Get IRS 2553 Form in PDF

The IRS 2553 form is a crucial document for small business owners who wish to elect S corporation status for their entity. This election allows corporations to pass corporate income, losses, deductions, and credits directly to their shareholders, which can lead to significant tax benefits. To qualify, businesses must meet specific criteria, including having no more than 100 shareholders and only one class of stock. The form must be filed within a certain timeframe, typically within two months and 15 days of the beginning of the tax year for which the election is to take effect. Completing the IRS 2553 requires providing essential information such as the corporation's name, address, and the names and addresses of all shareholders. It's important for business owners to understand the implications of this election, as it affects how income is taxed and how profits are distributed. Additionally, filing the form correctly is vital to ensure compliance with IRS regulations and to avoid potential penalties or issues down the line.

Misconceptions

The IRS Form 2553 is an important document for small business owners who wish to elect S corporation status. However, several misconceptions surround this form, which can lead to confusion and potential errors in filing. Below are seven common misconceptions about Form 2553, along with clarifications.

- Misconception 1: Only corporations can file Form 2553.

- Misconception 2: Filing Form 2553 is optional for all businesses.

- Misconception 3: There is no deadline for filing Form 2553.

- Misconception 4: All shareholders must be U.S. citizens or residents.

- Misconception 5: Form 2553 can be filed at any time during the year.

- Misconception 6: There are no restrictions on the number of shareholders.

- Misconception 7: Filing Form 2553 guarantees S corporation status.

In reality, both corporations and limited liability companies (LLCs) can file Form 2553 to elect S corporation status. This option allows them to benefit from pass-through taxation.

While filing Form 2553 is optional, businesses that want to be taxed as an S corporation must file this form. Without it, they will be taxed as a default C corporation.

There is a specific deadline for filing Form 2553. Generally, it must be submitted within 75 days of the beginning of the tax year for which the election is to take effect.

This is true. An S corporation can only have shareholders who are U.S. citizens or residents. Non-resident aliens cannot hold shares in an S corporation.

Form 2553 must be filed during a specific timeframe to be effective for the current tax year. Late filings may result in the election being effective only for the next tax year.

In fact, S corporations are limited to 100 shareholders. This restriction is a crucial factor for businesses considering this election.

While filing the form is necessary, it does not guarantee approval. The IRS reviews the application, and any failure to meet the eligibility criteria can result in denial of S corporation status.

IRS 2553: Usage Instruction

After obtaining the IRS Form 2553, the next steps involve carefully completing the form to ensure it is accurate and submitted on time. This process is essential for electing S corporation status for your business. Follow the steps outlined below to fill out the form correctly.

- Download the IRS Form 2553 from the official IRS website or obtain a physical copy.

- Enter the name of your corporation in the designated field at the top of the form.

- Provide the corporation’s address, including the city, state, and ZIP code.

- Fill in the Employer Identification Number (EIN) if you have one. If not, leave this section blank.

- Indicate the date of incorporation and the state in which your corporation was formed.

- Specify the tax year for which the S corporation election is being made.

- Complete the section regarding the shareholders. List the names, addresses, and percentage of stock owned by each shareholder.

- Sign and date the form at the bottom. Ensure that an authorized officer of the corporation signs the form.

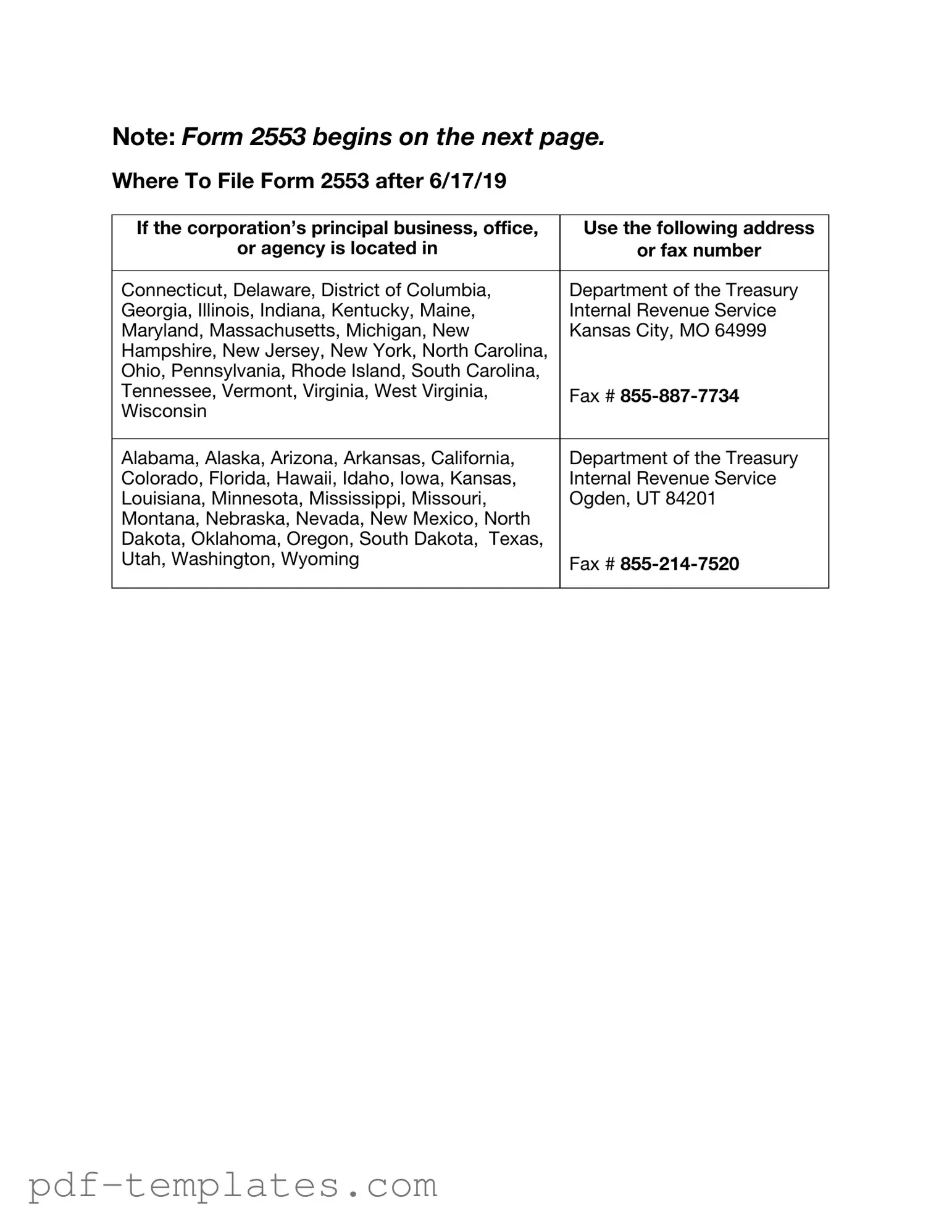

- Submit the completed form to the appropriate IRS address, which can be found in the instructions accompanying the form.

Ensure that the form is filed within the required timeframe to avoid any issues with your S corporation election. Double-check all information for accuracy before submission.

Common mistakes

-

Missing Signatures: Failing to sign the form can lead to delays or rejection. Both the business owner and all shareholders must sign.

-

Incorrect Tax Year: Selecting the wrong tax year can cause complications. Ensure the tax year matches the business's fiscal year.

-

Late Filing: Submitting the form after the deadline can result in losing S corporation status. File within the appropriate timeframe.

-

Incorrect Entity Type: Ensure your business qualifies as an eligible entity. Filing for an ineligible entity can lead to issues.

-

Not Including All Shareholders: All shareholders must be listed on the form. Omitting any can invalidate the election.

-

Missing or Incorrect EIN: An Employer Identification Number is essential. Double-check that the EIN is correct and included.

-

Failure to Provide Required Information: Incomplete forms can lead to rejection. Ensure all sections are filled out accurately.

-

Incorrect Shareholder Information: Verify that names, addresses, and ownership percentages are accurate. Errors can cause complications.

-

Not Following Submission Instructions: Adhere to the IRS submission guidelines. Missteps in the submission process can result in delays.

-

Ignoring State Requirements: Some states have additional requirements for S corporation status. Check local laws to ensure compliance.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 2553 is used by small businesses to elect to be taxed as an S corporation. |

| Eligibility | To qualify, a business must meet certain criteria, including having no more than 100 shareholders and only one class of stock. |

| Filing Deadline | The form must be filed within 75 days of the beginning of the tax year for which the election is to take effect. |

| State Requirements | Some states require their own forms to recognize the S corporation status, governed by state-specific laws such as California Revenue and Taxation Code Section 23802. |

Dos and Don'ts

When filling out the IRS 2553 form, attention to detail is crucial. Here are nine essential dos and don'ts to guide you through the process.

- Do ensure that your business qualifies for S Corporation status.

- Do fill out the form completely and accurately to avoid delays.

- Do submit the form within the required timeframe, typically within 75 days of starting your business.

- Do provide all necessary signatures from shareholders.

- Do keep a copy of the submitted form for your records.

- Don't leave any sections blank; incomplete forms can lead to rejection.

- Don't forget to check the eligibility criteria before filing.

- Don't submit the form without consulting a tax professional if you have questions.

- Don't assume that electronic submission is available; verify the submission method.

Similar forms

The IRS Form 8832, also known as the Entity Classification Election, is similar to Form 2553 in that it allows businesses to choose how they want to be classified for federal tax purposes. While Form 2553 is specifically for S corporations, Form 8832 can be used by various types of entities, including limited liability companies (LLCs) and partnerships. Both forms require timely submission to ensure the desired classification is effective for the tax year in question, emphasizing the importance of understanding the implications of the chosen classification.

Form 1065, the U.S. Return of Partnership Income, shares similarities with Form 2553 in that both are used by entities that can elect to be taxed differently. While Form 2553 is for S corporations, Form 1065 is specifically for partnerships. Each form requires detailed information about the entity's income, deductions, and other financial details. The completion of these forms is crucial for compliance with tax regulations, and both forms must be filed annually to report the entity's financial activities.

Form 1120, the U.S. Corporation Income Tax Return, is another document that has similarities with Form 2553. Both forms are utilized by corporations for tax reporting purposes. While Form 2553 is used to elect S corporation status, Form 1120 is filed by C corporations to report their income, gains, losses, and deductions. Understanding the differences between these forms is essential for business owners as they navigate their tax obligations and make informed decisions about their entity structure.

The IRS Form 941, Employer's Quarterly Federal Tax Return, is related to Form 2553 in that both forms involve reporting tax-related information for businesses. While Form 2553 is focused on the election of S corporation status, Form 941 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Timely filing of Form 941 is critical for compliance and to avoid penalties, making it essential for S corporations to be aware of their obligations under both forms.

Form 1120-S, the U.S. Income Tax Return for an S Corporation, directly relates to Form 2553 since it is the form that S corporations must file once they have elected S corporation status through Form 2553. This form provides a way for S corporations to report their income, deductions, and credits, and it is essential for ensuring that the tax benefits of S corporation status are realized. The timely filing of Form 1120-S is crucial for maintaining compliance with IRS regulations.

Form 1065-B, the U.S. Return of Income for Electing Large Partnerships, is another document that shares similarities with Form 2553. Both forms cater to specific types of business entities that wish to elect a particular tax treatment. While Form 2553 is for S corporations, Form 1065-B is designed for large partnerships that have made an election to be treated as a partnership for tax purposes. Understanding the nuances of these forms is important for businesses to ensure they are meeting their tax obligations appropriately.

Form 8868, Application for Extension of Time to File an Exempt Organization Return, can be seen as related to Form 2553 in that both involve the timely submission of forms to the IRS. While Form 2553 is for electing S corporation status, Form 8868 allows organizations to request an extension for filing their annual returns. This form is critical for ensuring that organizations do not face penalties for late filing, emphasizing the importance of staying on top of tax deadlines.

Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, is another document that, while different in purpose, can be linked to Form 2553 in terms of compliance and reporting requirements. Both forms require detailed information about the entity's financial status and ownership structure. For U.S. shareholders of foreign corporations, filing Form 5471 is essential to avoid significant penalties, much like the timely filing of Form 2553 is crucial for maintaining S corporation status.

Lastly, Form 990, Return of Organization Exempt From Income Tax, while primarily for tax-exempt organizations, shares the commonality of being a required IRS form that must be filed by certain entities. Similar to Form 2553, which is focused on S corporations, Form 990 requires comprehensive financial reporting and compliance with IRS regulations. Organizations must be diligent in their filing to maintain their tax-exempt status, highlighting the need for thorough understanding and adherence to IRS requirements.

Other PDF Forms

Form Dr-835 - Required for anyone looking to have someone else file or amend tax returns.

Guardianship Paperwork - Such requests for temporary custody should be handled with care and compassion.

Proof of Pregnancy Form Planned Parenthood - The collection of demographic data supports the clinic’s service adaptation to community needs.