Investment Letter of Intent Document

When embarking on a new investment opportunity, clarity and intention are paramount. The Investment Letter of Intent (LOI) serves as a crucial document that outlines the preliminary terms and conditions of a potential investment agreement. It acts as a roadmap, guiding both investors and businesses through the early stages of negotiation. Typically, the LOI includes key details such as the proposed investment amount, the structure of the deal, and the expectations from both parties. Additionally, it may address timelines, confidentiality clauses, and conditions that must be met before finalizing the investment. By establishing a mutual understanding, the LOI helps to mitigate risks and fosters a collaborative environment for future discussions. Ultimately, this document is not just a formality; it lays the groundwork for a successful partnership and can significantly influence the trajectory of the investment process.

Misconceptions

Here are some common misconceptions about the Investment Letter of Intent form:

- It is a legally binding contract. Many people think that signing this form means they are legally obligated to proceed with the investment. In reality, it is often a preliminary document that outlines intentions, not a binding agreement.

- It guarantees funding. Some believe that submitting an Investment Letter of Intent ensures that the funds will be provided. However, it simply expresses interest and does not guarantee any financial commitment.

- It must be signed by both parties. There is a misconception that both the investor and the recipient must sign the letter for it to be valid. In many cases, only the investor's signature is required to indicate their intent.

- It is the final step in the investment process. Many think that once the Investment Letter of Intent is submitted, the process is complete. In fact, it is usually just one step in a longer process that includes due diligence and negotiations.

- It can be used for any type of investment. Some assume that this form is suitable for all types of investments. However, its use is often specific to certain types of investments or situations, and it may not be appropriate in every case.

- It does not require legal review. A common belief is that the Investment Letter of Intent is simple enough to bypass legal review. In reality, having a legal expert review the document can help avoid misunderstandings and ensure clarity.

Investment Letter of Intent: Usage Instruction

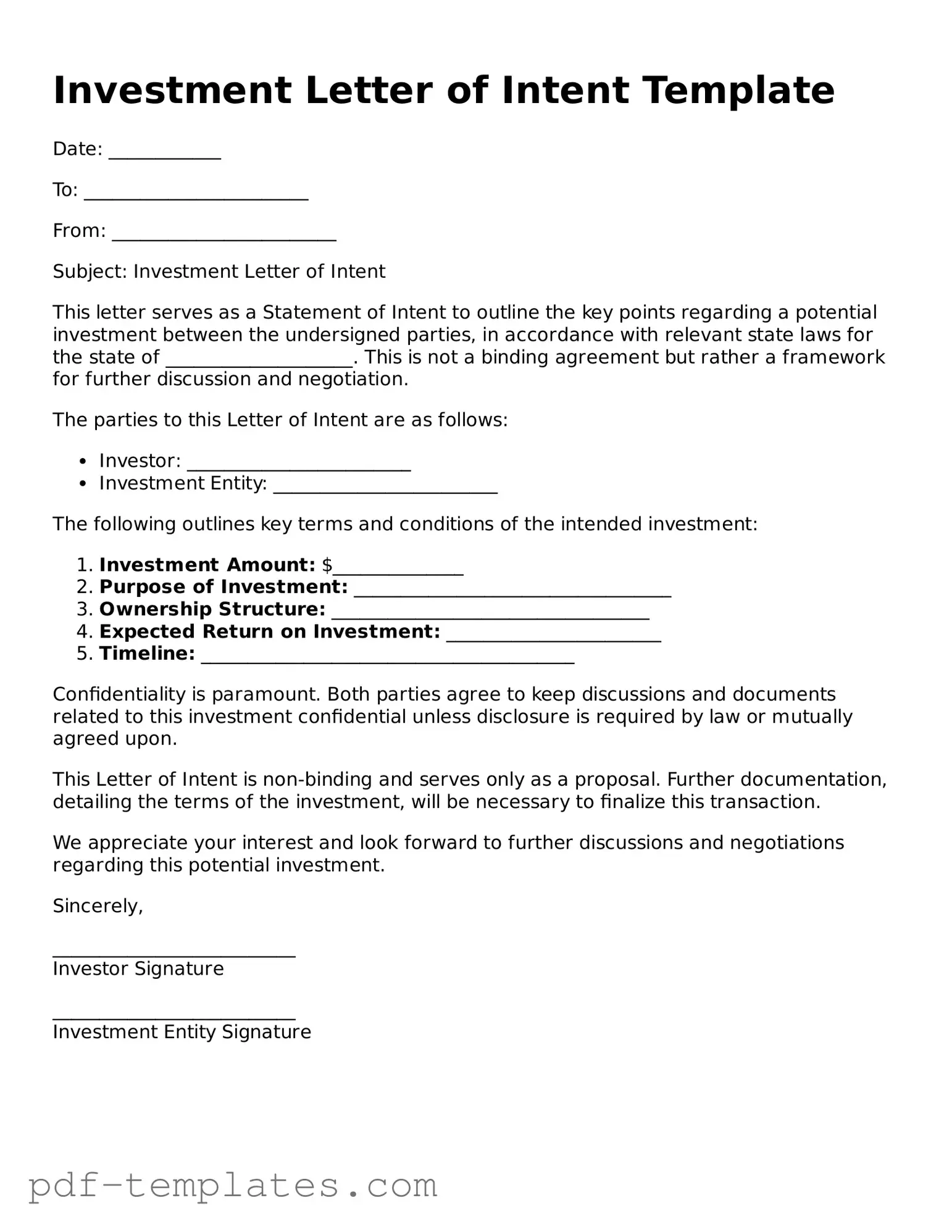

After obtaining the Investment Letter of Intent form, you are ready to begin the process of filling it out. This form is essential for outlining your investment intentions and helps establish a clear understanding between parties involved. Follow these steps carefully to ensure that all necessary information is accurately provided.

- Begin by entering your full name in the designated field at the top of the form.

- Provide your contact information, including your phone number and email address.

- Next, fill in the date on which you are completing the form.

- In the section labeled "Investment Amount," specify the total amount you intend to invest.

- Indicate the type of investment you are making (e.g., equity, debt, etc.) in the appropriate area.

- Describe the purpose of your investment briefly. This could include the project or business you are supporting.

- Review any additional terms or conditions that may be listed on the form. Make sure to understand them fully.

- Sign and date the form at the bottom to validate your intentions.

Once you have completed the form, you can submit it as directed, whether electronically or via mail. Ensure that you keep a copy for your records, as it may be needed for future reference or discussions.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all required details. Ensure that every section of the form is filled out completely.

-

Incorrect Contact Information: Double-check that your phone number and email address are accurate. Incorrect information can lead to missed communications.

-

Failure to Sign: Forgetting to sign the form can delay the process. Always ensure that you have signed and dated the document before submission.

-

Not Reviewing Terms: Many people overlook the terms outlined in the form. Take the time to read and understand all terms before signing.

-

Using Unclear Language: Avoid vague language when describing your investment intentions. Clear and specific language helps in better understanding your goals.

-

Neglecting to Include Supporting Documents: Sometimes, additional documents are required. Ensure you attach any necessary paperwork to support your application.

-

Missing Deadlines: Be mindful of submission deadlines. Late submissions may not be accepted, which could hinder your investment opportunity.

-

Ignoring Formatting Guidelines: Follow any specific formatting requirements provided. Ignoring these can result in confusion or rejection of your application.

-

Not Seeking Assistance: If you find the form confusing, don’t hesitate to ask for help. Consulting with a financial advisor can clarify any uncertainties.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | The Investment Letter of Intent serves as a preliminary agreement outlining the terms of a potential investment. |

| Binding Nature | This document is typically non-binding, meaning it expresses intent rather than creating enforceable obligations. |

| Key Components | Common elements include the investment amount, proposed terms, and conditions for further negotiations. |

| Confidentiality | Often, the letter includes a confidentiality clause to protect sensitive information shared during negotiations. |

| Governing Law | The governing law may vary by state; for example, in California, it would be governed by California state law. |

| Duration | The letter may specify a timeframe during which the parties will negotiate or finalize the investment. |

| Signatures | While not always required, signatures from both parties can signify mutual agreement on the intent expressed. |

| Use in Due Diligence | This form can facilitate the due diligence process by outlining expectations and responsibilities of both parties. |

Dos and Don'ts

When filling out an Investment Letter of Intent form, it's important to approach the task with care. Here are some key do's and don'ts to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information to avoid delays.

- Do double-check your contact details to ensure they are correct.

- Do seek clarification on any sections that are unclear.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any required fields blank; this could lead to rejection.

- Don't use jargon or abbreviations that might confuse the reader.

- Don't submit the form without reviewing it for errors.

Similar forms

The Investment Letter of Intent (LOI) shares similarities with a Memorandum of Understanding (MOU). Both documents serve as preliminary agreements that outline the intentions of the parties involved. An MOU typically details the goals and objectives of a partnership or project, similar to how an LOI expresses the intent to invest. While an LOI is more focused on financial commitments, an MOU can cover a broader range of topics, such as roles and responsibilities. Each document acts as a stepping stone toward a more formal agreement, allowing parties to clarify their expectations before entering into a binding contract.

A Term Sheet is another document that resembles the Investment Letter of Intent. It outlines the key terms and conditions of an investment deal, providing a summary that both parties can review. Like an LOI, a Term Sheet is not legally binding but serves as a framework for negotiations. It typically includes details such as the amount of investment, valuation, and any rights or obligations of the investors. Both documents aim to ensure that all parties are on the same page before drafting a more comprehensive agreement.

The Confidentiality Agreement, or Non-Disclosure Agreement (NDA), is another document that parallels the Investment Letter of Intent. While an LOI focuses on investment intentions, an NDA ensures that sensitive information shared during negotiations remains protected. Both documents are often used in conjunction when parties are discussing potential investments. The NDA builds trust by allowing parties to exchange information freely, while the LOI expresses the desire to move forward with an investment based on that shared information.

Lastly, a Partnership Agreement can be seen as similar to an Investment Letter of Intent, though it is more formal and binding. A Partnership Agreement outlines the roles, responsibilities, and profit-sharing arrangements between partners in a business venture. While an LOI indicates an intention to invest, a Partnership Agreement solidifies the commitment and details how the partnership will operate. Both documents reflect the collaborative nature of business relationships, setting the stage for future success.

Additional Types of Investment Letter of Intent Templates:

Loi Meaning in Job - Can ease anxieties for candidates waiting for the final job offer.

Intent to Homeschool - Completing the Homeschool Letter of Intent allows you to formally request a homeschooling status for your child.

Intent to Sue Letter Template - A Letter of Intent to Sue outlines a party’s intention to file a lawsuit, indicating the seriousness of their claim.