Get Free And Invoice Pdf Form in PDF

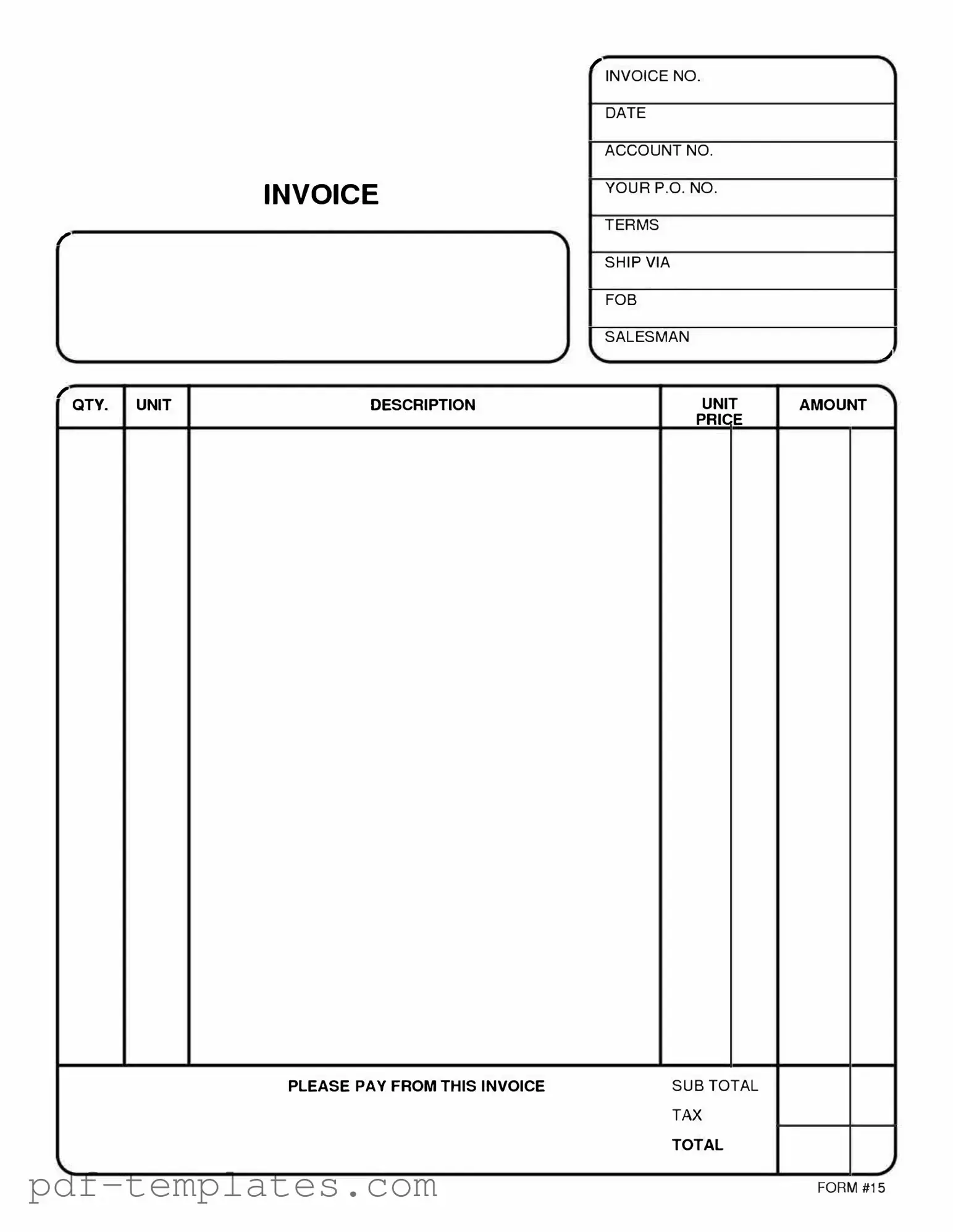

The Free And Invoice PDF form serves as a crucial tool for individuals and businesses alike, streamlining the process of billing and invoicing. This form allows users to create professional-looking invoices that can be easily customized to fit specific needs. Users can input essential details such as the recipient's information, item descriptions, quantities, and prices. Additionally, the form typically includes fields for payment terms and due dates, ensuring clarity in financial transactions. By utilizing this form, users can maintain organized records of their sales and purchases, which is vital for accounting and tax purposes. The convenience of a PDF format ensures that the invoices can be easily shared via email or printed for physical delivery. Overall, the Free And Invoice PDF form simplifies the invoicing process, making it accessible to everyone from freelancers to large corporations.

Misconceptions

Understanding the Free And Invoice PDF form is crucial for accurate financial documentation. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings about this form.

- It is only for businesses. Many individuals also use the Free And Invoice PDF form for personal transactions, not just businesses.

- It requires extensive technical knowledge. The form is designed to be user-friendly, allowing anyone to fill it out without advanced skills.

- It can only be used in specific industries. The form is versatile and applicable across various sectors, including retail, services, and freelancing.

- It is not legally binding. When filled out correctly, the form serves as a legal document for transactions.

- Only one version exists. Multiple templates are available, catering to different needs and preferences.

- It cannot be customized. Users can modify the form to include specific details relevant to their transactions.

- It is outdated. The Free And Invoice PDF form is regularly updated to meet current standards and user needs.

- It does not support digital signatures. Many versions of the form allow for digital signatures, enhancing convenience.

- It is only available in English. Translations may be available, making it accessible to non-English speakers.

- Filling it out takes too much time. With practice, completing the form can be a quick and efficient process.

By addressing these misconceptions, users can better utilize the Free And Invoice PDF form for their financial documentation needs.

Free And Invoice Pdf: Usage Instruction

Filling out the Free And Invoice PDF form is a straightforward process that requires attention to detail. Once you have the form ready, you will be able to provide the necessary information to complete your invoice accurately. Follow these steps to ensure you fill out the form correctly.

- Open the Free And Invoice PDF form on your device.

- Begin by entering your name in the designated field at the top of the form.

- Next, fill in your contact information, including your address, phone number, and email address.

- Move on to the section for the recipient's details. Input the recipient's name and contact information.

- In the itemized list section, specify the products or services provided. Include a description, quantity, and price for each item.

- Calculate the total amount due by summing the prices of all items listed.

- If applicable, include any taxes or additional fees in the designated area.

- Review all the information you have entered to ensure accuracy.

- Once everything is correct, save the form to your device.

- Finally, print the form or send it electronically to the recipient as needed.

Common mistakes

-

Incomplete Information: One of the most common mistakes is leaving out essential details. Make sure to fill in all required fields, such as your name, address, and payment information. Missing even a small piece of information can delay processing.

-

Incorrect Formatting: People often overlook the formatting requirements for dates, phone numbers, or monetary amounts. Ensure you follow the specified format to avoid confusion and potential errors.

-

Using Inaccurate Figures: Double-check the amounts you enter. Whether it’s the total due or tax calculations, inaccuracies can lead to significant issues later on.

-

Neglecting to Review: After filling out the form, some individuals forget to review their entries. A quick review can catch mistakes before submission, saving time and hassle.

-

Ignoring Instructions: Each form typically comes with specific instructions. Failing to read these can lead to misunderstandings and errors in how the form should be completed.

-

Not Saving a Copy: Once submitted, many forget to save a copy of the completed form for their records. Keeping a copy can be invaluable for future reference or in case of disputes.

-

Submitting Late: Timing is crucial. Some people submit their forms after the deadline, which can result in penalties or missed opportunities. Always be mindful of submission deadlines.

File Specifics

| Fact Name | Details |

|---|---|

| Document Type | Free and Invoice PDF Form |

| Purpose | This form is used for creating invoices in a PDF format. |

| Cost | The form is available for free. |

| Accessibility | Users can access the form online and download it easily. |

| Compatibility | The form is compatible with various PDF readers and editors. |

| State-Specific Use | Some states may have specific requirements for invoices. |

| Governing Law | Each state has its own laws regarding invoicing and payment terms. |

| Customization | The form allows for customization to include business logos and details. |

Dos and Don'ts

When filling out the Free And Invoice PDF form, it’s essential to follow some best practices to ensure your submission is accurate and complete. Here’s a helpful list of things to do and avoid:

- Do read the instructions carefully before starting.

- Do fill in all required fields completely.

- Do double-check your information for accuracy.

- Do use clear and legible handwriting if filling out by hand.

- Do save a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use abbreviations or slang that may cause confusion.

- Don't submit the form without reviewing it first.

- Don't forget to sign and date the form if required.

Following these guidelines can help ensure your Free And Invoice PDF form is processed smoothly and efficiently.

Similar forms

The Free Invoice Template is similar to a Standard Invoice. Both documents serve the purpose of requesting payment for goods or services rendered. A Standard Invoice typically includes details such as the seller's and buyer's information, a description of the items sold, the total amount due, and payment terms. The Free Invoice Template may offer a more simplified layout, making it user-friendly for small businesses or freelancers.

Another document that resembles the Free Invoice Template is the Pro Forma Invoice. A Pro Forma Invoice is often used before a sale is finalized, providing an estimate of costs. While a Free Invoice Template is issued after services are completed, the Pro Forma Invoice helps clients understand potential charges before committing to a purchase. Both documents outline similar information but serve different purposes in the transaction process.

The Receipt is also comparable to the Free Invoice Template. A Receipt is a document that confirms payment has been made for goods or services. While an invoice requests payment, a receipt acknowledges that payment has been received. Both documents contain similar details, such as transaction dates and amounts, but differ in their function within the payment process.

The Bill is another document that shares similarities with the Free Invoice Template. A Bill is a statement of charges for services or goods provided, often used in ongoing services like utilities. Like an invoice, it details the amount owed and payment terms. However, a Bill is typically more straightforward, while an invoice may include additional information like itemized lists and tax details.

The Sales Order is also related to the Free Invoice Template. A Sales Order is a confirmation of a purchase made by a buyer. It outlines the specifics of the order, including quantities and prices. While the Free Invoice Template is issued after the sale, the Sales Order serves as an agreement before payment, ensuring both parties understand the transaction's terms.

The Purchase Order is similar to the Free Invoice Template in that it initiates the purchasing process. A Purchase Order is created by the buyer and sent to the seller, detailing what is being ordered. Once the seller accepts the Purchase Order, it can lead to the generation of an invoice. Both documents play crucial roles in the transaction process, but they are used at different stages.

The Credit Note is another document that has a connection to the Free Invoice Template. A Credit Note is issued to the buyer, indicating a reduction in the amount owed, often due to returned goods or overbilling. While an invoice outlines what is owed, a Credit Note serves to adjust that amount, maintaining accurate records for both parties.

The Statement of Account is similar as well, as it summarizes all transactions between a buyer and seller over a specific period. This document provides an overview of invoices issued, payments received, and any outstanding balances. While the Free Invoice Template focuses on individual transactions, the Statement of Account offers a broader view of the financial relationship.

Lastly, the Work Order shares similarities with the Free Invoice Template. A Work Order is a document that authorizes work to be done and may include details about the services to be provided. It is often used in service industries. While the Free Invoice Template is issued after work is completed, the Work Order initiates the process, ensuring both parties agree on the work to be performed.

Other PDF Forms

Cdph Tb Risk Assessment - This form promotes proper record-keeping within healthcare systems regarding TB testing.

Odometer Disclosure Texas - Double-check odometer readings against physical inspection before signing.