Official Transfer-on-Death Deed Template for Florida State

The Florida Transfer-on-Death Deed (TODD) is a valuable estate planning tool that allows property owners to transfer real estate to designated beneficiaries upon their death, without the need for probate. This straightforward form enables individuals to maintain control over their property during their lifetime while ensuring a seamless transfer process for their heirs. One of the key advantages of the TODD is that it can be revoked or modified at any time before the owner’s death, providing flexibility in estate planning. Additionally, the form must be executed in accordance with specific legal requirements, including notarization and recording with the county clerk, to ensure its validity. By utilizing the Transfer-on-Death Deed, property owners in Florida can simplify the transfer of their assets, reduce potential disputes among heirs, and ultimately provide peace of mind regarding their estate. Understanding the intricacies of this form is essential for anyone considering its use as part of their estate planning strategy.

Misconceptions

Understanding the Florida Transfer-on-Death Deed (TOD) form is essential for anyone considering estate planning in the state. However, several misconceptions often arise regarding its use and implications. Here are four common misconceptions:

- Misconception 1: The Transfer-on-Death Deed avoids probate entirely.

- Misconception 2: A Transfer-on-Death Deed can be revoked only through a court process.

- Misconception 3: The beneficiary of a TOD deed automatically has ownership of the property during the owner's lifetime.

- Misconception 4: All types of property can be transferred using a Transfer-on-Death Deed.

This is partially true. While the TOD deed allows for the direct transfer of property to a beneficiary upon the owner's death, it does not prevent probate for other assets. If the deceased had other assets that require probate, those will still go through the probate process.

This is incorrect. The owner can revoke a TOD deed at any time before their death without needing to go to court. This can be done by creating a new deed that explicitly revokes the previous one or by recording a formal revocation document.

This misconception is common. The beneficiary does not gain any rights to the property while the owner is still alive. The owner retains full control and ownership until their death, at which point the property transfers to the beneficiary.

This is not entirely accurate. While the TOD deed works for real property, it cannot be used for other types of assets, such as bank accounts or personal property. Each type of asset may require different estate planning tools.

Florida Transfer-on-Death Deed: Usage Instruction

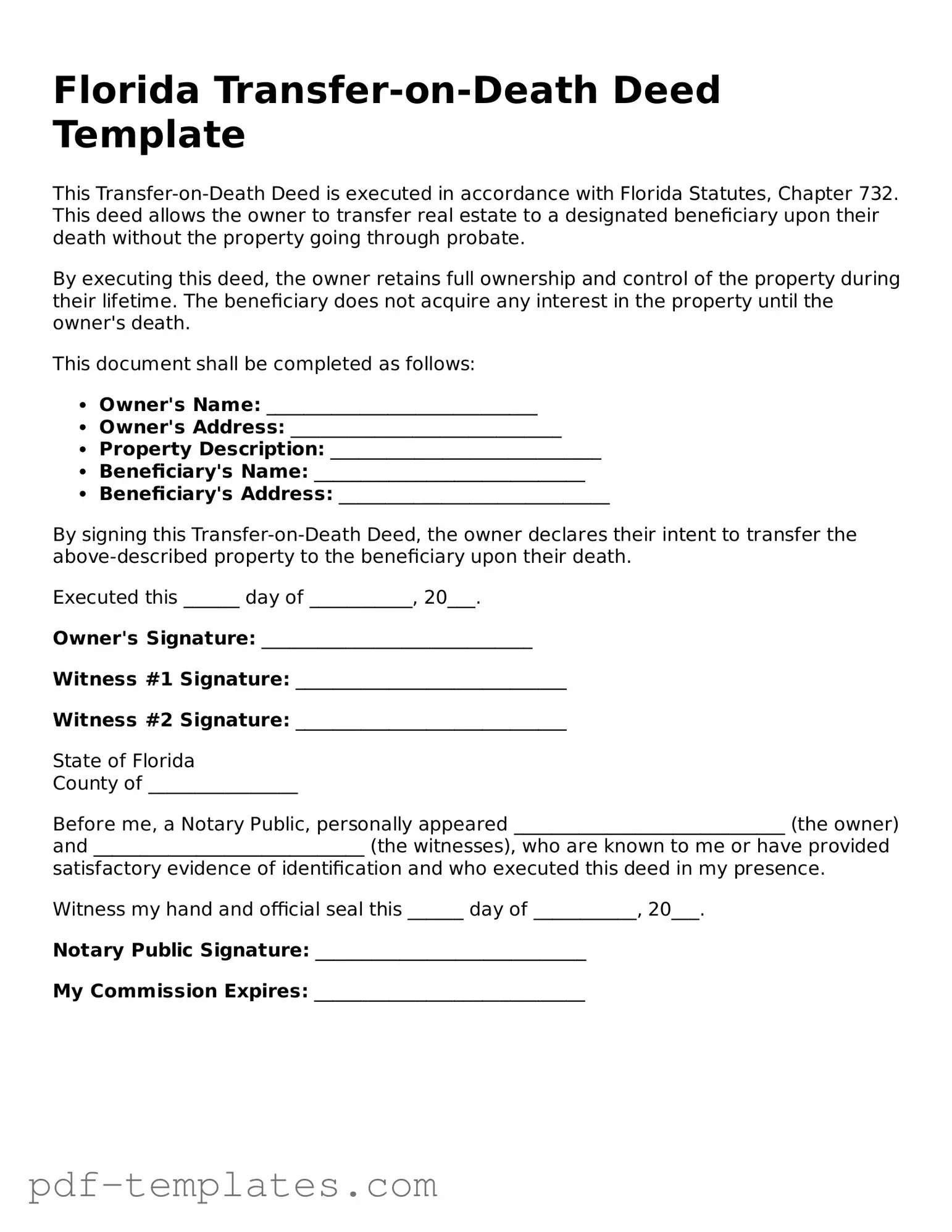

Once you have the Florida Transfer-on-Death Deed form ready, it’s essential to fill it out carefully to ensure that your intentions are clearly communicated. This form allows you to designate a beneficiary who will receive your property upon your passing, and completing it accurately is crucial for its validity. Follow these steps to fill out the form correctly.

- Obtain the Form: Download or request a copy of the Florida Transfer-on-Death Deed form from a reliable source.

- Property Description: In the designated section, provide a clear description of the property. Include the address and legal description, which can typically be found on your property deed.

- Owner Information: Fill in your name as the current owner of the property. Ensure that you use your full legal name as it appears on official documents.

- Beneficiary Information: Enter the name of the person or entity you wish to designate as the beneficiary. Be specific and include their full legal name.

- Alternate Beneficiary: If you want to name an alternate beneficiary in case the primary beneficiary cannot inherit, include their name as well.

- Signature: Sign the form in the designated area. Your signature must match your name as listed in the owner information section.

- Notarization: Have the form notarized. This step is crucial for the form to be legally binding. Find a notary public to witness your signature.

- Recording the Deed: After notarization, take the completed form to the county clerk’s office where the property is located. Record the deed to make it effective.

Once the form is filled out and recorded, it will be part of the public record. This means that your wishes regarding the property will be clear and enforceable upon your passing. It’s always a good idea to keep a copy for your records and inform your beneficiary about the deed. This ensures that they know what to expect in the future.

Common mistakes

-

Not understanding the purpose: Many individuals fill out the Transfer-on-Death Deed without fully grasping its purpose. This deed allows property owners to transfer their property to beneficiaries upon their death, avoiding probate. Without this understanding, mistakes are likely to occur.

-

Incomplete information: Failing to provide all required information can lead to complications. Every section of the form must be filled out completely, including names, addresses, and property descriptions. Incomplete forms may be rejected or lead to disputes later.

-

Incorrect property description: A common error is not accurately describing the property. It's essential to include the legal description of the property as it appears on the deed. Relying solely on the address can lead to confusion and potential legal issues.

-

Not signing the deed: A Transfer-on-Death Deed must be signed by the property owner. Forgetting to sign can invalidate the document entirely. It's also important to ensure that the signature matches the name on the deed.

-

Failure to notarize: In Florida, the deed must be notarized to be valid. Skipping this step can result in the deed being deemed ineffective. Always ensure that a notary public witnesses the signing.

-

Not recording the deed: After completing the form, it must be recorded with the county clerk's office. Many people neglect this step, thinking the deed is valid simply because it was signed. Recording is crucial for the deed to take effect.

-

Choosing the wrong beneficiaries: Selecting beneficiaries without careful consideration can lead to family disputes. It’s important to discuss these decisions with family members to avoid misunderstandings.

-

Overlooking the impact on taxes: Some individuals do not consider how the transfer might affect taxes for their beneficiaries. Understanding potential tax implications is vital for making informed decisions about property transfer.

-

Not updating the deed: Life changes, such as marriage, divorce, or the death of a beneficiary, may require updates to the deed. Failing to revise the deed accordingly can create complications in the future.

-

Ignoring state-specific requirements: Each state has its own rules regarding Transfer-on-Death Deeds. Ignoring Florida's specific requirements can lead to invalidation. Always consult state guidelines or seek assistance to ensure compliance.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Florida to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Florida Transfer-on-Death Deed is governed by Florida Statutes, Chapter 732.401, which outlines the rules for such deeds. |

| Eligibility | Only individuals who own real property in Florida can execute a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the deed, and they do not need to be relatives. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner, provided the revocation is executed in writing. |

| Filing Requirements | The deed must be recorded in the county where the property is located to be effective. |

| Impact on Creditors | Transfer-on-Death Deeds do not shield property from creditors; debts may still need to be settled from the estate. |

| Tax Implications | Beneficiaries may inherit the property with a stepped-up basis for tax purposes, potentially reducing capital gains taxes. |

Dos and Don'ts

When filling out the Florida Transfer-on-Death Deed form, it's important to approach the task with care. This deed allows property owners to transfer their real estate to beneficiaries upon their death, simplifying the process of inheritance. Here are ten tips to guide you through the process:

- Do ensure you have the correct form for your county.

- Do clearly identify the property you wish to transfer.

- Do include the full legal names of all beneficiaries.

- Do sign the deed in front of a notary public.

- Do record the completed deed with your county’s property records office.

- Don't forget to check for any outstanding liens on the property.

- Don't use vague language when describing the property.

- Don't leave out important details, such as your own name and address.

- Don't assume that the deed will automatically take effect without recording it.

- Don't overlook state-specific requirements that may apply.

Following these guidelines can help ensure that your Transfer-on-Death Deed is filled out correctly and meets all necessary legal standards.

Similar forms

The Florida Transfer-on-Death Deed (TOD) form shares similarities with the Last Will and Testament. Both documents allow individuals to express their wishes regarding the distribution of their property after death. However, while a will goes through the probate process, which can be time-consuming and costly, a TOD deed allows for a more straightforward transfer of property without the need for probate, making it a more efficient option for many individuals.

When engaging in the sale or transfer of a vessel, it's essential to utilize the appropriate documentation, such as a Florida Boat Bill of Sale form, to ensure the process is legally sound. This form functions similarly to various estate planning documents, streamlining the transfer of ownership and providing a clear record of the transaction. For a comprehensive understanding of the required paperwork, you may refer to All Florida Forms, which offers guidance on completing and utilizing essential forms effectively.

Check out Popular Transfer-on-Death Deed Forms for Different States

Virginia Tod Deed - Clear communication with beneficiaries can enhance the effectiveness of a Transfer-on-Death Deed.

In addition to understanding the basic functions of a California Quitclaim Deed, it's important to have access to the appropriate resources and documents necessary for its completion. For those seeking further information or tools pertaining to this legal process, you may find useful resources at All California Forms, which can assist in ensuring a smooth transaction.

Transfer on Death Deed Washington Form - This document is recorded with the county to ensure that your intentions regarding property transfer are legally recognized.