Get Independent Contractor Pay Stub Form in PDF

When it comes to managing payments for independent contractors, clarity and transparency are essential. The Independent Contractor Pay Stub form serves as a vital tool for both contractors and businesses, ensuring that everyone is on the same page regarding compensation. This form typically includes crucial details such as the contractor's name, the services rendered, the payment amount, and any deductions that may apply. It's not just a piece of paper; it’s a record that helps contractors track their earnings and provides businesses with a clear account of their financial obligations. Additionally, the pay stub can include payment dates and methods, which are important for maintaining accurate financial records. Understanding the components of this form can empower both parties, fostering a professional relationship built on trust and accountability.

Misconceptions

Understanding the Independent Contractor Pay Stub form can be challenging. Here are eight common misconceptions that often arise:

- Independent contractors do not need pay stubs. Many believe that since contractors are not employees, they don’t require pay stubs. However, pay stubs can help track earnings and provide proof of income for tax purposes.

- All pay stubs are the same. Some think that all pay stubs follow a standard format. In reality, pay stubs can vary significantly based on the contractor's agreement and the company issuing them.

- Independent contractors cannot request pay stubs. It’s a misconception that contractors cannot ask for pay stubs. Contractors have the right to request documentation of their earnings for clarity and record-keeping.

- Pay stubs are only for employees. Many assume that pay stubs are exclusively for employees. However, independent contractors can also receive pay stubs to document their payments.

- Pay stubs include tax deductions for independent contractors. Some believe that independent contractor pay stubs will show tax deductions. In most cases, contractors are responsible for their own taxes, so deductions may not appear on their pay stubs.

- Independent contractors do not need to keep pay stubs. A common belief is that contractors can discard their pay stubs. Keeping these records is essential for accurate tax reporting and financial management.

- All companies provide pay stubs to independent contractors. Not every company issues pay stubs to contractors. It depends on the company’s policies and the terms of the contractor’s agreement.

- Pay stubs are not legally required. Some think that pay stubs are not necessary for independent contractors. While not legally mandated, they are beneficial for maintaining clear financial records.

By addressing these misconceptions, independent contractors can better understand their rights and responsibilities regarding pay stubs.

Independent Contractor Pay Stub: Usage Instruction

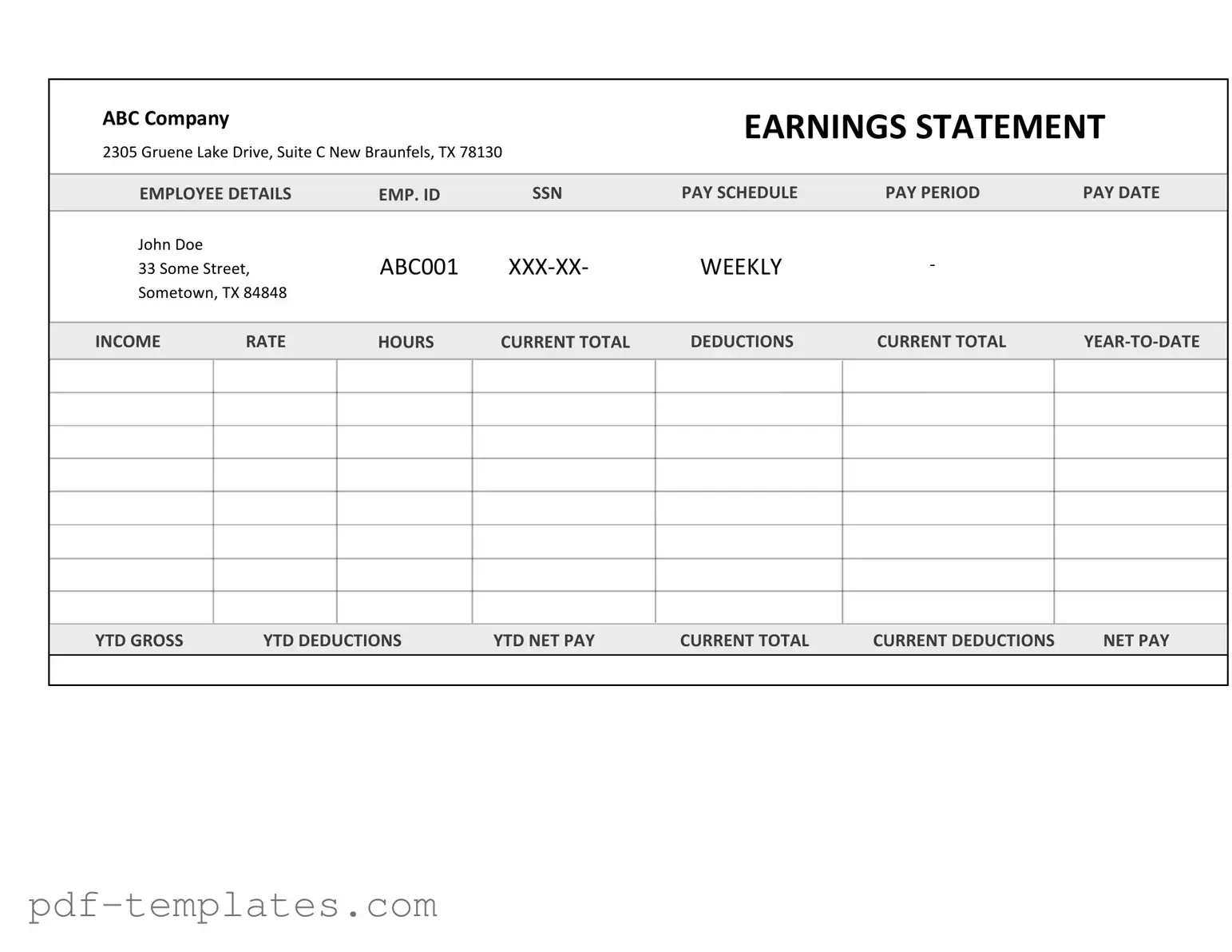

Completing the Independent Contractor Pay Stub form is a straightforward process. This form allows independent contractors to document their earnings and any deductions accurately. Follow the steps below to ensure all necessary information is provided correctly.

- Begin by entering your name in the designated field. Ensure that it matches the name on your tax documents.

- Next, fill in your address. Include your street address, city, state, and ZIP code.

- Provide your Social Security number or Tax Identification Number. This is crucial for tax purposes.

- Indicate the pay period. Specify the start and end dates of the period during which the work was performed.

- Enter the total amount earned during that pay period. This should reflect the gross earnings before any deductions.

- If applicable, list any deductions. This may include taxes withheld, insurance, or retirement contributions.

- Calculate the net pay by subtracting total deductions from gross earnings. Enter this final amount in the net pay field.

- Sign and date the form at the bottom to validate the information provided.

Once the form is completed, it is important to keep a copy for your records. This documentation can be useful for tax filing and financial tracking.

Common mistakes

-

Incorrect Personal Information: Many individuals forget to double-check their name, address, and Social Security number. Even a small typo can lead to significant issues with tax reporting.

-

Misclassification of Work Hours: Some contractors either underestimate or overestimate the hours worked. Accurate reporting is crucial for proper compensation and tax calculations.

-

Omitting Deductions: Failing to include necessary deductions can result in overpayment or complications during tax season. Always account for expenses related to your work.

-

Not Including Payment Dates: Payment dates are essential for tracking income. Omitting them can create confusion about when payments were received.

-

Ignoring State and Federal Tax Obligations: Some contractors overlook their tax responsibilities. Understanding how much to set aside for taxes is vital to avoid penalties later.

File Specifics

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub is a document that outlines the earnings of an independent contractor for a specific pay period. |

| Purpose | It serves to provide transparency in payment, detailing hours worked, rates, and deductions. |

| Tax Implications | Independent contractors are responsible for their own taxes, which should be reflected in the pay stub. |

| State-Specific Forms | Some states require specific formats for pay stubs. For example, California mandates certain disclosures under Labor Code Section 226. |

| Required Information | A pay stub must include the contractor's name, pay period dates, total earnings, and any deductions. |

| Record Keeping | Contractors should keep pay stubs for at least three years for tax and audit purposes. |

| Legal Compliance | Failure to provide accurate pay stubs can lead to disputes or legal issues under labor laws. |

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, it is important to be meticulous and thorough. Here is a list of things you should and shouldn't do:

- Do ensure that all personal information is accurate, including your name and address.

- Do clearly outline the services provided during the pay period.

- Do double-check the payment amount to ensure it reflects the agreed-upon rate.

- Do include the date of payment for clarity.

- Don't leave any sections blank; every part of the form should be completed.

- Don't use vague descriptions for the services rendered; specificity is key.

By following these guidelines, you can create a clear and professional pay stub that accurately represents your work and payment. This attention to detail not only fosters transparency but also helps maintain a positive relationship with clients.

Similar forms

The Independent Contractor Pay Stub form is similar to a traditional employee pay stub, which provides a detailed breakdown of wages earned, taxes withheld, and deductions. Both documents serve to inform the recipient about their earnings for a specific period. While employee pay stubs typically include information about benefits and tax withholdings, the independent contractor version focuses more on gross pay and any applicable fees or commissions. This makes both forms essential for understanding compensation, although they cater to different types of workers.

Another document that resembles the Independent Contractor Pay Stub is the invoice. An invoice is a request for payment that outlines the services rendered and the amount owed. Like a pay stub, it provides clarity on the payment details, including the date of service and the total amount due. However, invoices are usually sent from the contractor to the client, while pay stubs are generated by the payer to inform the contractor of their earnings.

Understanding the nuances of various financial documents is crucial for independent contractors, including forms such as the California Agreement Room form, which is essential for rental arrangements in private homes. This specific document outlines the essential rights and responsibilities of both landlords and tenants, much like the agreement details in contracts. For access to various related documents and resources, you can find them at All California Forms.

Similar to both the pay stub and invoice, the 1099 form is crucial for independent contractors. This tax document reports income earned by freelancers and is issued by clients who have paid them. While the pay stub details earnings for a specific pay period, the 1099 summarizes total earnings for the entire year. Both documents play significant roles in tax reporting, helping contractors keep track of their income and obligations.

The earnings statement is another document that shares similarities with the Independent Contractor Pay Stub. This statement provides a comprehensive overview of an individual’s earnings, including bonuses and commissions. While it is typically used for employees, it can also apply to independent contractors who receive variable compensation. Both documents aim to provide transparency regarding earnings, making it easier for recipients to manage their finances.

A commission statement also resembles the Independent Contractor Pay Stub, particularly for contractors who earn commissions on sales or services. This document details the commissions earned over a specific period, breaking down sales figures and percentages. Like a pay stub, it helps the contractor understand their earnings, but it is more focused on performance-based compensation rather than hourly or flat-rate payments.

The expense report is another document that shares some similarities. While it primarily focuses on costs incurred during the course of work, it can accompany a pay stub to provide a complete financial picture. Both documents are essential for independent contractors, as they help track income and expenses, which is vital for tax purposes. Together, they ensure that contractors have a comprehensive understanding of their financial situation.

The contract agreement can also be seen as related to the Independent Contractor Pay Stub. Although it does not provide a breakdown of earnings, it outlines the terms of the working relationship, including payment rates and schedules. Both documents are essential for independent contractors, as they establish expectations and clarify payment arrangements, ensuring both parties are on the same page.

Lastly, the payroll ledger is a document that may resemble the Independent Contractor Pay Stub in terms of tracking payments. This ledger records all transactions related to payments made to contractors, offering a historical view of earnings over time. While a pay stub provides a snapshot of a single payment, the payroll ledger gives a broader perspective on all payments made, making it a useful tool for financial management.

Other PDF Forms

Create a Gift Card - An uncomplicated gifting solution that guarantees smiles—gift certificates!

For those looking to secure a rental property, it is helpful to complete the required documentation. You can obtain a clear understanding of the process by reviewing the necessary important Rental Application guidelines.

Texas Temporary Tag - This form allows for legal driving during registration delays.