Get Illinois Final Waiver Of Lien Form in PDF

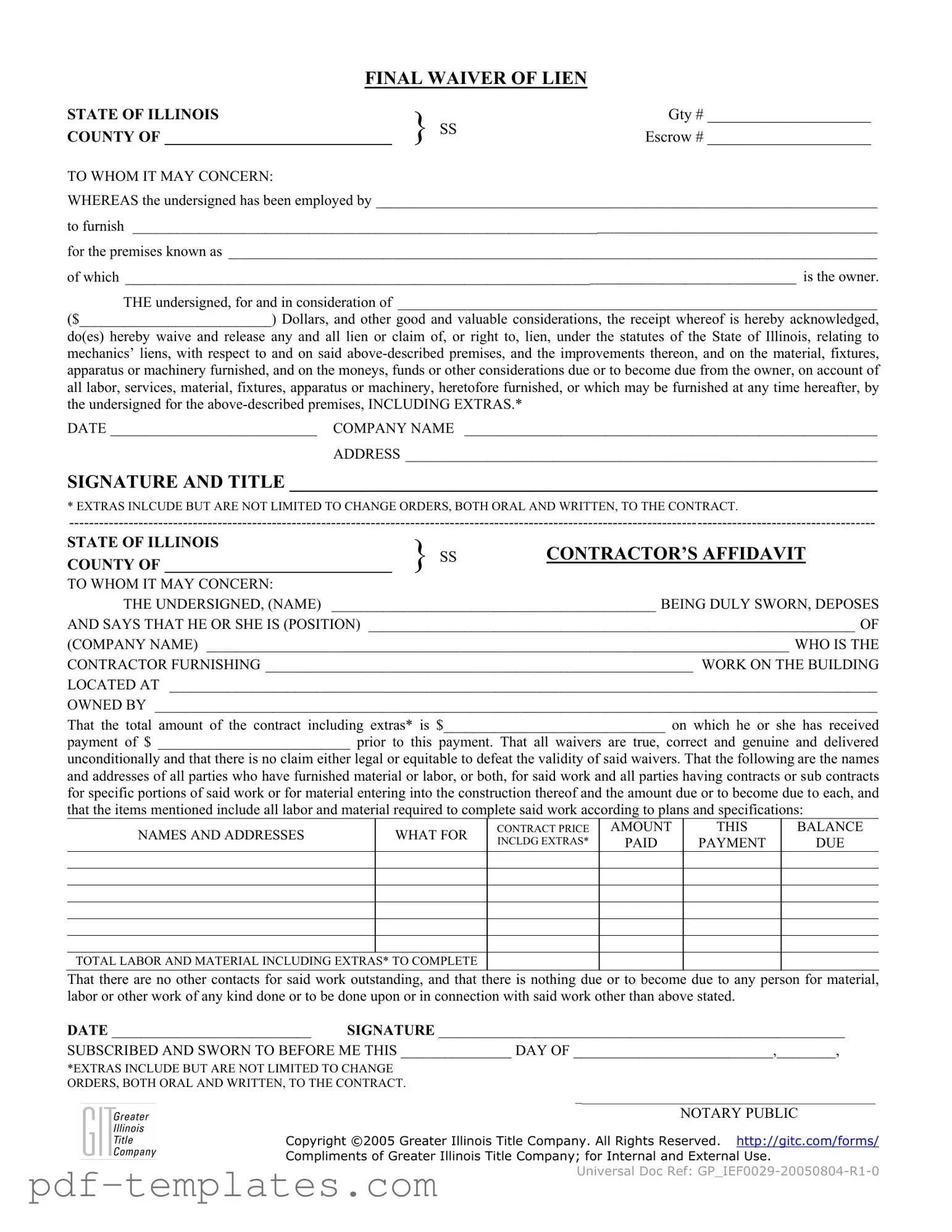

The Illinois Final Waiver of Lien form is a crucial document in the construction and real estate industries, serving as a formal declaration that a contractor or subcontractor has received payment for their work and waives any future claims against the property. This form is particularly important because it protects property owners from potential liens that could arise if contractors or suppliers claim they have not been paid. The document includes essential details such as the parties involved, the nature of the work performed, and the amount paid. It also requires the contractor to disclose any additional parties who may have worked on the project, ensuring transparency and accountability. By signing this waiver, the contractor acknowledges receipt of payment and relinquishes any rights to file a lien for the work completed, including any extras or change orders that may have been agreed upon. The form must be completed accurately, with signatures from both the contractor and a notary public to validate the transaction. Understanding this form is vital for both contractors and property owners, as it helps facilitate smoother transactions and mitigates the risk of disputes over unpaid work.

Misconceptions

There are several misconceptions about the Illinois Final Waiver of Lien form. Understanding these can help ensure proper use and compliance. Here are five common misunderstandings:

- The waiver eliminates all rights to payment. Many people believe that signing the waiver means they will never receive any payment for their work. In reality, the waiver only releases claims for payment related to the specific work described in the document. If additional work or changes occur, those may still be compensated.

- It is only necessary for contractors. Some individuals think that only contractors need to complete this form. However, anyone who provides labor or materials for a project, including subcontractors and suppliers, may need to use the waiver to protect their interests.

- Signing the waiver is optional. Some assume that the waiver is not mandatory. In certain situations, especially when working on a construction project, submitting a waiver may be required to receive payment. It is essential to check the terms of the contract and local regulations.

- The waiver is a one-time document. Many people believe that a single waiver covers all future work. This is not the case. If additional work is performed or new contracts are established, a new waiver may need to be signed to cover those specific circumstances.

- All waivers are the same. Some assume that all lien waivers have identical language and implications. In truth, waivers can vary significantly in terms of their legal language and the rights they protect. It is important to understand the specific form being used and its implications.

Being aware of these misconceptions can help individuals navigate the complexities of the Illinois Final Waiver of Lien form more effectively. Proper understanding can lead to better decision-making and financial protection in construction projects.

Illinois Final Waiver Of Lien: Usage Instruction

Completing the Illinois Final Waiver of Lien form is a critical step in ensuring that all parties involved in a construction project are clear about payments and obligations. After filling out this form, it will need to be submitted to the relevant parties to finalize the waiver of any claims related to the work performed. Follow these steps to accurately fill out the form.

- Enter the date: Write the current date at the top of the form.

- Fill in the company name: Provide the name of the company or individual that has performed the work.

- Provide the address: Write the complete address of the company or individual.

- State the employer: Fill in the name of the party that employed you for the project.

- Describe the work done: Clearly state the type of work or materials provided.

- Identify the premises: Write the address of the property where the work was performed.

- State the owner's name: Enter the name of the property owner.

- Enter the amount received: Specify the amount of money you are acknowledging receipt of in exchange for your services.

- Sign and date: Sign the form and include your title, if applicable.

- Complete the contractor's affidavit: Fill in your name, position, and company name, then provide details about the total contract amount, payments received, and any outstanding balances.

- List all parties: Include names and addresses of all individuals or companies who provided labor or materials for the project, along with the amounts due.

- Sign in front of a notary: Finally, sign the form in the presence of a notary public, who will then complete their section.

Common mistakes

-

Failing to provide complete information about the contractor and the work performed. This includes not filling in the contractor’s name, position, and company name accurately.

-

Omitting the property address. The waiver must specify the exact location of the premises where the work was done. Missing this information can lead to confusion.

-

Not including the total contract amount. It is essential to state the total amount of the contract, including any extras, to ensure clarity regarding payments.

-

Leaving out the amount received prior to this payment. This information is critical as it demonstrates the payment history and confirms the amounts owed.

-

Failing to list all subcontractors or suppliers. It is important to include the names and addresses of all parties who have contributed to the work, as this ensures that all claims are accounted for.

-

Not signing the document. The waiver must be signed by the contractor or authorized representative to be valid. A missing signature renders the document ineffective.

-

Forgetting to have the document witnessed or notarized. A notary public must verify the identity of the signer, which adds an important layer of authenticity to the waiver.

File Specifics

| Fact Name | Fact Details |

|---|---|

| Purpose | The Illinois Final Waiver of Lien form is used to waive any lien rights for work performed or materials supplied on a construction project. |

| Governing Law | This form is governed by the Illinois Mechanics Lien Act, which outlines the rights and responsibilities related to construction liens. |

| Consideration | The waiver is executed in exchange for a specified amount of money or other valuable consideration, which must be acknowledged in the form. |

| Extras Definition | Extras may include change orders, both oral and written, that modify the original contract terms. |

| Notarization Requirement | The form must be notarized to ensure the authenticity of the signatures and declarations made by the contractor. |

| Contractor's Affidavit | A contractor's affidavit is included, confirming the contractor's position and the payment status related to the contract. |

| Finality | Once executed, the waiver serves as a final release of lien rights, preventing any future claims related to the specified work or materials. |

Dos and Don'ts

When filling out the Illinois Final Waiver of Lien form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are four things you should and shouldn't do:

- Do provide complete and accurate information about the contractor, including name, position, and company name.

- Do clearly state the total contract amount, including any extras, and the payment received prior to this waiver.

- Don't leave any sections blank. Ensure all required fields are filled out completely.

- Don't forget to have the form notarized. A signature without notarization may render the waiver invalid.

Similar forms

The Illinois Final Waiver of Lien form shares similarities with the Mechanic’s Lien Waiver form, which is commonly used across many states. Like the Illinois form, the Mechanic’s Lien Waiver serves to release a contractor’s right to file a lien against a property once payment has been received. Both documents aim to provide assurance to property owners that all parties involved in a construction project have been compensated for their work. This helps to prevent disputes over unpaid labor or materials, fostering a smoother transaction process in real estate dealings.

Another document akin to the Illinois Final Waiver of Lien is the Partial Waiver of Lien form. While the Final Waiver indicates that all obligations have been met, the Partial Waiver allows contractors or subcontractors to acknowledge receipt of payment for specific work completed, while still retaining the right to file a lien for any remaining unpaid amounts. This distinction is crucial for contractors who may wish to secure their rights while still maintaining a working relationship with the property owner. Both forms serve to clarify payment status and protect the interests of those involved in construction projects.

The Contractor’s Affidavit is another document that bears resemblance to the Illinois Final Waiver of Lien. This affidavit is often submitted by contractors to confirm that they have been paid for their work and that all subcontractors and suppliers have also been compensated. Similar to the waiver, it aims to eliminate any potential claims against the property by ensuring that all parties involved have been satisfied financially. The Contractor’s Affidavit provides an additional layer of security for property owners, as it verifies that there are no outstanding debts associated with the construction project.

In California, it's essential for vehicle owners to understand the implications of appointing someone through a Motor Vehicle Power of Attorney form. This document facilitates a range of activities such as vehicle registration and signing relevant sales documents, thus ensuring that even in an owner's absence, necessary actions can still be carried out effectively. For those looking for additional resources and options related to this form, you can check out All California Forms for comprehensive information and guidance.

The Subcontractor’s Waiver of Lien also parallels the Illinois Final Waiver of Lien form. This document is specifically designed for subcontractors who have worked on a project and wish to waive their lien rights after receiving payment. Just like the Illinois waiver, it serves to protect the property owner from potential claims by ensuring that all subcontractors have been paid for their services. This helps to maintain clear communication and trust among all parties involved in a construction project, reducing the risk of future disputes.

Finally, the Final Payment Certificate is another document that shares characteristics with the Illinois Final Waiver of Lien. This certificate is issued upon completion of a project and signifies that the contractor has received full payment. It often includes a statement that all lien rights have been waived, similar to the Illinois waiver. The Final Payment Certificate provides peace of mind to property owners, confirming that they are free from any future claims related to the project. Both documents play essential roles in the closing stages of construction, ensuring all parties have fulfilled their obligations.

Other PDF Forms

Free Printable Bill of Lading - The Straight Bill must accurately reflect the contents of the shipment for compliance.

A Texas Vehicle Purchase Agreement is a legal document that outlines the terms and conditions of a vehicle sale between a buyer and a seller. This form serves to protect both parties by detailing the specifics of the transaction, including the sale price, vehicle information, and any warranties or representations. Understanding this agreement is essential for ensuring a smooth and legally compliant purchase process, and you can find a sample at documentonline.org/blank-texas-vehicle-purchase-agreement.

What Does the S in S Corp Stand for - The filing date for Form 2553 is critical, as late submissions may result in denial of S corporation status.