Get Goodwill donation receipt Form in PDF

When donating items to Goodwill, obtaining a donation receipt is an essential step in the process. This receipt serves multiple purposes, including providing proof of your charitable contribution for tax deductions. It typically includes important details such as the date of the donation, a description of the items donated, and their estimated value. Donors must be aware that the IRS requires a written acknowledgment for any contribution over a certain amount, making the Goodwill donation receipt form a valuable document. Additionally, the form may specify whether the items were accepted in good condition, which can influence the valuation for tax purposes. By keeping this receipt, donors can ensure they are compliant with tax regulations while also supporting a good cause. Understanding how to properly fill out and retain this form is crucial for anyone looking to maximize their charitable contributions.

Misconceptions

Many people have questions about the Goodwill donation receipt form. Misunderstandings can lead to confusion when donating items. Here are some common misconceptions:

-

Donations are only tax-deductible if I receive a receipt.

While a receipt is helpful, it is not the only requirement for claiming a deduction. You must also keep records of the items donated and their fair market value.

-

I can claim any amount I want for my donated items.

The IRS requires that you use the fair market value of the items. This is the price that someone would pay for the items in their current condition.

-

Goodwill determines the value of my donations.

Goodwill provides a receipt but does not assign a specific value to your items. It is your responsibility to determine their fair market value.

-

I can donate anything, and it will be accepted.

Goodwill has guidelines on what items can be accepted. Items that are damaged or unsafe may not be accepted.

-

The receipt is only for tax purposes.

While the receipt is useful for taxes, it also serves as proof of your charitable contribution. This can be important for personal records.

-

I need to itemize my deductions to benefit from the donation.

To claim a deduction for your donations, you must itemize. However, even if you take the standard deduction, you can still feel good about your charitable contributions.

-

I can only donate items that are in perfect condition.

Goodwill accepts gently used items. They appreciate donations that can still be sold, even if they are not brand new.

-

All donations are treated the same.

Different items have different values. Clothing may have a different fair market value than furniture or electronics.

-

I can get a receipt for items left outside the donation center.

Receipts are only provided for items handed directly to a Goodwill employee. Leaving items outside does not guarantee you will receive a receipt.

Understanding these misconceptions can help you navigate the donation process more effectively. Donating is a generous act, and being informed can enhance your experience.

Goodwill donation receipt: Usage Instruction

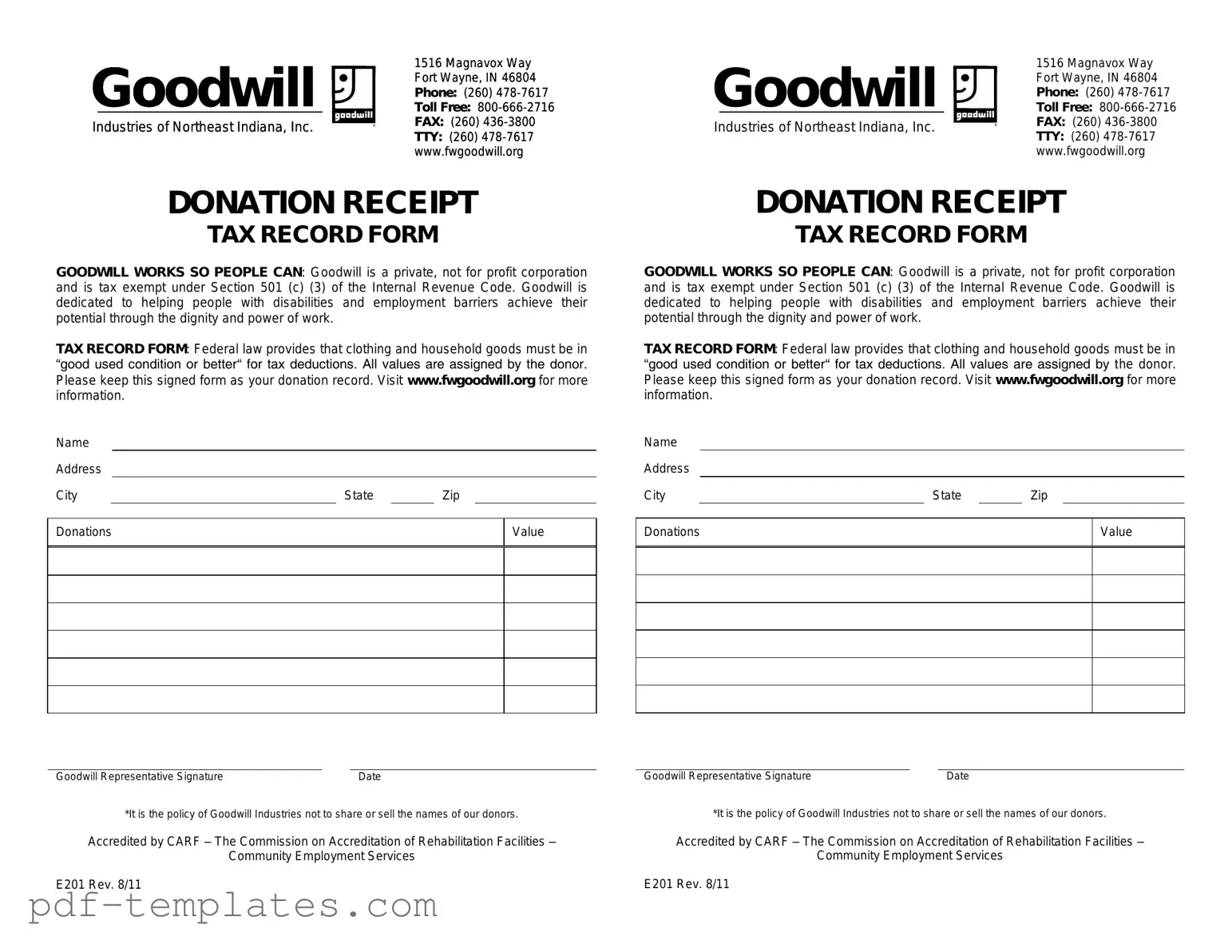

After you have gathered your items for donation, it’s time to fill out the Goodwill donation receipt form. This form serves as a record of your charitable contribution, which may be useful for tax purposes. Follow these steps to complete the form accurately.

- Start with the date of your donation. Write the current date in the designated space.

- Provide your name. Fill in your full name as the donor.

- Enter your address. Include your street address, city, state, and zip code.

- List the items donated. Write a brief description of each item you are donating. Be specific.

- Estimate the value of each item. Assign a fair market value to each item you listed.

- Sign the form. At the bottom, sign your name to confirm the donation.

- Keep a copy. Make sure to keep a copy of the completed form for your records.

Once you have completed the form, you can hand it to the Goodwill representative or place it in the designated area if you are donating at a drop-off location. This receipt will help you track your donations for potential tax deductions.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details on the receipt. This often includes missing names, addresses, or dates of the donation.

-

Incorrect Item Descriptions: Donors sometimes describe items inaccurately or generically. This can lead to confusion during tax filing, as specific item descriptions are necessary for valuation.

-

Failure to Estimate Value: Some people neglect to assign a fair market value to their donated items. This oversight can impact potential tax deductions.

-

Not Keeping a Copy: A common mistake is failing to retain a copy of the receipt. Without a duplicate, individuals may struggle to provide proof of their donations when required.

-

Ignoring Donation Limits: Donors may overlook specific guidelines regarding the maximum allowable deductions for certain types of items. Understanding these limits is crucial for accurate tax reporting.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Goodwill donation receipt form serves as proof of a donation for tax purposes. |

| Tax Deduction | Donors can claim a tax deduction for the fair market value of donated items. |

| Item Description | Donors should describe the items donated on the receipt. |

| Value Assessment | It is the donor's responsibility to determine the value of the donated items. |

| State-Specific Forms | Some states may require specific forms for donations. Check local laws. |

| IRS Guidelines | The IRS provides guidelines on how to value donated items. |

| Non-Cash Donations | The form is primarily used for non-cash donations, such as clothing or household goods. |

| Record Keeping | Donors should keep the receipt for their records and for tax filing. |

| Goodwill's Role | Goodwill provides the receipt upon request when items are donated. |

| Donation Limits | There may be limits on the amount you can claim, depending on the value of items. |

Dos and Don'ts

When filling out the Goodwill donation receipt form, it's important to ensure accuracy and completeness. Here are some guidelines to help you through the process:

- Do: Clearly list all items you are donating. Be specific about each item to avoid confusion later.

- Do: Estimate the fair market value of each item. This will help you when claiming deductions on your taxes.

- Do: Sign and date the receipt. This confirms the transaction and serves as proof of your donation.

- Do: Keep a copy of the receipt for your records. This is important for tax purposes and future reference.

- Don't: Leave any sections blank. Incomplete forms may cause issues with your donation record.

- Don't: Overstate the value of your items. Being honest about the worth is crucial for tax deductions.

Similar forms

The Goodwill donation receipt form shares similarities with the IRS Form 8283, which is used for non-cash charitable contributions. Like the Goodwill receipt, this form provides a record of donations made to qualified organizations. Both documents require detailed descriptions of the donated items and their estimated fair market value. While the Goodwill receipt is typically issued at the point of donation, Form 8283 is often submitted with tax returns to substantiate the claimed deductions, emphasizing the importance of accurate record-keeping for tax purposes.

Another document akin to the Goodwill donation receipt is the Salvation Army donation receipt. This receipt serves a similar purpose, providing donors with proof of their contributions to the organization. It includes details such as the date of the donation, a description of the items given, and the donor's name. Both receipts are essential for individuals seeking to claim tax deductions, as they validate the charitable contributions made throughout the year.

The 501(c)(3) acknowledgment letter is also comparable to the Goodwill receipt. Organizations classified under this designation must provide written acknowledgment for donations exceeding a certain value. This letter includes information about the donor, the date of the donation, and a description of the items. Like the Goodwill receipt, it serves as a formal record for tax purposes, ensuring that donors can substantiate their charitable giving when filing their taxes.

In addition, the donor acknowledgment letter from a local charity functions similarly to the Goodwill receipt. This letter confirms the receipt of donations and may include a description of the items donated and their estimated value. Both documents aim to provide donors with the necessary proof for tax deductions, reinforcing the importance of maintaining accurate records of charitable contributions.

The Form 990, which nonprofit organizations file annually with the IRS, also bears resemblance to the Goodwill donation receipt in terms of financial transparency. While not a receipt per se, Form 990 provides a comprehensive overview of an organization's financial activities, including donations received. This form helps ensure accountability and transparency, allowing donors to understand how their contributions are utilized within the organization, much like the Goodwill receipt confirms the donation process.

The cash donation receipt, which is issued when a donor gives money rather than goods, shares similarities with the Goodwill donation receipt. Both documents serve as proof of the donation and can be used for tax deduction purposes. While the Goodwill receipt details physical items, the cash receipt focuses on monetary contributions, highlighting the diverse ways individuals can support charitable organizations.

The donor intent letter, though less common, can also be compared to the Goodwill donation receipt. This letter outlines the donor's intentions regarding their contributions, whether they are for specific projects or general support. While the Goodwill receipt confirms the donation itself, the intent letter provides context, helping organizations understand how to utilize the donated items or funds effectively.

To ensure a smooth transaction for purchasing firearms, individuals can utilize a Texas firearm bill of sale form, which acts as proof of ownership during the exchange. For a comprehensive understanding and to access the form, please refer to the Texas Firearm Bill of Sale document page.

Lastly, the charitable gift annuity agreement, while more complex, shares a purpose with the Goodwill donation receipt in terms of documenting charitable contributions. This agreement outlines the terms of a donation that provides the donor with fixed payments for life in exchange for a gift to a charity. Both documents serve to formalize the donation process and provide a record for tax purposes, though the gift annuity agreement involves a more intricate arrangement between the donor and the organization.

Other PDF Forms

Odometer Disclosure Texas - This form ensures accurate reporting of a vehicle's mileage at the time of sale.

Understanding the significance of the California Notary Acknowledgement form is essential for anyone navigating legal processes, as it serves to officially validate a signature and the intent behind it. This form is particularly important because it ensures that the signer’s identity is verified and that they are acting voluntarily, thereby preventing fraud and misrepresentation. For those in need of compliant documentation, additional resources can be found, including All California Forms, which provide a comprehensive overview of necessary forms to facilitate these legal transactions.

Living Will Downloadable 5 Wishes Printable Version - This form helps alleviate the burden on family members by clarifying your healthcare preferences in advance.