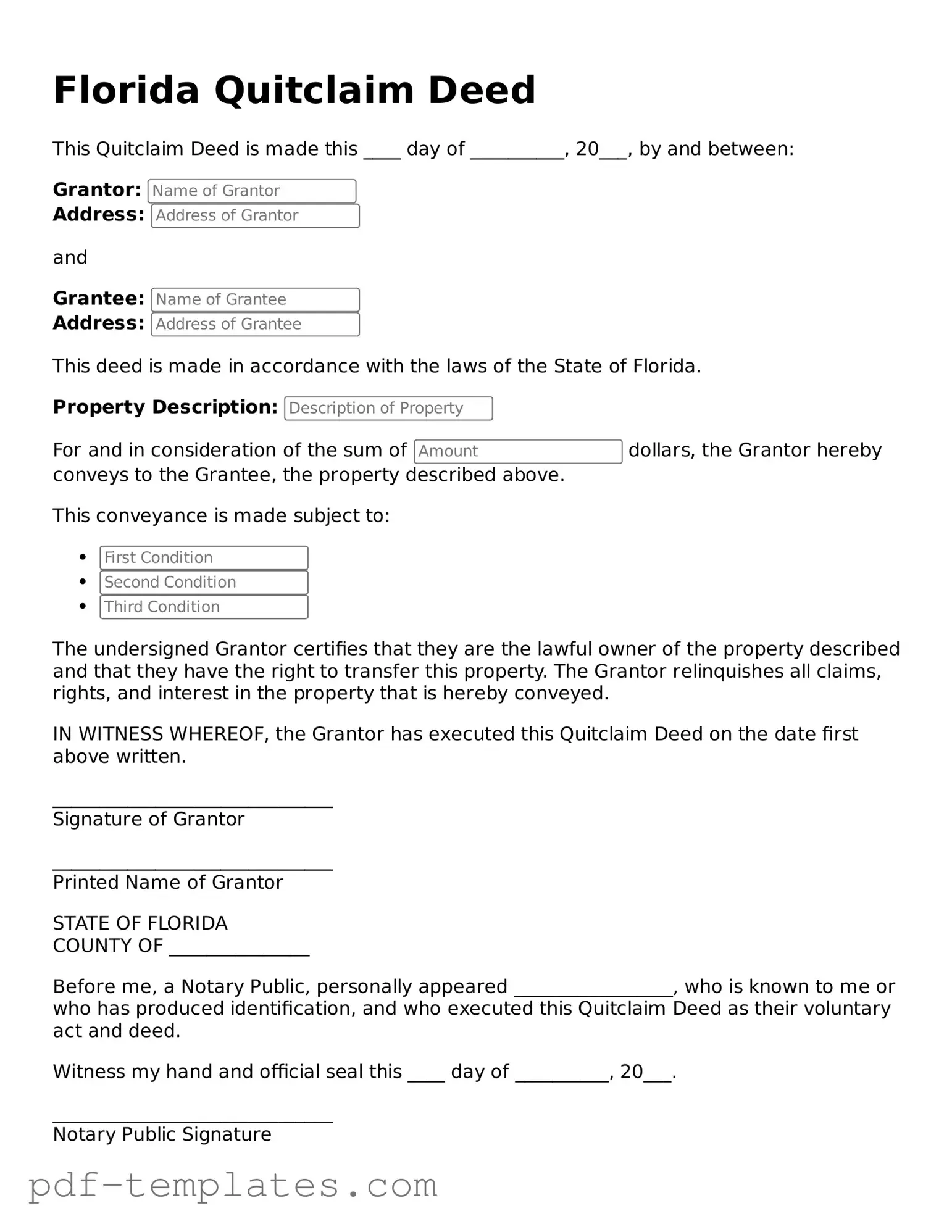

Official Quitclaim Deed Template for Florida State

In the realm of real estate transactions, the Florida Quitclaim Deed form serves as a vital tool for property owners looking to transfer their interest in a property without the complexities typically associated with traditional sales. This straightforward document allows one party, known as the grantor, to relinquish any claim they may have on a piece of real estate to another party, the grantee. Unlike other types of deeds, the Quitclaim Deed does not guarantee that the grantor holds a clear title to the property; instead, it simply conveys whatever rights the grantor possesses at the time of transfer. This makes it particularly useful in situations such as divorce settlements, inheritance transfers, or when property is gifted among family members. While the Quitclaim Deed is relatively easy to complete and does not require extensive legal knowledge, it is essential for both parties to understand the implications of the transfer, including potential liabilities and the lack of warranties. Understanding the nuances of this form can empower property owners to make informed decisions, ensuring that their interests are protected in the ever-evolving landscape of real estate in Florida.

Misconceptions

When it comes to property transfers in Florida, the Quitclaim Deed is often misunderstood. Here are seven common misconceptions about this legal form, along with clarifications to help you navigate its use.

- A Quitclaim Deed transfers ownership without guarantees. Many people believe that this type of deed offers a complete transfer of ownership rights. While it does transfer whatever interest the grantor has, it does not guarantee that the title is clear or free of liens.

- Quitclaim Deeds are only for family members. Some think these deeds are exclusively for transferring property between relatives. In reality, anyone can use a Quitclaim Deed to transfer property to anyone else, whether they are family, friends, or even strangers.

- Using a Quitclaim Deed is the same as selling property. A common misconception is that a Quitclaim Deed equates to a sale. Unlike a traditional sale, this deed does not involve money or consideration; it simply conveys interest in the property.

- Quitclaim Deeds are only valid if notarized. While it is true that notarization adds a layer of authenticity, a Quitclaim Deed can still be valid without it, provided it meets other legal requirements. However, having it notarized is highly recommended to avoid disputes.

- Once a Quitclaim Deed is signed, it cannot be revoked. Some believe that signing a Quitclaim Deed is irreversible. In fact, the grantor can revoke the deed or create a new one to transfer the property back, provided all parties agree.

- Quitclaim Deeds are only for residential properties. This deed is often associated with homes, but it can be used for any type of property, including commercial real estate and vacant land.

- Quitclaim Deeds do not require a title search. Many assume that a Quitclaim Deed eliminates the need for a title search. However, it is wise to conduct a title search before using this deed to ensure there are no hidden issues with the property.

Understanding these misconceptions can help you make informed decisions regarding property transfers in Florida. Always consider consulting a professional for personalized advice tailored to your specific situation.

Florida Quitclaim Deed: Usage Instruction

After completing the Florida Quitclaim Deed form, the next step involves submitting it for recording with the appropriate county clerk's office. This step ensures that the transfer of property rights is officially documented and recognized. Following submission, it is advisable to keep a copy for personal records.

- Obtain the Florida Quitclaim Deed form from a reliable source, such as a legal website or local government office.

- Begin by entering the name and address of the grantor (the person transferring the property).

- Next, fill in the name and address of the grantee (the person receiving the property).

- Provide a legal description of the property being transferred. This may include the parcel number and physical address.

- Indicate the county where the property is located.

- Include the date of the transfer.

- Have the grantor sign the document in the presence of a notary public.

- Ensure that the notary public completes their section by signing and sealing the document.

- Make copies of the completed deed for both the grantor and grantee.

- Submit the original Quitclaim Deed to the county clerk’s office for recording.

Common mistakes

-

Incorrect Names: One of the most common mistakes is failing to list the names of the grantor and grantee accurately. All parties must be identified correctly, including middle names or initials, to avoid confusion.

-

Missing Signatures: The deed must be signed by the grantor. If the grantor neglects to sign, the document will be invalid, and the transfer of property will not occur.

-

Improper Notarization: A quitclaim deed must be notarized to be legally binding. Failing to have the document notarized or using an unqualified notary can lead to complications.

-

Incorrect Legal Description: The property’s legal description must be precise. Errors in this section can create issues in establishing ownership and may lead to disputes.

-

Omitting the Date: The date of the transaction is crucial. If the date is missing, it may lead to questions about when the transfer occurred, potentially affecting tax implications.

-

Failure to Record the Deed: After completing the quitclaim deed, it must be recorded with the county clerk’s office. Neglecting this step can result in the deed not being recognized by third parties.

-

Using the Wrong Form: Different types of deeds exist for various purposes. Using a quitclaim deed when a warranty deed is more appropriate can lead to misunderstandings regarding the nature of the property transfer.

-

Not Checking for Liens: Before transferring property, it is vital to ensure there are no outstanding liens or encumbrances. Failing to do so can result in the new owner inheriting these financial obligations.

-

Ignoring Tax Implications: Property transfers can have tax consequences. Not consulting a tax professional can lead to unexpected tax liabilities for both the grantor and grantee.

-

Assuming All Information is Clear: It is essential to ensure that all information is clear and legible. Handwritten forms should be neat, as any ambiguity can lead to disputes or challenges to the deed’s validity.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed transfers ownership of property without guaranteeing the title's validity. |

| Governing Law | The Florida Quitclaim Deed is governed by Florida Statutes Chapter 689. |

| Use Cases | Commonly used in property transfers between family members or to clear up title issues. |

| Title Assurance | No warranty is provided; the grantor makes no claims about the title's quality. |

| Execution Requirements | The deed must be signed by the grantor and notarized to be valid. |

| Recording | To protect against future claims, it is advisable to record the deed with the county clerk. |

| Consideration | Consideration (payment) is not required, but it is often included for tax purposes. |

| Tax Implications | Florida does not impose documentary stamp taxes on quitclaim deeds in certain transfers. |

| Revocation | A quitclaim deed cannot be revoked once executed and recorded, unless a new deed is created. |

| Limitations | It does not provide any protection against claims from third parties or liens on the property. |

Dos and Don'ts

When filling out the Florida Quitclaim Deed form, it is important to follow certain guidelines to ensure accuracy and compliance with state requirements. Below is a list of things to do and avoid during this process.

- Do provide the correct names of the grantor and grantee.

- Do include a legal description of the property being transferred.

- Do ensure that the form is signed in front of a notary public.

- Do check for any outstanding liens or mortgages on the property before transferring ownership.

- Do file the completed Quitclaim Deed with the appropriate county clerk's office.

- Don't leave any required fields blank.

- Don't use outdated forms; always use the most current version.

- Don't forget to include the date of the transfer.

- Don't sign the document without a notary present.

Similar forms

A Warranty Deed is similar to a Quitclaim Deed in that both are used to transfer ownership of real estate. However, a Warranty Deed provides a guarantee from the seller that they hold clear title to the property and have the right to sell it. This means if any issues arise regarding ownership, the seller is responsible for resolving them. In contrast, a Quitclaim Deed does not offer any such guarantees, making it a riskier option for the buyer.

A Bargain and Sale Deed also shares similarities with a Quitclaim Deed, as it transfers property ownership without providing warranties against encumbrances. However, a Bargain and Sale Deed implies that the seller has some interest in the property, even though they do not guarantee a clear title. This type of deed is often used in foreclosure sales or by executors of estates when selling property, where the seller might not have full knowledge of the property's history.

The Florida Lady Bird Deed is a unique option in estate planning, allowing property owners to retain control over their real estate while facilitating a smooth transfer to beneficiaries. By utilizing the Lady Bird Deed form, individuals can simplify the conveyance process and potentially avoid probate, ensuring that their wishes are respected and protecting their interests during their lifetime.

A Special Purpose Deed, such as a Deed in Lieu of Foreclosure, is another document that resembles a Quitclaim Deed. This type of deed allows a property owner to transfer ownership back to the lender to avoid foreclosure. Like a Quitclaim Deed, it does not provide any warranties regarding the title. The primary difference lies in its specific purpose of addressing financial distress, making it a tool for both parties to avoid the lengthy foreclosure process.

A Life Estate Deed is also comparable to a Quitclaim Deed in that it transfers property rights but does so with a specific condition. A Life Estate Deed allows the original owner to retain certain rights to the property during their lifetime, while transferring ownership to another party upon their death. This document can be beneficial for estate planning purposes, ensuring that property passes to heirs without going through probate, unlike a Quitclaim Deed, which transfers full ownership immediately.

Finally, a Transfer on Death (TOD) Deed shares some features with a Quitclaim Deed. It allows an individual to designate a beneficiary who will receive the property upon their death. The property owner retains full control during their lifetime, similar to a Life Estate Deed. However, unlike a Quitclaim Deed, a TOD Deed does not transfer ownership until the owner's passing, making it a useful estate planning tool while still ensuring a smooth transfer of property to heirs.

Check out Popular Quitclaim Deed Forms for Different States

Quit Claim Deed Cost - Utilize a Quitclaim Deed when gifting property to a friend.

To ensure a proper transaction, it is crucial to understand the nuances of the Texas trailer ownership transfer process. For those looking to facilitate the sale effectively, a detailed approach to the essential Trailer Bill of Sale document is necessary. You can learn more about its significance by visiting this page: key points on the Trailer Bill of Sale form.

How to File a Quitclaim Deed in Virginia - It’s a quick way to transfer property without involving a real estate sale.

Quitclaim Deed Form Pennsylvania - This deed may also be beneficial in cases where a property needs to be quickly sold or transferred for financial reasons.

How to File a Quitclaim Deed in Texas - It can be used to add or remove someone from the title of a property.