Get IRS 941 Form in PDF

The IRS 941 form is a crucial document for employers in the United States, serving as a quarterly report that details payroll taxes withheld from employees' paychecks. This form is essential for reporting income taxes, Social Security, and Medicare taxes, which employers must withhold and pay to the federal government. Each quarter, businesses must accurately complete and file this form to ensure compliance with tax laws and avoid penalties. The 941 form not only helps the IRS track tax liabilities but also allows employers to reconcile their payroll tax obligations. Understanding the various sections of the form, including employee wages, tax deductions, and adjustments, is vital for maintaining accurate records. Timely submission of the IRS 941 form is necessary to meet deadlines and keep your business in good standing with the IRS. Whether you are a small business owner or part of a larger organization, familiarity with this form can help streamline your payroll processes and ensure that you meet your tax responsibilities effectively.

Misconceptions

The IRS Form 941 is a crucial document for employers in the United States, used to report payroll taxes. However, there are several misconceptions surrounding this form. Here are seven common misunderstandings:

-

Form 941 is only for large businesses.

This is not true. Any employer who pays wages to employees must file Form 941, regardless of the size of the business. Small businesses are equally required to report their payroll taxes.

-

Form 941 is filed only once a year.

In reality, Form 941 is filed quarterly. Employers must submit it four times a year to report the wages paid and the taxes withheld from employees’ paychecks.

-

Only full-time employees' wages need to be reported.

This misconception overlooks part-time employees. All wages paid to employees, whether full-time or part-time, must be reported on Form 941.

-

Employers can ignore Form 941 if they have no payroll taxes to report.

Even if no payroll taxes are due for a quarter, employers are still required to file Form 941. A zero return must be submitted to avoid penalties.

-

Filing Form 941 is optional.

This is incorrect. Filing Form 941 is mandatory for employers who meet the criteria. Failure to file can result in penalties and interest on unpaid taxes.

-

Form 941 is the same as Form 944.

These forms serve different purposes. Form 944 is designed for smaller employers with lower payroll tax liabilities, allowing them to file annually instead of quarterly.

-

Once filed, Form 941 cannot be amended.

This is a misconception. If an error is found after filing, employers can amend Form 941 using Form 941-X to correct any mistakes.

Understanding these misconceptions can help employers stay compliant and avoid unnecessary penalties. It's essential to accurately report payroll taxes and stay informed about the requirements surrounding Form 941.

IRS 941: Usage Instruction

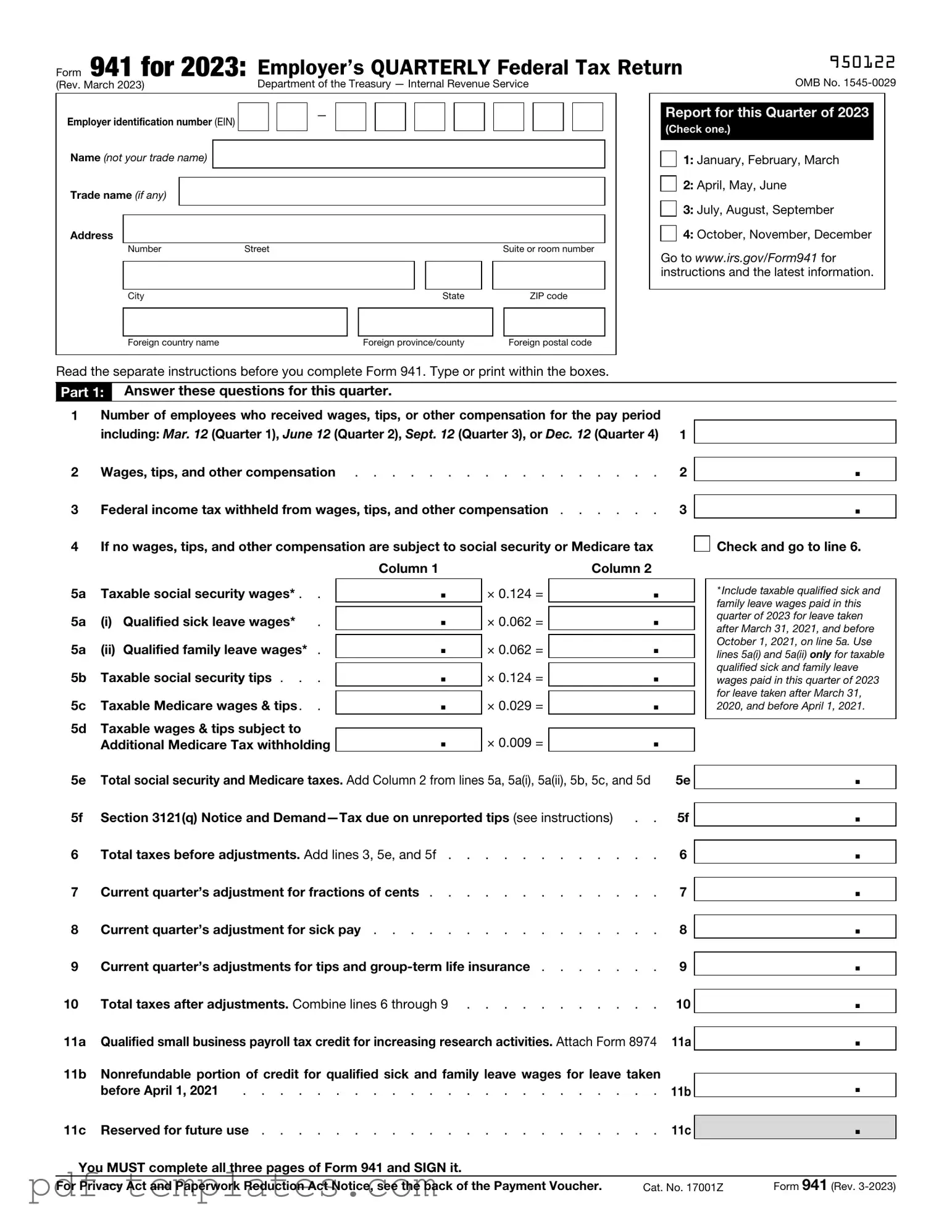

Completing the IRS 941 form is an important step for employers to report payroll taxes withheld from employee paychecks. After filling out the form, you will need to submit it to the IRS by the deadline to ensure compliance and avoid penalties. Here’s a straightforward guide to help you navigate the process of filling out the form.

- Gather necessary information: Collect your business name, address, Employer Identification Number (EIN), and the total number of employees.

- Identify the quarter: Determine which quarter you are reporting for (e.g., January to March, April to June, July to September, October to December).

- Complete Part 1: Fill in the number of employees, total wages, tips, and other compensation, as well as the total taxes withheld.

- Complete Part 2: If applicable, report any adjustments for fractions of cents, sick pay, or other adjustments.

- Fill out Part 3: If you had any employees who earned tips, report the total tips received here.

- Complete Part 4: This section is for reporting the total tax liability for the quarter and any payments made.

- Sign and date the form: Ensure that an authorized person signs the form and includes the date of signing.

- Submit the form: Mail the completed form to the appropriate IRS address or file electronically if preferred.

By following these steps, you can ensure that your IRS 941 form is filled out accurately and submitted on time. This helps maintain good standing with the IRS and keeps your business compliant with tax obligations.

Common mistakes

-

Incorrect Employer Identification Number (EIN): Many individuals mistakenly enter the wrong EIN. This number is crucial for identifying the employer. A simple typo can lead to significant delays or issues with processing.

-

Misreporting Wages: Some filers fail to accurately report total wages paid. This can happen if they overlook certain payments or miscalculate figures. Such errors can affect tax liabilities and compliance.

-

Inaccurate Calculation of Tax Liability: Errors in calculating the amount of taxes owed can occur, particularly when applying the correct rates for Social Security and Medicare. This mistake can lead to underpayment or overpayment of taxes.

-

Failure to Sign and Date the Form: A common oversight is neglecting to sign and date the form. Without a signature, the IRS may consider the submission incomplete, resulting in potential penalties.

-

Not Filing on Time: Some individuals miss the deadline for filing the IRS 941 form. Late submissions can incur penalties and interest, making timely filing essential for compliance.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 941 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee's paychecks. |

| Filing Frequency | This form is typically filed quarterly, meaning employers must submit it four times a year. |

| Due Dates | Form 941 is due on the last day of the month following the end of each quarter: April 30, July 31, October 31, and January 31. |

| Who Must File | Any business that pays wages to employees must file Form 941, regardless of the size of the business. |

| Penalties for Late Filing | Failure to file Form 941 on time can result in penalties, which may include fines and interest on unpaid taxes. |

| State-Specific Forms | Some states have their own forms for reporting employment taxes, such as California's DE 9, governed by California Revenue and Taxation Code. |

| Electronic Filing | Employers can file Form 941 electronically, which is often faster and may help reduce errors. |

| Recordkeeping Requirements | Employers must keep records of employment taxes, including wages, tips, and other compensation for at least four years. |

| Amending Form 941 | If an error is found after filing, employers can amend their Form 941 by filing Form 941-X. |

| Impact on Employees | Information reported on Form 941 affects employees' Social Security and Medicare benefits, as well as their tax returns. |

Dos and Don'ts

When filling out the IRS Form 941, it's essential to be careful and thorough. This form is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Here are some important do's and don'ts to keep in mind:

- Do double-check all employee information for accuracy.

- Do ensure that you are using the correct version of the form for the applicable quarter.

- Do calculate your tax liabilities accurately to avoid penalties.

- Do file the form on time to prevent late fees.

- Do keep a copy of the completed form for your records.

- Don't forget to sign and date the form before submitting it.

- Don't use pencil or any erasable ink; always use black or blue ink.

- Don't overlook any additional schedules that may be required for your business type.

- Don't assume previous entries are correct; verify all numbers each time you file.

- Don't ignore any notices from the IRS regarding discrepancies or issues with your form.

Similar forms

The IRS Form 940 is similar to Form 941 in that both are used by employers to report taxes related to employee wages. While Form 941 focuses on federal income tax withholding and Social Security and Medicare taxes on a quarterly basis, Form 940 is an annual report of the Federal Unemployment Tax Act (FUTA) tax. Employers must file Form 940 to report unemployment taxes, which help fund unemployment benefits for workers who lose their jobs. Both forms require accurate reporting of wages, but they serve different tax purposes.

Form W-2 is another document that shares similarities with Form 941. Both forms are related to employee wages and tax withholding. Form W-2 is issued annually to employees, summarizing their total earnings and the taxes withheld from their paychecks throughout the year. Employers use information from Form 941 to prepare Form W-2, ensuring that the amounts reported for federal income tax, Social Security, and Medicare match what was withheld from employees’ pay. Thus, both forms play a crucial role in the tax reporting process for employees.

Form 1099-MISC is also comparable to Form 941, as both documents are used for reporting payments made to individuals. While Form 941 reports wages paid to employees, Form 1099-MISC is typically used to report payments made to independent contractors or other non-employees. Employers must issue Form 1099-MISC when they pay $600 or more to a non-employee during the year. Both forms require accurate reporting of payments to ensure compliance with federal tax laws.

Form 944 is similar to Form 941 in that it is also used to report employment taxes, but it is designed for smaller employers. Employers who owe less than $1,000 in payroll taxes annually can file Form 944 instead of Form 941. This annual filing simplifies the reporting process for small businesses, allowing them to report their federal income tax withholding and Social Security and Medicare taxes just once a year, rather than quarterly.

Form 943 is another document that parallels Form 941. It is specifically for agricultural employers who need to report income tax withheld from their employees’ wages. Like Form 941, Form 943 is filed on a quarterly basis, but it focuses on the unique tax situations faced by those in the agricultural sector. Both forms require detailed reporting of employee wages and withholdings, but they cater to different types of employers.

Form 945 is used to report backup withholding and is similar to Form 941 in that it deals with tax withholding from payments. While Form 941 reports withholding for wages, Form 945 is used for reporting non-payroll payments, such as interest and dividends, where backup withholding is applicable. Employers must file Form 945 annually to report these withholdings, ensuring compliance with IRS regulations.

Form 1095-C is related to health care reporting and shares a connection with Form 941 in terms of employer responsibilities. Employers with 50 or more full-time employees must file Form 1095-C to report information about health coverage offered to employees. While Form 941 focuses on tax withholding, Form 1095-C is essential for compliance with the Affordable Care Act, ensuring that employees have access to health insurance.

Form 4868 is similar to Form 941 in that it involves the reporting of taxes owed, but it serves a different purpose. Form 4868 is an application for an automatic extension of time to file an individual income tax return. While Form 941 reports employment taxes, Form 4868 allows taxpayers to extend their filing deadline for their personal income taxes, providing a temporary reprieve from the filing requirement.

Form 1065 is used by partnerships to report income, deductions, and credits, making it similar to Form 941 in that both forms require detailed financial reporting. While Form 941 focuses on employment taxes, Form 1065 reports the financial performance of a partnership. Both forms are essential for compliance with IRS regulations, but they apply to different types of entities and tax situations.

For those navigating property transfers, it's important to understand various legal documents, including the California Quitclaim Deed form, which can be particularly useful for swiftly transferring property interests without title guarantees. For more information about this essential document, you can visit https://formcalifornia.com/.

Finally, Form 1120 is the corporate income tax return, which shares a connection with Form 941 in terms of tax reporting. Corporations must file Form 1120 to report their income, gains, losses, deductions, and credits. While Form 941 is concerned with payroll taxes for employees, Form 1120 focuses on the overall financial performance of a corporation. Both forms are critical for ensuring that businesses meet their tax obligations to the IRS.

Other PDF Forms

How to Gift a Car to a Family Member in Louisiana - The act of donation is recognized under Louisiana civil law.

To properly navigate the process of buying or selling a vessel in Florida, it is essential to utilize the Florida Boat Bill of Sale form, ensuring all necessary details are accurately captured. For additional resources and templates, refer to All Florida Forms to facilitate a smooth transaction and maintain compliance with state regulations.

Printable Youth Baseball Evaluation Form - Encouraging player growth is a fundamental aspect of using the assessment form.