Official Power of Attorney Template for Florida State

The Florida Power of Attorney form serves as a crucial legal document that empowers individuals to designate someone else to act on their behalf in various financial and legal matters. This form can be tailored to meet specific needs, allowing the principal—the person granting the authority—to choose the scope of power granted to the agent. It can cover a wide range of actions, from managing bank accounts and real estate transactions to making healthcare decisions. Furthermore, the Florida Power of Attorney can be durable, meaning it remains effective even if the principal becomes incapacitated, or it can be limited to specific tasks or timeframes. Understanding the nuances of this form is essential for anyone considering appointing an agent, as it not only facilitates decision-making during critical times but also ensures that the principal's wishes are honored. The proper completion and execution of the form are vital, as they help prevent potential disputes and misunderstandings among family members and other stakeholders.

Misconceptions

When it comes to the Florida Power of Attorney (POA) form, many people hold misconceptions that can lead to confusion or even legal issues. Understanding the truth behind these myths is essential for making informed decisions. Here are five common misconceptions:

- A Power of Attorney is only for the elderly or sick. Many believe that only those who are aging or ill need a POA. In reality, anyone can benefit from having a POA in place, regardless of their age or health status. Life can be unpredictable, and having someone you trust to make decisions on your behalf can provide peace of mind.

- A Power of Attorney can make any decision on my behalf. While a POA does grant significant authority, it does not give the agent unlimited power. The scope of authority is defined by the principal, the person who creates the POA. This means you can specify what decisions your agent can make, whether they pertain to finances, healthcare, or other matters.

- Once I sign a Power of Attorney, I lose control over my decisions. This is a common fear, but it is unfounded. A POA can be designed to take effect immediately or only under certain conditions, such as when you become incapacitated. Until that time, you retain full control over your decisions.

- A Power of Attorney is permanent and cannot be revoked. Many people think that once a POA is established, it cannot be changed. In fact, you have the right to revoke or amend your POA at any time, as long as you are mentally competent. This flexibility allows you to adapt to changing circumstances.

- All Power of Attorney forms are the same. This misconception overlooks the fact that POA forms can vary significantly by state and purpose. Florida has specific requirements and forms that must be followed. It’s crucial to use the correct form that meets your needs and complies with Florida law.

By dispelling these misconceptions, individuals can better understand the importance of a Power of Attorney and make informed choices about their legal and financial futures.

Florida Power of Attorney: Usage Instruction

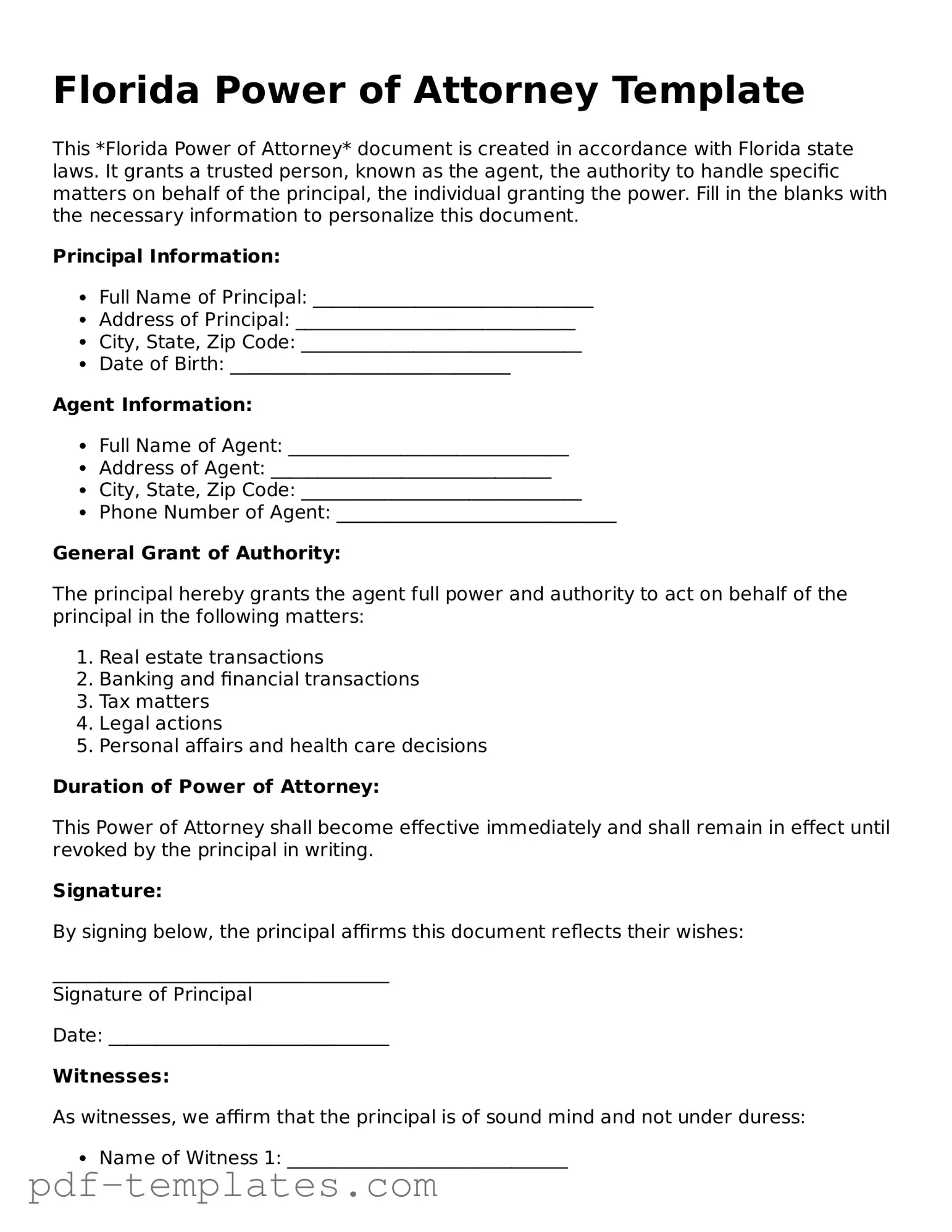

Filling out the Florida Power of Attorney form is a straightforward process that requires careful attention to detail. Once you have completed the form, it will need to be signed and notarized to ensure its validity. Here’s how to go about it:

- Begin by downloading the Florida Power of Attorney form from a reliable source or obtain a hard copy.

- Read through the entire form to familiarize yourself with the sections and requirements.

- In the designated area, fill in your name and address as the principal, the person you are granting authority to (the agent), and their address.

- Clearly specify the powers you wish to grant to your agent. You can choose general powers or limit them to specific tasks.

- Indicate the duration of the Power of Attorney. Decide if it will be effective immediately or if it will become effective at a later date.

- Provide any additional instructions or limitations regarding the agent’s authority if needed.

- Sign the form in the presence of a notary public. Ensure that the notary completes their section to validate the document.

- Make copies of the signed and notarized form for your records and for the agent.

After completing these steps, your Power of Attorney will be ready for use. Ensure that you communicate with your agent about their responsibilities and the powers you have granted them.

Common mistakes

-

Not specifying the powers granted: Individuals often overlook the importance of clearly defining the powers they are granting. This can lead to confusion and disputes later on.

-

Failing to date the document: A common mistake is not including the date on the Power of Attorney form. Without a date, the validity of the document may be questioned.

-

Not signing the document: It may seem obvious, but some people forget to sign their Power of Attorney. Without a signature, the document is not legally binding.

-

Neglecting witnesses or notarization: Florida law requires either witnesses or notarization for the Power of Attorney to be valid. Skipping this step can invalidate the entire document.

-

Choosing the wrong agent: Selecting an untrustworthy or unqualified agent can lead to misuse of authority. It's crucial to choose someone reliable and competent.

-

Not reviewing the document regularly: Life circumstances change. Failing to review and update the Power of Attorney can result in outdated information or powers.

-

Ignoring state-specific requirements: Each state has its own rules regarding Power of Attorney forms. Not adhering to Florida's specific requirements can render the document ineffective.

-

Overlooking revocation procedures: If you need to revoke a Power of Attorney, it's essential to understand the proper procedures. Failing to do so can leave room for complications.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Florida Power of Attorney form allows an individual (the principal) to designate another person (the agent) to make decisions on their behalf. |

| Governing Law | The Florida Power of Attorney is governed by Florida Statutes, Chapter 709. |

| Durability | The form can be made durable, meaning it remains effective even if the principal becomes incapacitated. |

| Agent's Authority | The agent's authority can be broad or limited, depending on how the form is completed by the principal. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are competent to do so. |

| Witness Requirement | In Florida, the Power of Attorney must be signed in the presence of two witnesses and a notary public. |

| Healthcare Decisions | A separate document, often called a Healthcare Proxy or Advance Directive, is typically needed for medical decisions. |

| Financial Transactions | The agent can handle financial matters, such as banking, real estate, and taxes, as specified in the Power of Attorney. |

Dos and Don'ts

When filling out a Florida Power of Attorney form, it’s important to ensure that the document is completed correctly to avoid any potential issues in the future. Here’s a list of things to do and not to do:

- Do read the entire form carefully before filling it out.

- Do ensure that you understand the powers you are granting to your agent.

- Do choose a trusted individual as your agent.

- Do sign the form in front of a notary public.

- Do keep a copy of the completed form for your records.

- Don't leave any blank spaces on the form; fill them in or cross them out.

- Don't use the form if you are under duress or do not fully understand it.

- Don't appoint someone who may have conflicting interests with you.

- Don't forget to date the form when you sign it.

- Don't assume that your agent can act without the proper documentation; ensure they have a copy of the signed form.

By following these guidelines, you can help ensure that your Power of Attorney is valid and effective when you need it most.

Similar forms

The Florida Power of Attorney form is similar to a Living Will, which outlines an individual's wishes regarding medical treatment in situations where they cannot communicate their preferences. Both documents serve to protect a person's interests, but while a Power of Attorney appoints someone to make decisions on behalf of another, a Living Will specifically addresses healthcare decisions. This ensures that an individual’s medical preferences are respected even when they are unable to voice them.

Another document akin to the Florida Power of Attorney is the Healthcare Proxy. This legal document designates a person to make healthcare decisions for someone else when they are unable to do so themselves. Like the Power of Attorney, a Healthcare Proxy empowers a trusted individual to act on behalf of another. However, it focuses exclusively on medical decisions, whereas the Power of Attorney can encompass a broader range of financial and legal matters.

A Trust is also comparable to the Florida Power of Attorney. While a Power of Attorney grants someone authority to act on your behalf, a Trust allows for the management and distribution of assets. Both documents can help in planning for incapacity, but a Trust is often used for estate planning and can provide a mechanism for asset protection and management during a person’s lifetime and after their death.

The Advance Directive shares similarities with the Florida Power of Attorney as well. This document combines elements of a Living Will and a Healthcare Proxy, allowing individuals to express their healthcare wishes and appoint someone to make decisions on their behalf. Both documents emphasize the importance of having a say in one’s medical care, ensuring that personal values and preferences are honored.

A Financial Power of Attorney is another document that closely resembles the Florida Power of Attorney. This form specifically grants authority to an individual to handle financial matters, such as managing bank accounts or paying bills. While the Florida Power of Attorney can cover both financial and healthcare decisions, a Financial Power of Attorney focuses solely on financial aspects, making it essential for those looking to delegate financial responsibilities.

The Durable Power of Attorney is similar in function to the Florida Power of Attorney, with the key distinction being its durability. A Durable Power of Attorney remains effective even if the person who created it becomes incapacitated. This ensures that the appointed agent can continue to manage affairs without interruption, providing peace of mind during challenging times.

A Declaration of Guardian is another related document. This form allows an individual to designate a guardian in the event they become incapacitated. While the Florida Power of Attorney empowers someone to act on your behalf, a Declaration of Guardian ensures that a specific person is appointed to make decisions about your personal care and well-being, reinforcing the importance of choosing trusted individuals for critical roles.

Lastly, the Marital Power of Attorney is similar in that it allows spouses to act on each other's behalf. This document is particularly useful in situations where one spouse may be unable to manage their affairs. While the Florida Power of Attorney can be used by anyone, the Marital Power of Attorney specifically addresses the unique relationship between spouses, facilitating decision-making during times of need.

Check out Popular Power of Attorney Forms for Different States

Va Poa - The document can outline specific powers, like managing bank accounts or signing contracts.

Ca Poa - Incorporating a Power of Attorney into your estate plan is a proactive step for future care.

Power of Attorney Washington State - It facilitates smoother transactions in your absence, minimizing delays.

Texas Power of Attorney Form - Establishes authority in financial transactions.