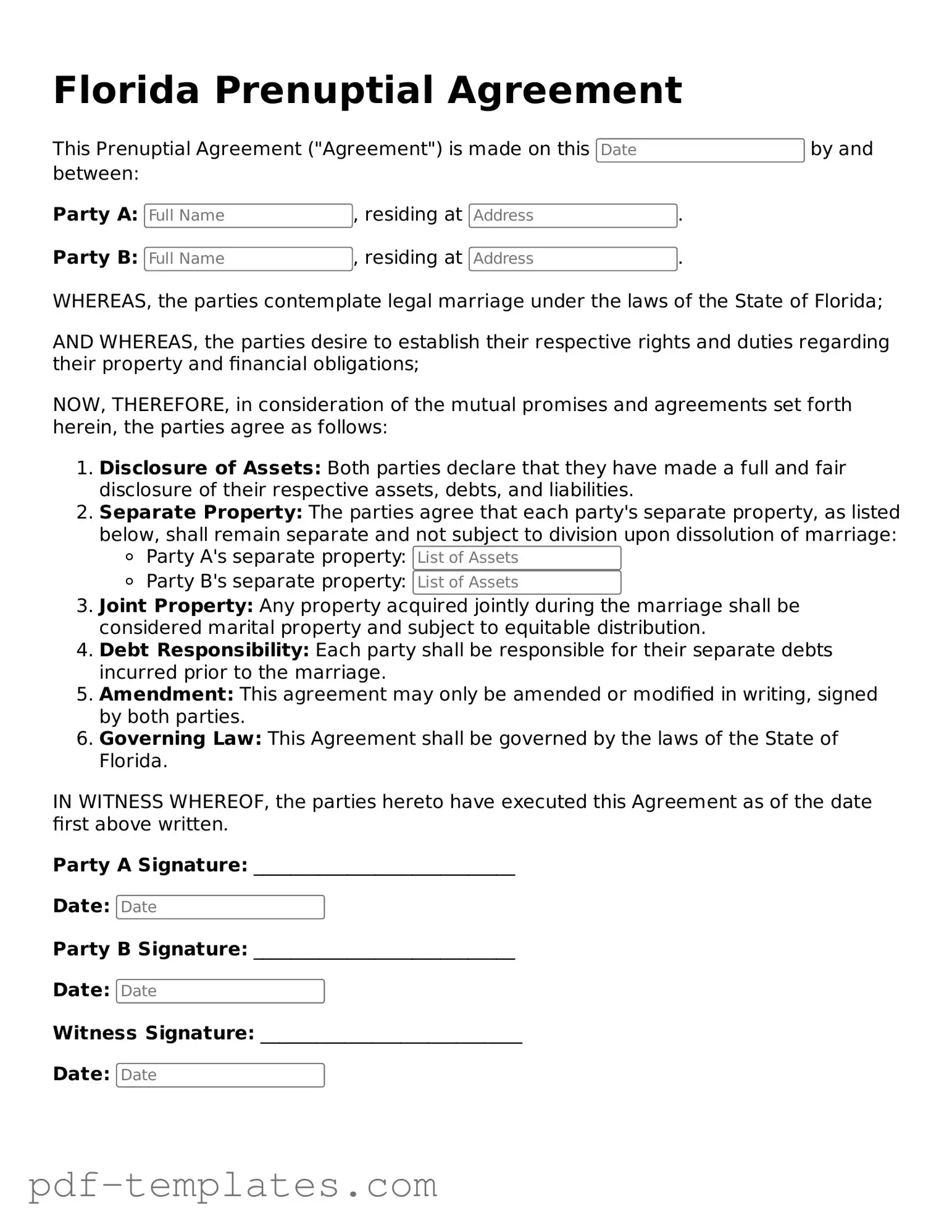

Official Prenuptial Agreement Template for Florida State

When considering marriage in Florida, many couples choose to create a prenuptial agreement to protect their individual assets and clarify financial responsibilities. This legal document outlines how property and debts will be managed during the marriage and what will happen in the event of a divorce. A Florida prenuptial agreement can cover various aspects, including the division of property, spousal support, and the handling of debts. It's important for both parties to fully disclose their financial situations to ensure fairness and transparency. Additionally, the agreement must be in writing and signed by both individuals to be enforceable. Understanding the key components of the Florida Prenuptial Agreement form can help couples navigate their financial futures with confidence, ensuring that their interests are safeguarded as they embark on their journey together.

Misconceptions

Many people hold misconceptions about prenuptial agreements, particularly in Florida. Understanding these misunderstandings can help individuals make informed decisions. Here are nine common misconceptions:

- Prenuptial agreements are only for the wealthy. Many believe that only those with significant assets need a prenup. In reality, anyone can benefit from a prenuptial agreement, regardless of their financial status.

- Prenuptial agreements are unromantic. Some think that discussing a prenup undermines the love in a relationship. However, a prenup can promote open communication about finances, which is crucial for a healthy marriage.

- Prenuptial agreements are only for divorce. Many assume that prenups are solely about protecting assets in the event of a divorce. They can also outline financial responsibilities during the marriage, providing clarity and reducing potential conflicts.

- Prenuptial agreements are difficult to enforce. Some individuals worry that a prenup won't hold up in court. If properly drafted and executed, prenuptial agreements are generally enforceable in Florida.

- Prenuptial agreements can cover anything. A common misconception is that a prenup can address any issue. In Florida, prenuptial agreements cannot dictate child custody or child support matters.

- Only one partner needs a lawyer. Some believe that only one party needs legal representation. Both partners should seek independent legal advice to ensure fairness and understanding of the agreement.

- Prenuptial agreements are permanent. Many think that once signed, a prenup cannot be changed. In fact, couples can modify or revoke a prenup at any time, as long as both parties agree.

- Prenuptial agreements are unnecessary if there is a will. Some people think that having a will eliminates the need for a prenup. A will and a prenup serve different purposes and do not replace each other.

- Prenuptial agreements are only for heterosexual couples. There is a misconception that prenuptial agreements are only applicable to heterosexual marriages. In Florida, same-sex couples can also benefit from prenuptial agreements.

Understanding these misconceptions can help individuals approach prenuptial agreements with clarity and confidence.

Florida Prenuptial Agreement: Usage Instruction

Completing the Florida Prenuptial Agreement form requires careful attention to detail. This process involves gathering necessary information and ensuring that all sections are filled out accurately. Following these steps will help you complete the form correctly.

- Begin by downloading the Florida Prenuptial Agreement form from a reliable source.

- Read through the entire form to understand what information is required.

- Fill in the full names of both parties at the top of the form.

- Provide the current addresses for both individuals.

- State the date of the upcoming marriage.

- List any assets owned by each party before the marriage. Be specific about property, bank accounts, and investments.

- Include any debts each party has, as this information is also important.

- Discuss and write down how you wish to handle property acquired during the marriage.

- Sign and date the form in the designated areas. Both parties should do this.

- Consider having the agreement notarized to strengthen its validity.

Once the form is completed, both parties should keep a copy for their records. It is wise to consult with a legal professional to ensure that the agreement meets all legal requirements and adequately protects both parties' interests.

Common mistakes

-

Inadequate Disclosure of Assets: One common mistake is failing to fully disclose all assets and debts. Each party should provide a complete picture of their financial situation. Omitting significant assets can lead to disputes later.

-

Not Seeking Legal Counsel: Many individuals attempt to navigate the process without legal advice. This can result in misunderstandings about the implications of certain clauses or the overall enforceability of the agreement.

-

Using Ambiguous Language: Clarity is key. Vague terms can create confusion and lead to different interpretations. Each clause should be specific to avoid potential legal challenges in the future.

-

Failing to Update the Agreement: Life circumstances change. Not revisiting and updating the prenuptial agreement after major life events—such as the birth of a child or significant changes in income—can render the document outdated.

-

Not Considering Future Changes: Many people overlook the need to address how future income or property will be handled. Anticipating changes in financial circumstances can help avoid complications later.

-

Ignoring State Laws: Each state has its own laws regarding prenuptial agreements. Ignoring Florida's specific requirements can result in an agreement that is unenforceable. Understanding these laws is crucial for creating a valid document.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement is a legal document that outlines the division of assets and responsibilities in the event of divorce or separation. |

| Governing Law | Florida Statutes, Chapter 61, governs prenuptial agreements in the state. |

| Requirements | For a prenup to be valid in Florida, it must be in writing and signed by both parties. |

| Disclosure | Both parties must fully disclose their assets and liabilities before signing the agreement. |

| Enforceability | A prenuptial agreement can be challenged in court if it is found to be unconscionable or if one party did not enter into it voluntarily. |

| Amendments | Couples can amend a prenuptial agreement at any time, but any changes must also be in writing and signed by both parties. |

Dos and Don'ts

When filling out a Florida Prenuptial Agreement form, it's important to approach the process thoughtfully. Here’s a list of things to consider doing and avoiding:

- Do ensure both parties fully understand the terms of the agreement before signing.

- Do seek legal advice to clarify any questions about the implications of the agreement.

- Do be transparent about all assets and debts to avoid future disputes.

- Do discuss the agreement openly with your partner to foster trust and understanding.

- Do keep copies of the signed agreement in a safe place for future reference.

- Don’t rush the process; take the time needed to consider all aspects of the agreement.

- Don’t hide any financial information, as this could lead to legal issues later on.

- Don’t use overly complicated language that may confuse either party.

- Don’t assume that a prenup is only for the wealthy; it can benefit anyone.

- Don’t forget to review and update the agreement as circumstances change.

Similar forms

A Cohabitation Agreement is similar to a prenuptial agreement in that it outlines the rights and responsibilities of partners who live together without being married. Both documents serve to clarify financial arrangements and property rights, helping to prevent disputes in the event of separation. While a prenuptial agreement is established before marriage, a cohabitation agreement is created for couples who choose to live together, ensuring both parties understand their obligations and entitlements.

If you are considering purchasing a horse, having the right documentation in place is essential. You can find a reliable resource for this by accessing our comprehensive Horse Bill of Sale form guide at Horse Bill of Sale.

A Postnuptial Agreement is another document akin to a prenuptial agreement. It is executed after a couple is married and serves a similar purpose: to define property rights and financial responsibilities. Both agreements can address issues like asset division and spousal support, but a postnuptial agreement may be necessary when circumstances change, such as the birth of a child or a significant change in financial status.

A Separation Agreement is also comparable to a prenuptial agreement. This document is used when a couple decides to live apart but is not yet divorced. It outlines the terms of separation, including asset division, child custody, and support. Like a prenuptial agreement, it aims to minimize conflict by clearly stating each party's rights and obligations during the separation period.

A Marital Settlement Agreement is similar to a prenuptial agreement in that it resolves issues related to property and finances during a divorce. This document details how assets and debts will be divided, as well as any spousal support arrangements. Both agreements focus on financial matters and aim to protect individual interests, although a marital settlement agreement is created in anticipation of divorce rather than marriage.

An Estate Plan, including a Will and Trust, shares similarities with a prenuptial agreement in that both documents deal with the distribution of assets. While a prenuptial agreement addresses asset division during marriage or divorce, an estate plan outlines how assets will be distributed upon death. Both documents are crucial for ensuring that individuals’ wishes are respected and that their assets are managed according to their preferences.

A Financial Power of Attorney can also be likened to a prenuptial agreement. This document grants someone the authority to manage another person's financial affairs if they become unable to do so. Both agreements involve financial considerations and aim to protect the interests of the parties involved. A prenuptial agreement focuses on asset division during marriage, while a financial power of attorney is concerned with decision-making in the event of incapacitation.

Finally, a Business Partnership Agreement is similar to a prenuptial agreement in that it establishes the terms of a partnership, including financial contributions and profit sharing. Both documents are designed to prevent disputes by clearly defining each party's rights and responsibilities. While a prenuptial agreement pertains to personal relationships, a business partnership agreement focuses on professional partnerships, yet both aim to provide clarity and protection for the parties involved.

Check out Popular Prenuptial Agreement Forms for Different States

Pennsylvania Prenuptial Contract - It can protect intellectual property created before or during marriage.

The California Identification Card or Senior Identification Card form, officially known as form DL 410 ID, is a crucial document for residents aiming to apply for, renew, or replace their ID card in the state. For more information and access to the application process, you can visit formcalifornia.com/. This public service document highlights the requirement of a Social Security Number for application and details specific criteria for renewal by mail. Additionally, it includes sections for organ donor status, veteran benefits information, and voter registration, ensuring that applicants are thoroughly informed of their options and responsibilities.

Texas Prenuptial Contract - This agreement can help avoid misunderstandings regarding finances post-marriage.

Washington Prenuptial Contract - This document can assist in minimizing conflicts over financial matters if the marriage ends.