Official Promissory Note Template for Florida State

In Florida, a Promissory Note is a crucial financial document that outlines the terms of a loan agreement between a borrower and a lender. This form serves as a written promise from the borrower to repay a specified amount of money, typically including interest, within a designated timeframe. Key aspects of the Florida Promissory Note include the principal amount, interest rate, repayment schedule, and any applicable late fees. Additionally, the document may specify collateral, which secures the loan, providing the lender with a safety net in case of default. Both parties must understand their rights and obligations as outlined in the note, ensuring clarity and protection throughout the lending process. By adhering to state laws and guidelines, the Promissory Note helps facilitate a transparent and legally binding agreement, fostering trust between the borrower and lender.

Misconceptions

Understanding the Florida Promissory Note form can be tricky, especially with the many misconceptions floating around. Here are six common misunderstandings, along with clarifications to help you navigate this important document.

-

Misconception 1: A Promissory Note is the same as a loan agreement.

While both documents relate to borrowing money, a Promissory Note is a simpler, more straightforward promise to pay back a specific amount. A loan agreement typically includes more detailed terms and conditions.

-

Misconception 2: You don’t need to write a Promissory Note for informal loans between friends or family.

Even informal loans can benefit from a written Promissory Note. It helps clarify expectations and protects both parties in case of misunderstandings.

-

Misconception 3: A verbal agreement is enough to enforce a loan.

Verbal agreements can be difficult to enforce in court. Having a written Promissory Note provides clear evidence of the terms agreed upon.

-

Misconception 4: You can’t modify a Promissory Note once it’s signed.

While it’s true that changes can be complicated, it is possible to modify a Promissory Note. Both parties must agree to the changes and document them properly.

-

Misconception 5: All Promissory Notes must be notarized to be valid.

Notarization is not always required for a Promissory Note to be valid in Florida. However, having it notarized can add an extra layer of authenticity and protection.

-

Misconception 6: A Promissory Note doesn’t need to specify a repayment schedule.

It’s crucial to include a repayment schedule in the Promissory Note. This helps both parties understand when payments are due and prevents confusion down the line.

By clearing up these misconceptions, you can approach the Florida Promissory Note with confidence and ensure that your financial agreements are well-documented and understood by all parties involved.

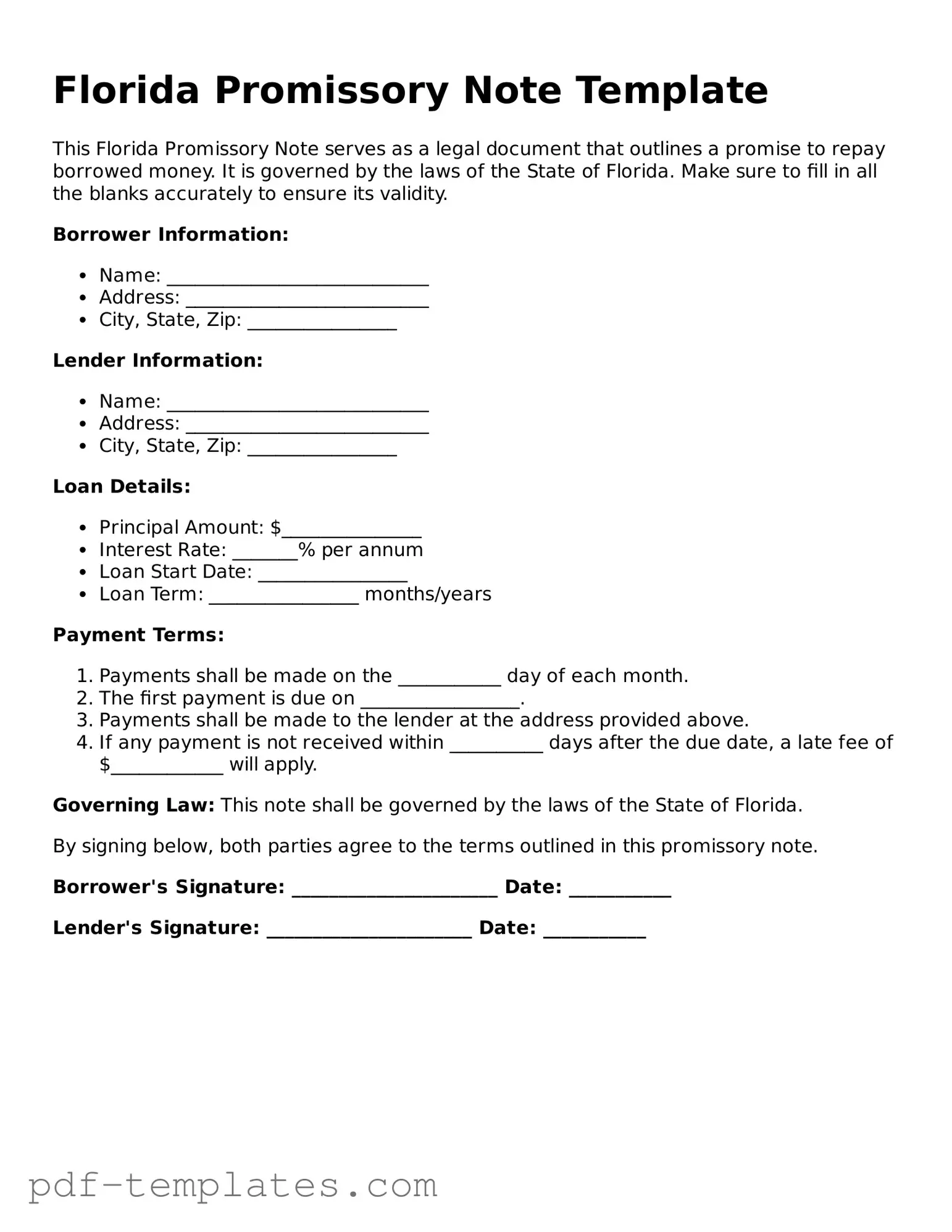

Florida Promissory Note: Usage Instruction

Once you have the Florida Promissory Note form in hand, it's essential to fill it out accurately to ensure that it serves its intended purpose. After completing the form, you will typically sign it and provide it to the lender or the party receiving the payment. Be sure to keep a copy for your records.

- Begin by entering the date at the top of the form. This should be the date on which the note is being executed.

- Next, identify the borrower. Write the full legal name of the person or entity borrowing the money.

- In the following section, list the lender's information. Include the full legal name and address of the lender.

- Clearly state the principal amount being borrowed. This is the total amount of money that the borrower agrees to repay.

- Specify the interest rate. Indicate whether it is fixed or variable and include the exact percentage rate.

- Outline the repayment terms. This includes the schedule of payments, such as monthly or quarterly, and the duration of the loan.

- Include any additional terms or conditions that apply to the loan. This may cover late fees, prepayment penalties, or collateral if applicable.

- At the bottom of the form, both the borrower and lender must sign and date the document. Ensure that all parties have a copy for their records.

Common mistakes

-

Not Including All Necessary Information: One of the most common mistakes is failing to provide complete information. This includes the names of the borrower and lender, the amount of the loan, and the interest rate. Omitting any of these details can lead to confusion later on.

-

Improperly Stating the Loan Amount: Some people mistakenly write down the loan amount in words but not in numbers, or vice versa. This inconsistency can create disputes about the actual amount owed.

-

Ignoring Payment Terms: Clearly outlining the payment schedule is crucial. Failing to specify how often payments are due (monthly, quarterly, etc.) can lead to misunderstandings about when payments should be made.

-

Not Including a Default Clause: A default clause is essential in case the borrower fails to make payments. Many overlook this, which can leave the lender without recourse if the borrower defaults.

-

Forgetting to Sign and Date: A Promissory Note is not valid unless both parties sign and date it. Some individuals neglect this crucial step, rendering the document unenforceable.

-

Using Vague Language: Ambiguous terms can lead to different interpretations. It’s important to use clear and specific language throughout the document to avoid potential disputes.

-

Neglecting to Consult Legal Advice: Many individuals fill out the form without seeking legal advice. Consulting a legal professional can help ensure that the Promissory Note complies with Florida laws and protects both parties' interests.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Florida Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Florida Promissory Note is governed by Florida Statutes, specifically Chapter 673, which relates to commercial paper and negotiable instruments. |

| Requirements | The note must include essential elements such as the amount owed, the interest rate, payment terms, and the signatures of the parties involved. |

| Enforceability | For a promissory note to be enforceable, it must be in writing and signed by the borrower, ensuring clarity and mutual consent. |

| Types | Florida recognizes various types of promissory notes, including secured and unsecured notes, which differ based on whether collateral is involved. |

| Default Consequences | If the borrower defaults, the lender has the right to take legal action to recover the owed amount, which may include foreclosure on collateral if applicable. |

Dos and Don'ts

When filling out the Florida Promissory Note form, it’s important to follow certain guidelines to ensure everything is completed correctly. Here’s a helpful list of dos and don’ts:

- Do read the entire form carefully before you start filling it out.

- Do provide accurate information, including the names of all parties involved.

- Do specify the loan amount clearly to avoid any confusion later.

- Do include the repayment terms, such as interest rates and due dates.

- Don't leave any sections blank unless instructed to do so.

- Don't forget to sign and date the document; this is crucial for its validity.

By following these guidelines, you can help ensure that your Promissory Note is properly filled out and legally binding.

Similar forms

The Florida Promissory Note is similar to a Loan Agreement. Both documents outline the terms of borrowing money and specify the obligations of the borrower. A Loan Agreement typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. While a Promissory Note serves as a simple promise to pay, a Loan Agreement is more comprehensive, often including additional clauses about default, remedies, and other legal considerations. Both documents are essential for protecting the interests of the lender and ensuring clarity in the borrowing process.

Another document that shares similarities with the Florida Promissory Note is a Mortgage. A Mortgage secures a loan with real property, while a Promissory Note is a promise to repay the loan. In a Mortgage, the borrower agrees to give the lender a legal claim to the property if they fail to repay the loan as agreed. This relationship is often documented together, with the Promissory Note detailing the repayment terms and the Mortgage providing security for the lender. Both documents are crucial in real estate transactions, ensuring that lenders can recover their investments in case of default.

A Secured Loan Agreement also resembles the Florida Promissory Note. Like a Promissory Note, it outlines the terms of borrowing, but it includes specific information about the collateral securing the loan. This collateral can be personal property, real estate, or other assets. The Secured Loan Agreement details what happens if the borrower defaults, including the lender's rights to the collateral. Both documents aim to protect the lender's interests while providing borrowers with clear terms for repayment.

Understanding the significance of a Living Will is crucial for making informed healthcare decisions. By utilizing this important legal document, individuals can articulate their preferences regarding medical treatment. Don't miss the opportunity to secure your medical wishes by filling out your Living Will form today. You can find more information and the necessary documents in the Texas Living Will form resource.

The Florida Promissory Note is also comparable to an IOU. An IOU is a simpler, informal acknowledgment of a debt, whereas a Promissory Note is a formal legal document. An IOU typically states the amount owed but lacks the detailed terms and conditions found in a Promissory Note. While both documents signify a debt obligation, the Promissory Note provides a more structured framework, including interest rates and repayment schedules, making it more enforceable in a legal context.

Lastly, a Personal Loan Agreement is similar to the Florida Promissory Note. This document outlines the terms of a personal loan between individuals. It specifies the loan amount, interest rate, repayment terms, and any other conditions agreed upon by the parties. While a Promissory Note focuses primarily on the promise to repay, a Personal Loan Agreement often includes additional provisions, such as late fees or prepayment penalties. Both documents serve to clarify the expectations of both the lender and borrower, minimizing the potential for misunderstandings.

Check out Popular Promissory Note Forms for Different States

Promissory Note Texas - It ensures both parties are informed about the structure of the loan repayment.

The California Identification Card is an essential document for residents, facilitating various personal identification needs. For those looking to apply, renew, or replace their ID, the official form DL 410 ID provides thorough guidelines on eligibility requirements and the application process. It highlights the importance of having a Social Security Number, while also addressing mail renewal eligibility and offering sections dedicated to organ donor status, veteran benefits, and voter registration. For comprehensive resources, applicants can refer to All California Forms to ensure they have all necessary information at hand.

New York Promissory Note - This form is often required by lenders to provide legal protection against default.