Get Gift Letter Form in PDF

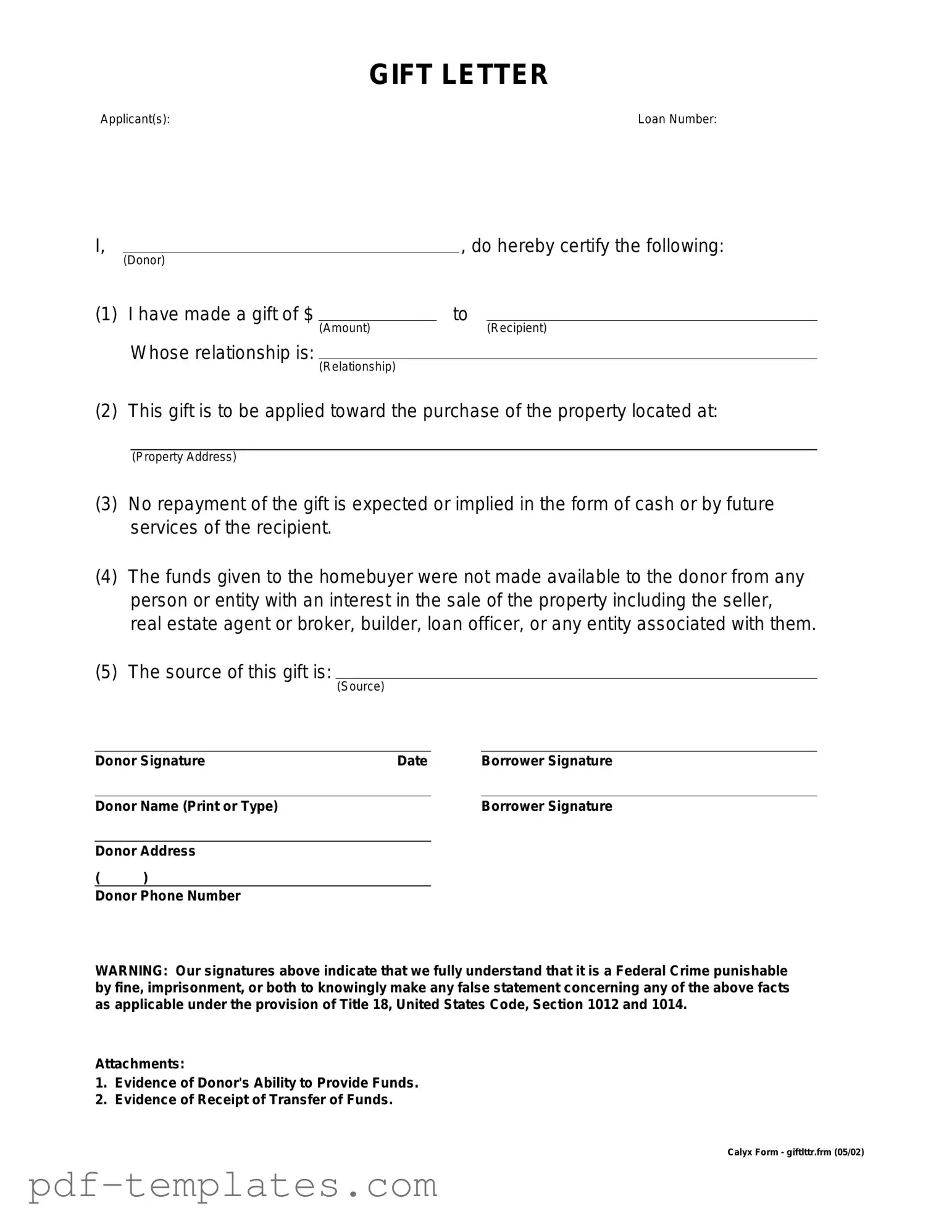

When it comes to purchasing a home, many buyers may receive financial assistance from family or friends in the form of a monetary gift. This is where the Gift Letter form comes into play. It serves as a formal document that outlines the details of the gift, including the amount, the donor’s relationship to the recipient, and a clear statement that the funds are indeed a gift and not a loan. Lenders often require this letter to ensure that the buyer's financial situation is accurately represented, as it can impact mortgage approval. Additionally, the form helps to clarify that the gift will not create any future repayment obligations for the recipient. By providing this information, both the donor and recipient can avoid potential misunderstandings. Understanding the importance of the Gift Letter form is crucial for anyone looking to navigate the complexities of home financing successfully.

Misconceptions

Understanding the Gift Letter form is crucial for many financial transactions, especially in real estate. Here are six common misconceptions surrounding this important document:

-

Gift letters are only necessary for large sums of money.

Many believe that gift letters are only required for significant financial gifts. However, lenders may request a gift letter for any amount, especially if it could impact the borrower’s financial profile.

-

Gift letters can be handwritten and informal.

Some think that a simple handwritten note suffices. In reality, lenders typically require a formal gift letter that includes specific details about the gift, such as the amount and the relationship between the giver and recipient.

-

All gifts require a gift letter.

This is not entirely true. Gifts that do not affect the borrower’s qualifying criteria may not need a gift letter. It’s essential to check with the lender for their specific requirements.

-

Gift letters are only for home purchases.

While commonly associated with home buying, gift letters can also be relevant for other financial transactions, such as securing loans for education or starting a business.

-

Once a gift letter is signed, it cannot be changed.

People often think that a gift letter is set in stone once signed. In fact, if circumstances change, a revised letter can be issued to reflect the new situation.

-

Gift letters do not need to be notarized.

While notarization is not always required, some lenders may prefer or require it to verify the authenticity of the gift. Always confirm the specific requirements with your lender.

By addressing these misconceptions, individuals can better navigate the process involving gift letters and ensure compliance with lender requirements.

Gift Letter: Usage Instruction

Once you have your Gift Letter form ready, it’s time to fill it out accurately. This document typically serves as a declaration that funds are a gift and not a loan, which is crucial in various financial transactions, such as mortgage applications. Follow these steps to ensure you complete the form correctly.

- Start with the date at the top of the form. Write the current date in the designated space.

- Provide the name of the donor. This is the person giving the gift. Include their full name as it appears on their identification.

- Next, enter the donor's address. Make sure to include the street address, city, state, and zip code.

- In the following section, write the recipient's name. This is the person receiving the gift.

- Fill in the recipient's address, including the street address, city, state, and zip code.

- Indicate the amount of the gift. Be clear and precise, using numerals and words to avoid any confusion.

- Provide a brief description of the purpose of the gift. This could be related to a home purchase, education, or other financial needs.

- Sign the form as the donor. Include your signature in the designated area, confirming the information provided is accurate.

- Finally, if required, have the form notarized. This step may not be necessary for all situations, but it can add an extra layer of authenticity.

Common mistakes

-

Inaccurate Donor Information: Many individuals fail to provide complete and accurate details about the donor. This includes the donor's full name, address, and relationship to the recipient. Missing or incorrect information can lead to delays in processing.

-

Insufficient Recipient Information: Just as donor details are crucial, the recipient's information must also be precise. Omitting the recipient's full name or address can create confusion and complications.

-

Not Specifying the Gift Amount: Some people neglect to clearly state the exact amount of the gift. Without this information, lenders may question the legitimacy of the funds.

-

Failure to Sign the Letter: A common oversight is not obtaining the donor's signature. This step is essential to validate the gift and confirm that the donor is aware of the transaction.

-

Omitting the Date: It is important to include the date when the gift is given. Without this, it may be unclear when the transaction took place, which could raise questions during the review process.

-

Not Including a Statement of No Repayment: Some individuals forget to add a clear statement indicating that the gift does not need to be repaid. This clarification is vital for lenders to understand the nature of the funds.

-

Ignoring Additional Documentation: Many people overlook the need to attach supporting documents, such as bank statements or proof of funds. Providing these documents can strengthen the credibility of the gift.

File Specifics

| Fact Name | Description |

|---|---|

| Definition | A gift letter is a document used to confirm that a monetary gift is not a loan and does not need to be repaid. |

| Purpose | It is often used in real estate transactions to help a borrower qualify for a mortgage. |

| Content Requirements | The letter typically includes the donor's name, the recipient's name, the amount of the gift, and a statement confirming that it is a gift. |

| Signature | The donor must sign the letter to validate the gift and confirm their intent. |

| State-Specific Forms | Some states may have specific requirements for gift letters, so it's important to check local laws. |

| Tax Implications | Gift amounts over a certain threshold may have tax implications for the donor, as per IRS regulations. |

| Loan vs. Gift | Clarifying that the funds are a gift helps lenders assess the borrower's financial situation accurately. |

| Format | The letter can be handwritten or typed, but clarity and professionalism are important. |

| Documentation | It is advisable to keep a copy of the gift letter for personal records and for any future financial transactions. |

Dos and Don'ts

When filling out the Gift Letter form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are seven important dos and don'ts to consider:

- Do provide complete and accurate information about the donor.

- Do clearly state the amount of the gift.

- Do include the relationship between the donor and the recipient.

- Do sign and date the letter to validate it.

- Don't use vague language that may confuse the intent of the gift.

- Don't omit any required details, as this could delay processing.

- Don't forget to keep a copy of the letter for your records.

Adhering to these guidelines will help ensure that the Gift Letter form is filled out correctly and efficiently.

Similar forms

The Gift Letter form is often compared to the Affidavit of Support. Both documents serve as declarations of financial support, but they differ in their applications. An Affidavit of Support is typically used in immigration cases, where a sponsor pledges to support a foreign national financially. In contrast, a Gift Letter confirms that a financial contribution is a gift, not a loan, which is crucial for various financial transactions, especially in real estate. This clarity helps lenders assess the borrower's financial situation without concerns about repayment obligations.

Another document similar to the Gift Letter is the Loan Agreement. While a Loan Agreement outlines the terms under which money is borrowed and must be repaid, the Gift Letter explicitly states that the funds provided do not require repayment. This distinction is vital for both parties involved. The clarity provided by the Gift Letter can simplify the mortgage approval process, as lenders prefer to see that the funds are genuinely a gift, reducing the risk of additional debt for the borrower.

Understanding the importance of the Mobile Home Bill of Sale is crucial for a smooth transaction. This detailed Mobile Home Bill of Sale form ensures that both parties are fully informed and protected throughout the sale process.

The Promissory Note also shares similarities with the Gift Letter. A Promissory Note is a written promise to pay back borrowed money, detailing the amount, interest rate, and repayment schedule. In contrast, the Gift Letter assures the recipient that the funds are a gift, removing any obligation to repay. This difference is significant in financial contexts, as it influences how lenders evaluate the borrower's debt-to-income ratio and overall financial health.

The Financial Gift Declaration is another document that aligns closely with the Gift Letter. Like the Gift Letter, this declaration confirms that funds given to a recipient are a gift. However, the Financial Gift Declaration may include additional details about the donor's financial situation or the purpose of the gift. Both documents aim to clarify the nature of the funds, but the Financial Gift Declaration may provide more context, which can be beneficial in certain financial transactions.

The Donor's Statement of Gift is also akin to the Gift Letter. This statement typically includes details about the donor, the recipient, and the amount given. It serves a similar purpose: to confirm that the funds are a gift rather than a loan. However, the Donor's Statement of Gift may also include tax implications, which can be important for both the donor and recipient. Understanding these implications can help both parties navigate potential tax responsibilities associated with large gifts.

Lastly, the Charitable Contribution Receipt shares some characteristics with the Gift Letter. While a Charitable Contribution Receipt is used to document donations made to nonprofit organizations, it also serves to confirm that no goods or services were exchanged for the contribution. This is akin to the Gift Letter's function of clarifying that the funds provided are a gift. Both documents help ensure transparency in financial transactions and can be useful for tax purposes, although their specific applications differ significantly.

Other PDF Forms

I 983 - It asks for a clearly defined outline of the training opportunity.

In addition to the essential information required in the California Rental Application form, landlords can streamline the tenant selection process by utilizing resources such as All California Forms, which provide templates and guidance on navigating the application process effectively.

What Is Signature Release - Keep a copy of this form for your records after submission.

High School Transcript - Transcripts should be reviewed for accuracy, as mistakes can impact college admissions and scholarships.