Gift Deed Document

When it comes to transferring property without the exchange of money, a Gift Deed form plays a crucial role. This legal document allows individuals to convey ownership of real estate or personal property to another person as a gift, ensuring that the transfer is recognized and documented. One of the key aspects of a Gift Deed is that it must be executed voluntarily, reflecting the true intent of the giver. Additionally, the form typically requires the inclusion of specific details such as the names of both the donor and the recipient, a clear description of the property being gifted, and any conditions that may apply to the transfer. It is also important to note that the Gift Deed must be signed and witnessed to be legally valid. Understanding the nuances of this document can help individuals navigate the process of gifting property, ensuring that their intentions are honored and legally upheld.

Misconceptions

Many people hold misconceptions about the Gift Deed form. Understanding the truth behind these misconceptions can help individuals make informed decisions. Here are five common misconceptions:

- Gift Deeds are only for family members. Many believe that Gift Deeds can only be used to transfer property between family members. In reality, anyone can gift property to anyone else, as long as both parties agree to the terms.

- A Gift Deed does not need to be in writing. Some think that verbal agreements are sufficient for gifting property. However, a Gift Deed must be in writing to be legally valid and enforceable.

- Gift Deeds are the same as wills. While both involve the transfer of property, they serve different purposes. A Gift Deed transfers ownership immediately, whereas a will only takes effect after the person's death.

- Gifting property incurs no tax implications. Many assume that gifting property is tax-free. In truth, depending on the value of the gift, there may be gift tax implications that the donor needs to consider.

- Once a Gift Deed is signed, it cannot be revoked. Some believe that a Gift Deed is irrevocable. However, under certain circumstances, a donor can revoke a Gift Deed if both parties agree or if specific conditions are not met.

Clarifying these misconceptions can lead to better understanding and more effective use of Gift Deeds in property transactions.

Gift Deed - Customized for State

Gift Deed: Usage Instruction

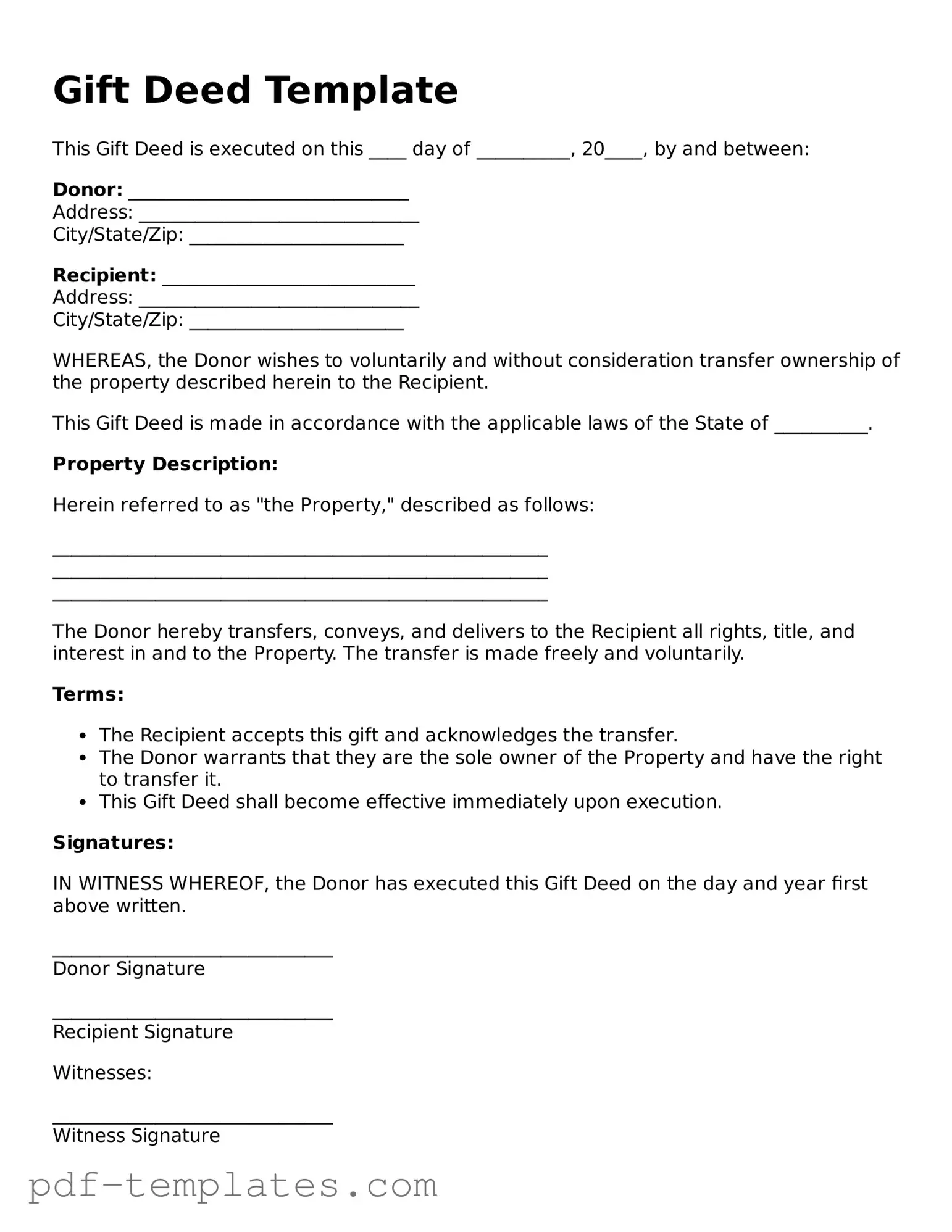

After gathering the necessary information, you can proceed to fill out the Gift Deed form. This form will require specific details about the donor and the recipient, as well as information about the property being gifted. Ensure that all information is accurate to avoid any complications later.

- Begin by entering the full name of the donor in the designated space.

- Provide the address of the donor, including the city, state, and zip code.

- Next, fill in the full name of the recipient.

- Enter the recipient's address, ensuring it is complete with city, state, and zip code.

- Describe the property being gifted. Include details such as the type of property, address, and any relevant identification numbers.

- Specify the date of the gift in the appropriate section.

- Both the donor and recipient should sign the form where indicated.

- Have the signatures notarized if required, as this may be necessary for legal validity.

- Finally, make copies of the completed form for both parties' records.

Common mistakes

When filling out a Gift Deed form, individuals often encounter several common mistakes that can lead to complications. Below is a list of four significant errors to avoid:

-

Incomplete Information: Failing to provide all necessary details can invalidate the deed. Ensure that all required fields, such as the names of the donor and recipient, property description, and signatures, are filled out completely.

-

Incorrect Property Description: A vague or inaccurate description of the property being gifted can lead to disputes. Always include a precise legal description, including boundaries and any identifying information.

-

Not Having Witnesses: Many states require that a Gift Deed be signed in the presence of witnesses. Neglecting this step can result in the deed being deemed unenforceable.

-

Failure to Record the Deed: After completion, it is crucial to record the Gift Deed with the appropriate local government office. Failing to do so may prevent the recipient from asserting their rights to the property.

By being aware of these common pitfalls, individuals can ensure a smoother process when completing their Gift Deed form.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document that allows one person to transfer ownership of property to another without any exchange of money. |

| State-Specific Forms | Each state may have its own specific form for a Gift Deed. It's important to check local regulations to ensure compliance. |

| Governing Laws | In the United States, the laws governing Gift Deeds vary by state. For example, California Civil Code Section 1146 outlines the requirements for a valid gift. |

| Tax Implications | Gifts may have tax implications. The IRS allows a certain annual exclusion amount, which changes periodically, so it's wise to consult a tax professional. |

| Revocation | Once executed, a Gift Deed generally cannot be revoked unless specific conditions are met. This underscores the importance of understanding the commitment involved. |

Dos and Don'ts

When filling out a Gift Deed form, there are several important dos and don'ts to keep in mind. Following these guidelines can help ensure that your gift is legally valid and recognized.

- Do provide accurate information about the donor and recipient. Ensure that names, addresses, and other details are correct.

- Do clearly describe the gift being given. Include specifics like the type of property or assets involved.

- Do have the document notarized. This adds an extra layer of authenticity and can help prevent disputes later.

- Do keep a copy of the completed form for your records. This can be useful for future reference.

- Don't leave any sections blank. Incomplete forms can lead to complications or invalidate the deed.

- Don't use vague language. Be precise in your descriptions to avoid misunderstandings.

- Don't forget to check state-specific requirements. Different states may have unique rules regarding gift deeds.

- Don't rush through the process. Take your time to ensure everything is filled out correctly.

Similar forms

A Quitclaim Deed is a legal document that transfers ownership of property from one party to another without any guarantees or warranties. Like a Gift Deed, it can be used to transfer property without monetary exchange. However, a Quitclaim Deed typically does not involve a gift; it is often used to clear up title issues or transfer property between family members or co-owners. Both documents require the signature of the grantor, but a Quitclaim Deed does not necessitate the same level of intention to gift as a Gift Deed does.

A Warranty Deed is another document similar to a Gift Deed, as it also transfers property ownership. Unlike a Gift Deed, a Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. This document is often used in real estate transactions involving a sale, ensuring that the buyer is protected against future claims to the property. While both documents serve to transfer ownership, a Warranty Deed offers more legal protection than a Gift Deed.

A Texas Vehicle Purchase Agreement is a legal document that outlines the terms and conditions of a vehicle sale between a buyer and a seller. This form serves to protect both parties by detailing the specifics of the transaction, including the sale price, vehicle information, and any warranties or representations. Understanding this agreement is essential for ensuring a smooth and legally compliant purchase process, and you can find a blank template for this form at https://documentonline.org/blank-texas-vehicle-purchase-agreement/.

A Deed of Trust is similar to a Gift Deed in that it involves property transfer, but it serves a different purpose. This document is used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. The borrower conveys the property to the trustee, who holds it as security for the loan. While a Gift Deed transfers property without consideration, a Deed of Trust involves financial obligations, highlighting the differing intents behind these documents.

An Easement is a legal document that grants one party the right to use another party's property for a specific purpose. While it does not transfer ownership like a Gift Deed, it allows for certain rights over the property. Both documents require the consent of the property owner, but an Easement does not involve a transfer of title. Instead, it creates a limited right that can benefit another property, emphasizing the different legal implications of property use versus ownership transfer.

A Lease Agreement also shares similarities with a Gift Deed in that it involves property rights. However, a Lease Agreement grants temporary possession and use of property in exchange for payment, unlike a Gift Deed, which involves a permanent transfer of ownership without compensation. Both documents require clear terms and mutual consent, but the Lease Agreement is a contractual arrangement that outlines specific conditions for use, while a Gift Deed is a one-time transfer without ongoing obligations.

Finally, a Power of Attorney can be compared to a Gift Deed in that it allows one person to act on behalf of another regarding property matters. While a Gift Deed transfers ownership outright, a Power of Attorney grants authority to manage or dispose of property, including the ability to execute a Gift Deed. Both documents require the principal's consent, but a Power of Attorney is a temporary arrangement that can be revoked, whereas a Gift Deed is a permanent transfer of property rights.

Additional Types of Gift Deed Templates:

Quit Claim Deed Iowa - This deed can help streamline transactions when dealing with properties inherited from deceased relatives.

Having a clear understanding of your rights regarding medical decisions is essential, and the California Medical Power of Attorney form serves as a vital tool in this process. It empowers individuals to designate a trusted person to advocate for their healthcare choices when they are unable to express their desires. If you're looking for comprehensive resources to help you navigate these important decisions, you can find them in All California Forms, ensuring that your preferences are honored even in challenging times.

Correction Deed California - A Corrective Deed can streamline the real estate transaction process.

Lady Bird Document - With a Lady Bird Deed, the owner retains control over the property during their lifetime.