Get IRS Schedule C 1040 Form in PDF

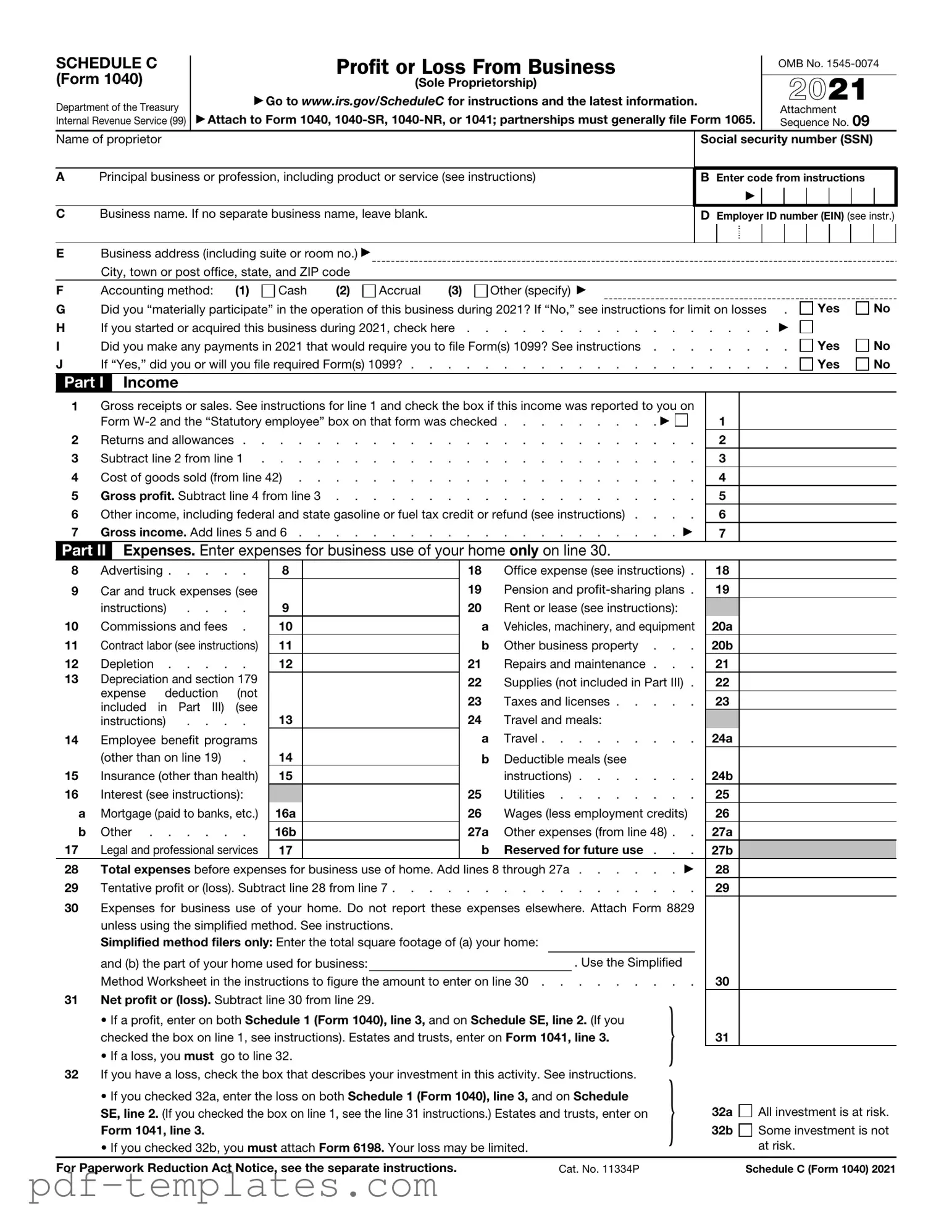

The IRS Schedule C 1040 form is a vital document for self-employed individuals and small business owners in the United States. It serves as a detailed report of income and expenses, allowing taxpayers to calculate their net profit or loss from their business activities. This form is essential for determining how much tax you owe and helps ensure compliance with federal tax regulations. Key sections of the Schedule C include reporting your business income, listing allowable deductions, and providing information about your business structure. Additionally, the form requires you to specify your principal business activity and may ask for details on vehicle use, home office expenses, and other pertinent information. Completing Schedule C accurately can significantly impact your tax obligations and financial health, making it crucial for anyone running a business to understand its components and requirements.

Misconceptions

Understanding the IRS Schedule C form can be challenging. Many people hold misconceptions about this important document. Here are ten common misunderstandings, along with clarifications to help you navigate your tax responsibilities more effectively.

- Only self-employed individuals need to file Schedule C. Many believe that only sole proprietors or freelancers must use this form. However, anyone running a business, including LLCs and partnerships, may need to file Schedule C to report income and expenses.

- Filing Schedule C guarantees a tax audit. While filing this form may attract attention, it does not automatically trigger an audit. Audits are based on various factors, and many Schedule C filers do not face audits.

- All expenses can be deducted. Not every expense related to your business is deductible. Personal expenses, or those not directly tied to your business operations, cannot be claimed on Schedule C.

- You can only report income received in cash. Income must be reported regardless of how it was received. This includes cash, checks, and even bartering transactions.

- Schedule C is only for businesses that make a profit. Even if your business operates at a loss, you still need to file Schedule C to report income and expenses accurately.

- Once filed, you cannot amend Schedule C. If you discover an error or need to make changes, you can file an amended return to correct the information on Schedule C.

- All business income is subject to self-employment tax. While most income reported on Schedule C is subject to self-employment tax, there are exceptions, such as certain rental income.

- Only expenses incurred directly in the business can be deducted. While direct expenses are deductible, some indirect expenses, like home office costs, can also be claimed if they meet certain criteria.

- Record-keeping is optional. It is crucial to maintain accurate records of income and expenses. Good record-keeping supports your claims and can be vital in case of an audit.

- You must file Schedule C by the tax deadline. While it is recommended to file on time, if you need more time, you can request an extension. However, any taxes owed must still be paid by the original deadline to avoid penalties.

By addressing these misconceptions, you can better prepare for filing your taxes and ensure compliance with IRS regulations. Always consider consulting a tax professional for personalized advice tailored to your specific situation.

IRS Schedule C 1040: Usage Instruction

Filling out the IRS Schedule C (Form 1040) is an important task for individuals who are self-employed or operate a business as a sole proprietor. This form allows you to report income and expenses associated with your business. Following the steps outlined below will help ensure that you accurately complete the form and provide the necessary information to the IRS.

- Gather all relevant financial documents, including income statements, expense receipts, and any other records related to your business activities.

- Begin by entering your name and Social Security number at the top of the form. If you have a business name, include it in the designated area.

- Fill out the section for your business address, including the city, state, and ZIP code.

- Indicate the type of business you operate by selecting the appropriate category from the list provided on the form.

- Report your gross receipts or sales. This is the total income earned from your business before any deductions.

- List your business expenses in the designated section. Common categories include advertising, car and truck expenses, and office supplies. Be sure to include only the expenses that are directly related to your business operations.

- Calculate your net profit or loss by subtracting total expenses from gross receipts. This figure is crucial, as it will affect your overall tax liability.

- Complete the additional sections as required, including any other necessary information about your business activities.

- Review the entire form for accuracy. Ensure that all figures are correct and that you have included all necessary documentation.

- Sign and date the form before submitting it to the IRS along with your tax return.

By carefully following these steps, you will be well-prepared to submit your Schedule C form. It is essential to take your time and ensure that all information is accurate, as this will help you avoid potential issues with the IRS in the future.

Common mistakes

-

Incorrect Business Name: Many individuals fail to provide the exact legal name of their business. This can lead to confusion and potential issues with the IRS.

-

Neglecting to Report All Income: Some people forget to include all sources of income. Every dollar counts, and overlooking even small amounts can create discrepancies.

-

Inaccurate Expense Reporting: Common mistakes include misclassifying expenses or failing to report all deductible expenses. Keeping detailed records can help avoid this issue.

-

Missing Signature: Forgetting to sign the form is a simple yet critical error. A missing signature can delay processing and lead to penalties.

-

Using the Wrong Tax Year: Some individuals mistakenly fill out the form for a different tax year. Always ensure you are using the correct version for the year you are filing.

-

Not Keeping Accurate Records: Failing to maintain organized records can lead to errors in reporting. It's essential to track income and expenses throughout the year.

-

Ignoring Self-Employment Tax: Some filers forget to account for self-employment tax. This can result in underreporting income and unexpected tax liabilities.

-

Inconsistent Information: Providing information that does not match other tax documents can raise red flags. Consistency is key to a smooth filing process.

-

Failing to Seek Help: Many people attempt to fill out the form without assistance, leading to mistakes. Consulting with a tax professional can provide clarity and reduce errors.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule C (Form 1040) is used by sole proprietors to report income or loss from their business. |

| Filing Requirement | Taxpayers must file Schedule C if they have net earnings from self-employment of $400 or more. |

| Deductible Expenses | Business expenses such as supplies, utilities, and travel costs can be deducted to reduce taxable income. |

| Net Profit or Loss | The form calculates the net profit or loss, which is then transferred to the taxpayer's Form 1040. |

| State-Specific Forms | Some states require additional forms for business income reporting. For example, California requires Form 540 Schedule C, governed by California Revenue and Taxation Code. |

Dos and Don'ts

When filling out the IRS Schedule C (Form 1040), it’s important to pay attention to detail. Here’s a helpful list of things you should and shouldn’t do to ensure your form is filled out correctly.

- Do keep accurate records of all your income and expenses throughout the year.

- Do report all income, even if it’s not documented on a 1099 form.

- Do categorize your expenses properly to avoid confusion during tax time.

- Do take advantage of deductions available to self-employed individuals, such as home office expenses.

- Don’t forget to sign and date your form before submitting it.

- Don’t mix personal and business expenses; keep them separate for clarity.

- Don’t ignore the importance of filing on time to avoid penalties.

- Don’t underestimate your tax liability; set aside enough funds to cover what you owe.

Following these tips can help simplify the process and ensure you’re on the right track with your Schedule C filing. Remember, being organized and informed is key to a smooth tax season!

Similar forms

The IRS Schedule C (Form 1040) is similar to the IRS Form 1065, which is used by partnerships to report income, deductions, and credits. Like Schedule C, Form 1065 provides a detailed breakdown of business income and expenses, allowing partners to understand their share of the partnership's financial activities. Both forms require a thorough accounting of income sources and allowable deductions, ensuring that all financial aspects are transparently reported. While Schedule C is tailored for sole proprietors, Form 1065 accommodates multiple partners, reflecting the collaborative nature of partnership businesses.

Understanding various tax forms is crucial for proper financial management, especially for those navigating income from diverse sources. Among these, the California Transfer-on-Death Deed form serves a significant purpose in estate planning; it enables property owners to simplify the transfer of their real estate to beneficiaries without going through probate. For those interested in broader documentation, thinking about tax forms in conjunction with estate planning documents can streamline the process. For more resources, check out All California Forms.

Another document akin to Schedule C is the IRS Form 1120, which is utilized by corporations to report their income and expenses. Similar to Schedule C, Form 1120 outlines the financial performance of a business over a specific period. Both forms require detailed reporting of revenue and expenditures, ensuring compliance with tax obligations. However, while Schedule C focuses on individual business owners, Form 1120 is designed for corporate entities, emphasizing the different structures and tax treatments applicable to each type of business.

The IRS Schedule C also shares similarities with the IRS Form 1040, specifically the main individual income tax return. While Schedule C is an attachment to Form 1040, it plays a crucial role in reporting self-employment income. Both documents work together to provide a comprehensive view of an individual’s financial situation, including wages, salaries, and business profits. The integration of Schedule C into Form 1040 allows taxpayers to combine their personal and business income into a single filing, simplifying the tax process for self-employed individuals.

Finally, the IRS Schedule E (Form 1040) is another document that resembles Schedule C in its purpose of reporting income and expenses. Schedule E is specifically designed for reporting supplemental income, such as rental income or income from partnerships and S corporations. Both forms require a detailed accounting of income sources and expenses, emphasizing the importance of accurate record-keeping. However, while Schedule C focuses on income derived from self-employment, Schedule E addresses passive income streams, highlighting the diverse nature of income sources that individuals may encounter.

Other PDF Forms

I134 - This form can be crucial for visa categories such as visitor visas and student visas.

To ensure your business is properly set up, consider utilizing a customizable Commercial Lease Agreement template that outlines the essential elements for your rental situation. For more information, you can access the full details through this informative Commercial Lease Agreement guide.

Guardianship Paperwork - Clear and honest answers on the form can facilitate a quicker resolution.