Get Intent To Lien Florida Form in PDF

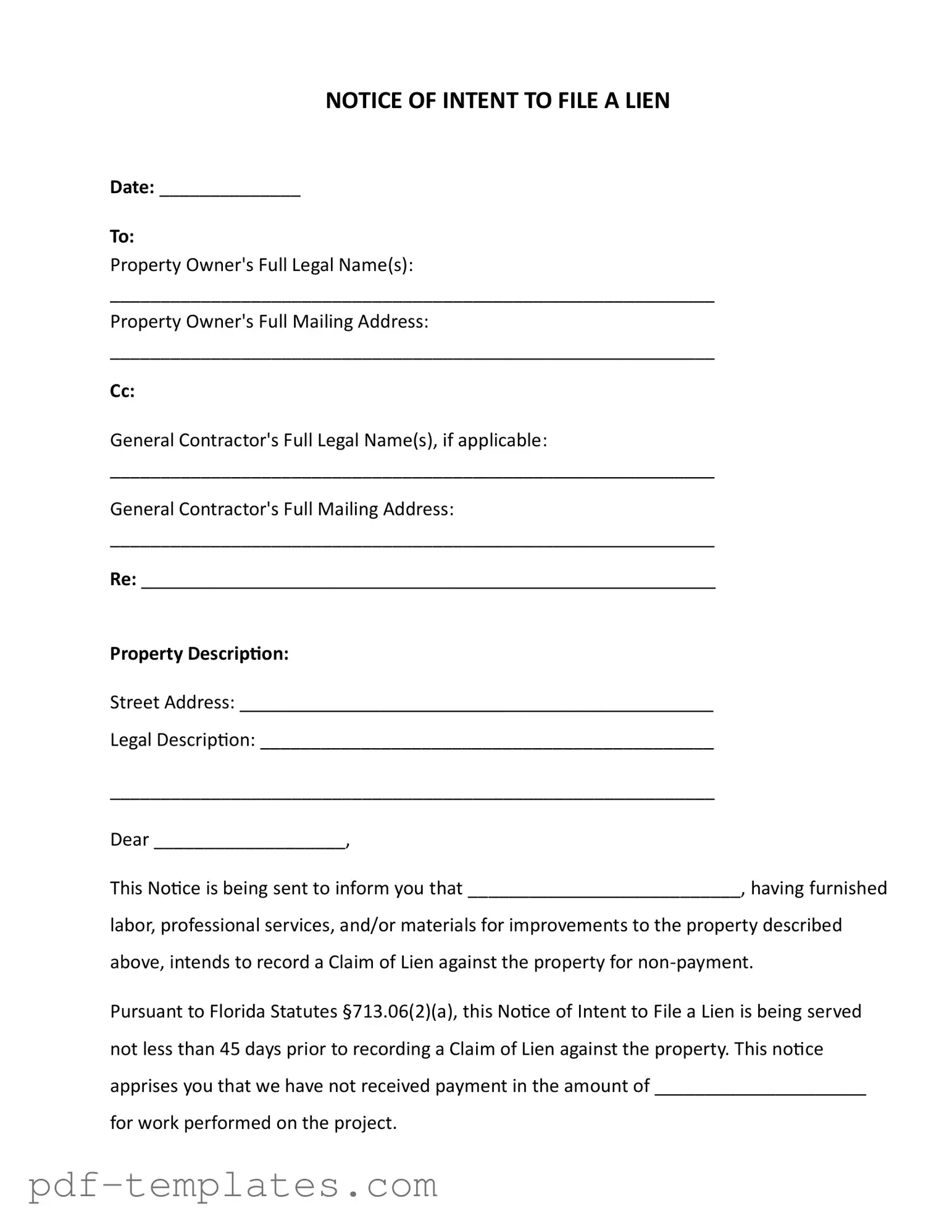

The Intent to Lien Florida form serves as a critical communication tool for those who have provided labor, materials, or services in connection with property improvements but have not received payment. This form is designed to formally notify property owners of the intention to file a lien against their property if payment is not made. It includes essential details such as the date of the notice, the names and addresses of the property owner and general contractor, and a description of the property in question. The form also specifies the amount owed for the work performed, emphasizing the importance of prompt payment. Under Florida law, this notice must be served at least 45 days before filing a Claim of Lien, providing the property owner with a clear deadline to respond. Failure to address the payment issue within 30 days may lead to serious consequences, including the potential for foreclosure proceedings and the incurrence of additional legal costs. The sender expresses a preference to resolve the matter amicably, urging the recipient to act quickly to avoid further legal action. Proper completion of this form is crucial, as it includes a certificate of service, ensuring that the notice has been delivered to the appropriate parties. By understanding the significance of the Intent to Lien Florida form, both property owners and contractors can navigate the complexities of payment disputes more effectively.

Misconceptions

Misconceptions about the Intent to Lien Florida form can lead to confusion and misunderstandings. Here are ten common misconceptions explained:

- It is a lien itself. Many believe that the Intent to Lien form is a lien. In reality, it is merely a notice that someone intends to file a lien if payment is not made.

- It guarantees payment. Some think that sending this notice ensures they will receive payment. However, it serves as a warning, not a guarantee.

- It must be sent by a lawyer. It is a common belief that only attorneys can send this notice. In fact, any party involved in the project can issue it.

- It can be ignored. Ignoring this notice is a mistake. Failure to respond can lead to a lien being filed against the property.

- It has no legal standing. Some may think the notice is just a formality. In Florida, it holds legal significance and can affect property rights.

- It is only for contractors. While often associated with contractors, suppliers and other service providers can also use this notice to protect their interests.

- It must be sent via certified mail. Although certified mail is a common method, the notice can be delivered through various means, including hand delivery or publication.

- It can be sent at any time. This notice must be sent at least 45 days before filing a lien. Timing is crucial to ensure compliance with Florida law.

- Once sent, the lien is inevitable. Sending the notice does not mean a lien will definitely be filed. It is a way to prompt payment and avoid further action.

- It is unnecessary if a contract exists. Having a contract does not eliminate the need for this notice. It is still advisable to send it to protect rights under Florida law.

Understanding these misconceptions can help property owners and service providers navigate the complexities of the lien process in Florida more effectively.

Intent To Lien Florida: Usage Instruction

After completing the Intent to Lien form, you will need to send it to the property owner and possibly the general contractor. Make sure to keep a copy for your records. This notice serves as a formal warning about your intent to file a lien if payment is not made.

- Date: Fill in the current date at the top of the form.

- Property Owner's Full Legal Name(s): Write the full legal name of the property owner(s).

- Property Owner's Full Mailing Address: Include the complete mailing address of the property owner(s).

- General Contractor's Full Legal Name(s): If applicable, add the full legal name of the general contractor.

- General Contractor's Full Mailing Address: Write the mailing address of the general contractor, if applicable.

- Property Description: Specify the street address of the property.

- Legal Description: Include the legal description of the property.

- Dear: Address the property owner by name.

- Furnisher's Name: Fill in your name or the name of the company that provided the services or materials.

- Amount Due: Write the amount that has not been paid for the work performed.

- Your Name: Sign your name in the space provided.

- Your Title: Indicate your title or position.

- Your Phone Number: Provide a contact phone number.

- Your Email Address: Include your email address for further communication.

- Certificate of Service: Fill in the date the notice was served and the name of the person served.

- Method of Delivery: Check the box that corresponds to how the notice was delivered.

- Name and Signature: Sign the document and print your name below your signature.

Common mistakes

-

Incorrect Property Information: Failing to provide the correct street address and legal description of the property can lead to complications. Ensure that all details are accurate and match public records.

-

Missing Dates: Omitting the date on the form can cause delays and confusion. Always fill in the date when the notice is being sent.

-

Incomplete Owner Information: Not including the full legal name and mailing address of the property owner can invalidate the notice. Double-check that this information is complete and accurate.

-

Failure to Specify Amount Due: Leaving the amount owed blank or incorrect can weaken your position. Clearly state the total amount you are owed for work performed.

-

Ignoring Response Timeframes: Not adhering to the required timeframes for responses can jeopardize your claim. Be aware that the property owner has 30 days to respond after receiving the notice.

-

Improper Certification of Service: Not properly certifying how the notice was served can lead to legal challenges. Ensure you check the appropriate box and provide all necessary details of service.

File Specifics

| Fact Name | Details |

|---|---|

| Purpose | The Intent to Lien form notifies property owners of an intention to file a lien for unpaid services or materials. |

| Governing Law | This form is governed by Florida Statutes §713.06, which outlines the procedures for filing liens. |

| Notice Period | It must be served at least 45 days before recording a Claim of Lien. |

| Response Time | Property owners have 30 days to respond before a lien may be recorded. |

| Consequences of Non-Payment | Failure to pay can lead to foreclosure proceedings and additional costs such as attorney fees. |

| Service Methods | Delivery can be made via certified mail, registered mail, hand delivery, process server, or publication. |

| Signature Requirement | The form must be signed by the individual sending the notice to validate the service. |

| Contact Information | Includes space for the sender's name, title, phone number, and email address for further communication. |

Dos and Don'ts

Things to Do:

- Ensure all property owner names are accurately spelled and complete.

- Provide a detailed property description, including both street and legal addresses.

- Clearly state the amount owed for work performed.

- Send the notice at least 45 days before filing the lien.

- Keep a copy of the notice for your records, along with proof of delivery.

Things Not to Do:

- Do not omit any required information, such as the contractor's name or address.

- Avoid using vague language; be specific about the services or materials provided.

- Do not delay sending the notice; timely action is crucial.

- Never ignore the response period; follow up if no payment is received.

- Do not forget to sign and date the certificate of service.

Similar forms

The Notice of Commencement is a document that serves as a formal declaration of a construction project. It is typically filed by the property owner before any work begins. This document provides essential information, including the property description and the general contractor's details. Like the Intent to Lien, it aims to protect the rights of those who provide labor or materials by notifying interested parties of the project's existence. Both documents play a crucial role in the construction process and help establish a clear chain of communication among stakeholders.

A Notice of Non-Payment is issued when a contractor or subcontractor has not received payment for services rendered. This document alerts the property owner and other parties that payment has not been made and that further action may be necessary. Similar to the Intent to Lien, it serves as a warning that a lien may be filed if the situation is not resolved. Both documents emphasize the importance of timely payment and communication to prevent legal complications.

A Claim of Lien is a legal claim against a property for unpaid services or materials. Once filed, it provides a public notice of the contractor's right to seek payment through the property itself. The Claim of Lien follows the Intent to Lien and is often the next step if payment is not received. Both documents share the goal of ensuring that those who contribute to a property are compensated for their work, highlighting the importance of financial accountability in construction projects.

The Lien Waiver is a document that releases a contractor's right to file a lien against a property once they have been paid. This document is often used to provide assurance to property owners that no further claims will be made for the completed work. While the Intent to Lien warns of potential claims, the Lien Waiver confirms that all obligations have been met. Both documents are critical in managing the financial aspects of construction and protecting the interests of all parties involved.

The Affidavit of Payment is a sworn statement confirming that all subcontractors and suppliers have been paid for their work on a project. This document is often required before a property owner can receive a final payment or release of lien. Like the Intent to Lien, it underscores the importance of financial transparency in construction. Both documents help ensure that all parties are informed about payment statuses, reducing the risk of disputes.

A Notice of Final Payment is issued to inform all parties that the final payment has been made for a construction project. This document serves to close out the project and provides clarity regarding any outstanding financial obligations. Similar to the Intent to Lien, it helps maintain clear communication among the parties involved, ensuring that everyone is aware of the project's financial conclusion.

The Certificate of Satisfaction is a document that confirms a lien has been satisfied and released. This document is filed after payment has been received and serves to inform the public that the lien is no longer valid. Both the Certificate of Satisfaction and the Intent to Lien deal with the status of financial obligations related to a property. They help protect the rights of contractors and property owners by clearly documenting the resolution of payment issues.

The Mechanic's Lien is a specific type of lien that can be filed by contractors, subcontractors, and suppliers who have not been paid for their work on a property. This document allows them to seek payment through the property itself. Similar to the Intent to Lien, it serves as a legal mechanism to enforce payment and protect the rights of those who contribute labor or materials. Both documents are essential tools in the construction industry, ensuring that financial disputes are handled appropriately.

In California, additional forms are often crucial for ensuring that financial obligations are met, one of which is the All California Forms that include the California Loan Agreement form. This form serves to outline the legal agreement between lenders and borrowers, specifying all necessary aspects such as the loan amount and repayment terms, thereby protecting both parties in a financial transaction.

The Demand for Payment is a formal request for payment that can be sent to a property owner or general contractor. This document outlines the amount owed and the services provided. Like the Intent to Lien, it serves as a precursor to more serious legal action if the payment is not made. Both documents emphasize the need for timely communication and resolution of financial issues in construction projects.

Other PDF Forms

Online Medication Administration Record - Attending physician’s name is a requirement for each consumer record.

For those looking to manage their firearm transactions effectively, a detailed Firearm Bill of Sale can be indispensable. To access a template and understand the requirements, you can refer to this guide on the vital Texas Firearm Bill of Sale form.

Esa Letter - It provides a formal acknowledgment of the need for emotional support in daily life.