Get Generic Direct Deposit Form in PDF

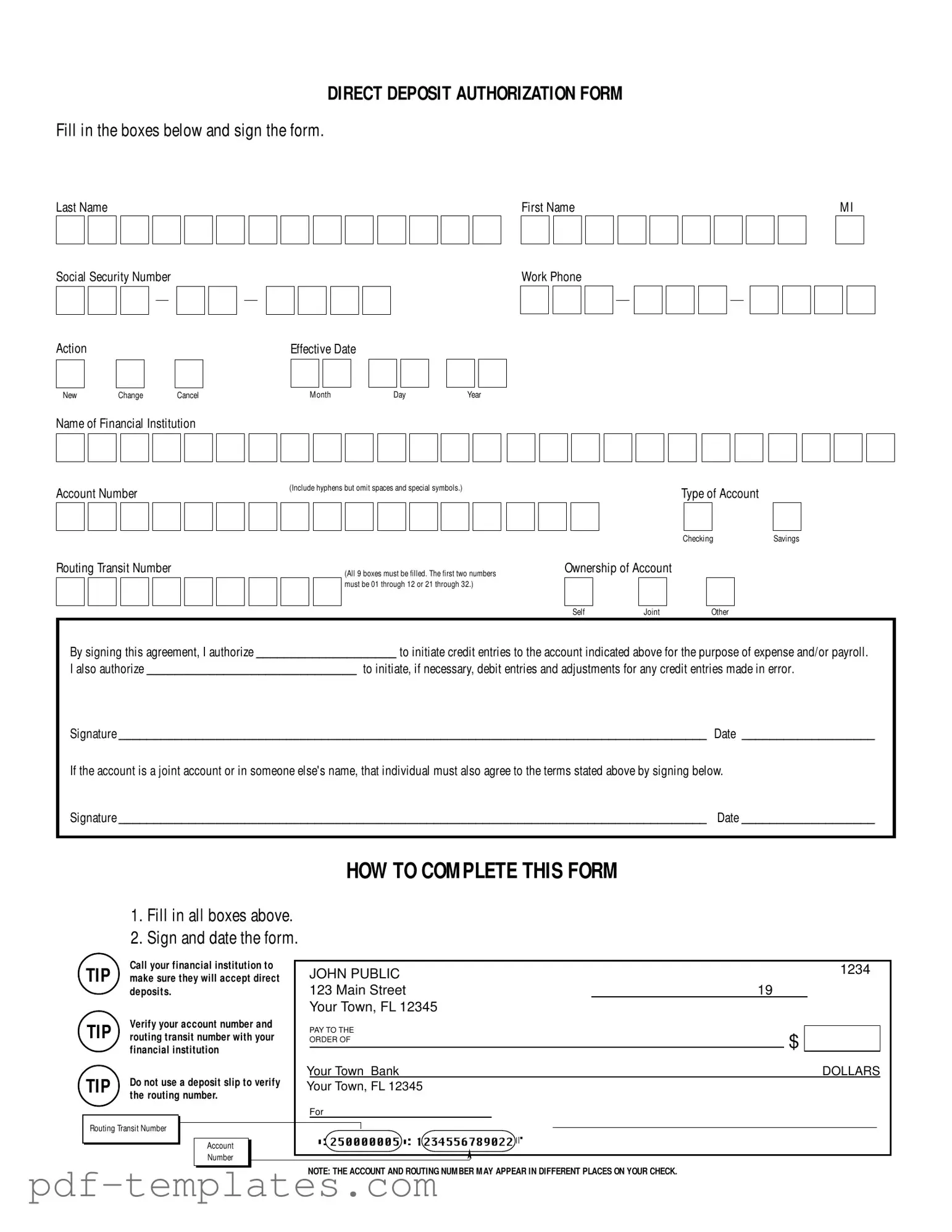

The Generic Direct Deposit form is a crucial document for anyone looking to streamline their payment process, whether for payroll or expense reimbursements. This form simplifies the way individuals receive funds by allowing them to authorize direct deposits into their bank accounts. Key elements include personal identification details such as your name and Social Security number, as well as the specifics of your financial institution, including the account number and routing transit number. It’s essential to indicate the type of account—either checking or savings—so that the funds are deposited correctly. The form also requires your signature to validate the authorization, and if the account is joint, another signature is needed. Completing this form is straightforward; you fill in the required boxes, sign, and date it. Additionally, tips are provided to ensure accuracy, such as verifying your account details with your bank before submission. This form not only enhances efficiency but also provides peace of mind, knowing that payments will be deposited directly into your account without delay.

Misconceptions

- Misconception 1: The Generic Direct Deposit form is only for payroll deposits.

- Misconception 2: You need to fill out the entire form every time you want to make a change.

- Misconception 3: The routing number and account number can be found on any document.

- Misconception 4: Only one person can authorize a joint account for direct deposit.

- Misconception 5: You can submit the form without a signature.

- Misconception 6: The form can be submitted without checking with your financial institution.

- Misconception 7: All banks have the same requirements for direct deposit forms.

- Misconception 8: The effective date of the direct deposit can be immediate.

- Misconception 9: Once you set up direct deposit, you never have to check it again.

This form can be used for various types of deposits, not just payroll. It may also be utilized for expense reimbursements and other credit entries.

If you are making a change to an existing direct deposit, you only need to complete the sections that have changed. However, always ensure that you sign and date the form.

It's crucial to verify these numbers directly with your financial institution. Using a deposit slip may lead to errors, as the numbers can appear in different places on checks.

In the case of a joint account, all account holders must agree to the terms by signing the form. This ensures that everyone is aware of the direct deposit arrangement.

A signature is essential for the authorization to be valid. Without it, the financial institution will not process the direct deposit request.

Before submitting the form, it is wise to contact your bank to confirm that they accept direct deposits and to verify your account details.

Different financial institutions may have specific requirements or additional forms. Always check with your bank to ensure you meet their criteria.

While some banks may process requests quickly, it can take several business days for a direct deposit to become effective. Plan accordingly to avoid any disruptions in your payments.

It is important to regularly monitor your account statements. This helps ensure that deposits are being made correctly and allows you to catch any potential issues early.

Generic Direct Deposit: Usage Instruction

After completing the Generic Direct Deposit form, it will be processed by your financial institution. Make sure to double-check all information for accuracy to avoid any delays in setting up your direct deposit.

- Fill in your last name, first name, and middle initial in the designated boxes.

- Provide your Social Security Number in the specified format.

- Select the appropriate action by checking the box for New, Change, or Cancel.

- Enter the effective date using the month, day, and year format.

- Include your work phone number in the provided space.

- Write the name of your financial institution clearly.

- Fill in your account number, including hyphens and omitting spaces or special symbols.

- Indicate the type of account by checking either Savings or Checking.

- Enter the Routing Transit Number, ensuring all nine boxes are filled and the first two numbers fall within the specified range.

- Select the ownership of the account by checking the appropriate box: Self, Joint, or Other.

- Sign and date the form to authorize the entries to your account.

- If applicable, have the other account holder sign and date the form as well.

It is advisable to contact your financial institution to confirm that they will accept direct deposits. Additionally, verify your account number and routing transit number with them, as these numbers may appear in different places on your checks.

Common mistakes

-

Not filling in all required fields. Each box on the form must be completed. Leaving any field blank can lead to processing delays.

-

Providing incorrect Social Security Number. Ensure that the number is accurate to avoid issues with payroll or deposits.

-

Forgetting to sign the form. Your signature is necessary to authorize the direct deposit.

-

Using a deposit slip to verify the routing number. This can lead to errors, as the routing number may not be the same on a deposit slip as it is on your checks.

-

Not confirming the account type. Make sure to select either Savings or Checking to ensure the funds go to the correct account.

-

Omitting the effective date. This date is important for the processing of your direct deposit.

-

Failing to check with the financial institution. Call to confirm they accept direct deposits and verify your account details.

-

Neglecting to include hyphens in the account number. This can result in an invalid account number and cause delays.

-

Not having joint account holders sign. If the account is joint, all parties must agree by signing the form.

File Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The Generic Direct Deposit form allows individuals to authorize the electronic transfer of funds into their bank accounts. |

| Required Information | Applicants must provide their name, Social Security number, account details, and signatures for authorization. |

| Account Types | Depositors can choose between a savings or checking account for direct deposit transactions. |

| Routing Number | The routing transit number must consist of 9 digits, with specific rules regarding the first two digits. |

| Governing Law | In Florida, the governing laws regarding direct deposits include the Florida Statutes, specifically Chapter 655. |

| Joint Accounts | If the account is joint, all account holders must sign the form to authorize direct deposit. |

| Completion Tips | It is advised to verify account information with the financial institution before submitting the form. |

Dos and Don'ts

When filling out the Generic Direct Deposit form, attention to detail is crucial. The following list outlines key actions to take and avoid, ensuring a smooth and successful submission.

- Do fill in all required boxes completely.

- Do sign and date the form to validate your authorization.

- Do confirm with your financial institution that they accept direct deposits.

- Do double-check your account number and routing transit number for accuracy.

- Do ensure that the routing transit number consists of exactly nine digits.

- Don't use a deposit slip to verify the routing number; contact your bank instead.

- Don't leave any boxes blank, as this may delay processing.

- Don't forget to obtain the necessary signatures if the account is joint.

- Don't include any special symbols or spaces in the account number.

Similar forms

The Generic Direct Deposit form shares similarities with the Payroll Deduction Authorization form. Both documents are used to manage how funds are deposited or withdrawn from a bank account. The Payroll Deduction Authorization form allows employees to authorize their employer to deduct specific amounts from their paychecks for various purposes, such as retirement contributions or health insurance premiums. Like the Direct Deposit form, it requires personal information, including the employee's name and Social Security number, and must be signed to be valid. Both documents aim to streamline financial transactions, ensuring that funds are managed efficiently and accurately.

Another document similar to the Generic Direct Deposit form is the Automatic Payment Authorization form. This form enables individuals to authorize recurring payments directly from their bank accounts, such as utility bills or loan payments. Like the Direct Deposit form, it requires essential banking details, including the account number and routing number, to facilitate transactions. Both forms serve the purpose of automating financial processes, reducing the need for manual payments, and ensuring timely transactions. The signature requirement ensures that the account holder agrees to the terms of the arrangement.

The Direct Deposit form is also comparable to the Bank Account Change Request form. When individuals need to update their banking information, such as switching to a new account for direct deposits, they often use this type of form. It typically requires the same basic information, including the new account number and routing number. Both forms aim to ensure that funds are deposited into the correct account, minimizing errors and delays in payment processing. The Bank Account Change Request form may also require a signature to confirm the account holder’s consent to the changes.

To facilitate the sale of a trailer, it is important to use a comprehensive form such as a Trailer Bill of Sale document. This form helps to officially certify the transfer of ownership while detailing essential information about the trailer, ensuring all parties involved have a clear understanding of the transaction.

Lastly, the Generic Direct Deposit form is similar to the Tax Refund Direct Deposit form. This document allows individuals to request that their tax refunds be deposited directly into their bank accounts rather than receiving a check. Like the Direct Deposit form, it requires the taxpayer's personal information, including their name and Social Security number, as well as banking details. Both forms streamline the process of receiving funds, ensuring that payments are delivered quickly and securely. The signature on the Tax Refund Direct Deposit form serves as a confirmation of the taxpayer's authorization for the direct deposit transaction.

Other PDF Forms

Family Law Financial Affidavit Short Form Florida - The financial affidavit form is designed to promote fair negotiation between parties involved.

The process of notifying your local school district about your intention to homeschool is initiated by completing the New York Homeschool Letter of Intent. This crucial document ensures that you are formally recognized as a homeschooling parent, which is essential for laying the groundwork for your child’s education outside of traditional schooling. For those looking to embark on this journey, it's important to understand the requirements and steps involved, including the necessary Homeschool Letter of Intent form that must be submitted.

Wage and Tax Statement - Identifying errors prior to tax season can save significant time and stress for both employers and employees.