Get IRS W-9 Form in PDF

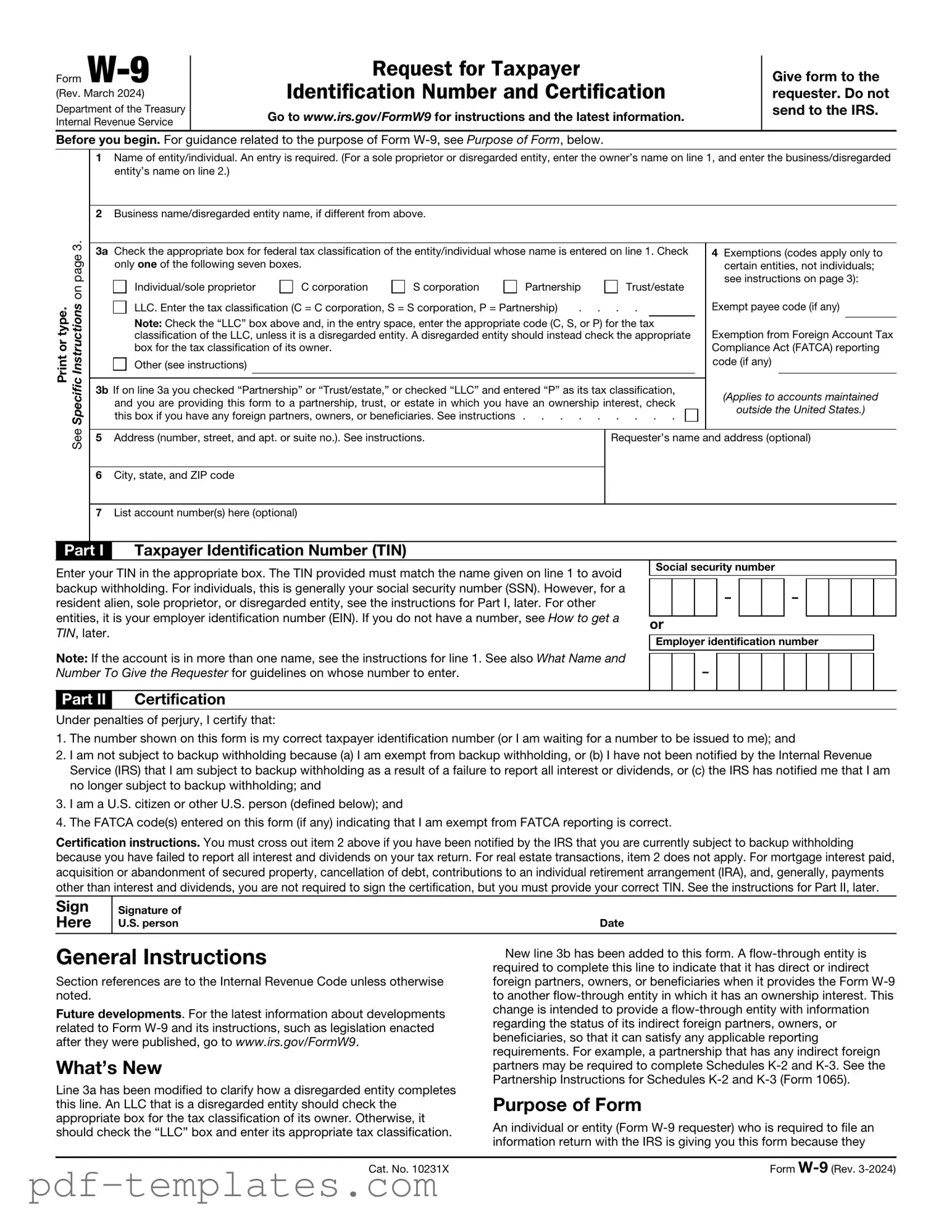

The IRS W-9 form is an essential document for anyone involved in the realm of freelance work or contract-based employment. This form serves as a request for taxpayer identification information, primarily used by businesses to obtain the necessary details from individuals or entities they pay. When you fill out a W-9, you provide your name, address, and Social Security number or Employer Identification Number, which helps ensure accurate tax reporting. Notably, the W-9 is not submitted directly to the IRS but is instead kept on file by the requester, who may use it to prepare tax documents like the 1099 form at the end of the year. Understanding the significance of this form is crucial, as it not only facilitates compliance with tax laws but also protects you from potential tax liabilities. Whether you are a freelancer, contractor, or a business owner, knowing how to properly complete and manage the W-9 form can save you from headaches down the line.

Misconceptions

The IRS W-9 form is a commonly used document, yet several misconceptions surround its purpose and use. Below is a list of ten common misunderstandings about the W-9 form, along with clarifications for each.

- The W-9 form is only for freelancers. Many believe that only independent contractors need to fill out a W-9. In reality, anyone who receives income that is subject to reporting must complete this form, including corporations and partnerships.

- Filling out a W-9 means I owe taxes. Completing a W-9 does not indicate that you owe taxes. It merely provides your taxpayer identification information to the entity that will report payments made to you to the IRS.

- The W-9 is only required for payments over a certain amount. There is no minimum threshold for requiring a W-9. If a business needs to report payments made to you, they will request a W-9 regardless of the total amount.

- Once I submit a W-9, I cannot change my information. You can submit a new W-9 at any time if your information changes, such as your name, address, or taxpayer identification number.

- The W-9 form is the same as the W-4 form. The W-9 and W-4 serve different purposes. The W-4 is used by employees to determine withholding for income tax, while the W-9 is used for reporting income paid to independent contractors and others.

- Only U.S. citizens need to fill out a W-9. While U.S. citizens do fill out the W-9, non-resident aliens and foreign entities may need to provide similar information using a different form, such as the W-8 series.

- Submitting a W-9 means I am an employee. Completing a W-9 does not classify you as an employee. It indicates that you are providing services as an independent contractor or receiving payments that require reporting.

- I can ignore requests for a W-9. Ignoring a request for a W-9 can lead to backup withholding on payments. It is important to provide the requested information to avoid complications.

- My information on the W-9 is confidential. While the W-9 contains sensitive information, it is not protected in the same way as some other documents. The entity receiving the W-9 is responsible for maintaining its confidentiality.

- The W-9 form is only for U.S. tax purposes. The W-9 is primarily a U.S. tax form, but it may also be required for compliance with certain state tax regulations or other financial reporting requirements.

Understanding these misconceptions can help individuals navigate the requirements of the W-9 form more effectively. Clarity about its purpose can lead to better compliance and fewer issues with tax reporting.

IRS W-9: Usage Instruction

After you complete the IRS W-9 form, you will need to submit it to the requester who asked for it. This could be a business or individual that requires your taxpayer information for reporting purposes. Ensure that you provide accurate information to avoid any issues with tax reporting.

- Download the IRS W-9 form from the official IRS website or obtain a copy from the requester.

- Begin by entering your name in the first box. If you are filling out the form for a business, use the business name instead.

- If applicable, fill in your business name in the second box. This is only necessary if it differs from your personal name.

- In the next section, select the appropriate tax classification that applies to you. Options include individual, corporation, partnership, or other types of entities.

- Provide your address, including street, city, state, and ZIP code. Make sure this is the address where you receive your tax documents.

- Next, enter your taxpayer identification number (TIN). This can be your Social Security Number (SSN) or Employer Identification Number (EIN).

- If you are exempt from backup withholding, indicate this in the appropriate box. If not, you can leave it blank.

- Review the certification section. By signing, you confirm that the information you provided is accurate.

- Sign and date the form at the bottom. Ensure that the date is current.

- Finally, submit the completed form to the requester. Keep a copy for your records.

Common mistakes

-

Failing to provide the correct name. The name on the W-9 must match the name on your tax return.

-

Using the wrong taxpayer identification number (TIN). Ensure that you provide either your Social Security Number (SSN) or Employer Identification Number (EIN) accurately.

-

Not checking the appropriate box for your tax classification. This step is crucial to indicate whether you are an individual, corporation, partnership, etc.

-

Overlooking the signature and date. Your signature certifies that the information provided is accurate, and the date is necessary for processing.

-

Providing outdated information. Always ensure that your address and other details are current to avoid any issues with the IRS.

-

Not including any necessary additional documentation. Some payers may require extra information, so check their requirements.

-

Failing to use a black or blue pen. While it may seem minor, using the right ink color can help ensure your form is processed correctly.

-

Ignoring instructions specific to the requester. Each business may have unique requirements for how they want the W-9 completed.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS W-9 form is used to provide taxpayer identification information to a requester, typically for income reporting purposes. |

| Who Uses It | Individuals and businesses use the W-9 form, including freelancers, contractors, and vendors who receive payments. |

| Tax Identification Number | The form requires the taxpayer's Social Security Number (SSN) or Employer Identification Number (EIN) for identification. |

| Submission | The W-9 form is not submitted to the IRS. Instead, it is provided to the entity requesting the information. |

| State-Specific Forms | Some states may have their own versions of the W-9 form. For example, California requires the use of Form 590 for withholding purposes. |

| Updates | The IRS periodically updates the W-9 form. Users should ensure they are using the most current version available on the IRS website. |

Dos and Don'ts

When filling out the IRS W-9 form, it's important to follow certain guidelines. Here’s a list of things you should and shouldn’t do:

- Do provide your full legal name as it appears on your tax return.

- Do check the correct box for your tax classification (individual, corporation, etc.).

- Do include your Social Security Number (SSN) or Employer Identification Number (EIN).

- Do sign and date the form to certify that the information is accurate.

- Don’t leave any required fields blank; incomplete forms may be rejected.

- Don’t use a nickname or any name other than your legal name.

- Don’t forget to keep a copy of the completed form for your records.

Similar forms

The IRS W-4 form is often compared to the W-9 because both are used to gather information about individuals for tax purposes. While the W-9 is used by independent contractors and freelancers to provide their taxpayer identification number to clients, the W-4 is filled out by employees to inform their employer about how much federal income tax to withhold from their paychecks. Both forms help ensure that the correct amount of taxes is reported and paid, but they serve different roles in the employment and contractor landscape.

The 1099 form is another document closely related to the W-9. When a business pays an independent contractor $600 or more in a year, it must report that payment to the IRS using a 1099 form. To complete the 1099 accurately, the business relies on the information provided in the contractor's W-9. This connection highlights the importance of the W-9 in ensuring that all income is reported correctly for tax purposes.

The W-8 form is similar to the W-9 but is used by foreign individuals and entities. This form certifies that the individual or entity is not a U.S. taxpayer and provides the necessary information to avoid or reduce withholding tax on income received from U.S. sources. Like the W-9, the W-8 helps ensure compliance with tax regulations, but it applies to a different group of taxpayers.

The 4506-T form is used by taxpayers to request a transcript of their tax return from the IRS. While it does not directly collect taxpayer identification information like the W-9, it serves a similar purpose in that it helps individuals and businesses verify their tax information. This can be particularly useful when applying for loans or other financial assistance, where proof of income is required.

The SS-4 form is used to apply for an Employer Identification Number (EIN). While the W-9 collects information from individuals and sole proprietors, the SS-4 is geared toward businesses. Both forms gather essential information for tax reporting, but the SS-4 focuses on businesses and their tax identification needs, whereas the W-9 is more individual-centric.

The 1040 form is the standard individual income tax return form used by U.S. taxpayers. Although it is used for reporting income and calculating taxes owed, it is similar to the W-9 in that it requires accurate taxpayer identification information. The W-9 provides the necessary details that may later be reported on the 1040, especially for those who are self-employed or have income from various sources.

The 1095-A form, which provides information about health insurance coverage, is another document that shares similarities with the W-9. Both forms require personal information and are essential for compliance with tax laws. The 1095-A helps individuals report their health insurance coverage when filing their taxes, while the W-9 ensures that income is reported accurately. Each form plays a role in maintaining accurate records for the IRS.

Other PDF Forms

Da 31 Leave Form - This form ensures that leave requests are properly documented and authorized.

Family Law Financial Affidavit Short Form Florida - The financial affidavit helps establish a baseline for potential alimony or child support calculations.

Parent Permission Form - This consent underscores the importance of parental involvement in children's activities.