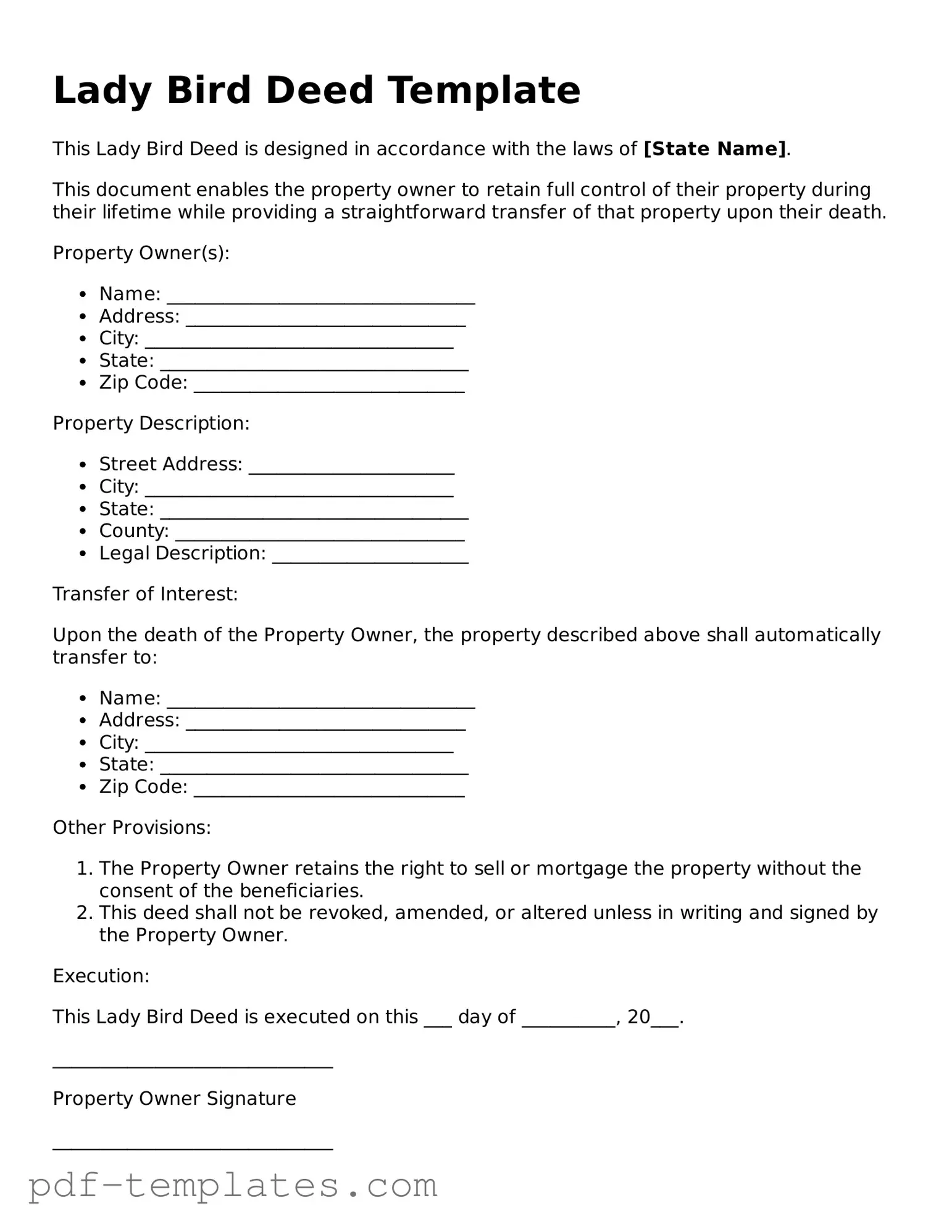

Lady Bird Deed: Usage Instruction

Filling out a Lady Bird Deed form requires careful attention to detail. This form facilitates the transfer of property while allowing the original owner to retain certain rights. Below are the steps to complete the form accurately.

- Begin by entering the full name of the property owner(s) in the designated section.

- Provide the address of the property being transferred, including the city, state, and ZIP code.

- Clearly describe the property. This may include details like lot number, subdivision name, or other identifying information.

- Identify the beneficiaries who will receive the property after the owner’s death. List their full names and relationships to the owner.

- Include any specific conditions or instructions regarding the transfer, if applicable.

- Sign and date the form in the presence of a notary public. Ensure that all signatures are legible.

- Make copies of the completed form for personal records and for each beneficiary.

- Finally, file the original form with the appropriate county clerk or recorder’s office to make the deed official.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to accurately describe the property being transferred. This includes not providing the correct legal description or using vague terms. A precise legal description is crucial for the deed to be valid.

-

Omitting Necessary Signatures: All required parties must sign the deed. People often overlook the necessity of having both the grantor and grantee sign the document. In some cases, witnesses or notarization may also be required, depending on state laws.

-

Not Understanding the Terms: Many individuals do not fully grasp the implications of a Lady Bird Deed. It is essential to understand that this type of deed allows the property owner to retain control of the property during their lifetime while designating beneficiaries for after their death.

-

Failure to Record the Deed: After completing the Lady Bird Deed, it is critical to file it with the appropriate county office. Neglecting to do so can lead to complications regarding the transfer of ownership and may result in legal disputes among heirs.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer real estate to a beneficiary while retaining control during their lifetime. |

| Governing Law | The Lady Bird Deed is primarily governed by state law, with specific regulations varying by state. States like Florida and Texas have established laws recognizing this type of deed. |

| Benefits | This deed helps avoid probate, allowing for a smoother transition of property ownership upon the owner's death. |

| Limitations | While beneficial, a Lady Bird Deed may not be recognized in all states, and it does not protect the property from creditors or Medicaid claims. |

Dos and Don'ts

When filling out the Lady Bird Deed form, it's crucial to follow specific guidelines to ensure accuracy and legality. Here’s a list of important dos and don'ts:

- Do verify that you understand the purpose of a Lady Bird Deed.

- Do ensure that you are the sole owner of the property or have the consent of co-owners.

- Do provide accurate and complete information about the property.

- Do include a clear description of the beneficiaries.

- Do consult with a legal professional if you have questions.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any fields blank unless they are marked as optional.

- Don't forget to sign and date the form where required.

- Don't overlook the need for notarization in some cases.

Completing the Lady Bird Deed form correctly is essential for ensuring your wishes are honored. Take these steps seriously to avoid complications down the line.

Similar forms

The Lady Bird Deed, also known as an enhanced life estate deed, shares similarities with a traditional life estate deed. Both documents allow a property owner to retain certain rights to their property during their lifetime. With a traditional life estate deed, the owner can live in and use the property, but they cannot sell or transfer it without the consent of the remainderman. In contrast, the Lady Bird Deed grants the owner the ability to sell or mortgage the property without needing permission, providing greater flexibility in managing the asset while still ensuring that the property passes to the designated beneficiaries upon the owner's death.

A quitclaim deed is another document that resembles the Lady Bird Deed in terms of property transfer. A quitclaim deed allows an individual to transfer their interest in a property to another person without making any guarantees about the title. While the Lady Bird Deed is more formal and retains the owner's rights during their lifetime, a quitclaim deed typically does not provide any life estate rights. Both documents facilitate the transfer of property, but the Lady Bird Deed offers more security and rights to the original owner.

When exploring various estate planning options, it is essential to understand the different tools available to ensure a smooth transition of assets. For those involved in financial transactions in California, utilizing the All California Forms can help secure the necessary legal protections and streamline the documentation process.

The warranty deed is another document that serves a different purpose but is related to property ownership. A warranty deed provides a guarantee that the property title is clear and free of any encumbrances. While the Lady Bird Deed focuses on retaining rights and transferring property upon death, a warranty deed assures the buyer of the property's title. Both documents are important in real estate transactions, but they serve distinct functions in protecting the interests of the parties involved.

Finally, a special warranty deed shares some characteristics with the Lady Bird Deed. A special warranty deed conveys property while guaranteeing that the seller has not encumbered the property during their ownership. However, it does not provide the same lifetime rights to the seller as the Lady Bird Deed does. The Lady Bird Deed allows the property owner to maintain control and use of the property until death, while the special warranty deed focuses on the seller's assurances about the property's title during the time they owned it.

Additional Types of Lady Bird Deed Templates:

Property Gift Deed Rules - It’s often used to facilitate intergenerational wealth transfer.

A Trailer Bill of Sale form is a legal document that facilitates the transfer of ownership of a trailer from one person to another. This form is essential for ensuring that both the seller and buyer have a clear record of the transaction. You can find a template for this important document at documentonline.org/blank-trailer-bill-of-sale. Filling out this document correctly can help prevent disputes and facilitate future transactions involving the trailer.

Sample Deed in Lieu of Foreclosure - The borrower relinquishes their rights to the property voluntarily.