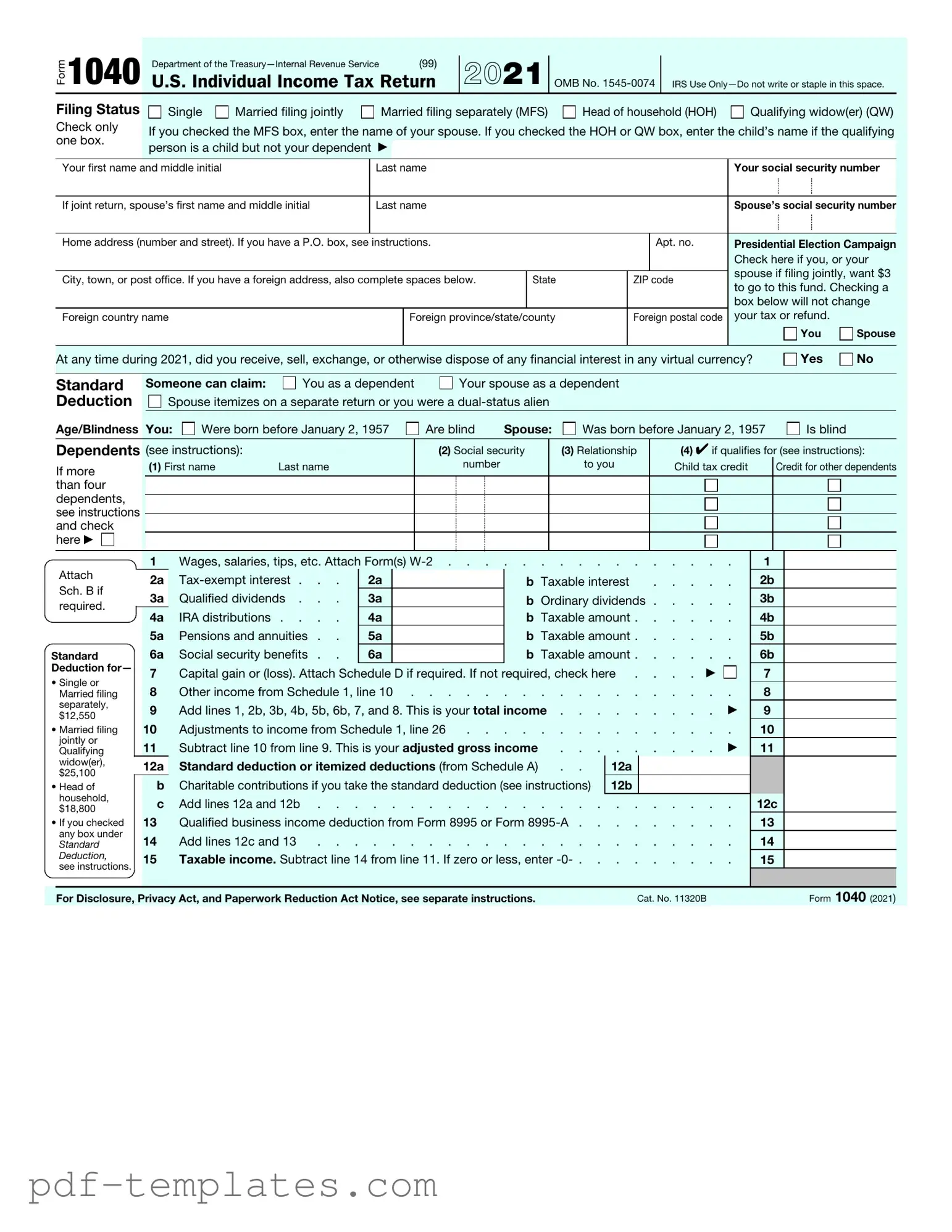

Get IRS 1040 Form in PDF

The IRS 1040 form serves as a crucial document for individuals filing their annual income tax returns in the United States. This form not only captures your total income from various sources, such as wages, dividends, and self-employment earnings, but it also allows you to claim deductions and credits that can significantly reduce your tax liability. As you navigate the 1040, you'll encounter sections that require you to report your filing status, dependents, and any additional income you may have received throughout the year. The form also provides a space for taxpayers to detail their adjustments to income, which can include contributions to retirement accounts or student loan interest payments. Understanding the various schedules that accompany the 1040 is essential, as they help to clarify more complex tax situations, such as business income or capital gains. Whether you are filing as a single individual, married couple, or head of household, the 1040 form is designed to accommodate a wide range of financial circumstances, making it a fundamental tool in the tax filing process.

Misconceptions

Understanding the IRS 1040 form can be challenging, and several misconceptions often arise. Here are five common misunderstandings:

-

Everyone Must Use the 1040 Form:

Many people believe that the 1040 form is the only option for filing taxes. In reality, there are different versions of the 1040 form, including the 1040-SR for seniors and the 1040-NR for non-residents. Depending on individual circumstances, some taxpayers may qualify to use simpler forms, such as the 1040-EZ.

-

Filing Late Automatically Results in Penalties:

While it is true that filing late can lead to penalties, not everyone will face them. If a taxpayer files for an extension and pays any owed taxes on time, they can avoid penalties. Additionally, some taxpayers may qualify for penalty relief under certain circumstances.

-

All Income is Taxable:

Another misconception is that all income is subject to taxation. Some types of income, such as gifts and inheritances, are not taxable. Taxpayers should be aware of what constitutes taxable income to accurately complete their 1040 forms.

-

Only Employees Need to File:

Many individuals think that only employees with W-2 forms need to file taxes. However, self-employed individuals, freelancers, and those with various sources of income, including rental income or investment earnings, are also required to file a 1040 form.

-

Filing a 1040 Guarantees a Refund:

It is a common belief that filing a 1040 form will always result in a tax refund. Refunds depend on various factors, including income, deductions, and credits. Some taxpayers may owe additional taxes instead of receiving a refund.

IRS 1040: Usage Instruction

Filling out the IRS 1040 form is an essential step in reporting your annual income to the federal government. Once you have completed the form, you will need to review it carefully for accuracy before submitting it to ensure compliance with tax regulations.

- Gather your financial documents, including W-2s, 1099s, and any other income statements.

- Obtain a copy of the IRS 1040 form, which can be downloaded from the IRS website or obtained at a local post office or library.

- Begin by entering your personal information at the top of the form, including your name, address, and Social Security number.

- Indicate your filing status by checking the appropriate box (e.g., single, married filing jointly, etc.).

- Report your income by filling in the relevant lines with amounts from your income documents.

- Calculate your adjusted gross income (AGI) by applying any deductions or adjustments listed on the form.

- Claim any tax credits and deductions you qualify for, such as the standard deduction or itemized deductions.

- Determine your tax liability using the tax tables provided in the form instructions.

- Subtract any tax payments already made, including withholding and estimated payments, to find your total tax due or refund.

- Sign and date the form at the bottom. If filing jointly, your spouse must also sign.

- Choose your filing method: mail the form to the IRS or file electronically using tax software.

After completing these steps, double-check your entries for any errors. This will help avoid delays in processing your return and ensure that you receive any refund you may be owed promptly.

Common mistakes

-

Failing to use the correct filing status. Choosing the wrong status can affect tax rates and eligibility for certain credits.

-

Omitting income sources. All income, including side jobs and freelance work, must be reported. Missing any source can lead to penalties.

-

Incorrectly entering Social Security numbers. Errors in these numbers can delay processing and refunds.

-

Mathematical errors. Simple addition or subtraction mistakes can change the amount owed or refunded.

-

Neglecting to sign and date the form. An unsigned form is considered incomplete and will not be processed.

-

Missing out on deductions and credits. Many taxpayers overlook eligible deductions, which can lead to paying more than necessary.

-

Not keeping proper records. Failing to maintain documentation for income and deductions can create issues if the IRS requests verification.

-

Filing late without an extension. Late filings can result in penalties and interest on unpaid taxes.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS 1040 form is used by individuals to file their annual income tax returns with the federal government. |

| Filing Deadline | The deadline for filing the IRS 1040 form is typically April 15th of each year, unless it falls on a weekend or holiday. |

| State-Specific Forms | Many states have their own tax forms that must be filed in addition to the IRS 1040. Each state has its governing laws regarding tax filing. |

| Eligibility | Most U.S. citizens and resident aliens are required to file a 1040 form if their income exceeds a certain threshold. |

Dos and Don'ts

When filling out the IRS 1040 form, it's important to be thorough and accurate. Here are some guidelines to help you navigate the process smoothly.

- Do double-check your personal information, including your name, address, and Social Security number.

- Don't rush through the form. Take your time to ensure all information is correct.

- Do keep copies of all documents you use to fill out the form, including W-2s and 1099s.

- Don't forget to sign and date your form before submitting it. An unsigned form is considered invalid.

- Do review the instructions carefully for each section of the form to avoid common mistakes.

- Don't ignore deadlines. File your return on time to avoid penalties and interest.

Following these tips can help ensure a smoother filing experience and reduce the likelihood of issues with your tax return.

Similar forms

The IRS 1040 form is similar to the IRS 1040A form, which is a simplified version of the standard 1040. The 1040A allows taxpayers to report income from wages, pensions, and interest, but it does not accommodate itemized deductions. Instead, it provides a straightforward way to claim the standard deduction and certain tax credits, making it ideal for those with less complex tax situations.

Another document that resembles the IRS 1040 is the IRS 1040EZ form. This form is even more streamlined than the 1040A and is designed for single or married taxpayers filing jointly with no dependents. The 1040EZ allows for basic income reporting and is limited to those with taxable income below a certain threshold. Its simplicity is appealing to individuals who have straightforward tax situations.

The IRS Schedule C form shares similarities with the 1040 in that it is used to report income or loss from a business operated by a sole proprietor. While the 1040 captures the taxpayer's overall financial situation, Schedule C specifically details business earnings and expenses. This allows for a comprehensive view of both personal and business finances when filed together.

Form 1099 is another document that is related to the 1040. This form is used to report various types of income other than wages, salaries, and tips. Freelancers and independent contractors typically receive 1099 forms from clients. Taxpayers must include this income on their 1040, making the 1099 an essential component of the overall tax filing process.

The IRS Schedule A form is akin to the 1040 in that it allows taxpayers to itemize deductions. While the 1040 captures total income and tax liability, Schedule A breaks down specific deductions such as mortgage interest, medical expenses, and charitable contributions. This form is crucial for those who wish to maximize their deductions beyond the standard deduction available on the 1040.

Form 4868 is another document that relates to the IRS 1040, as it is used to request an extension for filing individual income tax returns. While it does not directly impact the content of the 1040, it allows taxpayers additional time to prepare their return. Filing Form 4868 grants an automatic six-month extension, providing relief for those who need more time to gather their financial information.

The IRS W-2 form is also similar to the 1040 in that it reports income earned from employment. Employers provide W-2 forms to employees, detailing wages, tips, and other compensation, along with taxes withheld. Taxpayers use this information to complete their 1040, ensuring that all earned income is accurately reported and taxed.

Understanding the nuances of various tax forms is crucial for accurate reporting, just as familiarizing oneself with specific documents like the California Agreement Room form is important for both landlords and tenants. This form outlines essential details, including rent and deposit conditions, similar to how tax forms detail income and liabilities. For further guidance, you can visit https://formcalifornia.com/.

Form 8889 is related to the 1040 for those who have Health Savings Accounts (HSAs). This form is used to report contributions to and distributions from HSAs, which can impact tax liability. Taxpayers must include the information from Form 8889 on their 1040 to accurately reflect their health savings activity and any associated tax benefits.

Lastly, the IRS Schedule D form is relevant to the 1040 as it is used to report capital gains and losses from the sale of assets. While the 1040 captures overall income, Schedule D provides the necessary details regarding investment transactions. Taxpayers who buy and sell stocks or other investments must use this form to ensure that their capital gains are reported correctly on their 1040.

Other PDF Forms

Ms Word Chart Examples - Share the completed form with relevant parties as needed.

The Asurion F-017-08 MEN form is a crucial document used for processing specific insurance claims related to electronic devices. This form serves as a formal request for assistance, ensuring that customers receive the support they need for their devices in a timely manner. For more information, visit pdftemplates.info/asurion-f-017-08-men-form/ to get started on filling out the form by clicking the button below.

Imm1294 - Provide details about your current mailing and residential addresses.