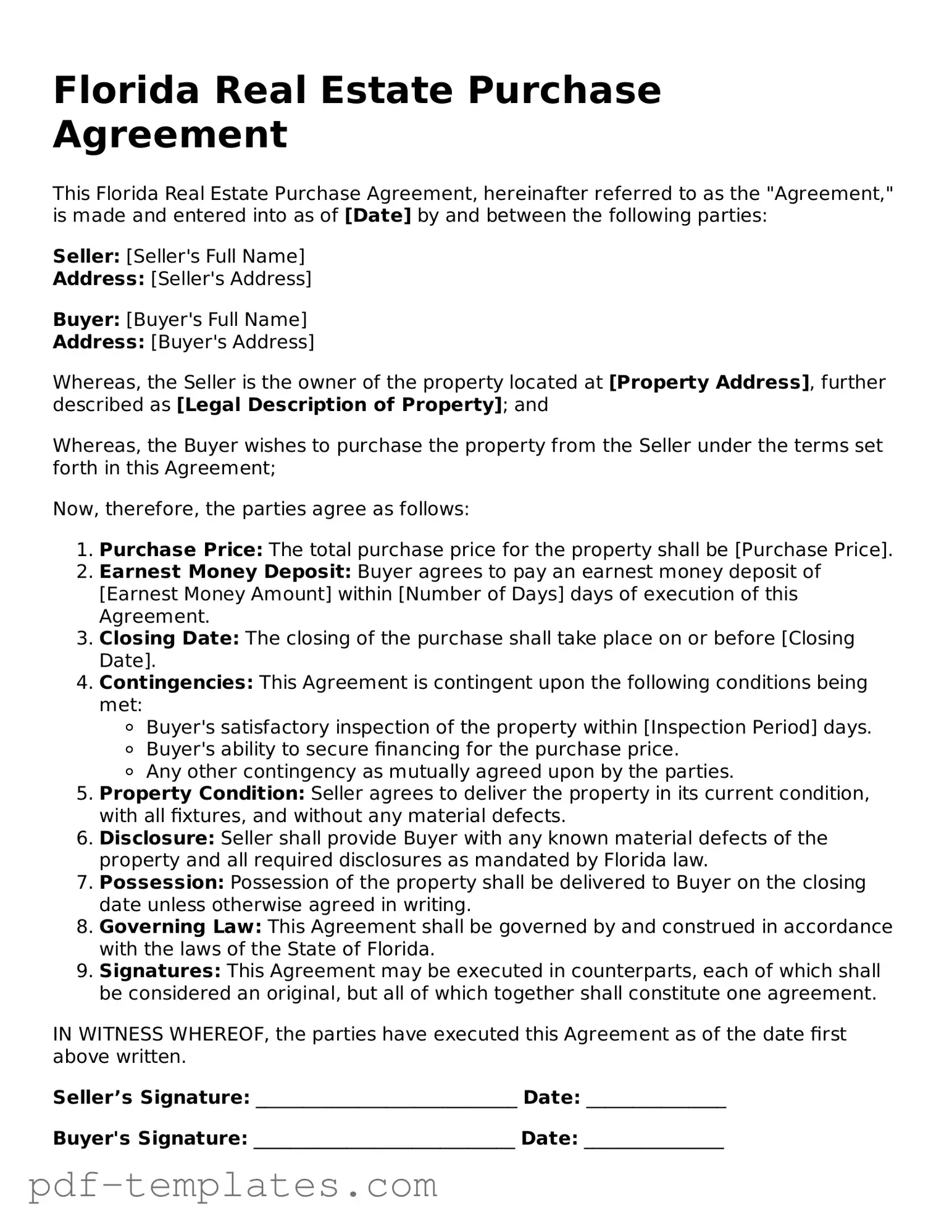

Official Real Estate Purchase Agreement Template for Florida State

The Florida Real Estate Purchase Agreement form is a crucial document in the home buying and selling process, serving as the foundation for a legally binding transaction between buyers and sellers. This form outlines essential details such as the purchase price, property description, and the closing date, ensuring that both parties are on the same page regarding their obligations. It also addresses contingencies, which are conditions that must be met for the sale to proceed, such as financing or inspection requirements. Additionally, the agreement includes provisions for earnest money deposits, which demonstrate the buyer's commitment to the transaction. Other key aspects involve disclosures about the property's condition and any associated fees, providing transparency to both parties. Understanding this form is vital for anyone involved in real estate transactions in Florida, as it helps protect their interests and facilitates a smoother buying or selling experience.

Misconceptions

The Florida Real Estate Purchase Agreement form is a crucial document in real estate transactions. However, several misconceptions often surround it. Below are six common misunderstandings, along with clarifications to help you navigate the process more effectively.

-

The form is only for experienced buyers and sellers.

This is not true. The Florida Real Estate Purchase Agreement is designed for all parties, regardless of their experience level. It provides a clear framework for the transaction, making it accessible for first-time buyers and seasoned investors alike.

-

Once signed, the agreement cannot be changed.

While it is true that the agreement is a binding contract, it can be amended if both parties agree to the changes. Communication is key, and any modifications should be documented in writing.

-

The agreement guarantees the sale will go through.

Signing the agreement does not guarantee that the sale will be completed. Various factors, such as financing issues or inspection results, can affect the outcome. Understanding the contingencies outlined in the agreement is essential.

-

All terms are negotiable.

While many terms in the agreement can be negotiated, some aspects may be standard or non-negotiable based on local laws or lender requirements. It is important to know which terms can be adjusted and which cannot.

-

The agreement is the same for every property.

This is a misconception. While the Florida Real Estate Purchase Agreement follows a general template, specific details can vary based on the property type, location, and other factors. Each agreement should be tailored to reflect the unique aspects of the transaction.

-

Real estate agents handle everything, so I don’t need to read the agreement.

It is crucial for buyers and sellers to read and understand the agreement thoroughly. While real estate agents provide valuable assistance, they are not a substitute for your own understanding of the terms and conditions. Being informed will empower you to make better decisions.

Florida Real Estate Purchase Agreement: Usage Instruction

Filling out the Florida Real Estate Purchase Agreement is an essential step in the property buying process. This document outlines the terms of the sale and ensures that both the buyer and seller are on the same page. Once completed, the agreement will facilitate the next steps in the transaction, including inspections, financing, and closing.

- Begin by entering the date on which the agreement is being filled out.

- Identify the parties involved in the transaction. This includes the full legal names of the buyer(s) and seller(s).

- Provide the property address including the city, state, and zip code.

- Clearly state the purchase price for the property, ensuring that it is accurate and reflects any negotiations that have taken place.

- Outline the earnest money deposit amount, specifying how and when this deposit will be made.

- Indicate the financing terms, detailing whether the buyer will be obtaining a mortgage and any relevant conditions.

- Specify the closing date or timeframe within which the closing should occur.

- Include any contingencies that must be met for the sale to proceed, such as inspections or financing approvals.

- Both parties should sign and date the agreement to indicate their acceptance of the terms.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary details. Buyers and sellers must ensure that names, addresses, and contact information are accurately filled out. Missing information can lead to confusion or delays in the transaction process.

-

Incorrect Property Description: It is crucial to accurately describe the property being purchased. Omitting details such as the legal description or property address can create legal issues later on.

-

Neglecting Contingencies: Buyers often overlook important contingencies, such as financing or inspection clauses. These provisions protect buyers and should be clearly stated to avoid future complications.

-

Not Specifying the Purchase Price: Failing to clearly state the agreed-upon purchase price can lead to misunderstandings. Both parties should ensure that the price is prominently noted in the agreement.

-

Ignoring Closing Date: A common oversight is not specifying a closing date. This date is critical for both parties to plan their next steps and should be agreed upon in advance.

-

Forgetting Signatures: The agreement is not legally binding without the necessary signatures. Buyers and sellers must ensure that all required parties sign the document before it is considered valid.

-

Failing to Review the Document: Many individuals rush through the process and neglect to review the entire agreement. A thorough review can help identify errors or omissions that need to be corrected before finalizing the sale.

PDF Features

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Real Estate Purchase Agreement is governed by Florida state law. |

| Parties Involved | The agreement typically involves a buyer and a seller, both of whom must be clearly identified. |

| Property Description | A detailed description of the property being sold is required, including its address and legal description. |

| Purchase Price | The agreement must specify the purchase price, which is the amount the buyer agrees to pay. |

| Earnest Money | Earnest money is often required to demonstrate the buyer's commitment, and the amount should be stated in the agreement. |

| Contingencies | The agreement may include contingencies, such as financing or inspection requirements, which must be satisfied for the sale to proceed. |

| Closing Date | A closing date must be established, indicating when the transaction will be finalized and ownership transferred. |

| Disclosure Obligations | Florida law requires sellers to disclose certain information about the property, which must be acknowledged in the agreement. |

Dos and Don'ts

When filling out the Florida Real Estate Purchase Agreement form, there are certain best practices to follow and common pitfalls to avoid. Here’s a helpful list to guide you through the process:

- Do: Read the entire form carefully before starting. Understanding each section will help you provide accurate information.

- Do: Use clear and concise language. Avoid abbreviations or jargon that may confuse the reader.

- Do: Double-check all numbers, especially the purchase price and any deposit amounts. Accuracy is crucial.

- Do: Ensure all parties involved in the transaction sign the agreement. Missing signatures can delay the process.

- Do: Include any contingencies that are important to you, such as financing or inspection contingencies.

- Don't: Rush through the form. Taking your time can help prevent mistakes that could lead to complications later.

- Don't: Leave any sections blank unless instructed. Incomplete forms can cause confusion or be rejected.

- Don't: Assume that verbal agreements are sufficient. Everything should be documented in writing within the form.

- Don't: Forget to keep a copy of the completed agreement for your records. This can be vital for future reference.

Following these guidelines can help ensure a smoother experience when completing the Florida Real Estate Purchase Agreement form. Being thorough and careful will serve you well throughout the real estate transaction process.

Similar forms

The Florida Real Estate Purchase Agreement is similar to the Residential Lease Agreement. Both documents outline terms related to property use, but they serve different purposes. A lease agreement allows a tenant to occupy a property for a specified period, typically in exchange for rent. Like the purchase agreement, it includes details such as the parties involved, property description, and terms of payment. However, the lease agreement focuses on the rights and responsibilities of both the landlord and tenant during the lease term, rather than the transfer of ownership.

When considering the delegation of vehicle-related tasks, understanding the significance of the California Motor Vehicle Power of Attorney form is essential. This legal document allows vehicle owners to appoint someone to manage tasks such as registration and signing relevant sales documents on their behalf. It becomes particularly useful for those who are unable to handle these matters due to absence or incapacity. For additional resources regarding similar legal forms, you can visit All California Forms.

Another similar document is the Listing Agreement. This agreement is between a property owner and a real estate agent. It authorizes the agent to sell the property on behalf of the owner. Like the purchase agreement, it specifies important details such as the property description, sale price, and commission fees. However, the listing agreement is primarily about marketing and selling the property, while the purchase agreement is about the actual sale and transfer of ownership.

The Option to Purchase Agreement is also comparable to the Florida Real Estate Purchase Agreement. This document gives a buyer the right to purchase a property within a certain time frame, usually for a set price. Both agreements outline essential terms, such as the property description and price. However, the option agreement is different because it does not require the buyer to purchase the property; it simply grants them the choice to do so, whereas the purchase agreement signifies a commitment to buy.

Lastly, the Seller Financing Agreement shares similarities with the Florida Real Estate Purchase Agreement. This document is used when the seller agrees to finance the buyer's purchase of the property. Both documents detail the sale price and payment terms. However, the seller financing agreement includes specific terms related to the loan, such as interest rates and repayment schedules, which are not present in a standard purchase agreement. This makes it crucial for both parties to understand their obligations regarding the financing arrangement.

Check out Popular Real Estate Purchase Agreement Forms for Different States

Washington State Purchase and Sale Agreement Pdf - Includes considerations for closing incentives or credits.

Trec License - All parties' signatures are required to validate the agreement, establishing its legal weight.

In addition to understanding the key elements of a Vehicle Purchase Agreement, buyers and sellers can find a template to facilitate their transaction at documentonline.org/blank-texas-vehicle-purchase-agreement/, making the process of drafting this important document both straightforward and efficient.

Property Purchase Agreement Format - Buyers and sellers outline repairs and improvements in the contract to ensure transparency.