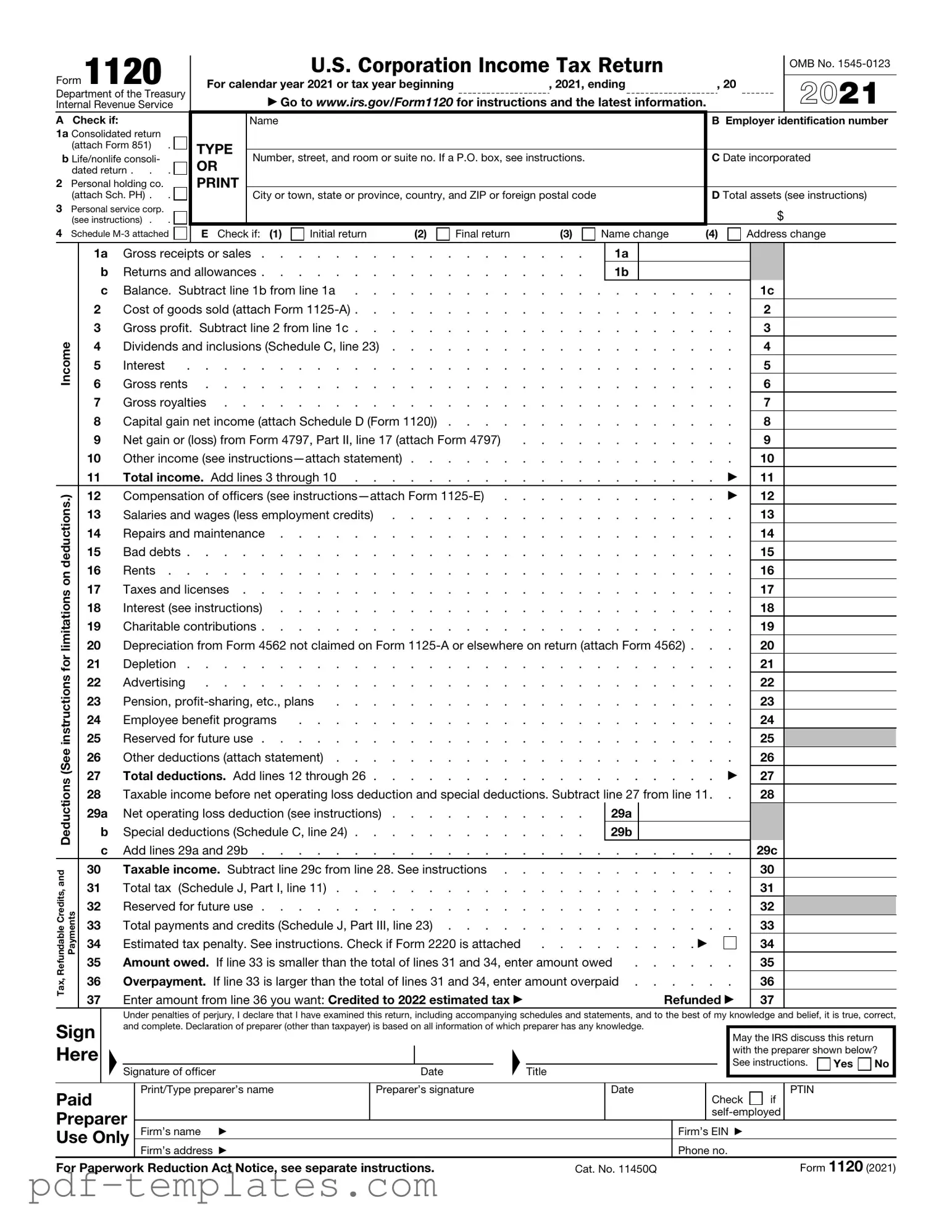

Get IRS 1120 Form in PDF

The IRS 1120 form is an essential document for corporations operating in the United States, serving as the primary means for reporting income, gains, losses, deductions, and credits to the Internal Revenue Service. Corporations must file this form annually, detailing their financial performance and tax obligations. It includes sections for reporting various types of income, such as sales revenue and investment income, as well as allowable deductions like operating expenses and employee salaries. Additionally, the form provides a space for calculating the corporation's tax liability, which is based on the net income reported. Understanding the intricacies of the 1120 form is crucial for compliance and can help businesses maximize their deductions and credits. Filing this form accurately ensures that corporations meet their legal obligations while minimizing potential penalties or interest charges. For many, navigating the 1120 form can seem daunting, but with careful attention to detail, it can be managed effectively.

Misconceptions

The IRS Form 1120 is a crucial document for corporations in the United States, but several misconceptions surround its purpose and requirements. Understanding these misconceptions can help ensure compliance and accurate reporting.

- All corporations must file Form 1120. Not all corporations are required to file this form. Only C corporations, which are taxed separately from their owners, must submit Form 1120. S corporations, on the other hand, file Form 1120S.

- Filing Form 1120 guarantees a refund. Filing this form does not guarantee a tax refund. Refunds depend on various factors, including the corporation's income, deductions, and credits.

- Only profitable corporations need to file. Even if a corporation operates at a loss, it must still file Form 1120. Reporting losses can be beneficial for future tax years.

- Form 1120 is only for large corporations. This form is used by corporations of all sizes. Small businesses that are structured as C corporations also need to file it.

- Filing late results in automatic penalties. While there can be penalties for late filing, the IRS may offer relief in certain situations. It is essential to communicate with the IRS if a corporation cannot meet the deadline.

- Form 1120 is the same as personal tax returns. Form 1120 is specifically designed for corporations and differs significantly from personal tax returns. Each type of tax return has unique requirements and structures.

- All income must be reported on Form 1120. While most income must be reported, there are specific exclusions and deductions that may apply. Understanding what qualifies as taxable income is important.

- Filing Form 1120 is the only requirement for corporations. Corporations may have additional obligations, such as state filings and other federal forms. Compliance extends beyond just filing Form 1120.

IRS 1120: Usage Instruction

Completing the IRS 1120 form is an important step for corporations filing their federal income tax return. This process requires careful attention to detail to ensure accuracy. Follow the steps below to fill out the form correctly.

- Begin by gathering all necessary financial documents, including income statements, balance sheets, and any previous tax returns.

- Download the IRS 1120 form from the official IRS website or obtain a physical copy.

- At the top of the form, enter your corporation's name, address, and Employer Identification Number (EIN).

- Indicate the date of incorporation and the total assets of your corporation at the end of the tax year.

- In the income section, report all sources of income, including sales and other revenue. Make sure to total these amounts accurately.

- Deduct any allowable expenses, such as cost of goods sold, salaries, and other business expenses in the appropriate section.

- Calculate your taxable income by subtracting total deductions from total income.

- Determine the tax liability based on the taxable income using the current corporate tax rate.

- Fill out any additional schedules required, such as Schedule C for dividends or Schedule J for tax computation.

- Review the completed form for accuracy. Ensure all figures are correct and that you have signed the form where indicated.

- Submit the form by mail or electronically, depending on your preference and eligibility.

After completing the form, it is essential to keep a copy for your records. Make sure to file it by the deadline to avoid any penalties. If you have questions or need assistance, consider consulting a tax professional.

Common mistakes

-

Incorrect Business Name: Many individuals forget to match the business name exactly as it appears on their legal documents. This can lead to confusion and delays.

-

Wrong Employer Identification Number (EIN): Entering an incorrect EIN is a common mistake. This number must be accurate to ensure proper identification of the business.

-

Neglecting to Sign the Form: Failing to sign the form is a simple oversight that can result in the IRS rejecting the submission. Always double-check for a signature!

-

Misreporting Income: Some filers miscalculate their total income, which can lead to significant issues. Ensure that all income sources are included and accurately reported.

-

Omitting Deductions: Many people overlook potential deductions. Familiarizing oneself with eligible deductions can save money and reduce tax liability.

-

Incorrect Tax Year: Using the wrong tax year can create complications. Always verify that the year on the form matches the period for which you are filing.

-

Not Using the Correct Version of the Form: The IRS updates forms regularly. Using an outdated version can lead to errors and possible penalties.

-

Failing to Include All Required Schedules: Some filers forget to attach necessary schedules, which can result in incomplete submissions. Review the requirements carefully.

-

Ignoring State Requirements: While the IRS form is crucial, state tax obligations also exist. Neglecting state requirements can lead to additional issues.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 1120 is used by corporations to report their income, gains, losses, deductions, and credits, as well as to calculate their federal income tax liability. |

| Filing Requirement | Corporations must file Form 1120 annually, regardless of whether they owe tax or not, if they are classified as C corporations for tax purposes. |

| Deadline | The deadline for filing Form 1120 is the 15th day of the fourth month following the end of the corporation's tax year, typically April 15 for calendar year filers. |

| State-Specific Forms | Many states have their own corporate tax forms. For example, California requires Form 100, governed by the California Revenue and Taxation Code. |

| Penalties | Failure to file Form 1120 on time may result in penalties. The IRS imposes a penalty of $210 for each month the return is late, up to a maximum of 12 months. |

Dos and Don'ts

When filling out the IRS 1120 form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are four things you should do and four things you should avoid:

Things You Should Do:

- Gather all necessary financial documents before starting the form.

- Double-check all entries for accuracy to avoid errors.

- Use the most current version of the form available on the IRS website.

- Consult a tax professional if you have questions or need assistance.

Things You Shouldn't Do:

- Do not leave any fields blank; provide all required information.

- Avoid using outdated forms or instructions.

- Do not ignore deadlines; file on time to avoid penalties.

- Refrain from making assumptions; always verify your understanding of tax laws.

Similar forms

The IRS Form 1065 is similar to Form 1120 in that it is used for reporting income, deductions, and profits, but it specifically caters to partnerships. While Form 1120 is filed by corporations, Form 1065 allows partnerships to report their earnings without being taxed at the entity level. Instead, the income is passed through to the individual partners, who then report it on their personal tax returns. This distinction is crucial for understanding how different business structures are taxed in the United States.

When dealing with property transfers in California, understanding legal documentation is crucial, and one important tool is the California Quitclaim Deed form, which allows for the transfer of interest in real estate between parties without warranties regarding the property's title. This document can expedite transfers, particularly in family situations or to rectify title issues. For those seeking to navigate various legal forms effectively, All California Forms can serve as an invaluable resource.

Form 1120-S is another document that bears similarities to the IRS Form 1120. It is specifically designed for S corporations, which are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Like Form 1120, Form 1120-S is used to report financial information to the IRS, but it features different tax implications, allowing S corporations to avoid double taxation on their income. This makes it an important form for small businesses that qualify for S corporation status.

The IRS Form 990 serves a different purpose but shares the goal of transparency in financial reporting. Nonprofit organizations use Form 990 to provide information about their mission, programs, and finances to the public and the IRS. While Form 1120 focuses on for-profit entities, Form 990 highlights the financial accountability of nonprofits, ensuring they operate within their charitable missions. Both forms aim to promote transparency, but they cater to distinct types of organizations.

Form 1040, the individual income tax return, is another document that shares some similarities with Form 1120. While Form 1120 is for corporations, Form 1040 is used by individuals to report their personal income and claim deductions. Both forms require detailed financial information and are essential for determining tax liabilities. The key difference lies in the entity type—one is for corporations and the other for individuals—but both play critical roles in the U.S. tax system.

Lastly, Form 941 is relevant for employers and also shares a connection with Form 1120 in terms of reporting. Form 941 is used to report employment taxes withheld from employee wages and the employer's share of social security and Medicare taxes. While Form 1120 focuses on corporate income, Form 941 is about payroll taxes. Both forms are integral to compliance with federal tax obligations, but they serve different aspects of a business's financial responsibilities.

Other PDF Forms

Balancing Cash Drawer - Simplifies cash counting with categorized entry options.

D1 Form Online - If you're applying for specific vehicle licences, consider the D2 form instead.

To successfully navigate the leasing process, you will need a reliable resource for completing a Commercial Lease Agreement form effectively. Our guide provides insights into the necessary steps and considerations, ensuring you are fully prepared to formalize your lease by accessing the appropriate Commercial Lease Agreement.

How to Write Daily Report - Clearly outline any irregularities or concerns during the shift.